Trump shocks markets: he will hit Canada and Mexico with 25% tariffs on ALL exports

On Monday afternoon, November 25, Trump announced that on his first day as President, he would levy 25% tariffs on ALL imports from Canada and Mexico – if they did not halt the flow of illegal migrants and dangerous drugs into the USA. (This was somewhat reminiscent of Joe Biden cancelling the Keystone Pipeline on his first day as President – letting the world know there was a “new sheriff in town.”)

The announcement came during the “thinnest” volume hour of the 24-hour global FX market (when North American markets are effectively closed, and early Asian markets are barely open), and the CAD and MEX tumbled. The CAD plunged ~1.5% to 4-year lows.

The MEX plunged over 2% to 2-year lows.

By Friday’s close (circled), the CAD (and the MEX) had recovered all of the announcement losses as politicians, business people, and economists in Canada, Mexico, and the USA scrambled to “reach out” to Trump to explain cross-border trade bilateral benefits (and complexities). Mexico promised to block migrants from entering the USA.

Despite Trump repeatedly saying that he would institute 10% tariffs on all countries while campaigning, announcing a 25% levy on ALL Canadian and Mexican imports was a shock because the USMCA agreement (reached in 2018 during Trump’s first term) encouraged near-shoring and friend-shoring with Canada and Mexico as a way to reduce imports from China.

Two takeaways from Trump’s 25% tariff announcement

1) Markets should prepare for more “shocks” from Trump, even before he becomes President. President Trump = higher VOL.

2) CAD price action this week may be a “news failure” (a falling market is hit with bad news, falls briefly, but then recovers), signifying a possible trend reversal. Open interest falling ~10% in the past two weeks may indicate that the massive speculative short position in Canadian Dollar futures is being reduced. (The release of COT data as of November 26 is delayed until next week due to the Thanksgiving holiday.)

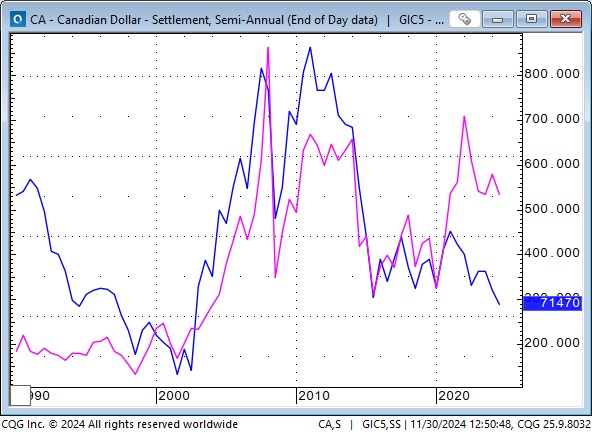

The CAD over the past thirty years

The CAD reached a historic low of around 62 cents (1.61 CAD to buy 1 USD) in January 2002. Less than six years later, it reached a historic high of 1.10 (91) in November 2007, as Chinese demand for commodities soared.

Since 1999, there has been a high correlation (in price trends, if not amplitude) between the CAD and the Goldman Sachs commodity index. The GIC5’s component weighting is approximately 54% energy, 27% agriculture, 12% industrial metals, and 7% precious metals.

The CAD is blue, and the GIC5 is pink in this analog chart. (The scale is set to the GIC5.)

The value of the CAD relative to the USD is impacted from time to time by Canada-specific events, such as a significant change in the Canadian Federal Government. Still, over time, events outside of Canada (such as a Trump announcement of a 25% tariff) seem to have a more significant impact.

In the long term, the CAD has fluctuated with commodity prices, which are not set in Canada.

The strength or weakness of the US Dollar against all currencies is also significant. If the USD is rising against most foreign currencies, it is probably also rising against the CAD.

Interest rate differentials are often crucial factors in foreign exchange rates. For the past 30+ years, Canadian rates have usually been above or level with US rates. But, over the past two years, and especially over the past several months, Canadian rates have been significantly below US rates as the BoC has cut (and is expected to keep cutting) more aggressively than the Fed as the Canadian economy is weaker than the US economy. (Why it is weaker may be due to Canada-specific reasons, such as poor Canadian government policies.) Canadian rates below US rates have been bearish for the CAD.

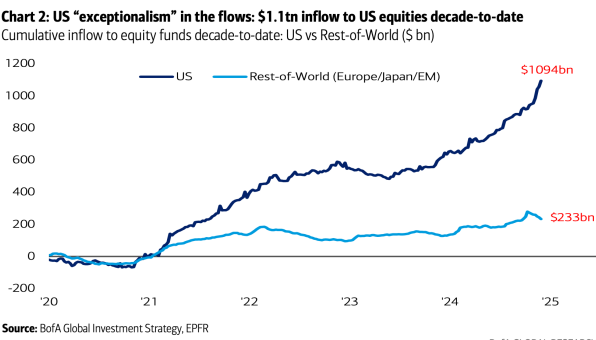

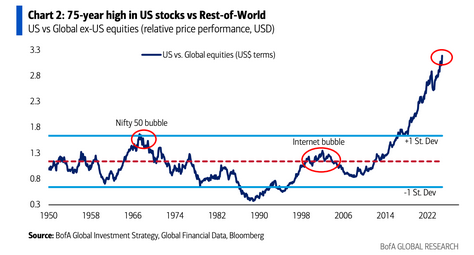

As I have frequently written on this blog, capital flows to America for safety and opportunity. Whether those flows come from short-term speculators or long-term investors like pension funds, capital flowing to the USA increases the value of the USD against other currencies, including the CAD.

American exceptionalism is apparent in relative economic outperformance and is stark in equity market outperformance.

Equity markets

The S&P closed November at another record high, with the biggest monthly gain since November last year. The DJIA also closed the month at a record high, with the best monthly gain since November 2022.

The Russell 2000 small-cap index surged higher in November and closed at a record high.

The Toronto Composite had its best month in four years and closed at a record high. It has rallied ~19% in the last four months.

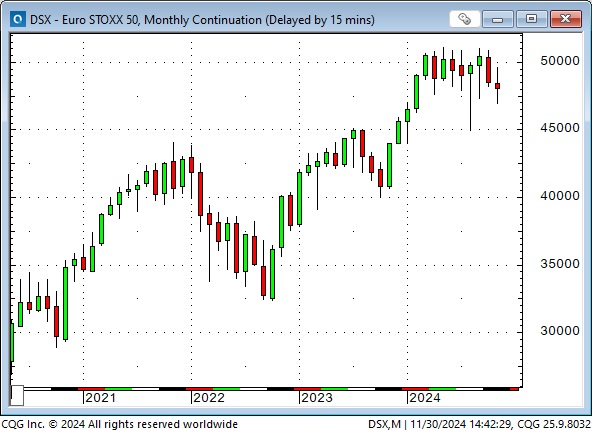

The Pan-European STOXX 50 Index has chopped sideways this year, falling behind the soaring North American equity market indices.

The Mexican market reached 10-year highs in April but has fallen ~30% since then.

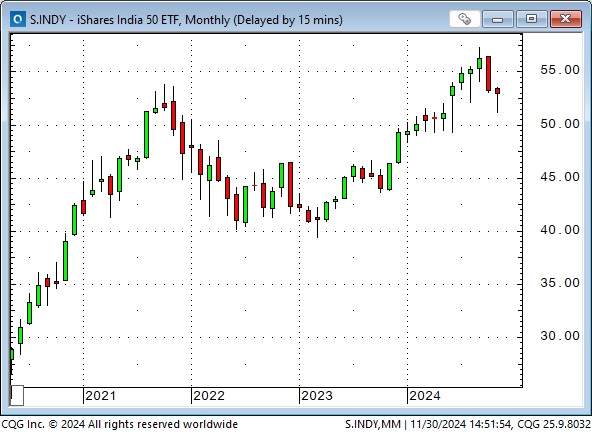

The Indian Nifty Fifty Index of big-cap stocks reached record highs in September but has corrected ~7%.

Bonds

The US Treasury 30-year bond future had its best week in three months, gapping higher Sunday afternoon (following Trump’s nomination of Scott Bressent as Treasury Secretary last Friday afternoon.)

You’ve got to love the correlation between the US long bond and the Yen!

Gold

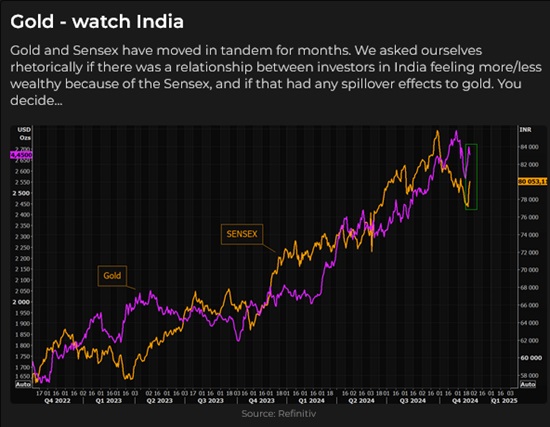

Comex December gold hit record highs above $2,800 at the end of October, sold off ~$260 into mid-November, bounced back ~$180, with every day green last week, and then plunged over $100 on Monday.

Comex open interest has declined ~20% since the late October price highs, and there has been significant net selling in gold ETFs. The GDX (ETF of gold mining company shares) is down ~14% from 4-year highs reached in October. Gold shares have underperformed gold this year. Gold price volatility seems to have been driven chiefly by ebbs and flows in geopolitical stress. Even though there has been an escalation in the Russian/Ukraine conflict recently, the market may be pricing a reduction/halt to hostilities under a Trump presidency.

Coffee

Coffee futures soared in November to a 50-year high!!!

China

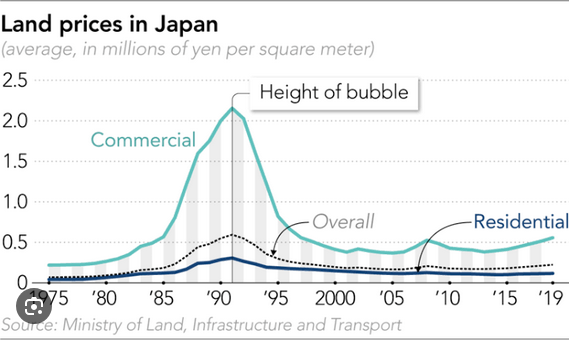

In a speech at the World Outlook Financial Conference in Vancouver in 2020, I asked, “Is China currently anything like Japan in 1989?”

In 1989, the Japanese stock market soared to the moon, then fell ~75% over the next twenty years. However, the bigger wealth explosion in the 1980s was in Japanese real estate. At its peak in 1989, the entire Japanese real estate market was said to be worth 4X all of the real estate in the USA. And then it fell—a lot.

When I asked my question in 2020, the overbuilt, overleveraged Chinese real estate market was starting to receive a lot of attention. My idea was that despite all the worrying about how China would “take over the world,” it was following the Japanese trajectory, with a 30-year lag, and was headed for a significant “correction.”

This week, 30-year Chinese bond yields were 2.2%, lower than Japanese bonds trading at 2.27%. US 30-year bonds are 4.4%. The PBoC has been cutting rates, but the domestic economy is “sluggish,” and citizens are buying bonds as a haven.

I’ve thought China was “uninvestable” for years, primarily because they could confiscate your money any time they felt like it. Innovation doesn’t happen in an autocratic dictatorship.

Thoughts on trading

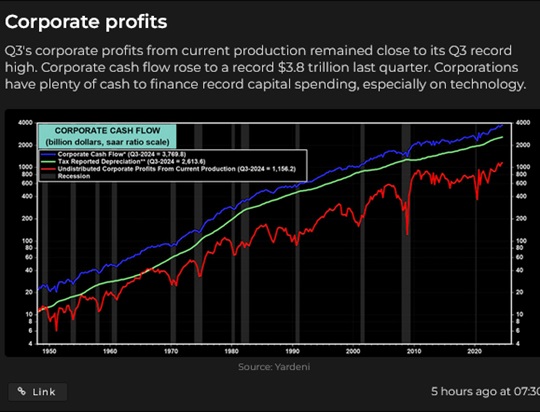

Yardini is bullish on US stocks.

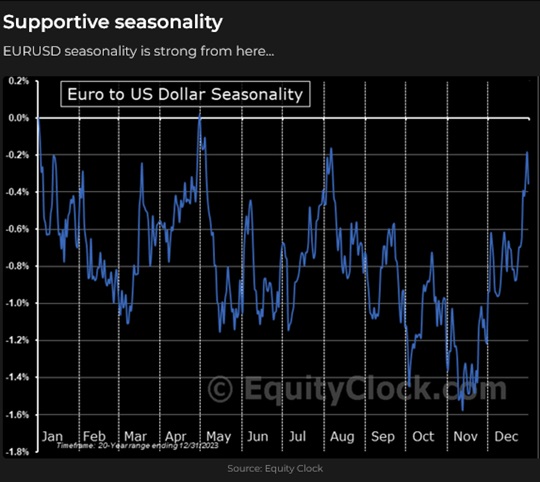

Everybody is bearish on the Euro, which has fallen hard since September, but it is seasonally bullish into January.

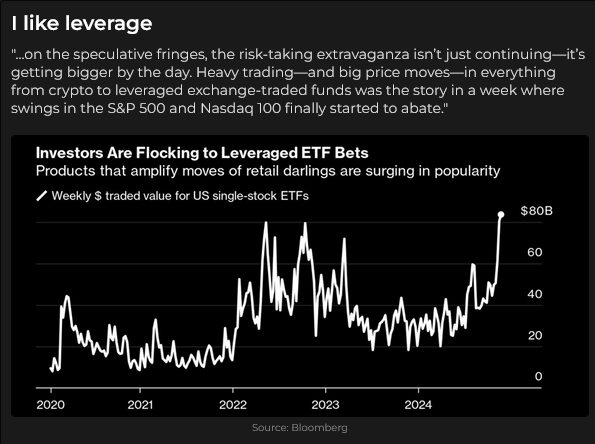

Sunday edit: I’m concerned that “animal spirits” may have driven some “Trump trades” too far, too fast. I’m not saying it’s time to get short, but be aware that sentiment in some sectors is “frothy,” and caution is warranted.

My short-term trading

I started this week long the CAD and the S&P. Both markets opened higher in reaction to Trump nominating Bressent as Treasury Secretary late Friday, but the follow-through was missing and I covered the positions for modest net gains.

I was fortunate to have covered the positions because both markets fell (the CAD much more than the S&P) on Trump’s late-day 25% tariff announcements.

That was all the trading I did this week as I was distracted by family matters and the possibility of illiquid markets during the Thanksgiving holiday.

Quote of the week

It’s not a question of enough, pal. It’s a zero-sum game: somebody wins, somebody loses. Money itself isn’t lost or made; it’s simply transferred from one perception to another. Gordon Gecko in the 1987 movie Wall Street

The Barney report

Many deer live around our house, and at this time of year, the bucks come down from the mountains for mating season. Barney has run off chasing deer before, and I’m worried that he may get injured if he chases a buck, so I’m careful about where I let him run off-leash.

This handsome buck was on the golf course just outside our back fence. Those horns could be dangerous for Barney.

Listen to Mike Campbell and me discuss markets on the Moneytalks show

This morning, Mike and I discussed the impact on the Canadian Dollar and the Mexican Peso following Trump’s announcement of 25% tariffs. We also discussed the gold market and its wild swings in November. You can listen to the entire show here. My spot with Mike starts around the 1 hour and 2 minute mark. Be sure to listen to Mike and Dr. Chris Keefer discuss Canada’s evolving nuclear energy landscape.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.