Too much leverage?

A couple of weeks ago, I wrote that “too much leverage is the market’s Achilles heel.” Google AI defines Achilles heel as: “a metaphor for a fatal weakness or vulnerability in an otherwise strong person or thing.”

I’ve traded futures and options for nearly fifty years. It’s a venue that offers exceptional opportunities for overleveraging, and I could spend the rest of the day telling you horror stories that would never have happened if the people involved hadn’t been overleveraged. (Long Term Capital Management probably rings a bell.)

The stories usually start with somebody making a lot of money quickly, using leverage, and then they do it again with more leverage, and again and then everything blows up.

I also recall writing about a winning trade a few years ago and concluding the story with a sardonic trader’s lament: “You can never have enough on when you’re right.”

Markets often react quickly to unexpected events, and the reaction can be dramatic if positioning and sentiment are dead wrong at the time. I recall a trader who made millions shorting S&P puts as the market rallied in the late 1990s. He kept doing the trade over and over, using bigger and bigger size, as “everybody knew” the market was going higher, and every dip was a golden opportunity to buy more. When the market broke, it broke hard because “everybody” was wrong, and he lost all his money (and then some); his brokers sued him for the debits.

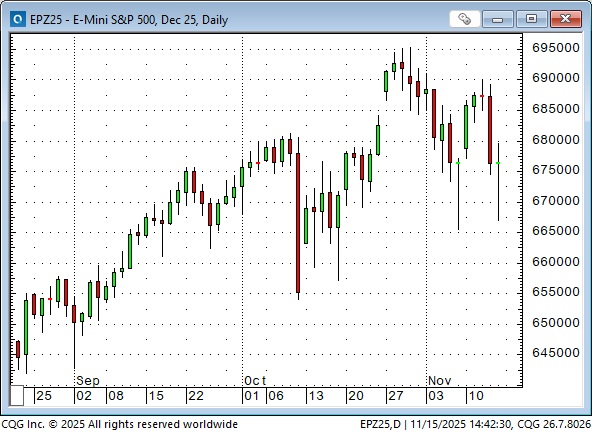

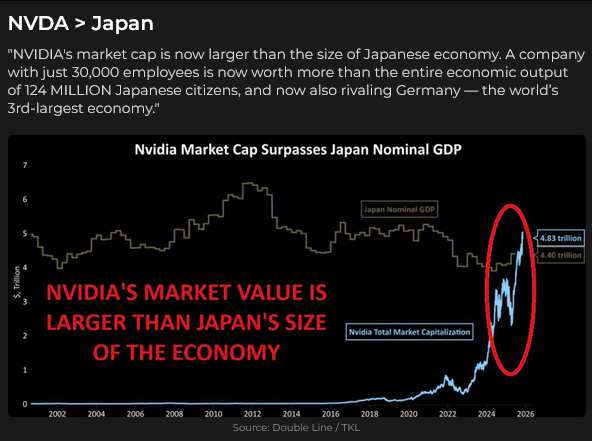

When you look at this chart, you don’t have to guess how “everybody” is positioned. I’m not saying it’s going to crash tomorrow, and it could go a lot higher from here, but with all the leverage people are using these days, the “correction” could be dramatic.

Recent events

The leading American stock indices, as well as many other global indices, have been at or near all-time highs in recent weeks. Price action has been choppy.

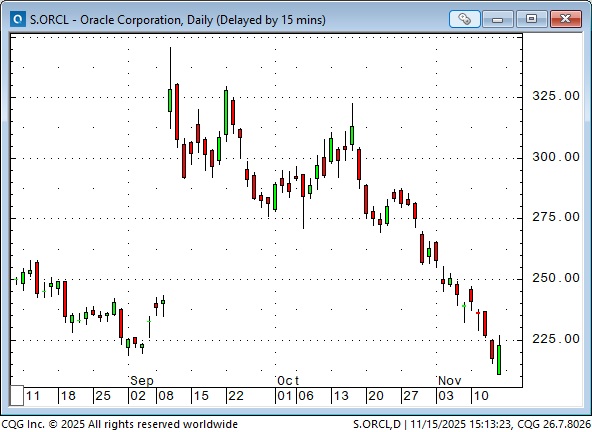

Oracle and META have been two of the weakest BigCap tech stocks in recent months.

Alphabet has been one of the strongest.

The overall tech sector surged higher in late October on the AI story, but fell back by ~8% as sentiment turned skeptical.

The more speculative issues, especially those aggressively bid by retail traders, have weakened more than the overall tech sector.

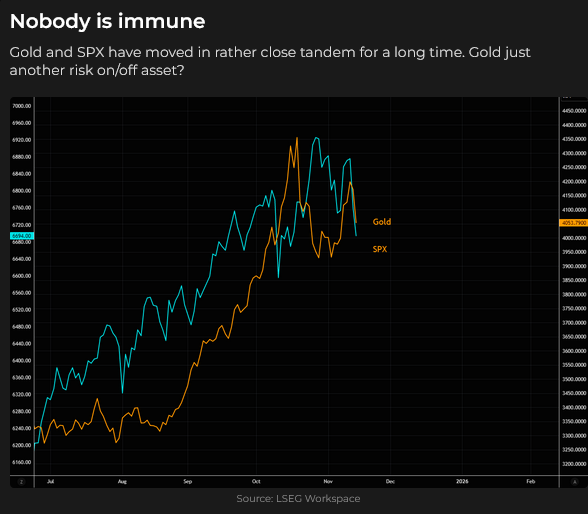

I actively trade S&P futures and use them as my “leading barometer” of risk sentiment. I also watch how price action in the S&P correlates with other assets. For instance, as gold rallied ~$1,000 from August to October, I think it “transitioned” from being primarily a “debasement hedge” to being just another risk asset for speculators to chase higher.

I don’t trade Bitcoin, but I watch it as another “risk sentiment barometer”, and, on balance, it adds to my skepticism.

NVDA’s quarterly report is due on Wednesday, November 19. My cynicism says it will beat expectations (don’t they all?), but the market bulls need a “leading light” right now, and a surging NVDA would make a great “Rudolf” for a Santa rally into year-end.

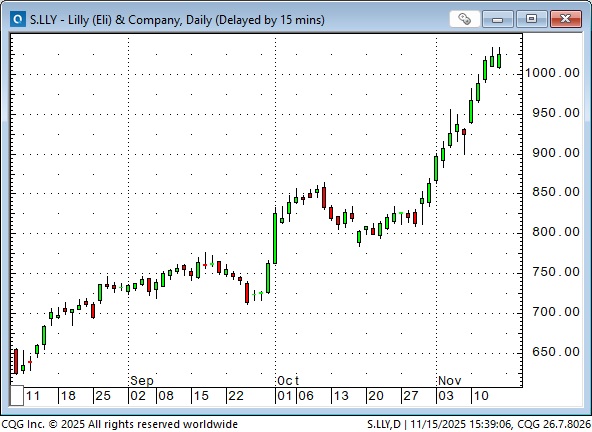

While skepticism about AI is weighing on the tech sector, the healthcare sector is “doing fine,” with some issues adding buoyancy by losing weight. LLY is up ~66% from the April lows.

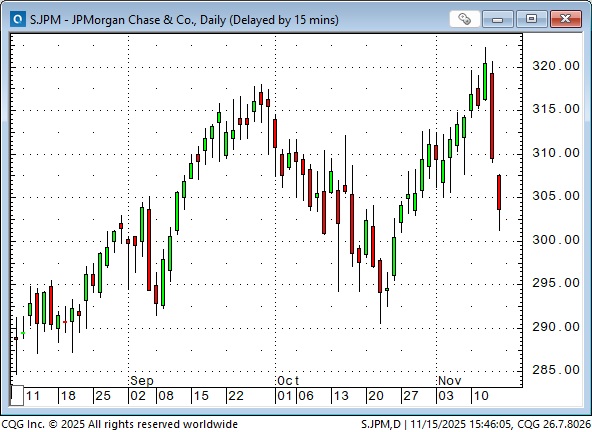

JPM hit an all-time high on Wednesday, but was down ~6.5% at Friday’s lows.

Interest rates

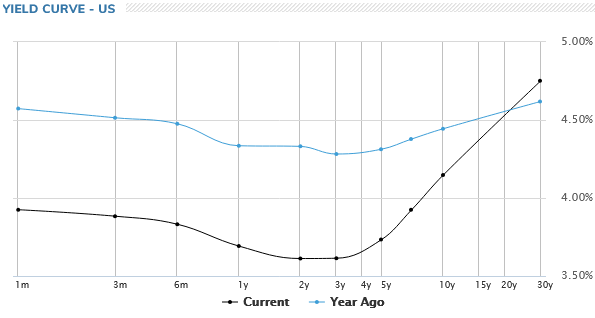

Short-term rates have been rising over the past month, with the market now pricing only a 50/50 chance of the Fed cutting rates in December. That’s down from a 90% chance last month.

Bond yields have also been rising over the last month, with the 10-year now at ~4.15%, and the 30-year at ~4.75%.

Currencies

The DXY US Dollar index hit a 40-month low on September 17, following the FOMC’s rate cut, and rallied over 4% to its highest level this month.

The Japanese Yen has been the weakest of the G10 currencies against the USD over the past several months, closing this week at its lowest levels since January.

Energy

Nymex front-month crude oil spiked in response to the Israel-Iran confrontation this summer, but has been under pressure since then as current (and early 2026) supply appears to be greater than demand.

Shares of oil producers have outperformed the oil price.

Refiners have had a strong rally.

Nymex natural gas prices are preparing for winter, and foreign demand for LNG.

My short-term trading

I started this week short WTI and long Yen and bond calls. I was flat the S&P after a good week last week, trading it from both the long and short side.

I covered my short WTI for a modest gain this week and covered the bond calls for a modest loss.

I kept my Yen calls as they gradually shrank in value. I mismanaged this trade. If I had been long Yen futures, I would have covered them, but the “limited loss” aspect of owning the calls allowed my “idea” that the Yen was overdue for a bounce to override my risk management rules. The options now have limited value, but they still have 19 days to expiry, so I may get a lucky bounce.

I shorted gold on Thursday after it dropped below Wednesday’s close. I thought the rally off last week’s close had run out of steam. However, I covered the trade in the overnight market for a slight loss and missed the $150 drop into Friday’s lows.

My primary focus this week was trading the S&P. I was looking for the bounce off last week’s lows to run out of steam, and I caught a good chunk of the Thursday/Friday breakdown, covering near Friday’s early morning low. I went long the S&P as it rose from Friday’s lows and covered ahead of the close. My P&L had a good week.

My positions at the end of the week: short CAD and long Yen calls.

If you were wondering: The guy in the cartoon drawing on the front page of this report is Michael Burry, who made millions in The Big Short when the market collapsed in 2008. I selected him for the lead spot because (apparently) he has been short the AI rally, but closed his fund this week. (Some folks say he is still short.)

The Barney report

Barney loves chasing a ball almost as much as he loves chewing on sticks. He’s great at chasing a ball and is getting better at bringing it back to me. Here he is having a little rest after 20 minutes of intensive ball chasing!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I focused on the extraordinary short-term volatility in stocks, precious metals and Bitcoin. You can listen to the entire show here. My spot with Mike starts around the 48-minute mark. Be sure to listen to Mike’s interview with my friend Kevin Muir, the Macrotourist.

Mike Campbell’s 2026 World Outlook Financial Conference will be on February 6 & 7 at the Bayshore Hotel in Vancouver. Click here for information and to buy a ticket.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.