The inevitable consequences of soaring commodity prices

In last week’s Notes, I wrote: “There are always unexpected consequences. Somewhere in the world, there is a massive “short commodity” position that may “blow up” as a result of soaring commodity prices – causing severe “collateral damage.” My first guess is that soaring European energy costs will blow a fuse, and my second guess is that it will be tied to soaring food costs – hungry peasants will be storming the castle somewhere.”

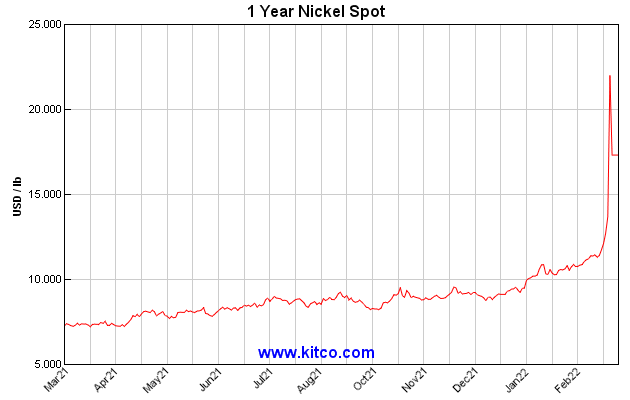

The nickel market “blew up” on Monday (For a colourful description of the event, see the Heisenberg Report) when LME prices surged 4X from last week’s level – and, sure enough, there was a massive short position in nickel. In terms of “collateral damage,” there were hundreds of millions of dollars worth of margin calls, other commodity prices spiked, the LME took the highly unusual action of suspending nickel trading (and cancelled many of Monday’s trades), and the share price of CMEGroup tumbled as people worried about the knock-on effects (solvency) of commodity brokerage firms and exchanges.

When a market moves sharply against “existing positions” (or existing sentiment), there is the possibility of a dramatically extended move – a “falling dominos” effect. Markets are currently extra sensitive to these “iceberg” risks; hence, we have lower liquidity and higher volatility.

FOMO (Fear Of Missing Out) orders are replaced by GMO (GET ME OUT) orders in a falling dominos market.

Arbitrage is a KEY market concept – if commodity prices are high in one location and cheap in another, traders will find a way to buy the cheap market and deliver into the higher-priced market to make a profit. (Think of US LNG headed for Europe.) But sanctions on Russia (and other effects of the war) have created a bifurcated market: commodities are cheaper in Russia and higher outside Russia, and traders can’t arb the difference. This “sets the table” for more commodity “blow-ups.”

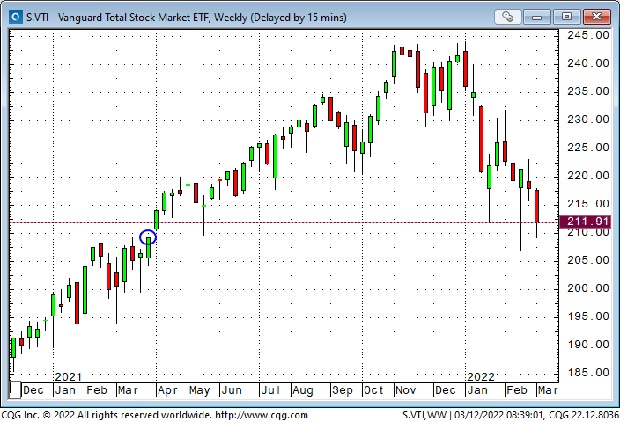

Equities fell further this week without the hoped-for ceasefire

The Vanguard Total Stock Market ETF had its lowest weekly close in nearly a year – down ~14% from ATH in January.

The Nasdaq Composite hit a 15 month low this week – down ~21% from November 2021 ATH.

The PowerShares Chinese Technology Portfolio ETF fell to a 2-year low – down ~60% from Jan 2021 ATH.

ARKK hit 22-month lows – down ~65% from Feb 2021 ATH.

Implied volatility on S+P put options closed ~26% this week – the highest weekly close since the Covid panic two years ago.

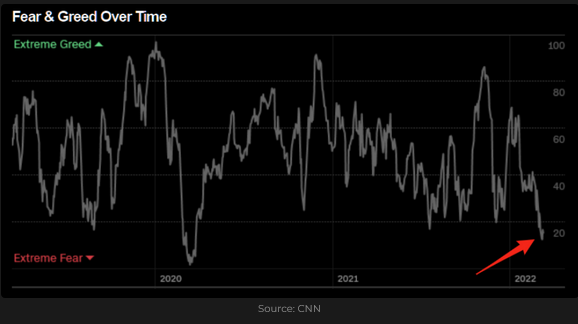

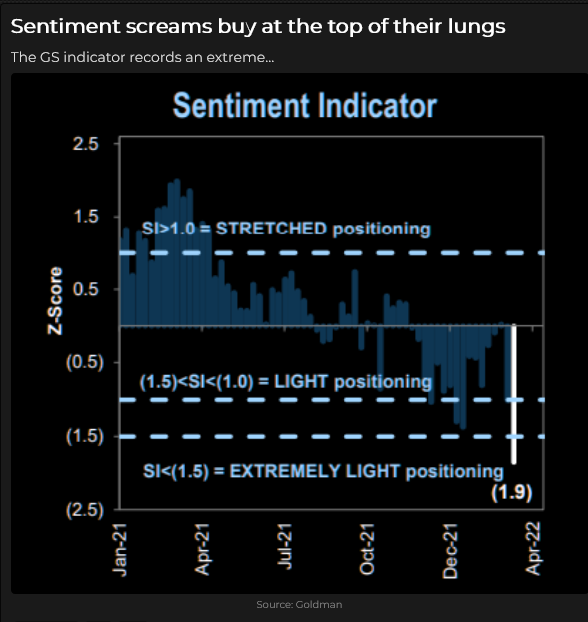

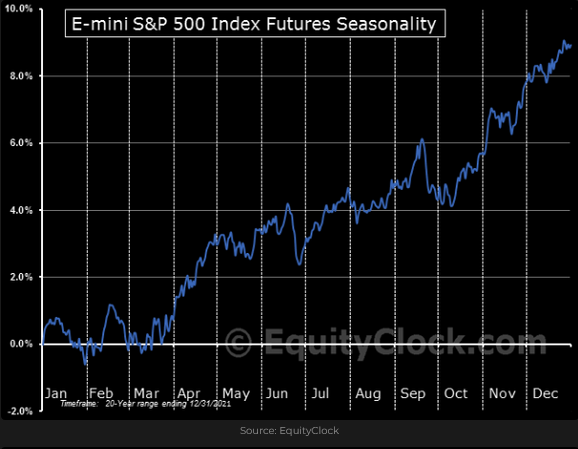

Equity market sentiment is currently very negative. If/when prices turn higher, the rally could be dramatic.

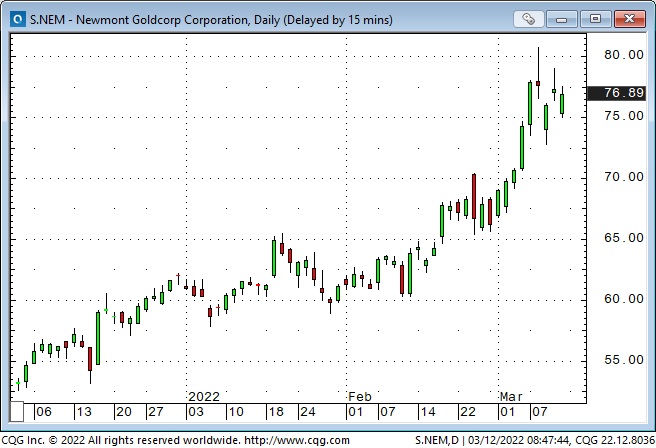

Gold hit All-Time Highs this week

Comex April gold futures hit $2078 on Monday but were $100 lower less than 24 hours later. At Monday’s high, gold was up ~$300 from the late January lows.

Newmont (the go-to gold investment for institutional accounts) rallied to an All-Time high of >$80 – up ~30% from early January lows.

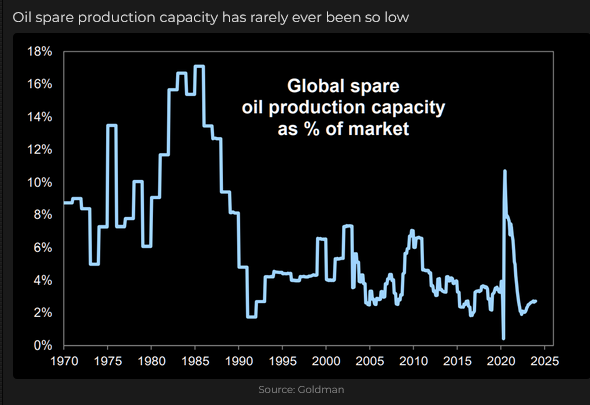

WTI crude oil hit $130, NYMEX Gasoline hit All-Time Highs

NYMEX front-month WTI surged to $100 on February 24th when the Russians invaded Ukraine but fell back to close the day ~$93 (expectations of a quick end to the conflict?) But in early March, prices surged from $95 to $130 as the consequences of sanctions and a prolonged war became apparent. Wild intra-day price swings took WTI down as much as $25 two days later.

Implied Vol on WTI call options ranged between 50 and 100% this week. Yikes!

NYMEX RBOB gasoline had similar price action to WTI but briefly eclipsed the previous all-time high in 2008.

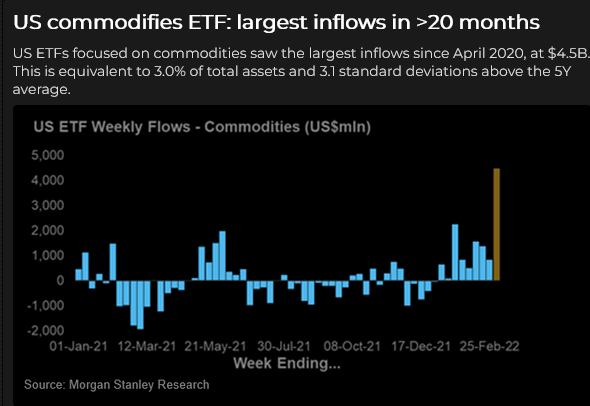

The public seems to be buying commodities aggressively. My long-time friend Ross Clark, who does terrific technical analysis, issued blow-off warnings for gold and commodities this week.

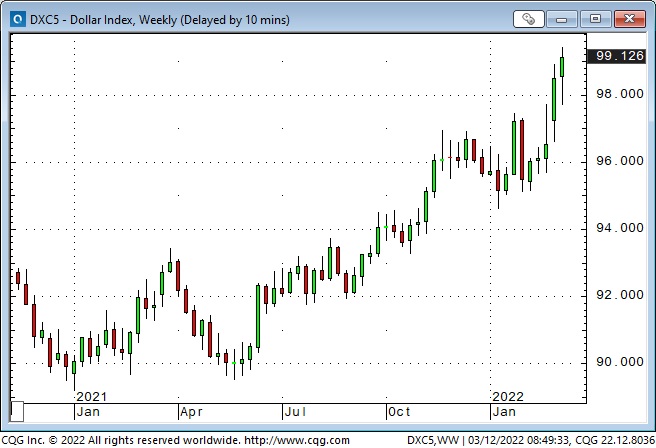

The US Dollar Index: highest weekly close in 22 months

The Japanese Yen tumbled to its lowest weekly finish in over six years.

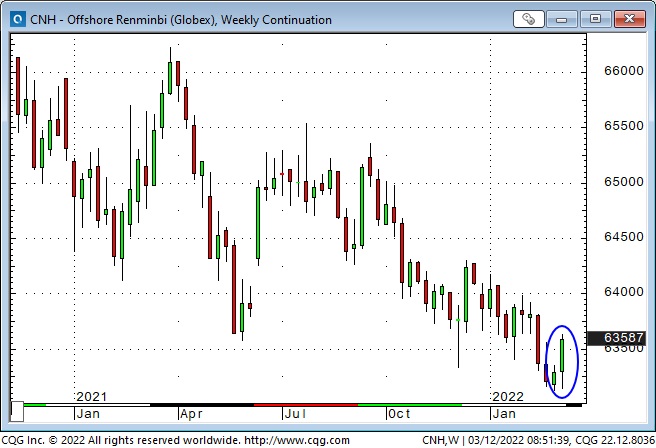

The offshore Renminbi hit its highest level against the USD in four years this week but weakened Friday as the USD rallied against most currencies. (In this chart, lower prices mean the USD is falling against the RMB.)

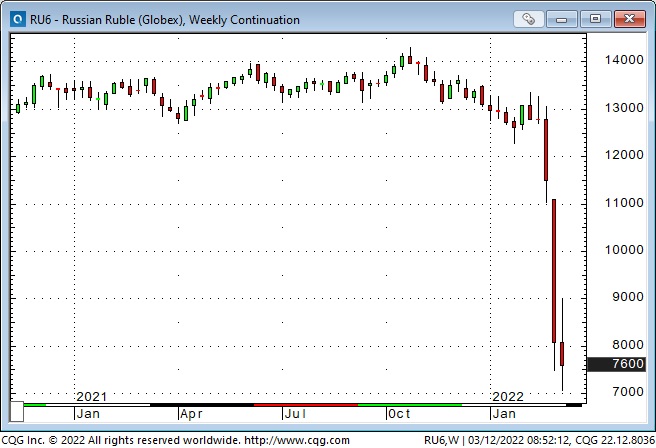

Russian Ruble futures have tumbled dramatically in the last three weeks – the Ruble is down ~80% from its July 2008 highs (when WTI was $147.)

The Canadian Dollar

Last week I posed the question: “What’s wrong with the Loonie?” Commodities have been soaring, but the CAD has not been keeping pace. What’s the problem? My answer was that the USD has been super strong against virtually all other currencies and that (together with rising risk-off sentiment) trumped the bullish effect that increasing commodity prices usually have on the CAD.

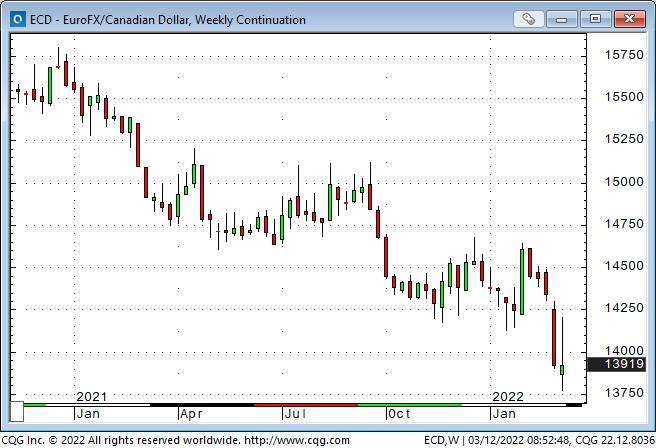

This EURCAD chart shows that the Euro is at seven-year lows against the CAD.

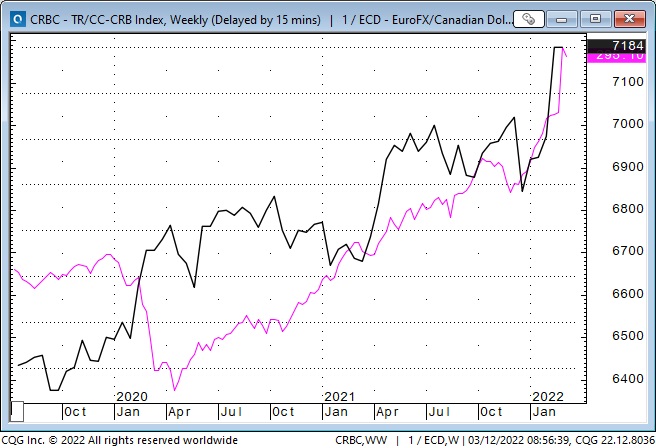

This chart shows that the reciprocal of the EURCAD (the rising black line is the CAD gaining on the Euro) has maintained a close correlation with the increasing CRBC commodity index (pink line.) So, In Euro terms, the CAD has been rising with commodities – in USD terms, not so much.

Expectations of Fed policy tightening have a more significant impact on US interest rates than the Russia/Ukraine conflict

American interest rates rose from December through February on expectations that the Fed would reverse ultra-easy monetary policies and start tightening in March 2022. Then Russia invaded Ukraine, and expectations briefly shifted to the Fed NOT tightening aggressively. But this week, sentiment turned back to the idea that the Fed will tighten policy because inflation will be even higher due to the invasion.

One-year forward Eurodollar contracts are pricing ~150 bp increase from current levels.

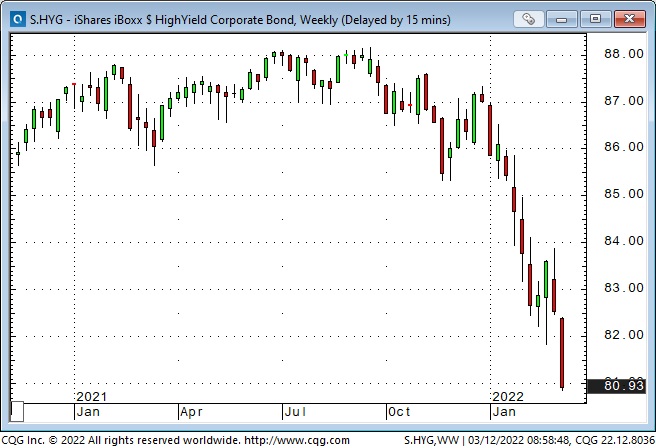

Credit quality spreads are widening as interest rates rise.

My short term trading

I was much more active this week than last week. My central theme was to try to pre-position ahead of a possible rally in the S+P (any indication of a ceasefire would cause stocks to soar.) I made several small-sized trades with tight stops. I had some winners and some losers, but net/net, I lost money.

I also bought the Euro and the CAD, thinking they would rally (after falling sharply last week) if there were any hint of a ceasefire. I made a little money on the Euro and was stopped for a slight loss on the CAD. I’m flat at the end of the week, and my P+L was down <0.50% on the week.

On my radar

ESG momentum may have stalled after being the “trendy” investment theme of 2021, but that doesn’t mean that long-term corporate Capex will surge because of higher energy prices. Corporations and investors will need to see a 180-degree change in attitude from Federal governments in North America before making serious long-term investments to develop domestic energy supplies. But Biden and Trudeau continue to be willfully oblivious to practical solutions that could make North American energy secure.

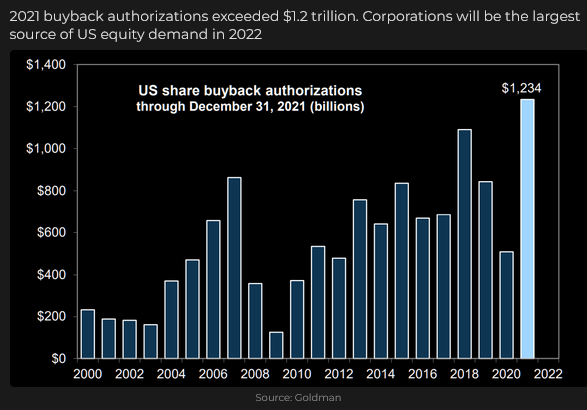

Regular readers know that my Big Picture thinking since last fall has been that equity markets are overdue for a substantial correction. I’ve written about “passive investing” (which now accounts for >50% of the new money coming into the market) being a relentless bid in the market. I think passive investors (who believe that the market only goes up over the long term) will NOT begin to sell unless the market has been trending lower for at least six months and the leading indices are down 30% or more.

Last week in the “Quotes” section, I quoted Michael Lewitt (The Credit Strategist) saying, “Wall Street’s job is to sell people things they should not buy. Like “short volatility!”

The ultra-low interest rate environment since 2008 has caused folks to “reach for yield” (to take more risk to generate income.) One of the things they have done is to sell option volatility and that selling depressed option Vol below where it would otherwise have been.

My guess (and my experience is that) unsophisticated option sellers will learn the hard way that they are taking too much risk, and that option Vols will trend higher as they leave the arena.

I first wrote about Fortress North America immediately after 9/11. My idea was that Canada, the USA and Mexico combined didn’t need much from the rest of the world.

That idea faded as globalization became the way of the world. Still, now that supply chain problems and geopolitical issues are generating thoughts of “on-shoring,” I wonder if the idea of a North American Bloc will re-surface (especially if China and Russia become best-of-friends.)

Thoughts on trading

People want to know “why” something happened – or will happen. They want a narrative that explains price action. For instance, crude oil is up because sanctions will reduce Russian supply. We’re told that if you’re going to be a good communicator, tell a story.

As a trader, I have to be aware that a narrative that “explains” price action may be deeply flawed or dead wrong. For instance, if I believe the story that “X” will cause “Y” to happen, and I make HUGE money betting on “Y” (without knowing that “X” had nothing to do with “Y”), then I’m at risk of thinking I can “see” things that other people can’t – that I have exceptional “variant perception.” That degree of hubris inevitably has painful consequences!

Trying to trade the “misinformation” flow from the Russia/Ukraine conflict is fraught with risk – especially if I’m predisposed to selectively choose the misinformation that supports my underlying bias (such as, “we must be close to a ceasefire!”)

Quotes from the notebook

“I acknowledge that I don’t have all the facts. I acknowledge that I don’t know what motivates other people participating in the markets that I trade. So why would price action in those markets have to “make sense” to me?” Victor Adair 2019

My comment: This kind of thinking is the basis of my risk management. I do not get stubborn with a trade that is going against me, and I never “give it a little more time.” I’m willing to take a slight loss and move on.

“It ain’t what you don’t know that gets you into trouble. It’s what you know “for sure” that just ain’t so…that gets you into trouble.” attributed to Mark Twain

My comment: 100%!

“In my darkest moments, Fanny, I’m afraid it’s all about marketing.” Victor Adair, during an unscripted TV interview with Fanny Kiefer, 2003

My comment: Fanny and I went back and forth about markets and human behaviour, and she got me to say the above quote. I had no idea I was going to say that – and once it was said, there was silence between us for a moment and then she faced the camera and said, “we will be right back after this commercial break.”

The Barney report

The Barns is six months old today. He’s forty-eight pounds and still growing. He’s asleep at my feet, but as soon as he wakes up, he will give me the “sad-face” until I leave my computers and play with him.

I love the way he prances along with his head up and his tail wagging when he’s found a good stick.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The March 12th podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.