The highest conviction trade in the world

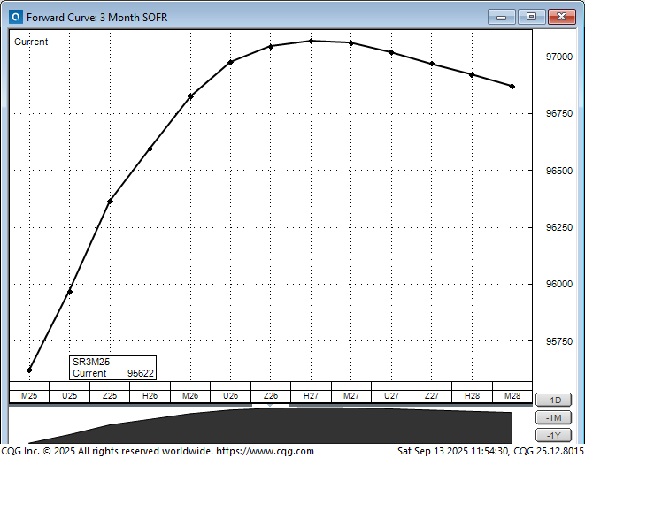

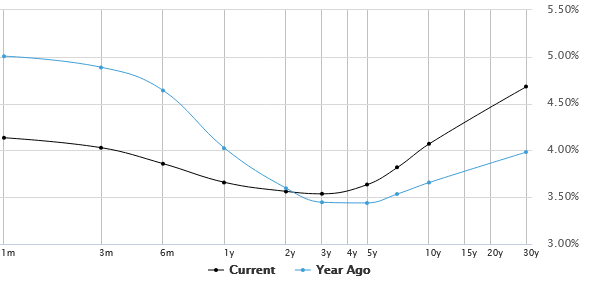

The highest conviction trade in the world is that the Fed will cut short-term rates by 25 basis points next week as it begins an easing cycle that will take interest rates down ~100 basis points by early 2026, and perhaps by ~150 basis points by late 2026.

The consensus view is that the Fed is making a fundamental shift in policy priorities; it is now more focused on its “full employment” mandate and is less concerned about containing inflation (despite inflation being a top concern for consumers, especially lower-income consumers).

The consensus view is that the “roll-out” of this change in policy priorities will occur gradually, unless 1) unemployment rises sharply and/or 2) inflation rises sharply. This week’s headline CPI was 2.9% YoY, core was 3.1% YoY, very close to market expectations. The market is currently pricing less than a 10% chance that the Fed will cut by 50 basis points on Wednesday.

The market appears to be accepting the idea that the Fed will tolerate inflation above its 2% target rate. (Is 3% the new 2%?)

The consensus view that the Fed will be cutting rates is having an impact across markets. Gold (and silver) are higher, as are global equity indices, while the US Dollar and bond yields are marginally lower.

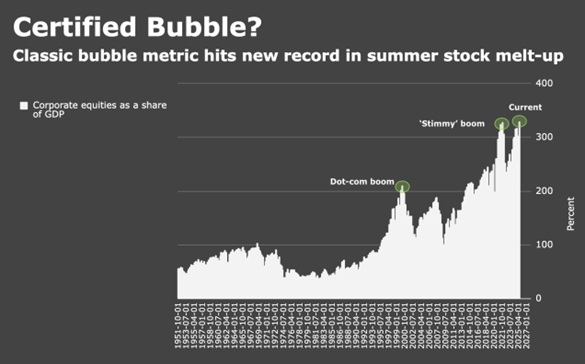

Ruchir Sharma (Chairman of Rockefeller International) wrote an excellent opinion piece in the FT on Wednesday, arguing that amid loose financial conditions and a bubbly market, this is exactly the wrong time for the Fed to be cutting rates. I expect the Fed and most market participants will ignore his advice, but he makes some good points.

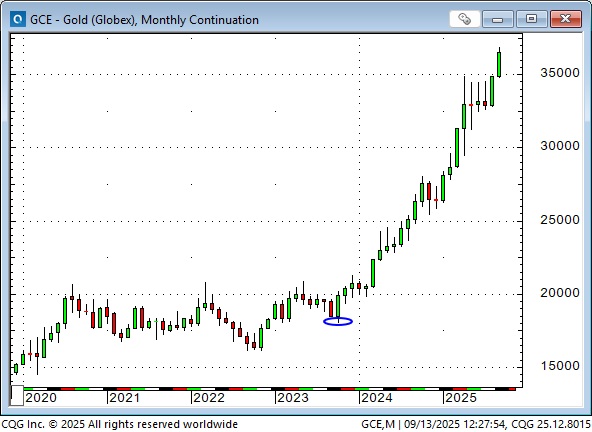

Gold

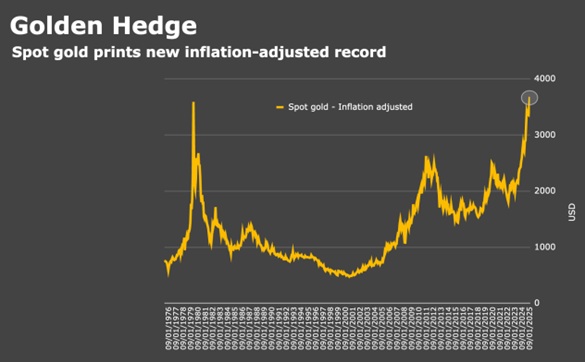

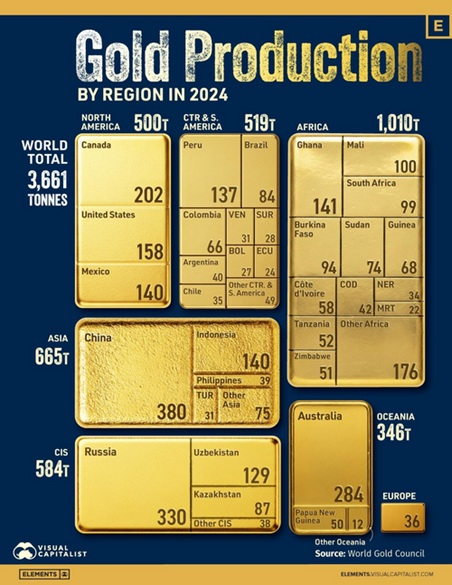

Gold is now at an all-time high in both nominal and inflation-adjusted terms. It is up ~40% YTD, ~100% since October 2023, before the Hamas attack on Israel (blue ellipse).

The total US dollar value of all known gold holdings (i.e., excluding unmined known gold reserves) is now over $20 trillion, which is approximately one-third of the market capitalization of the S&P 500 share index, currently around $56 trillion.

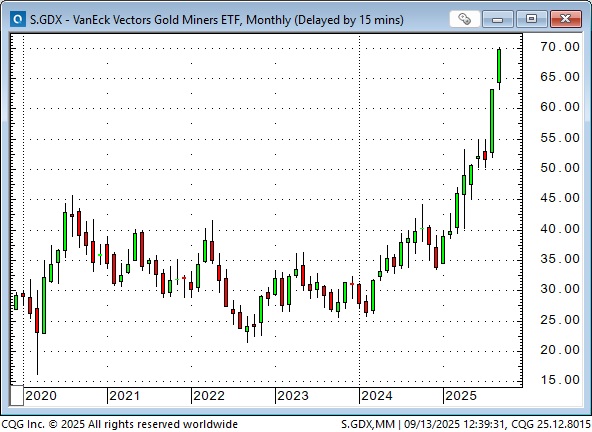

The GDX (an ETF of gold mining shares) rallied to all-time highs this week, up ~130% YTD.

Is the gold rally a referendum on the fiat monetary system? Are central bank bids price agnostic? If the Fed will tolerate higher inflation, is the gold rally foreshadowing the possibility of a return to negative real interest rates?

One of the topics Mike Campbell and I discussed on this morning’s Money Talks show was how to trade the gold market now that prices have gone parabolic. I started trading gold in 1974 and have vivid memories of the parabolic surge and collapse in late 1979 and early 1980 (gold rallied from ~$500 to ~$850 and back to ~$500 in twelve weeks. Silver was even more dramatic, rallying from ~$20 to ~$50 and back to ~$20 in thirteen weeks.) My general observation about parabolic markets (thank you, Bob Farrell and Lance Roberts!) is that they don’t correct by going sideways. Individuals purchasing gold as a long-term hedge (as opposed to seeking a quick trading profit) should be prepared for a potential price correction of 10-20%.

You can listen to this morning’s Moneytalks show here. My spot with Mike starts around the 1-hour, 8-minute mark.

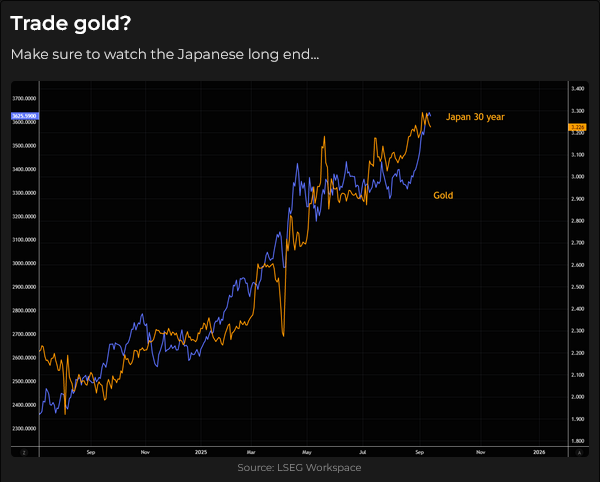

The yield on the Japanese 30-year bond and the price of gold are both near all-time highs, after a highly correlated rise over the past year.

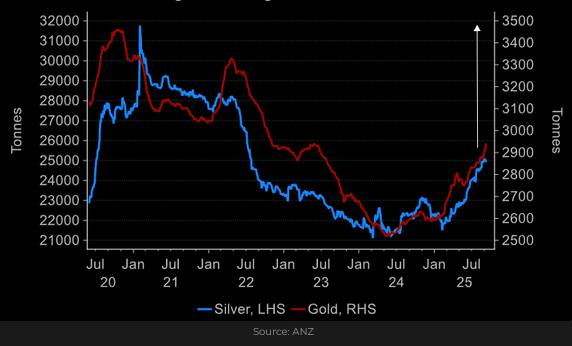

Gold and silver ETFs have been rising this year, following net sales over the past few years.

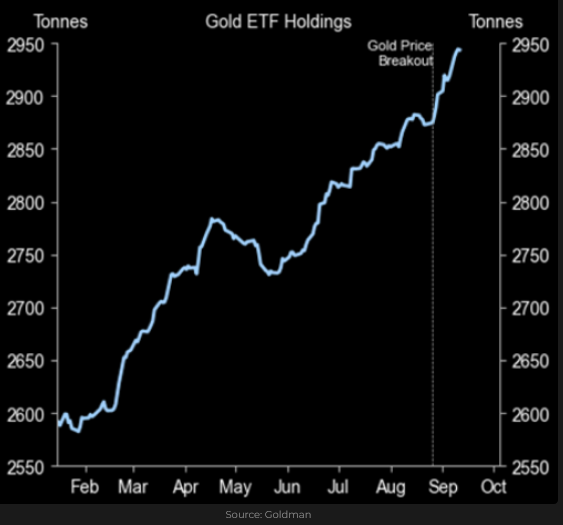

Here’s a close-up of the gold ETF YTD.

A dovish Fed = new record highs for stock indices

Bullish sentiment for AI and technology also boosted equities. Oracle’s market capitalization increased by approximately $245 billion on Wednesday’s opening.

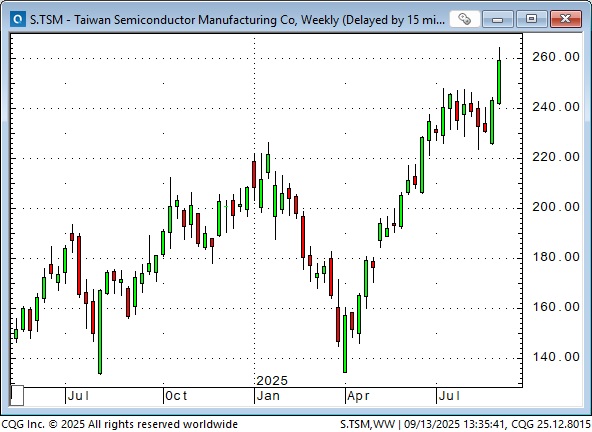

TSM shares doubled from their April lows to this week’s highs, representing an increase of roughly $500 million. Tony Greer states that the “bear case” for stocks is now akin to an asteroid hitting the Earth.

Not surprisingly, given the runaway bull market in equities, some analysts are making the case that “old school” valuations don’t apply to today’s markets. (That sounds a little like “it’s different this time” to me.)

An old friend, Hubert Marleau, the patriarch of Palos Capital Management in Montreal, makes a thoughtful “old school” case for new highs in the S&P. (Seven reasons why we will see new highs in the S&P: +4% by the end of 2025, +10% by the end of 2026) in his September 12 weekly letter.

1) strong capital expenditures, 2) solid productivity gains, 3) low energy costs, 4) easier Fed monetary policy, 5) the deregulation bias of the Trump administration, 6) share buybacks, 7) a weakening US Dollar.

Bonds

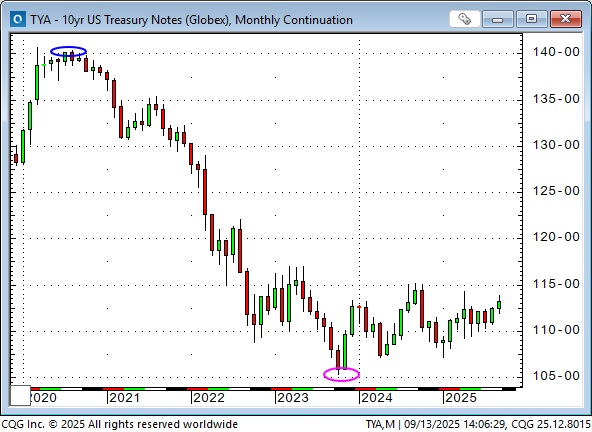

The yield on the US 10-year Treasury hit an all-time low of ~0.50% in August 2020 (blue ellipse) as covid swept the world. It rose to a 16-year high of ~4.95% in October 2023 (pink ellipse). (Yields rise as bond prices fall.)

10-year prices have trended higher (yields lower) YTD despite a sharp correction around Liberation Day, with yields now back to year-ago levels of ~4.07%.

30-year bond prices rallied in Q1, stumbled on Liberation Day, then fell to 30-month lows in mid-May. Prices have recovered since then, but not nearly as enthusiastically as shorter-term bonds, causing the yield curve to steepen. The 30-year yield high was ~5.05% in mid-May; it is now ~4.68%. One year ago, it was ~3.95%.

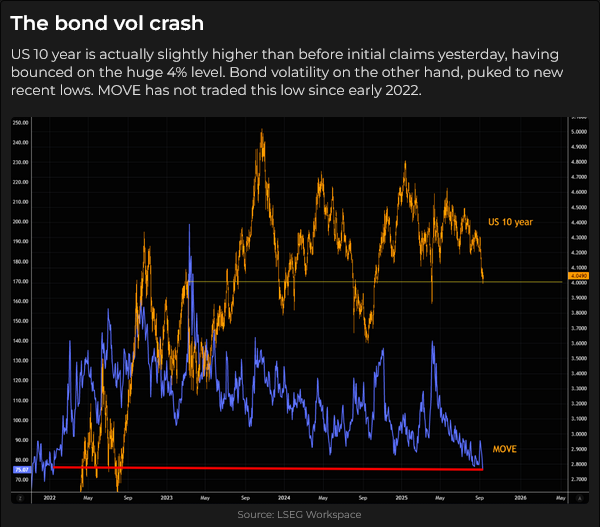

Bond VOL (the MOVE index) has fallen to three-and-a-half-year lows, down sharply from the Liberation Day spike.

In last week’s bond comments, I wrote:

“I can envision a “teeter-totter” of bond sentiment from now on, with the bullish side believing that bonds will rally as employment softens and the economy weakens (and bonds rise relative to stocks), while the bearish view holds that governments will be unable to match expenditures with revenue and will continue issuing more and more bonds (rather than balancing the books and getting voted out of office!)”

“I’m generally going to side with the bond bears, as I believe governments will choose to continue debasing (reducing the purchasing power) of their currencies rather than balance the books. Still, there will be times, and perhaps this coming week, with BLS revisions, CPI, and PPI, when the bond bulls will be winning.”

Currencies

The DXY US Dollar Index has been sideways to lower in a relatively narrow range since tumbling at the beginning of August, following a much weaker-than-expected employment report.

The Euro has been the inverse of the DXY.

The Yen rallied on the weak August US employment report, but has drifted lower over the last six weeks.

The Euro closed this week at an all-time high against the Yen, up ~12% from the February lows, up ~40% from the 2022 lows, and up over 80% since 2012 (when Abe introduced his Three Arrows program to stimulate the Japanese economy). At some point, I expect this trend to reverse. (The Yen has fallen much more than the Euro against the USD, and if there is pressure from the Trump administration to “revalue” foreign currencies, Asian currencies may be revalued more than European currencies.)

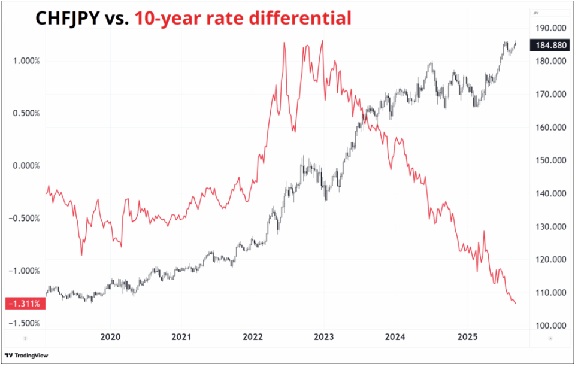

The chart below shows the Swiss Franc rallying against the Yen (the black line) over the past five years (the Swiss, like the Euro, is now at an all-time high against the Yen). The red line represents the 10-year interest rate differential between Swiss and Japanese bonds. In 2022, the Swiss 10-year bond had a yield premium of ~1.0% over the Japanese bond, but since then, the differential has shifted in favour of Japan, with the Japanese bond now at a yield premium of ~1.3% over the Swiss 10-year bond. The “correlation breakdown” of the Swiss rising, along with a rising interest rate differential, from 2020 to 2023 and then continuing to rise when the differential shifted dramatically in favour of the Yen, points to “something new” in the Swiss/Yen relationship.

What happened in late 2022? Well the DXY US Dollar Index (heavily weighted with European currencies) hit a 22-year high and reversed lower. Since then, the Euro has increased by ~22% against the USD, the Swiss Franc by ~26%, and the British Pound by ~30%. However, the Yen remains flat, maintaining its 2022 value against the USD.

Since the fall of 2022, the Euro STOXX 50 Index has increased by ~70%, and the Japanese Nikkei 225 Index has risen by ~80%. (So, both broad stock markets are up about the same amount.)

Since the USDX topped out in September 2022, the Yen has been inordinately weak against other leading currencies. I suspect that hasn’t gone unnoticed by people in the Trump administration.

The Josef Schachter Annual Energy Conference – Calgary, October 18, 2025

I look forward to attending Josef’s annual energy conference again this year. I’ve attended every one over the past several years, and I’m not only continually amazed at the quality and diversity of the presenters, but I also learn more every year about the energy business and the incredible technological advances the industry is undergoing. For more information about the conference and to buy a ticket, click here.

My short-term trading

I’ve done minimal trading this week. I don’t want to buy or sell stocks or gold at all-time highs. I’ve considered writing calls against the bonds, but I’ve dragged my feet on that, and so far, that’s been the right thing to do. The currency markets seem to be dead in the water, and I’ve been stopped twice for tiny losses trying to pick a bottom in the Yen. I was flat going into the weekend.

The Barney report

Here’s Barney, the Golden watchdog, at his watchtower window in a 2nd floor bedroom. He will sit there silently, watching people come and go in the neighbourhood, but if someone enters our driveway, he will start barking loudly. If they knock on our front door, he goes ballistic with the barking and runs downstairs to the front door. If we open the door, he immediately rolls on his back, inviting tummy rubs.

In addition to doing my regular weekly spot with Mike Campbell on the Moneytalks show this morning, I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money show. You can listen to the show here. My spot with Jim starts at the 9.42 minute mark, right after my long-time friend Ross Clark’s market overview.

Jim and I discussed the “highest conviction trade in the world.” Then we drilled down on bonds, gold, the US Dollar, the Canadian dollar, stock indices, copper and crude oil before wrapping it up with my thoughts about the things that have remained the same in markets after all these years: despite all the technological improvements, and despite all the “machines” trading the markets, people still make emotional trading decisions based on fear and greed – and that creates the big trading opportunities.

he Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.