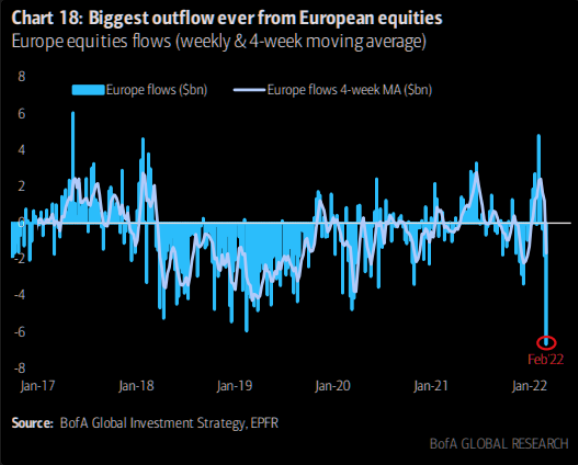

Existential stress is causing extreme capital flows

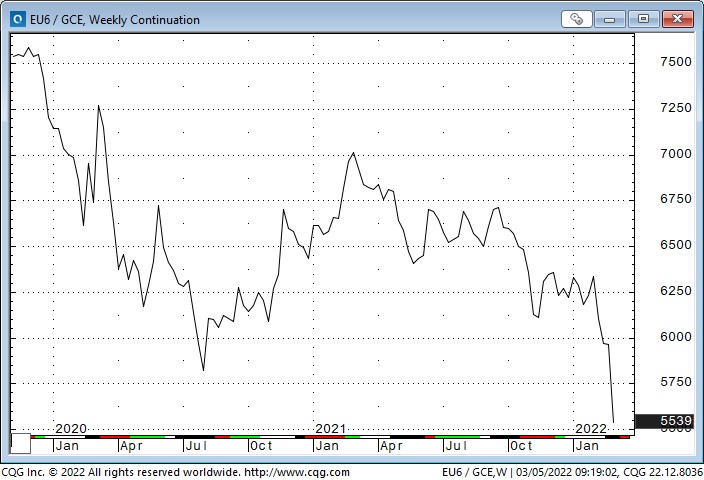

The Euro plunged ~5% against the USD and ~6% against the Swiss Franc since February 10th. It is at All-Time lows against gold.

When gold and the USD are both sharply higher, you know markets are fearful.

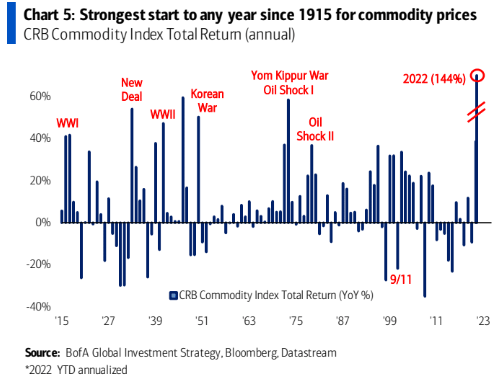

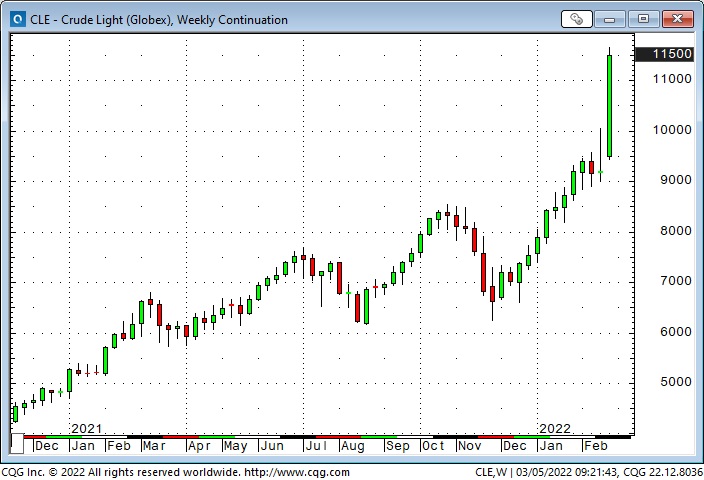

Perceived supply shortages across commodity markets have driven prices sharply higher

This chart shows the premium of April WTI over December WTI. The extreme backwardation shows the relative scarcity of nearby WTI compared to deferred dates. Many commodity forward price curves are now in backwardation.

Will the next “Lehman failure” be a result of soaring commodity prices?

There are always unexpected consequences. Somewhere in the world, there is a massive “short commodity” position that may “blow up” as a result of soaring commodity markets – causing severe “collateral damage.” My first guess is that soaring European energy costs will blow a fuse, and my second guess is that it will be tied to soaring food costs – hungry peasants will be storming the castle somewhere.

The DJIA and the S+P had their lowest weekly close since last summer

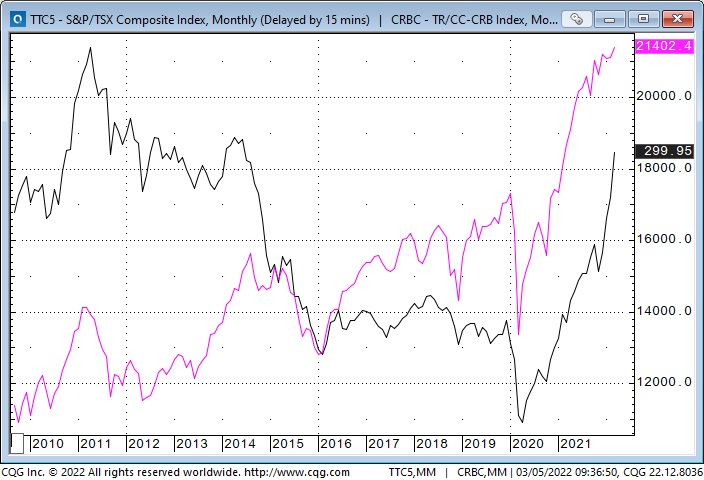

The Nasdaq had its lowest weekly close in nearly a year – yet the American markets are outperforming almost all other global stock indices with the NOTABLE exception of the commodity-heavy Toronto Stock Exchange Index. (Is capital flowing to North America for safety and opportunity?)

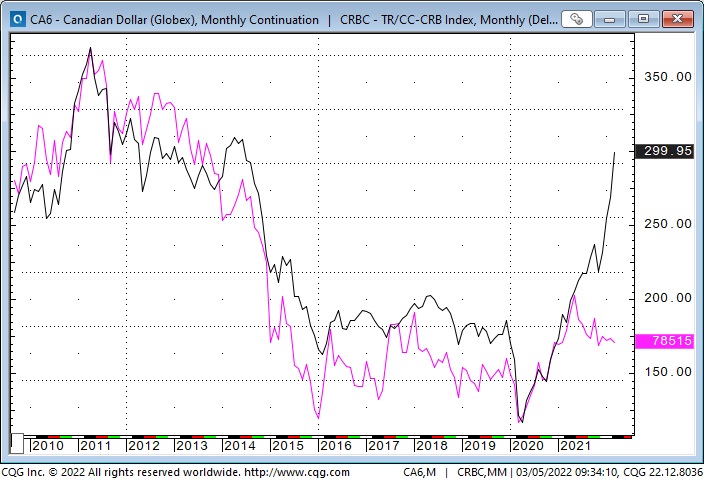

The Toronto Stock Index correlation with the CRB commodity index. (The TSE is the pink line.)

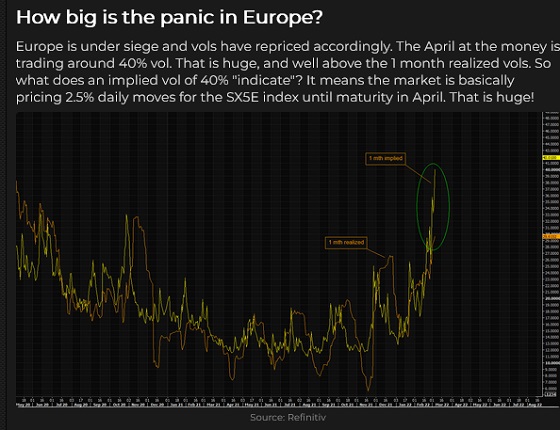

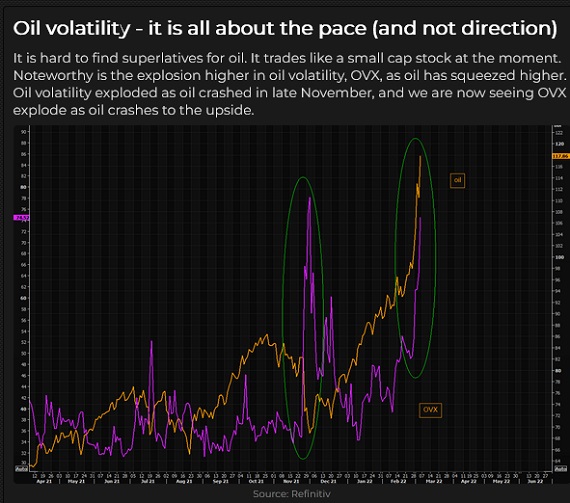

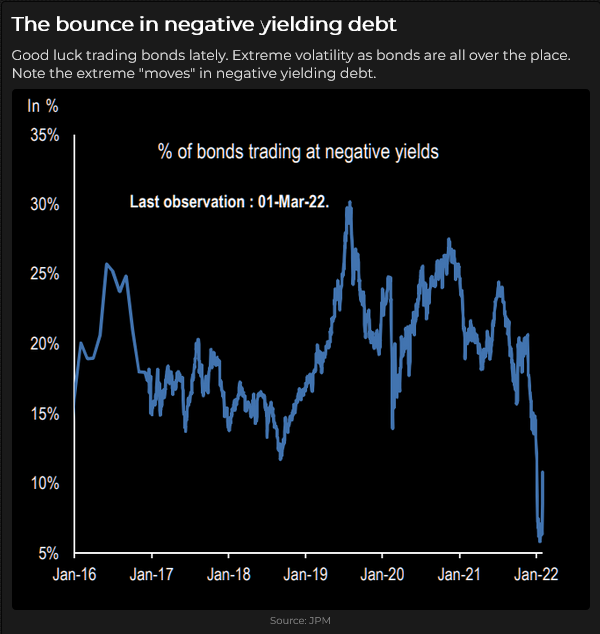

Bonds prices jump – volatility soars

Bond prices jumped on haven buying, thoughts that war and surging commodity prices might create a severe economic slowdown, and on short covering.

Since November, bond prices had been falling in anticipation of central bank tightening to cool inflation – with bond prices suddenly rising; shorts scrambled to cover their positions.

Stock market option vol is high, but bond market vol (the MOVE index is the gold line) is much higher.

What’s wrong with the Loonie?

The CAD has been highly correlated with commodity indices for the past 20 years. But lately, as commodities have soared, the CAD has languished. What’s the problem? (The CAD is the pink line.)

The short answer: the USD has been super-strong. The US Dollar Index is close to 2-year highs, and that, together with risk-off market sentiment, has trumped the super-strong commodity market impact on CAD valuation.

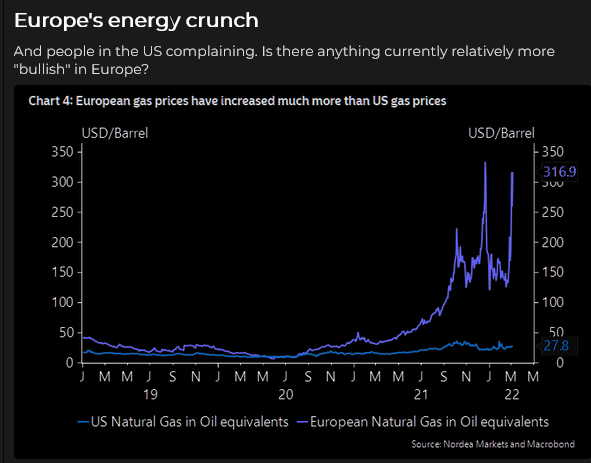

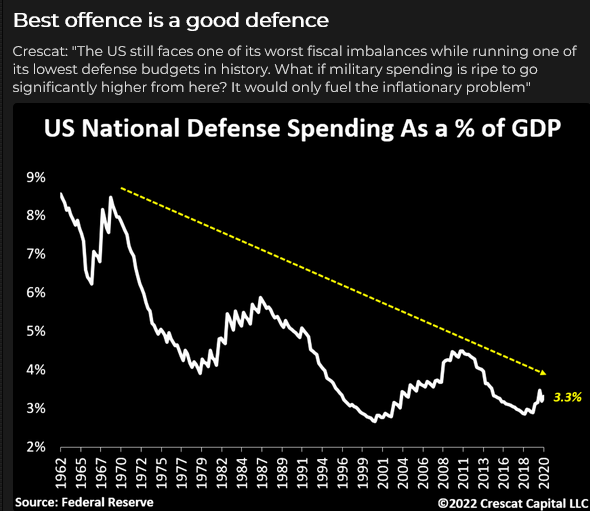

Will soaring energy costs reverse government ESG inspired energy policies?

With natural gas prices in Europe ~8X from year-ago levels (European Natgas in crude oil equivalent prices is ~US$ 320 BBL) and with prospects of much less Natgas coming from Russia – Germany is starting to change energy policies. Will Biden? Will Trudeau? Will China? How about John Kerry, the US Special Presidential Envoy For Climate?

From the WSJ: Former US Secretary of State John Kerry warned in an interview this week about “massive emissions consequences” from a Russian war against Ukraine, which he also said would be a distraction from work on climate change. Nevertheless, he added, “I hope President Putin will help us to stay on track with respect to what we need to do for the climate.“

Gasoline in Vancouver is nearly $2.00 per litre and will be more than that next week. At 3.8 litres to a US gallon and with the CAD ~79 cents, that works out to ~US$6 per gallon – which is the highest price anywhere in North America. Even Hawaii is cheaper.

In the February 5th TD Notes, I wrote: “Rising geopolitical tensions are contributing some “fear” premium to the crude oil price, but the ESG inspired “Consequences of Procrastination,” which have created self-destructive energy policies in much of the Western World, are the real driving force behind the energy rally.”

More recently, I wrote: “It’s ironic to see the USA fighting climate change and inflation at the same time. Higher energy prices = higher inflation.”

Higher energy prices will drive change and innovation. There will be some demand destruction (maybe a LOT if there is a recession – remember WTI fell from $147 to $33 between July and November 2008.)

Arbitrage will happen. For instance, LNG will flow from the USA to Europe and Asia. Despite having LOTS of Natgas, Canada currently has no operating LNG export terminals (think Consequences of Procrastination) but several are under consideration or development.

Governments will change energy policies that limit fossil fuel and nuclear energy development and use. The public will approve. ESG momentum to block the development and use of fossil fuels and nuclear energy has stalled.

There will be more nuclear power plants – but it will take years to bring them on stream.

High prices are the best fertilizer for next year’s crops. High prices will drive innovation to deliver more efficient energy production and consumption. Alternative energy sources will also benefit from innovation and may someday satisfy a significant part of total energy demand, but in the meantime…

I highly recommend the latest essay from Goehring & Rozencwajg: The Distortions From Cheap Energy.

My short term trading

I started this week with no open positions and decided not to “rush into anything.” The American stock indices had bounced back late last week, perhaps on the notion that “the worst was over” in Ukraine, given the West’s response to Russian aggression, but I was skeptical about that.

Despite my skepticism, I bought the S+P and (call options on) the CAD on Wednesday, and those trades looked good until mid-day Thursday. I was stopped at a b/e on the S+P Thursday and still own the CAD calls.

I was reluctant to trade this week because I thought there was an excellent chance that market shocks could blow a big hole in my account. I seem to make money from managing risks rather than having incredible “variant perceptions” about where markets will go, so when the market is “wild and crazy,” I stay on the sidelines and wait for it to calm down.

At the end of the week, I was a little offside on my OTM CAD calls, and my P+L on closed-out trades was flat.

On my radar

The key paragraph from last week’s TD Notes was this one:

“It is critical to understand that the (stock market) rally was NOT caused by people assuming that the war in Ukraine was “no big deal.” The war may end this weekend – or it may continue for months – but it is still a huge deal even if it does end this weekend. Putin has taken the gloves off, and a new cold war has started, which will have a HUGE impact on markets.”

The more I thought about it over the weekend, the more I realized that I had no idea just how “HUGE” the impact would be on markets – which was the underlying reason I decided not to trade for a couple of days. I needed to “get my mind right” (as in Cool Hand Luke.)

I think Putin’s invasion of Ukraine (and subsequent reactions from the West) may only be the “opening act” of a new world order, and if that’s true, then a lot of things that I assumed were “rock solid” may disappear like a puff of smoke.

Early this morning, I received Doomberg’s latest thoughts on this issue, and rather than paraphrase him, let me direct you to his essay. It is a 10-minute read, and I highly recommend you take the time to read it.

Thoughts on trading

I’ve been trading futures markets since 1977, but it felt “OK” to sit and watch the wild price action early this week and not make a trade. In a way, I was testing myself, would FOMO cause me to “chase,” or could I wait?

I thought about the difference between “trading the news” and “trading the price action.” Chasing headlines in this market could be costly, but trading the price action could be just as dangerous. I thought about “nothing ventured, nothing gained,” the idea that you can’t win if you don’t buy a ticket.

Then I remembered Peter Brandt telling me that it is easy to make money trading futures; that hard part is hanging onto your winnings! “There are bold traders, and there are old traders, but there are no old, bold traders.“

And then there is Ecclesiastes – there is a time for everything, which might mean that I will be trading up a storm next week!

Quotes from the notebook

Wall Street’s job is to sell people things they should not buy. Like “short volatility!” Michael Lewitt – the Credit Strategist 2018

My comment: I agree with Michael 100%, but Wall Street is Wall Street, and just like Vegas is Vegas, that’s what they do.

“When in doubt – stay out.” An old adage from the CBOT floor

My comment: I agree, but you can never trade without some doubt. If you’re 100% certain that you’re right about a trade, you’re setting yourself up for a licking.

“Every day, I assume every position I have is wrong.” Paul Tudor Jones The Market Wizards 1989

My comment: Who am I to argue with PTJ? I remember ordering a copy of Market Wizards from my local bookstore in 1989. (Amazon didn’t exist then.) I read it cover-to-cover as soon as I got it and reread it several times over the years. My ideas about trading are an amalgam of things I’ve read and things I’ve learned the hard way.

“Control what you can control, and let the other stuff go.” Pia Nilsson and Lynn Marriott, golf coaches, in their 2005 book, “Every Shot Must Have A Purpose.

My comment: I probably learn more about trading from golf than the other way round (my golf game could use better risk management!), and this quote is a great example. The only thing I can control in trading is what I do or don’t do. I have no control over where the markets go, what matters or doesn’t matter, or who says what at the wrong time! I have to let that stuff “go.”

The Barney report

Barney and I were having our usual off-leash walk along the abandoned railroad tracks this week when a deer appeared, and Barney ran after it. He disappeared into the Pacific Coast rain forest and did not return when I called him. For the next 30 minutes, I stumbled through the dense bush, calling and whistling and growing increasingly fearful that I would never see him again. But he finally showed up, soaking wet and gasping for air, and very happy to see me! I had tears of relief and joy when I hugged the little bugger.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 5th podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.