The US Dollar rallied against virtually all currencies over the past two weeks

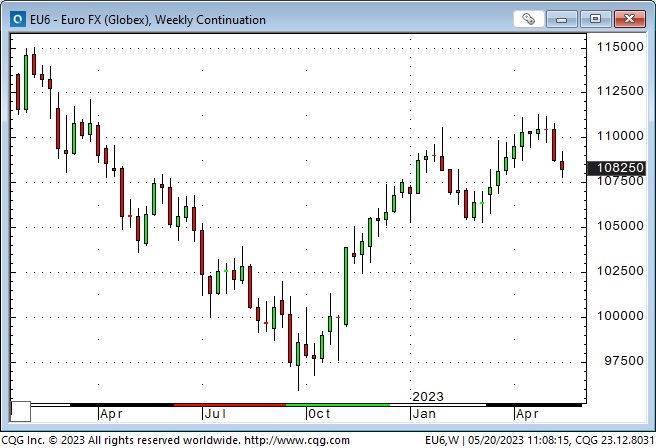

The US Dollar Index hit a 20-year high last September but then trended lower (down ~12%) to support levels ~101.

Net speculative positioning was very bullish on the USD leading up to the September 2022 highs. It had turned very bearish at the recent lows, with speculative traders aggressively net long the Euro. (I’ve recently called the Euro the “Antidollar” due to this positioning.)

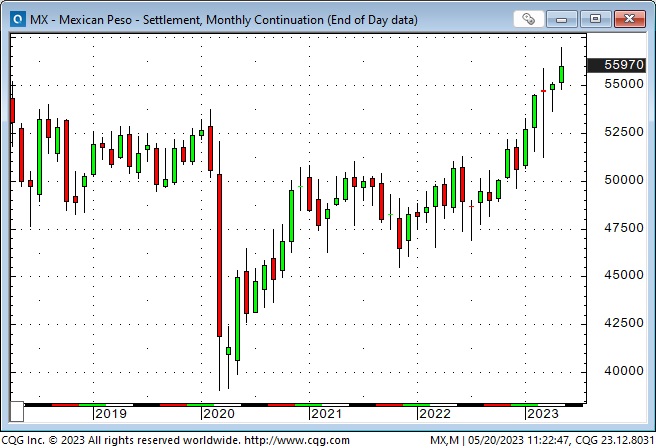

The Mexican Peso trended lower against the USD for 25 years, falling ~75% from 1995 to the All-Time Lows made during the Covid crisis in early 2020.

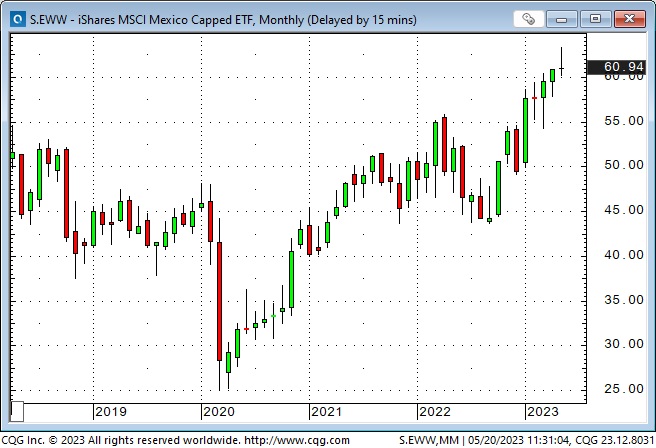

But the Peso has rebounded smartly; its ~42% gain against the USD over the past three years has made it one of the strongest currencies in the world! Short-term interest rates, currently ~11.5%, have supported the Peso, and the Mexican stock market (now at 9-year highs) has drawn capital to Mexico.

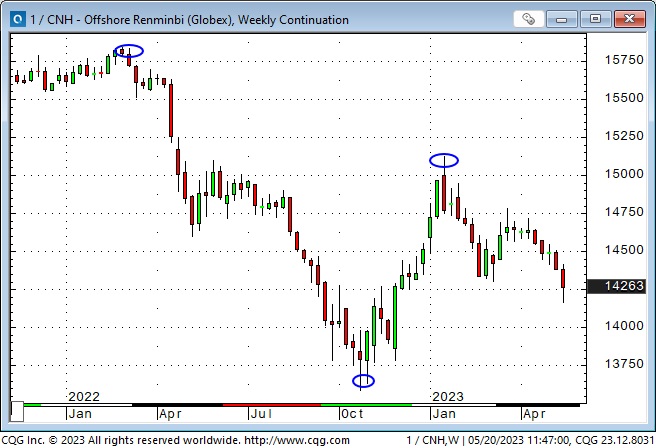

The Chinese RMB trended lower against the USD following the Russian invasion of Ukraine but turned higher in October (many currencies turned higher from multi-year lows against the USD in Sept/Oct 2022.) That rally reversed in January, and China’s tepid “re-opening” has seen the RMB drop to a 6-month low. (China is Germany’s largest export market, a tepid “re-opening” is not good news for the Euro.)

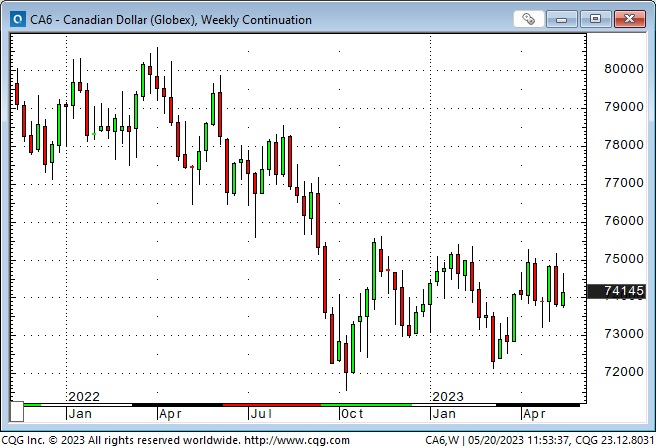

The Canadian Dollar has traded mostly within a 72 to 75-cent range over the last nine months.

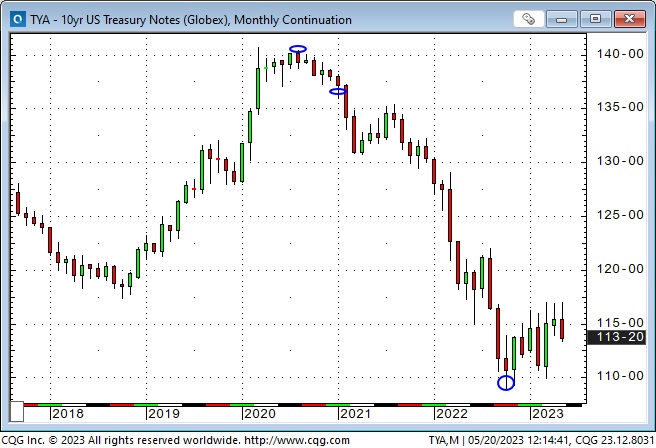

Interest rates

Bond prices hit record highs, and yields hit record lows in August 2020, with the 10-year at ~0.50%. Prices began a sharp decline in January 2021 (and the USD turned higher) in anticipation of an aggressive monetary policy from the Fed.

Prices bottomed in early October 2022 (about the same time the USD peaked), with the 10-year yield at ~4.25%.

Bonds rallied on the “banking crisis” in mid-March, but the 10-year futures contract ran into resistance around the 117 level, and the decline over the past two weeks (rising US interest rates) has coincided with the rally in the USD.

Short-term interest rates reacted dramatically to the mid-March “banking crisis,” with the SOFR futures pricing in a 2% drop in the anticipated December 2023 rate in only five trading sessions. However, over the last two weeks, as sentiment has returned to the Fed remaining “higher for longer,” the market has re-priced December rates higher by ~75 bps. This has contributed to USD gains. The next FOMC meeting is June 14, and there is an outside chance that the Fed will raise interest rates – if the debt ceiling issue is no longer a worry.

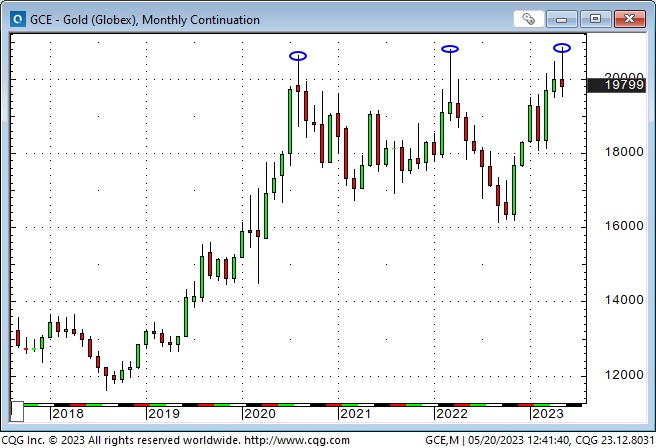

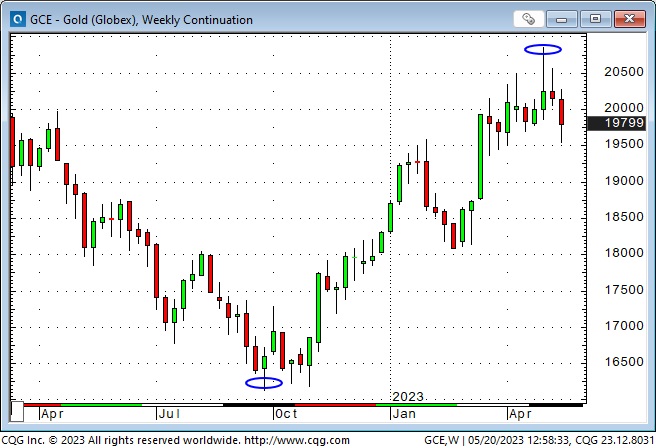

Gold

Comex gold prices hit All-Time Highs of ~$2063 in August 2020 as bond yields hit record lows. They made new All-Time Highs of ~$2079 following the Russian invasion of Ukraine and a higher All-Time High of ~$2085 on May 4 as US interest rates fell and the USD was weak.

Gold made a 30-month low of ~$1610 in September 2022 as the USDX made a 20-year high. Gold rallied ~$475 (29%) from those lows to the May 4 All-Time Highs as the USD fell and real interest rates declined.

Gold prices were also boosted by reports of substantial central bank buying, the “banking crisis,” and, most recently, debt ceiling concerns.

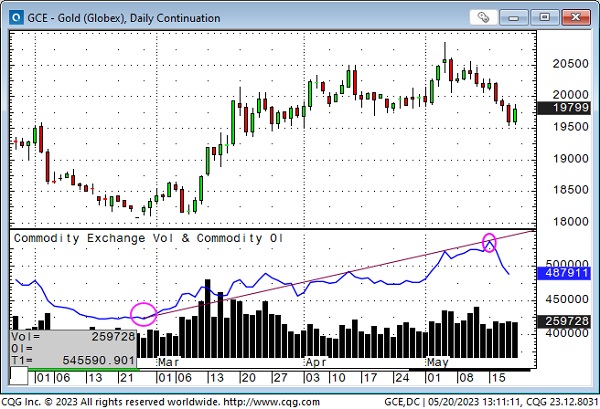

The net speculative long positioning in the gold market increased as the gold price rose from last September’s lows, and open interest increased dramatically (~27%) from the February lows to mid-May (after the price had peaked.)

Open interest increased by ~40,000 contracts (8%) from May 1 to May 4, when gold hit an All-Time High, and increased by ~60,000 (12%) contracts by May 15. This looked like very aggressive buying after a 6-month rally, and when prices fell as much as ~$80 on May 5, a good number of those new long positions were “underwater.” Gold prices fell as the USD and interest rates rose over the next two weeks, and many recently established speculative long positions were liquidated.

Stock indices rally

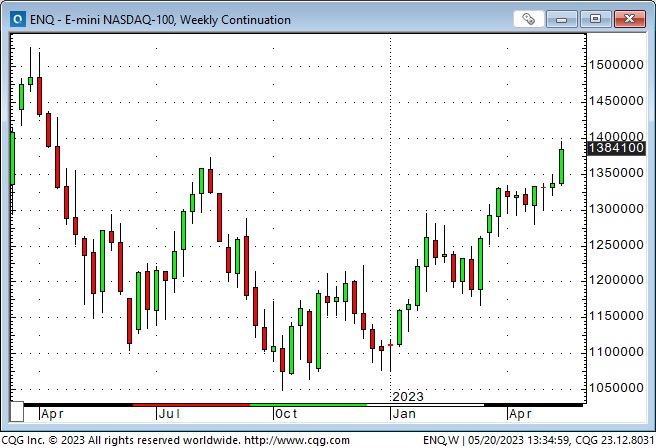

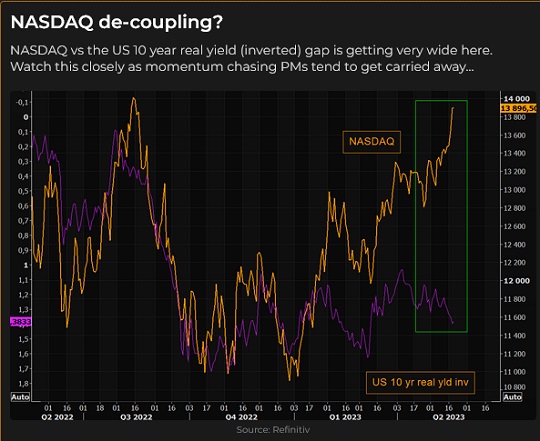

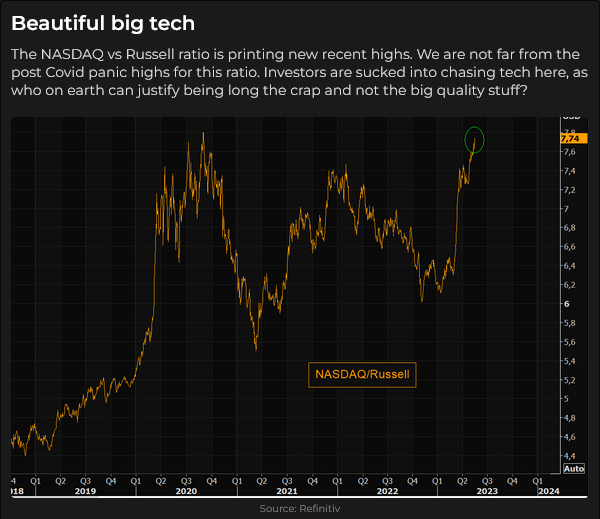

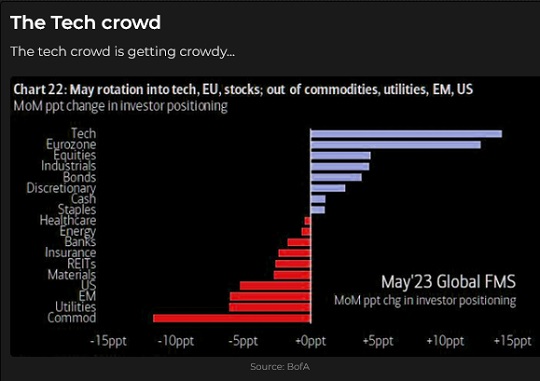

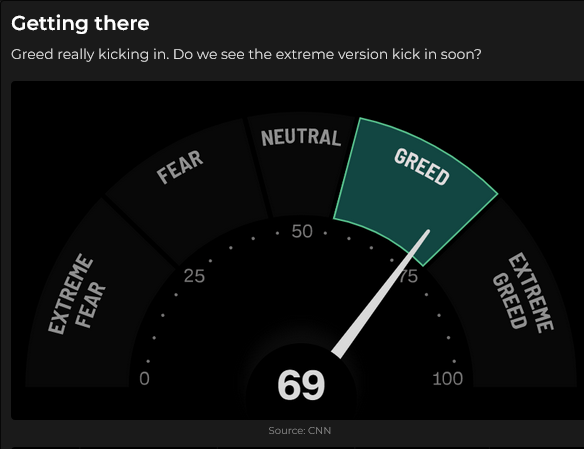

The Nasdaq 100, the weakest of the major indices last year, has been the strongest YTD (due to a heavy weighting of Megacap tech stocks), and it rallied to a 13-month high this week. The current “pain trade” for money managers is being underweight Megacap tech. (According to BoA’s Mike Harnett, who is bearish stocks at this level, the “pain trade” for H2 2023 might be Fed Funds at 6% rather than 3%.)

While the Nasdaq 100 is up ~26% YTD, the Russell 2000 is about flat with where it closed in 2022.

The Japanese Nikkei is up ~20% YTD, a 33-year high! The BOJ has not raised interest rates to fight inflation, which is at ~40-year highs, and the weak Yen makes Japanese stocks look like a bargain relative to other markets.

My short-term trading

I started this week short gold and the Euro. I had shorted the Euro on May 9 after patiently waiting for price action to confirm my bearish views, and I began to short gold on May 10. Both markets had heavy speculative long positioning, and I thought that if prices started to break, some of those long specs would liquidate, adding to downside pressure.

Both markets continued lower this week, and I added to my short gold position on May 16, with prices down ~$30 on the day.

With prices in both markets building downside momentum, I anticipated a possible bounce-back, so I trailed my stops behind the markets. There was a sharp reversal from Friday’s lows (gold jumped>$25 in 20 minutes), and I was stopped out of my positions with good profits.

I shorted the S&P on Thursday when it stalled after rising above the highs of the last few weeks but was quickly stopped for a slight loss.

I’m flat at the end of the week but happy to be back within my preferred trading time frame of a few days to a few weeks after “spinning my wheels” day trading.

On my radar

My bias is that chasing Megacap tech stocks is a very over-crowded trade (like chasing long Euro and gold was an over-crowded trade), but I will wait for price action to confirm my bias (and I may not get a confirmation!)

My bias is that the USD may continue to rise, so I will look for opportunities to sell the Euro and maybe gold.

My bias is that central banks will stay “higher for longer” unless there is a crisis, but the markets are priced for the Fed to pause and then cut, so I’ll look for opportunities to be short interest rate futures.

Thoughts on trading

I spend a lot of time reading market reports, listening to market podcasts/videos, and looking at hundreds of charts on my trading platform. I often develop an opinion or a bias about specific markets, but I’ve learned to be careful about trading upon my views. As my friend Denis Gartman used to say, “I have strong opinions, weakly held!”

I believe “confirmation bias” is dangerous to my financial well-being. I know only a tiny fraction of the things that may impact the prices of the markets I trade, and a market may move for or against me for reasons that will forever be unknown.

I constantly have to be “on guard” to not take a position based on what I think a market “should” do. I believe “stories” about what a market “should” do are more likely “marketing” material rather than research. My long-time friend in Chicago (JMP) tells me he believes nothing about trading except mean-reversion.

My job as a trader is to protect my financial and emotional capital – from me doing dumb things.

I have no illusions about having a special or unique skill set that allows me to see the future. I make money by managing risks, not by having an inside story about the future.

The Barney report

Summer weather hit the Island this past week, and temperatures jumped. I took Barney down to the ocean to see if the water was warm enough for us to swim. It wasn’t, but Barney rolled around in something very stinky, so when we drove from the beach to the forest, I had all the car windows open! When we got home after walking the forest trails, Barney got hosed down and shampooed in the backyard – not in the shower! This is a photo of him on an “erratic” – a boulder laying on some relatively flat land, and you wonder how it got there. He loves to jump up on things to get a better look around.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Listen to Victor talk about markets

I hosted Mike Campbell’s extremely popular Moneytalks show again this week while Mike was on vacation. I interviewed our regular commentators, Michael Levy and Ozzy Jurock, and I had a terrific 40-minute interview with our feature guest Greg Weldon (starting at the 18.45 – minute mark), about macro markets and trading.

I also interviewed Alan Oslie, a veteran realtor on Vancouver Island, about who is moving to the Island, why they are coming here and what kind of a home you can buy for $1 million.

It wouldn’t be a “Moneytalks” show without Mike Campbell, so we dug up a great “shocking stat” and a great “goofy” from the archive to round out the show. You can listen to the entire May 20 show here.

I’ll host the show again on May 27 with Kevin Muir, the Macrotourist, as my feature guest.

I recorded a 30-minute interview with Jim Goddard for This Week In Money on May 6. I talked about my Macro views and thoughts on several markets I trade. I also had some “practical” advice for traders who are “new to the game!” You can listen here. My interview starts at the 42.15-minute mark, following Ross Clark and Martin Armstrong.

Oceanside Special Olympics Charity Golf Tournament at Pheasant Glen golf course June 10, 2023

This event is the annual fund-raiser for the 50 special needs kids in the Oceanside area of Vancouver Island. If you’d like to play in this event (my team in the photo) or donate money to a worthy cause, click this link.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys, and talk with him.

Headsupguys has had over five million hits on its website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys save lives.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.