Is a long-term rotation out of US assets beginning?

The S&P hit all-time highs in February (Trump’s new Golden Era would be American exceptionalism on steroids), then trended lower into early April, down ~9%. Following “Liberation Day” and subsequent “tariff bluster” (which led to tariffs on China of 145%), the S&P plunged to 15-month lows on April 7, down ~21% from the February highs. At this week’s highs, the S&P had rebounded ~19% from the April lows to be down ~4% YTD.

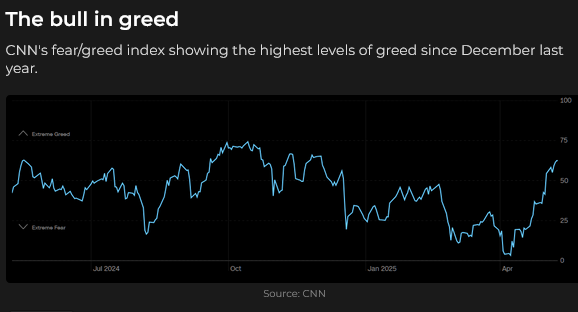

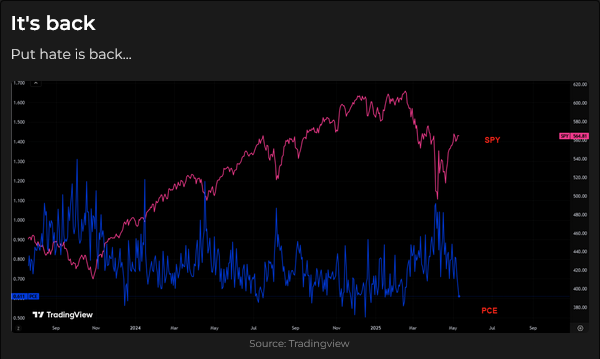

Sentiment has become progressively more bullish as the market rebounded from the April lows.

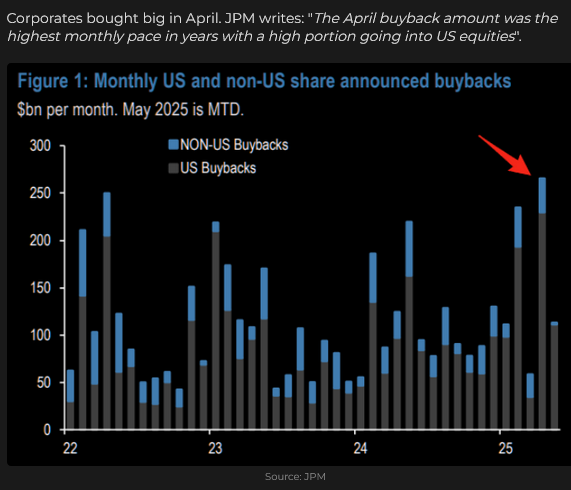

Corporate share buybacks in April were strong.

American stock markets were not the only markets to plunge in April. The Nikkei dropped ~25% from January highs to April lows.

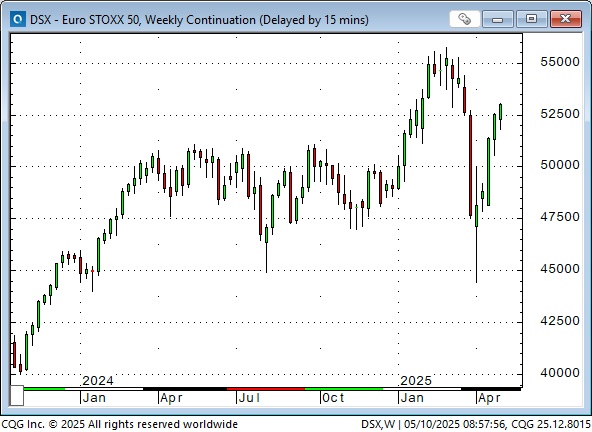

The Euro Stoxx 50 Index fell by ~20%.

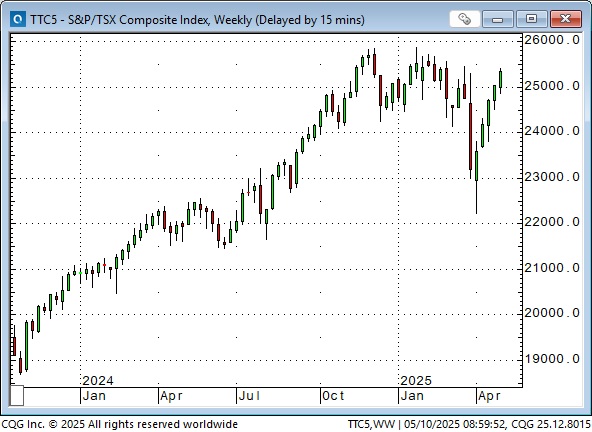

The TSE Composite fell by ~14%.

The Shanghai Index fell by ~12% (iShares China Large-Cap ETF fell by ~25%).

The iShares MSCI Emerging Markets ETF dropped ~16%.

The price action across most global stock indices – a sharp drop to multi-month lows in early April, followed by a sharp rebound – has been nearly identical, although some indices have rebounded more than others. The German DAX, for instance, has soared by ~25% from April lows to this week’s all-time highs.

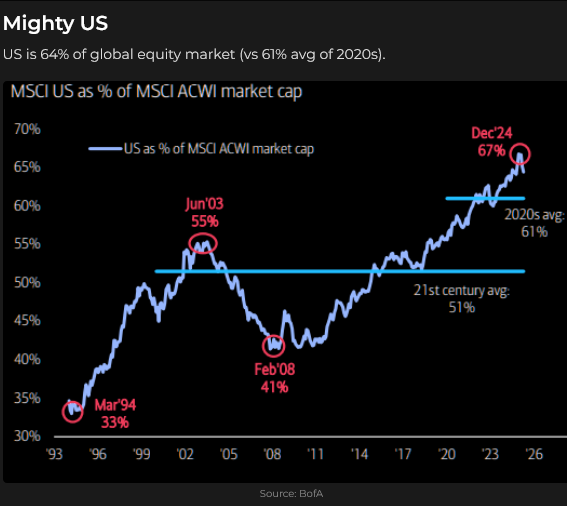

Since the GFC, the US equity market has outperformed the “Rest Of The World” by a substantial margin.

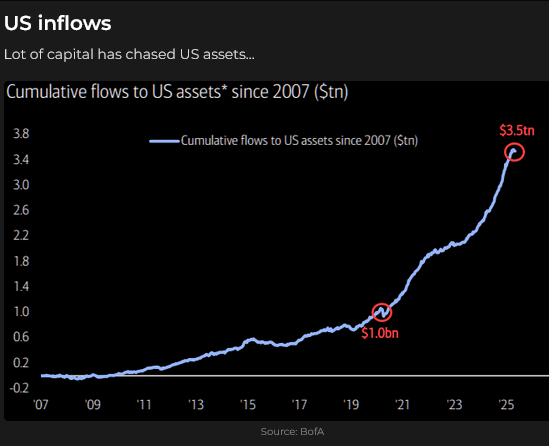

This outperformance has contributed to the US markets becoming a magnet for capital (including “recycled” foreign trade surpluses). Over the years, a frequent refrain in these Notes has been that “capital comes to America for safety and opportunity.” The dramatic “ramp-up” in capital flows to the US in the last few years may have “set the stage” for a correction, and the “Sell America” analysts see Trump as the catalyst for a correction.

Currencies

The US Dollar Index (heavily weighted with European currencies) reached a 23-year high in January 2025 (X, a few weeks in 2022 when it briefly spiked higher), and the US Dollar Trade Weighted Index (more weighted to Asian currencies) was at all-time highs. The USDX had risen nearly 60% from its all-time lows in early 2008. (Look at the chart above and the chart below; as capital flows to America surged higher, the US Dollar went higher.)

The USDX dropped ~12% from January highs to April lows as 1) a correction was “overdue”; positioning at the January highs was extremely long the USD, 2) some traders expected a “Mar-a-lago Accord” from Trump to devalue the dollar, 3) “Sell America” analysts believed that the world was “losing faith” in American commitments, and 4) the US was en route to losing reserve currency status.

The “bounce back” in the US Dollar from the April lows has been weak compared to the “bounce back” in equities (the USDX has bounced ~2%, the S&P has bounced ~19%), and it started later (the S&P turned higher on April 7, the USDX turned higher on April 22.)

April 22 may be a Key Turn Date (when several markets reverse course on or around the same date, something “BIG” has happened).

The S&P made a higher low on April 21/22 and traded higher for nine consecutive days.

The Euro peaked on April 21/22.

The Yen peaked on April 21. COT data shows that speculators have held their largest ever net long Yen position over the past four weeks.

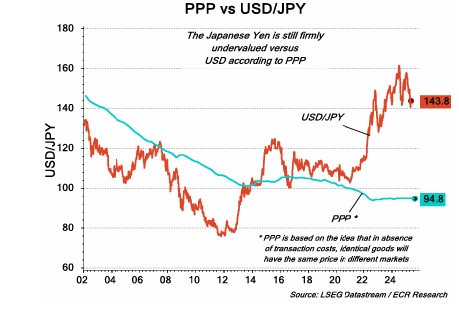

One reason speculators are so bullish on the Yen is that it has fallen by ~50% since 2012 and is grossly undervalued by some metrics (such as PPP, Purchasing Power Parity) (Chart courtesy of Martin Murenbeeld’s Gold Monitor).

Gold hit an all-time high on April 22 and reversed lower.

The US long bond made a higher low on April 22 and rallied for seven consecutive days.

WTI crude oil made a lower high on April 22 and fell ~15% into early May.

Copper made a lower high on April 23 and fell ~10% to this week’s lows.

Volatility (across many markets, not just equities) made a lower high on April 21 and has trended lower since.

Overall, market sentiment was extremely bearish on April 7 and has improved substantially since the KTD on/around April 22.

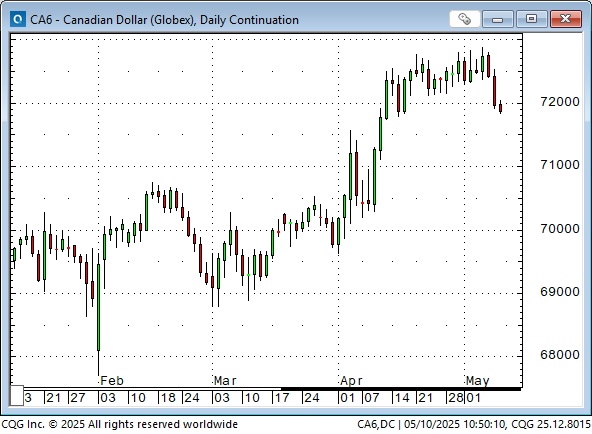

The Canadian dollar closed this week ~6% above the multi-year lows reached on February 3, when Trump imposed 25% tariffs on Canada and Mexico. (He “paused” those tariffs later the same day, and the CAD had a massive rally.)

At different times, the price changes in the CAD are correlated to the S&P, the USD, WTI, and commodities. Still, the correlation to the interest rate spread between Canada and the US is always significant.

My short-term trading

I started this week with a short Yen position I established last week. I was stopped for a loss early Tuesday as currencies (particularly Asian currencies) rallied on the Taiwan Dollar spike. I re-shorted the Yen later that day and covered it on Friday for about twice what I had lost on Tuesday.

I shorted the GBP on Tuesday and covered it for a slight gain on Friday.

I shorted short-dated OTM bond puts on Monday and held that position into the weekend.

I shorted the S&P on Tuesday but covered for a slight loss overnight. I re-shorted it on Friday after Trump posted this social media message: “BETTER GO OUT AND BUY STOCKS NOW.” The market rallied on that post but could not sustain the gains.

Sunday correction: I was rushing to finish the Notes on Saturday to attend a Celebration of Life with some old friends, and provided inaccurate information on my Friday S&P trade. I bought (not shorted) the S&P on Friday at 5682 and held that trade and my short bond puts into the weekend.

The Barney report

Barney has been enjoying the warmer weather and the longer daylight hours this time of year. I gave him a good shampoo and shower yesterday (he loves to jump into ditches), and I’m happy that he is more willing to go into the shower than he used to be. Our friends are arriving this afternoon, and I want him to look his best!

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the dramatic price and mood swings across markets YTD and how we used to say, “It’s all about the Fed,” but now we say, “It’s all about Trump!” You can listen to the entire show here. My spot with Mike starts around the 53-minute mark.

Shorter Trading Desk Notes this week

This week’s Notes are shorter than usual because I’m travelling to meet with friends to celebrate the life of another long-time friend.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.