Wicked price action may signal a shift in sentiment and positioning

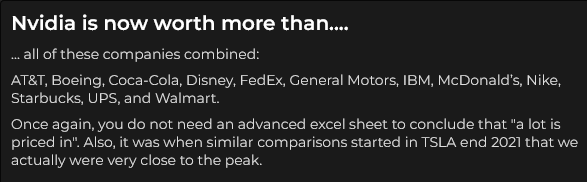

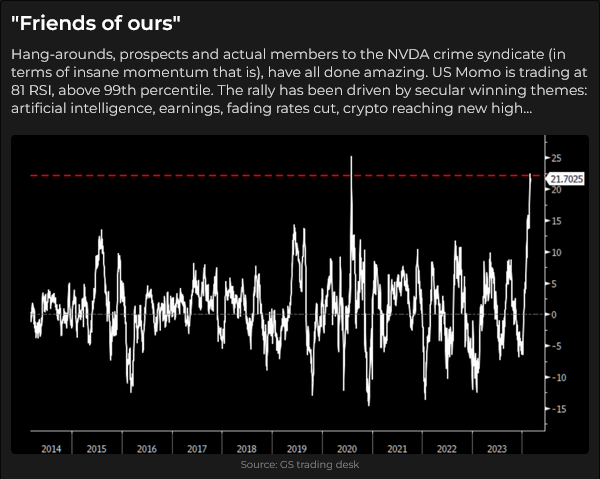

NVDA gapped higher on Friday’s opening and reached new All-Time Highs (up ~105% YTD) in the first hour of trading. It then dropped and closed below Wednesday and Thursday levels, creating a Daily Key Reversal down. NVDA’s market cap fell >$300 billion from Friday’s highs to lows.

The S&P and NAZ made new ATHs this week but closed below last week’s close. The DJIA closed lower for each of the previous two weeks.

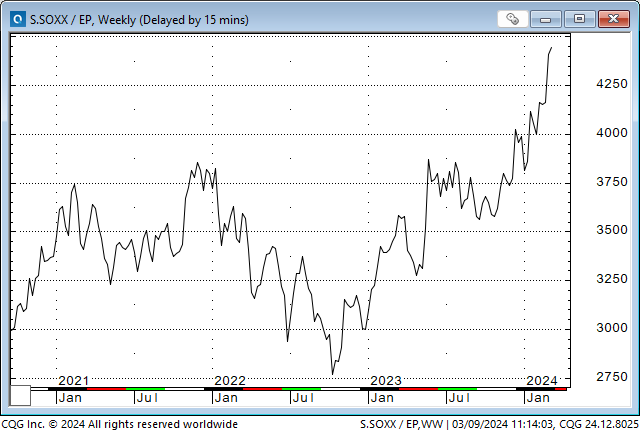

The Philly Semiconductor Index hit new ATHs against the S&P this week.

Healthcare ETFs had a strong rally from the October 2023 lows but have stalled lately.

The Nikkei made new ATHs on Wednesday but fell on Thursday and Friday to create a Weekly Key Reversal down.

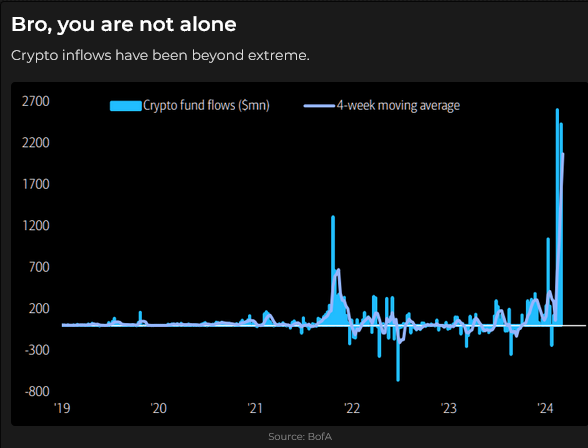

Bitcoin futures surged to ATHs this week, up ~87% from January 2024 lows.

The Bitcoin rally had a hiccup Tuesday when prices fell ~15% after hitting ATHs, but value-oriented long-term investors quickly righted the ship and drove prices to new ATHs by Friday. (LOL!)

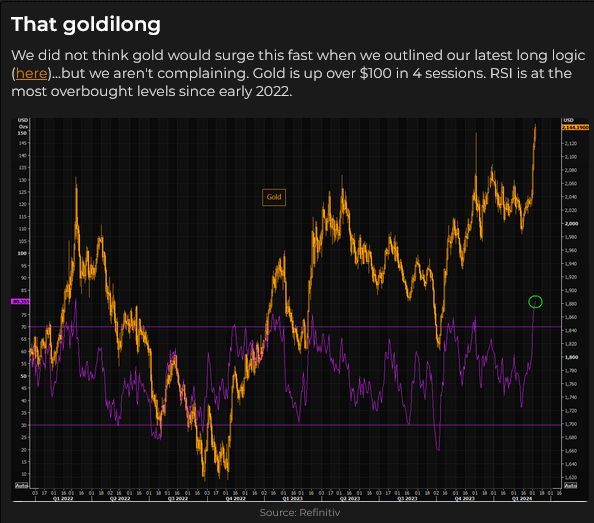

Gold

Front-month Comex gold futures soared to new ATHs above $2,200 on Friday, up ~10% from mid-February lows. Open interest has increased ~30% in the last eight trading days, and volume this week was the largest since the SVB scare one year ago. Commercial accounts usually take the other side of speculative accounts and have their largest net short position since the Russian invasion of Ukraine.

Central banks remain substantial buyers, while ETF investors continue to shun gold.

Gold shares have underperformed bullion for the past few years but bounced 15 – 20% from last week’s lows.

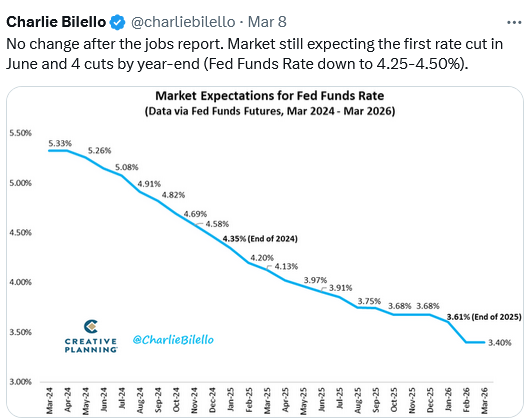

Interest rates

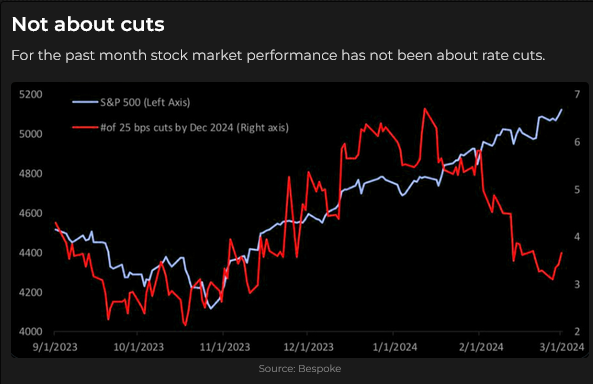

Powell to Congress: “…policy rate is likely at its peak…not far from rate cuts…” Economic data: softer. Bond prices continue to rally off February lows as forward markets price in a nearly 100% chance of a 25 bps cut by June and 100 bps cuts by year-end.

Currencies

The US Dollar Index fell to 7-week lows on Friday’s employment report before bouncing back.

The Japanese Yen was the strongest currency this week (up ~2.75%) as the market began to price in the BoJ possibly raising interest rates at their March 18 meeting. Speculators had built a substantial net short position against the Yen (last week’s COT report showed the largest position in six years), but they began to reduce those positions this week as prices rallied.

The British Pound also rallied sharply this week, with speculators now holding their largest net long position in years (outside of that price spike last July). The market seems to believe the UK is “turning things around” after floundering for years.

The Mexican Peso is back near the 8-year highs hit last August. Speculators have more than tripled their net long Peso positions from the price lows of last November and are now the most net long since just before the Covid panic in 2020. The Peso is up ~55% from the Covid lows as the BdM kept short rates above 4% during the initial Covid period and then gradually raised rates to ~11% by early 2023. Rates have stayed near 11% since early 2023.

The Swiss Franc hit ATHs against the USD in December 2023 (X a 2-day spike in August 2011) and has trended lower since, falling ~6%. (The Swissy has made record highs against most currencies over the past few months.) Speculators (large and small) have aggressively increased their net short positions since early January, with their combined position now near 5-year highs. Open interest has increased ~25% since the end of January.

Energy

Nymex natural gas prices traded near multi-year lows in February (in inflation-adjusted terms, prices may have made multi-decade lows). However, once again, low prices were the best cure for low prices, and producers began to limit production. Speculators also modestly reduced their large net short position.

Uranium prices reversed from multi-year highs in early February and tumbled ~15 – 20%. The bounce from the late February lows seemed to hit a brick wall this week.

Grains

Beans, corn and wheat traded near historical highs following the Russian invasion of Ukraine, but then prices began a multi-month tumble as, once again, high prices proved to be the best cure for high prices.

Recently, speculators have built large net short positions, and commercials have been in the rather unusual spot of being net long. Speculators’ net short position in the corn market grew to an 8-year high two weeks ago but was reduced a shade (short covering?) the past two weeks ahead of the monthly WASDE report released yesterday. The report was “neutral,” and prices rose – perhaps speculators had been looking for a bearish report.

My short-term trading

I started this week with three positions I initiated last week: long Yen calls, long corn calls, and long Sept SOFR (short-term interest rate) futures. I thought all three markets were oversold for different reasons, and I waited for a price-action setup to give me an opportunity to buy.

I stayed with those positions this week as each market moved in my favour. On Friday, I wrote OTM Yen calls with the Yen up nearly two cents from where I had purchased the original calls. (I now have a nicely in-the-money bull call spread with substantially less theta risk.)

I shorted the S&P on Monday after it fell from new ATHs and stayed with the position when it dropped ~70 points by Tuesday’s low. The market bounced back from its lows, and I was stopped in the overnight session for a slight gain. (I’ve had a handful of short S&P trades over the past few weeks that have initially gone my way, but all of them have ended up as either slight gains or slight losses.)

I shorted the CAD on Friday morning after the employment reports when it fell back from 1-month highs. As usual, when trading the CAD, I wasn’t looking at Canada-specific issues but instead saw it as a way to play the reversal in risk-on sentiment in stocks and currencies. I held the position into the weekend.

On my radar

The Tuesday, March 12 CPI report could significantly impact financial markets. A softer CPI opens the gate to earlier (and perhaps more) Fed cuts, and that “theoretically” should be bullish for stocks, bonds, and gold but negative for the USD. Positioning could trump “theoretical!”

The FOMC meets March 19/20. They will likely not make any policy changes but may provide “forward guidance” to future policy changes.

The BoJ meets on March 18, and given their “confidence is increasing,” they may raise interest rates.

Commercial real estate problems seem so “well known” that they won’t be a problem. However, Julian Brigden thinks that “collateral damage,” such as reduced tax revenue to local governments, may be a much bigger problem than people realize and may lead to weaker-than-expected economic growth.

I continue to think that the widening bifurcation of consumers is an underacknowledged problem. People who benefit from the “wealth effect” of owning stocks and real estate can pay higher prices for consumer items, while people who don’t own stocks and real estate are struggling. I think the “left behind” people constitute more than 50% of the population, and they will want “change,” which could manifest in strikes for better pay, demands for government help, support for taxes on “rich people and corporations,” and falling consumer confidence and spending.

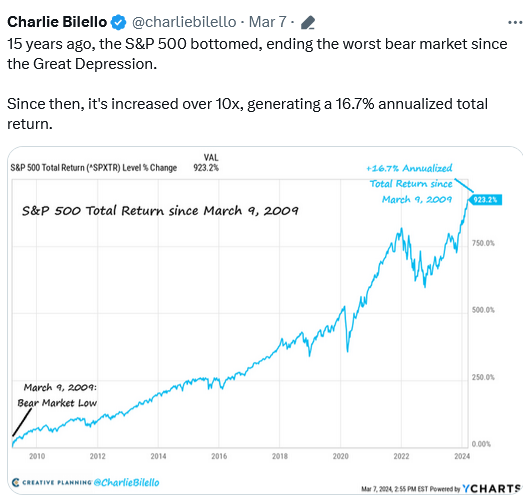

I think fundamental long-term money is a net seller of equities on a valuation basis in the current environment, while retail MOMO, FOMO and passive accounts are buying.

Quote of the week

Thoughts on trading

A long-time friend and fellow trader recently emailed me to ask if the results of a previous trade had any “bearing” on my decision to trade the market today. Here’s my lightly edited reply:

Where I got into or out of a previous trade has no bearing on my next trade. The last trade is “history.”

Yes, today/tomorrow is a new ball game, but yesterday’s price action is essential when deciding whether to trade today (whether or not I traded that market yesterday.)

I understand what you mean by revenge trades; they are extremely dangerous. A revenge trade is 100% ego-driven (as opposed to process-driven), and it is the first step into spiralling out of control.

My thoughts on my recent S&P trading: the market is in an “irrational exuberance” phase, which is a valuation judgment, not a timing tool. The “time frame” on that judgment is weeks/months. I’ve waited patiently for good technical entry setups to short the market, and on most of my trades, the market has moved in my favour before resuming the rally. I stayed with the trades when I was ahead because “one of these days,” I expect the market to keep falling, which aligns with my valuation judgment. So far, that hasn’t happened, and I’ve had several tiny wins and losses.

I’ve considered “not trading” the stock indices, but I think the market will have a substantial break at some point, and I’d like to catch that move, so I’m willing to keep doing this style of trading in the S&P.

I’ve been practicing patience and process-driven trading for the past few years. I’ve kept my trading size small; initial margin requirements are rarely over 20% of account equity. I will increase my trading size when I am confident I can trade my process without emotional interference. I think I’m close!

A highly recommended podcast is due for release tomorrow

Jason Shapiro has interviewed Peter Brandt. Jack Schwager interviewed Jason and Peter in his “Unknown Market Wizards” book. I subscribe to market services provided by both of them. Peter and I worked for ContiCommodity in the late 1970s and early 1980s, and I had a wonderful in-person visit with him in Tucson three years ago.

Peter and Jason have each been successful traders for over two decades, but in so many ways, they are as unlike as chalk and cheese! I’m guessing that the only way they “overlap” is in rigorous risk management!

I expect Jason will post a link to the interview on his Twitter page tomorrow. If not, check his website: crowded markets report.

Sunday, Mar 10 edit: here’s the link: (269) CMR Interview: Peter Brandt On Mastering Long-Term Trading Success – YouTube

The Barney report

Barney and I are home alone again with my wife in Vancouver. We had a splendid long walk (run for him) in the forest trails yesterday, and he was so dirty when we got home that it was straight to the shower! He looks so much better when he’s clean and fluffy. He is zonked out on my office floor after a two-hour forest run and a hot shower!

Listen to Victor talk markets with Mike Campbell

On Mike’s Moneytalks show this morning, we talked about the market “casino,” the wild speculative fever driving astonishing price action, Bitcoin, gold, the Yen, and the CAD. My spot with Mike starts around the 1 hour and 18 minutes mark. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.