KING Dollar higher for ten consecutive weeks

The US Dollar Index registered its highest weekly close in ten months, up ~6% from the mid-July Key Turn Date.

The Euro (the Anti-Dollar) has closed lower for ten consecutive weeks, falling ~6% from its mid-July highs.

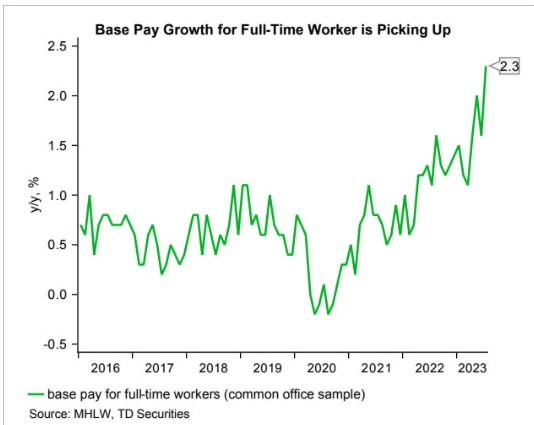

The Yen has dropped ~7% from its mid-July highs and closed this week at 10-month lows after the BoJ left monetary policy unchanged on Friday. (Short-term rates in Japan are zero to negative while core inflation is ~4%.) The Yen has fallen ~48% against the USD since 2012 when Abe introduced his “Three Arrows” policy to stimulate the Japanese economy.

The Canadian Dollar fell ~4% from mid-July highs to early September lows but has rallied ~1.5% since then, perhaps in sync with surging crude oil prices. (Or perhaps CAD, which has rallied against European and Asian currencies, including Aussie, is seen as a “play” on North American “exceptionalism” relative to the rest of the world.)

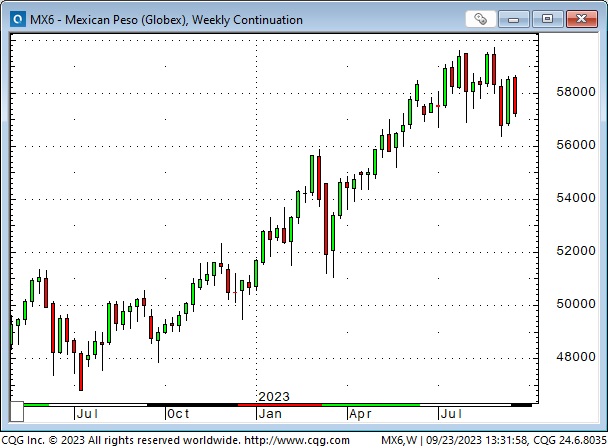

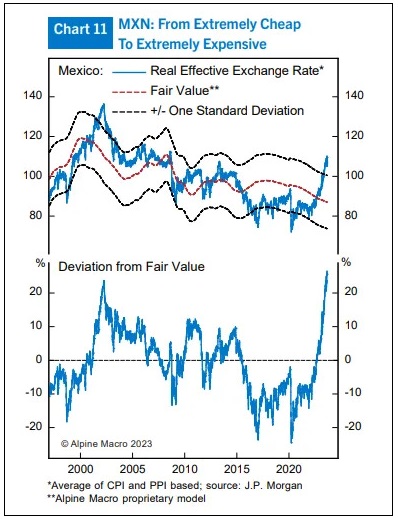

The Mexican Peso, the “strongest currency in the world” for most of the last twelve months, has lost momentum recently. If markets start to price in a greater chance of an American recession, the Peso will likely fall.

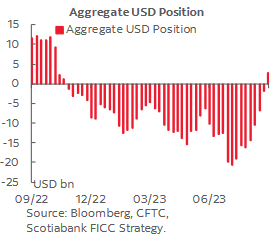

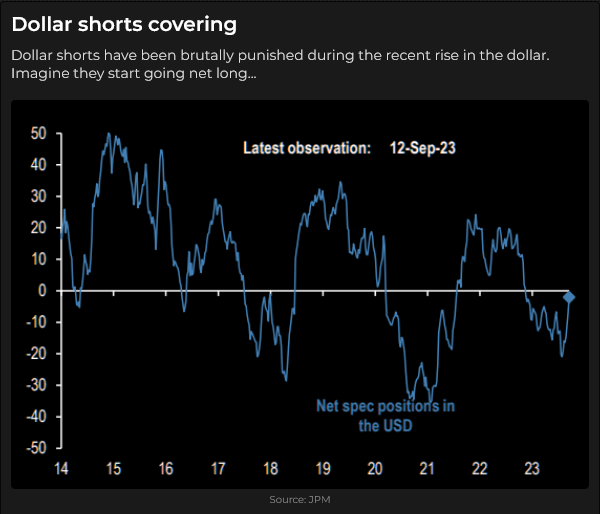

CFTC commitments of traders data show that CME currency futures net speculative positioning against the USD reached a 2-year high ~10 weeks ago and has fallen sharply as the USD rallied. The aggregate net speculative position turned long the USD this week for the first time in nearly a year.

This commitments of traders chart is a week old (it doesn’t show speculators now net long USD), but it gives an excellent 10-year history of USD speculative positioning.

This chart shows the 50-day MA crossing above the 200-day MA (the Golden Cross) and implies that the “path of least resistance” for the USD is higher.

I’ve traded currencies for 45 years. I believe capital flows to America for safety and opportunity and that currency trends go further than seems to make any “sense,” before they turn on a dime and go the other way.

Interest rates surged higher this week

The Fed keeps delivering the “higher for longer” message, but markets accept the news grudgingly. Three-month TBill yields are at 23-year highs, up ~5.5% from effectively zero less than two years ago. Ten-year Treasury yields traded above 4.5% this week for the first time in 16 years. Canadian five and ten-year bond yields also traded to a 16-year high.

Bill Ackman, a hedge fund manager, posted a “laundry list” of reasons why he is short bonds (via swaptions) on Twitter on September 21.

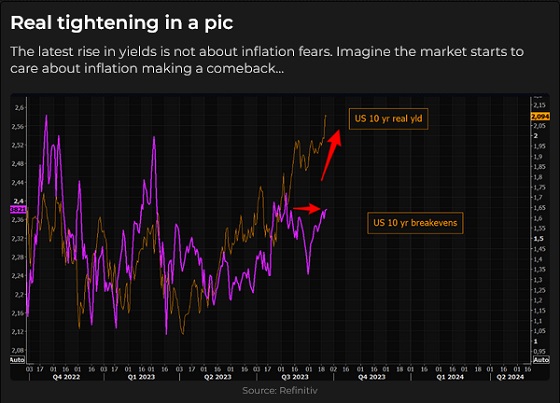

I agree with several of the points on Bill’s list, but why have real yields been driving nominal yields higher? In the simplest terms, I think the bond market has been more worried about the coming supply/demand imbalance than inflation. This chart shows a sharp rise in real 10-year yields while 10-year breakevens (a “measure” of future inflation) have been relatively flat.

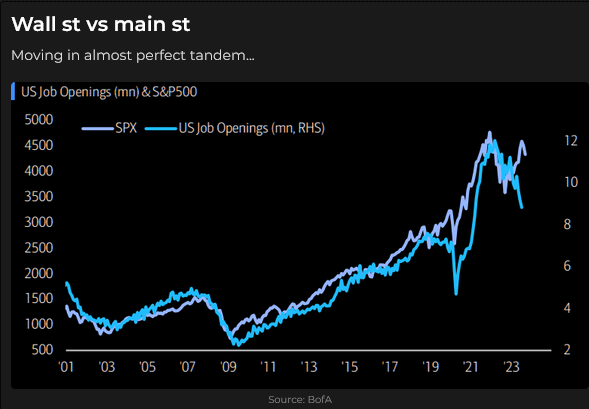

The “imbalance” I’m referring to is the possibility of a greater supply of bonds (as government deficits continue to grow) against a shrinking field of buyers (as foreign and domestic buyers slow or reverse their buying and as the Fed continues QT.)

Not only are interest rates rising, but credit spreads are widening.

Stock markets are weakening

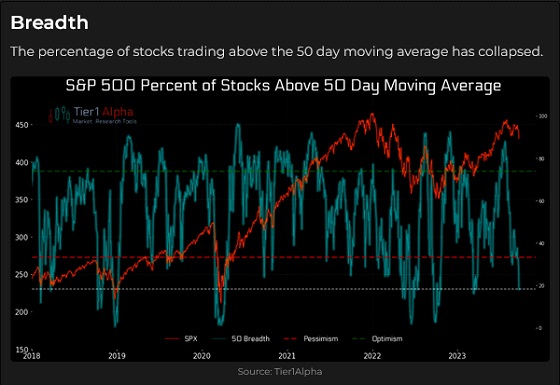

The Nasdaq hit a 19-month high on the mid-July Key Turn Date (up ~45% YTD at that point), and many market participants believed it would soon rally to new All-Time Highs. It closed this week down ~7% from the July highs as surging interest rates took a toll.

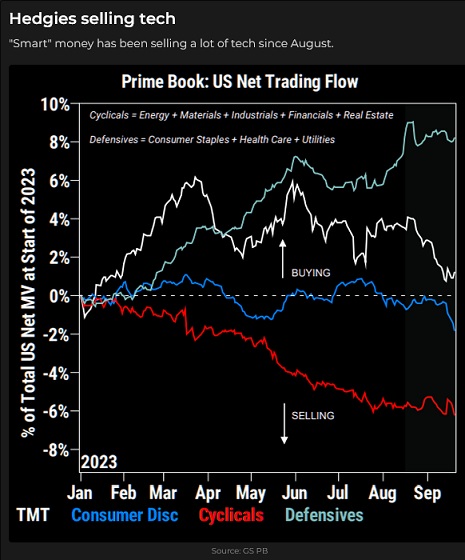

The “inside of the stock market” (Stan Druckenmiller’s term for sector rotation) shows that investors have become increasingly defensive over the past few months, even as the broad indices have rallied.

The S&P 500 index is up ~13% YTD. The Magnificent Seven is up ~50%, while the S&P 493 is up less than 4%.

All the broad American stock market indices show some version of a head-and-shoulders topping pattern.

WTI crude oil futures surged to a 13-month high this week

Front-month WTI futures traded to nearly $94 on Tuesday but closed the week near $90. There was a (very brief) spike low on May 4 of ~$63.50, but the “practical” YTD low has been around $67.

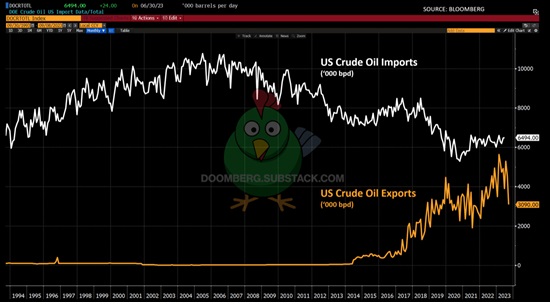

Saudi Arabia and Russia have extended their production cutback to the end of the year. US domestic production is ~12.9 mbd, larger than any other country, but American demand is at All-Time Highs ~21 mbd. Commitments of Traders’ data show that net speculative long positioning is now at the highest level in over a year, up ~35% since June. (Speculators have been aggressively buying the rally.)

Gold

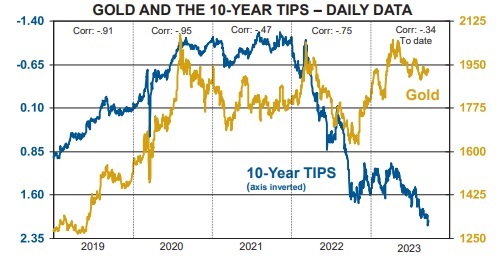

Gold dropped ~$100 from the mid-July Key Turn Date to the August lows as the USD rallied and interest rates rose. But since the August lows, gold has traded sideways within a $50 range despite a higher USD and interest rates.

Gold and real interest rates had a strong negative correlation from 2018 to 2022, but as this chart from Martin Murenbeeld’s Gold Monitor shows, that correlation has not been sustained this year. If it had, gold would be a few hundred dollars lower. Central bank buying may be supporting the gold price well above where it otherwise might be.

My short-term trading

Over the years, I’ve noticed that the first few trades I make after I’ve been away from my desk for a while are usually losers. That was the case again this week after I was visiting friends and family last week.

I took a handful of small losses in crude oil, Mexican Pesos, the S&P and the Euro. I made a little money buying the CAD and the Peso, but my net realized P+L on the week was a slight loss.

I bought TNotes on Friday, looking for a bounce, and that was the only position I held into the weekend.

On my radar

I have maintained that inflation and interest rates would stay “higher for longer” than consensus expectations. I’ve also thought we would see more strikes as workers try to “catch up,” not just to rising prices but also to other workers.

The UAW strike is expanding, no surprise, and Kaiser Permanente Health workers will probably strike in early October. The fact that GM’s CEO was paid ~$29 million in 2022 (about 350X the average GM worker’s pay) will be a strong rallying call for workers.

Rising energy costs and wages will keep inflation above the Fed’s target.

Budgetary wrangling in Congress may result in a partial US Government shutdown beginning in October.

I’m long TNotes because I think the bond market is oversold and due for a bounce, but I also think the stock market is “topping out” because of recession worries, and rising interest rates. A 4.5% TNote yield may look attractive to investors worrying about stock market weakness.

Positioning is a considerable risk for the stock market. Systematic and trend-following funds are very long, and if prices turn much lower, they will become sellers, exacerbating downside pressure.

The Barney report

The Barns turned two years old two weeks ago. My wife calls her picture of him on his birthday a classic – I agree!

Catch the Energy Conference in Calgary Saturday October 14

My long time friend (and excellent energy market analyst!) Josef Schachter is hosting his annual conference in Calgary three weeks from now. You can get all the details here.

I will attend the conference. I have been impressed every year at the quality, expertise and techological inovations of the energy companies that come to his conference to “tell their story.”

The Premier of Alberta, Danielle Smith, will be the opening speaker this year.

I recommend buying a quarterly subscription to Josef’s Black Gold Service (C$249 – use coupon code MT23 to get $100 off) which also gets you two tickets to the conference. Such a deal!

Listen to Victor talk about markets

I talked with Mike Campbell for about 8 minutes this morning on his hugely successful Moneytalks podcast. We talked about the Fed once again telling the market that rates will stay higher for longer and what that means for stocks, bonds and currencies. My spot with MIke starts around the 1-hour 9-minute mark. You can listen here.

I also did a 30 minute interview with Jim Goddard this morning on the This Week In Money show. We discussed Central Banks, currencies, interest rates, the stock market, gold and crude oil as well as some of my core trading principles. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Kings Links

I played golf with my son and a long-time friend at the Kings Links golf course last Saturday. The course is owned by the Newell family and they have done a fabulous job of maintaining a classic sea-side links course. It is my favourite course in Vancouver and I highly recommend it to all golfers.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.