Volatile price action in leading global stock indices

At Friday’s lows, the S&P was down ~6% from the October all-time highs, and the NAZ was down ~9%. Aggressive bullish sentiment and positioning in AI fuelled the run to October’s highs, but prices began to slip in November amid concerns about massive capex expenditures.

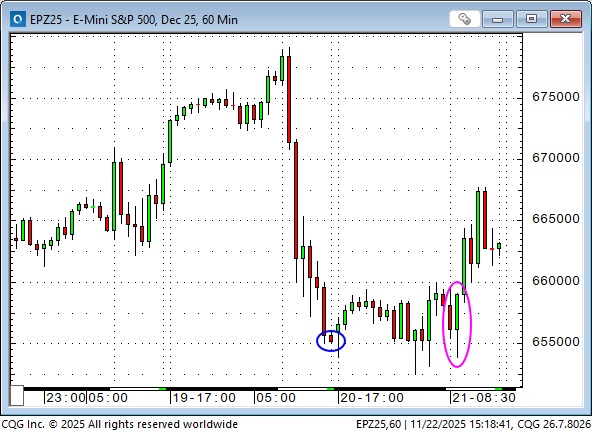

Bulls were hoping NVDA would “save the day” with their November 19 Q report, and they must have “wept for joy” when the report beat expectations (don’t they always?) on everything that mattered. NVDA gapped ~5% higher when the New York floors opened on Thursday morning (Blue ellipse) and then proceeded to tank ~12% to Friday morning’s lows (pink ellipse) in an astonishing reversal – a classic “news failure”.

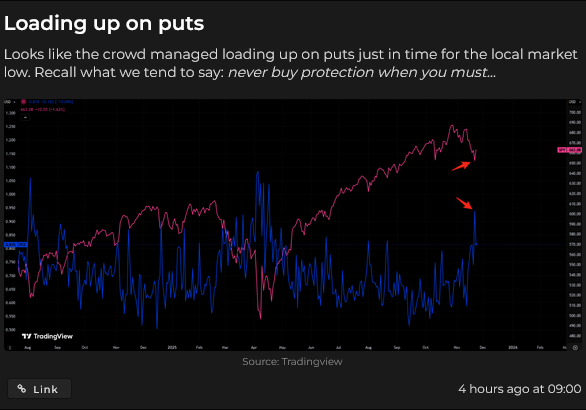

CME S&P futures trading volume on Thursday was the highest (outside of quarterly delivery periods) since the April meltdown. Put volumes also soared to the highest since April.

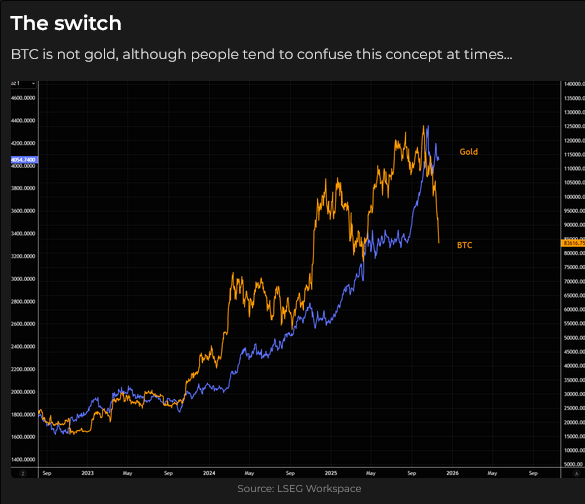

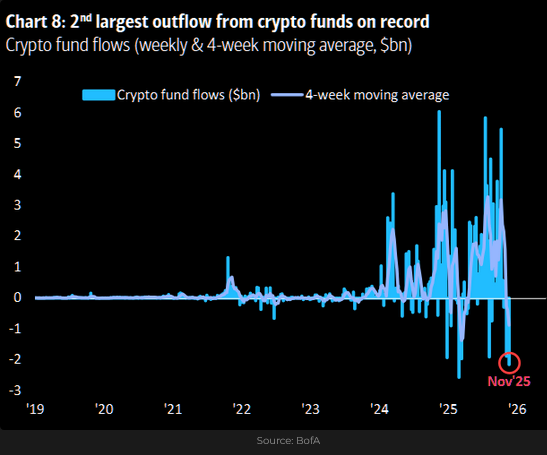

I actively trade S&P futures, and they are one of my leading “risk barometers.” I also keep a close eye on Bitcoin (although I don’t trade it) as an alternate “risk barometer.” Bitcoin reached an all-time high in early October and fell ~35% to Friday’s low, with more than half of that decline coming in the last 9 days as prices (and sentiment) accelerated downward.

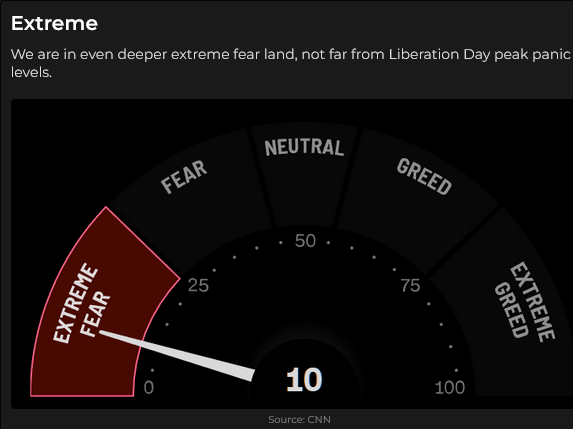

Short-term market sentiment was very bearish on Friday morning after the S&P closed Thursday at the lows on a high-volume day (blue ellipse on the chart below).

The S&P traded sideways in the Thursday (low volume) overnight session, and stayed within the overnight range on Friday’s opening (pink ellipse), but then rallied to close up on the day following positive comments from Williams (NY Fed) about an interest rate cut at the December 10 FOMC meeting.

GOOG seems to be the strongest of the big AI stocks (it’s certainly much stronger than Microsoft or Meta), and I wonder if that’s because Gemini #3 is perceived as at least as good, if not better, and much cheaper than other AI programs. (The competition in this space is going to be brutal.)

S&P Bulls Vs. Bears

The bearish arguments are essentially that the market is overvalued (priced for perfection) based on old-school metrics and is at risk of a cascade lower if a bearish trigger occurs. The granddaddy of potential bearish triggers is too much debt (or, as I wrote last week, the Achilles heel is too much leverage.)

The bullish arguments are essentially that “this time is truly different,” that AI will change the world and supercharge the economy, as the government (and the Fed, come 2026) stimulates the economy (run it hot) and as trillions of dollars of overseas capital pour into the USA. In addition, witness capital’s willingness to aggressively “Buy The Dip” at every opportunity (the trend is your friend!).

Interest rates

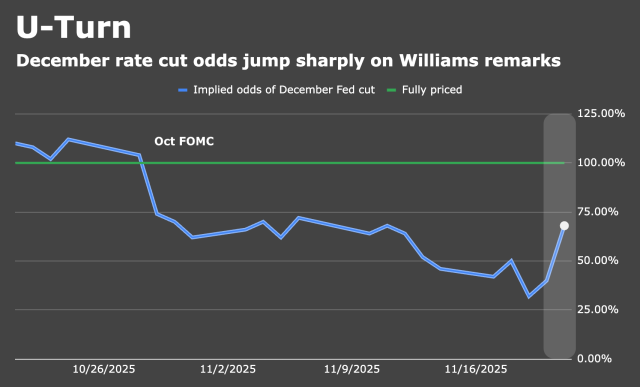

Since mid-October, the forward market has reduced expectations of a Fed cut in December from over 100% to a low of ~27% early this week. Those expectations jumped as the stock market tumbled on Thursday, and then surged higher on William’s comments on Friday. The market is now pricing ~70% chance that the FOMC will cut on Dec 10.

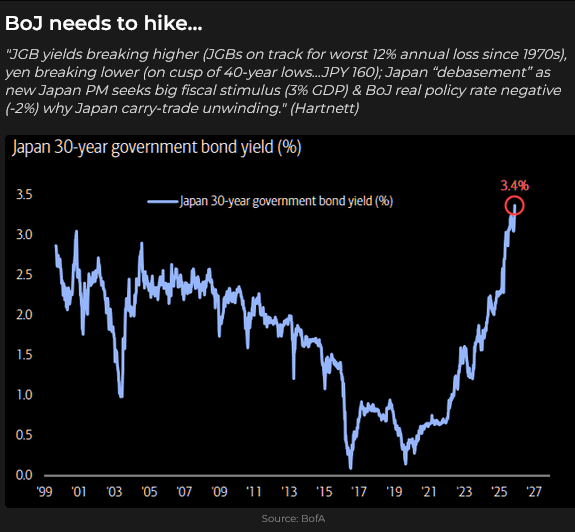

The yield of the 30-year Japanese government bond (JGB) soared to an all-time high this week as PM Takahichi plans more fiscal stimulus. The BoJ owns ~47% of the Japanese government bond market after years of “yield curve control” buying.

The US bond market has drifted sideways in November. It caught a bid on Friday morning on the weak stock market, but as the day progressed, and stocks rallied, bonds fell back. (Bonds probably didn’t like to hear Williams’ comments about a December cut, given expectations that the “New Fed” that shows up in 2026 won’t be “bond market friendly”). Bond market VOL has been rising.

Currencies

The DXY US Dollar Index posted its highest weekly close since May, as all of the other major currencies traded weaker.

The Japanese Yen has been the weakest of the major currencies over the past two months, falling to 11-month lows against the USD, and prompting “warnings” from the Japanese authorities that they don’t want to see it fall further (it has dropped over 11% against the USD since April, and hit all-time lows against the Euro this week).

The Japanese authorities intervened in the currency markets in July 2024 (when the Yen was slightly weaker than it is now), sparking a 16% rally over the following three months.

Consumer sentiment

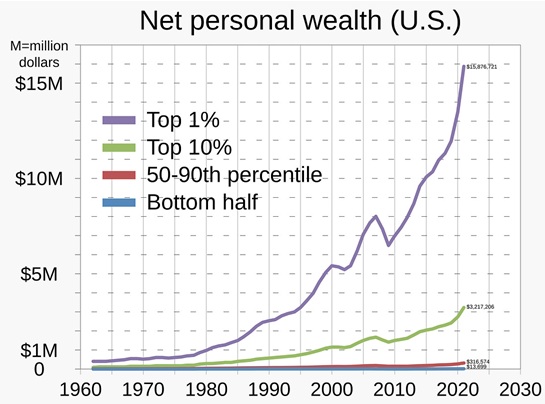

US consumer sentiment is at multi-decade lows due to the persistence of rising consumer prices and weakening incomes. Consumer debt is at record highs, while the top 10% account for ~50% of total consumer spending (they have the money to spend because their net worth has soared as real estate and financial assets have soared). If the value of their assets fell substantially, consumer spending would stop, and the country would be in a depression. Maybe there is no alternative but to “run it hot”.

Quote of the week

“As long as the price is going up, folks will believe the most preposterous stories.” Bob Hoye, market historian and long-time friend

Ukraine

I think we’re close to the end of the Ukraine war, with Ukraine ceding territory to Russia. How else could it end, as “unfair” as that may be? So what then? Russia reengages with the West and gets its “frozen assets” back. Ukraine rebuilds.

My short-term trading

I had a brutal cold this week, which meant I didn’t trade much. I started the week short CAD and long Yen calls. I covered the short CAD for a tiny loss when it rallied (for unknown reasons) on Tuesday, and I still hold my nearly worthless Yen calls (they are now “lottery tickets!”), and it will take intervention by the Japanese authorities to make them profitable.

I bought the S&P on Tuesday when it fell to its lowest level in a month, but covered for a slight loss.

I bought the S&P three times on Friday as it rallied off its lows for a slight net gain.

I’m flat into the weekend, outside of the Yen lottery tickets (they still have two weeks until expiry), and I hope to be well enough to resume trading this coming week.

The Barney report

I took Barney for lots of walks this week, hoping that fresh air and mild exercise would help me get over my cold (it didn’t). I also had afternoon naps every day, hoping that would help me get over my cold. It didn’t, but Barney was a trooper and napped alongside his Papa.

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the volatile price action in the stock market this week, how the NVDA quarterly report created a classic “news failure” in the market, which led to a nasty tumble on Thursday. You can listen to the entire show here. My spot with Mike starts around the 59-minute mark.

Mike Campbell’s 2026 World Outlook Financial Conference will be on February 6 & 7 at the Bayshore Hotel in Vancouver. Click here for information and to buy a ticket.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.