Check your old-school assumptions at the door

Market sentiment has been oscillating between believing that “higher for longer” is 1) dead or 2) will be indefinitely sustained. The oscillation frequency has shrunk from months (during the October to February period) to days (since mid-April), and this week, sentiment swung from pillar to post between Monday and Friday as different headline employment metrics painted dramatically different pictures of the economic landscape.

Before Friday’s NFP report, markets embraced the notion that “higher for longer” was dead, but the much-hotter-than-expected NFP headline employment number blew away those assumptions. Interest rates and the US Dollar rallied, and precious metals tumbled. Some analysts argue that the headline NFP number was “at odds” with the “true” picture of American employment (see this post on Zero Hedge), and they may be correct, but the price action across asset classes was a classic example of “shoot first and ask questions later.”

The leading American stock indices virtually ignored the “higher for longer” drama that hit other markets

The S&P and the NAZ rallied to new all-time highs on Friday, after a brief dip below Thursday’s lows on the NFP headline, but fell back to close slightly red on the day. Both indices registered record-high weekly closes.

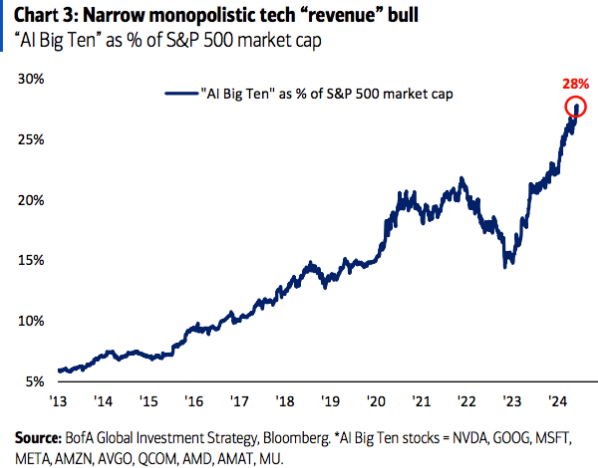

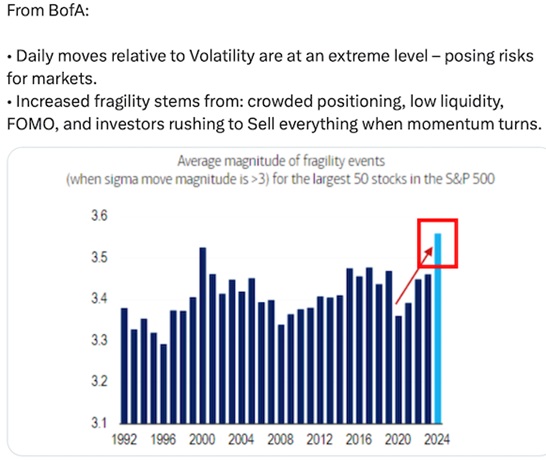

Big Tech has been the main “driver” of the leading stock indices, especially since the lows of October 2022. Changes in interest rate expectations have scarcely mattered.

NVDA IS THE MOST IMPORTANT STOCK IN THE WORLD. The share price has risen ~50% since May 1 and 150% YTD. This week, the NVDA market cap rose above ~$3 trillion, higher than AAPL’s. NVDA alone accounts for ~40% of the S&P’s YTD gains. The shares split 10-for-1 after the close Friday.

While the S&P and NAZ reached new ATHs this week, the Russell 2000 index of small-cap stocks closed in the red year-to-date.

Currencies

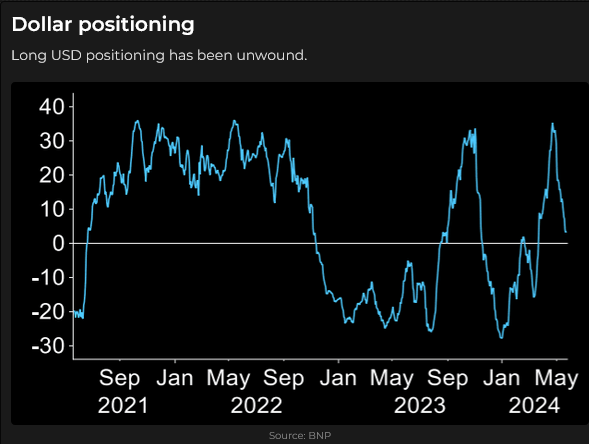

The US Dollar Index trended lower for six weeks but staged a sharp rebound following Friday morning’s NFP data. (My long-time friend Ross Clark, an excellent technical analyst, published a report on Thursday calling for a USD rebound based on a compelling 82-day cycle pattern.)

Speculators were heavily net short USD at its December lows, bought it aggressively as it rose to April highs, and are now nearly net neutral, with the USD down ~2 cents from the April highs.

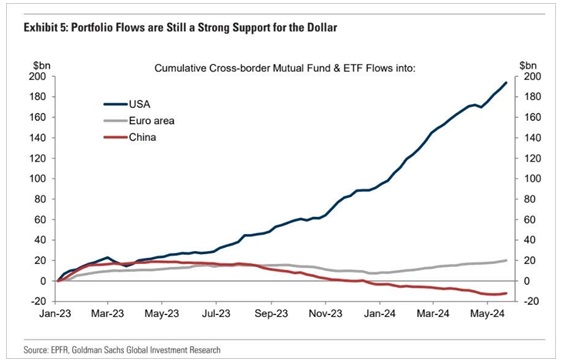

Capital continues to flow to America for safety and opportunity, especially as American equity indices hugely outperform the rest of the world.

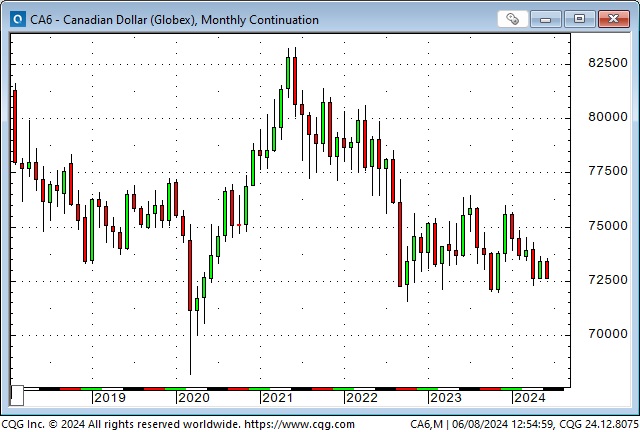

The Canadian Dollar was unfazed by the expected 25bps cut from the Bank of Canada on Wednesday but tumbled on Friday’s NFP report. COT data (as of June 4) shows that speculators have increased their net short position to a 7-year high. (This report was issued before Friday’s sharp tumble, which probably caused speculators to short more CAD.)

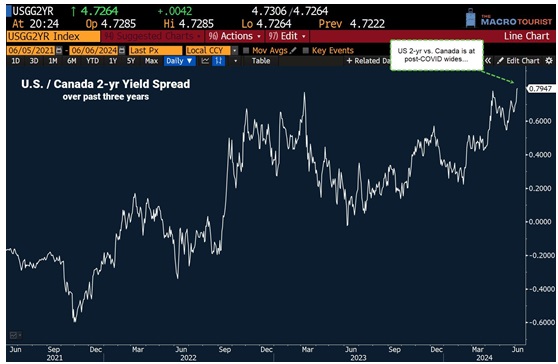

In late 2021, Canadian 2-year interest rates were ~60 bps higher than American rates, but now US rates are ~70 bps higher than Canada’s. The CAD fell from ~80 to ~73 cents during this time.

On Friday, CAD open interest surged to a new all-time high (X delivery spikes). June 20 is the delivery date for the June CAD contract, so some of the OI increase may be related to that, but that aside, if the USD continues to rally and/or the S&P tumbles, the CAD could tumble. A break below 72 cents would be ominous.

The Swiss Franc (effectively) hit all-time highs against the Euro and the USD in December and then trended lower into May. (The Swiss National Bank had signalled that the Franc had gone too high – although the strong Franc helped keep Swiss inflation low.) The SNB assisted the decline with an unexpected interest rate cut in March. The CHF turned higher last week and got a boost when the head of the SNB said the currency had fallen too much and hinted at intervention.

As the Franc fell from its December highs, speculators built net short positions to a 5-year high (with open interest at record highs). The growth in net short spec positioning peaked around the beginning of May and has remained steady at those levels despite the recent 3-cent rally.

CARAMBA! The Mexican Peso rallied ~50% from historic (COVID-related) lows in early 2020 to 9-year highs in early April. However, the Peso weakened against the USD in April (as nearly all currencies did) as market sentiment was in a “higher for longer” mood and geopolitical tensions rose. (The spike down on April 19 happened in the early Asian morning trading session on reports of “explosions” in Iran—assumed to have been caused by Israeli attacks.)

The MEX made a “lower high” on May 21 and then began to weaken ahead of the June 2 Mexican Federal election. The Peso started to tumble when the ruling Morena party’s landslide victory became evident. It closed the week at an 8-month low, having fallen ~12% in just two weeks!

The MSCI ETF for Mexican shares hit an 11-year high in early April but closed ~19% lower this week, at an 8-month low. Numerous research reports and editorials focused on concerns that the landslide victory may clear the way for substantial constitutional changes.

Metals

Gold was barely above $1,800 in early October 2023 when Hamas attacked Israel. It subsequently rallied ~$650 (~36%) to all-time highs of ~$2,450 in mid-May.

Increasing geopolitical stress was a supportive factor during the gold rally, but a truly “bedrock” support was the “declared” strong buying from various central banks, including the Chinese central bank. During this week’s overnight Thursday trading session, the market learned that the PBOC did not buy gold in May, and the price quickly dropped by ~$50. Gold fell further on the NFP report, dropping >$100 from the overnight high. Two of the last three weeks have registered weekly Key Reversals down.

Comex copper soared to all-time highs on May 20 at ~ $5.20 per pound. The bullish narrative was that the world would be unable to meet the voracious demand for copper due to the electrification of “everything.” It was a compelling story.

At Friday’s close, copper prices were ~75 cents (15%) below the May highs. COT data shows that speculators began to buy copper aggressively in early March, and their net long position rose to 3-year highs in May. Open interest rose to a 6-year high. The June 4 COT report shows that the net long spec position has only been incrementally reduced despite the ~15% price decline.

In terms of “check your assumptions,” the bullish copper narrative “assumed” that the electrification of everything was a “given,” and since there would never be enough copper to meet demand, prices “had” to go up. Well, maybe not, or at least maybe not overnight. What if the electrification of everything doesn’t happen? High prices are often the best cure for high prices.

Energy

OPEC+ met last weekend and planned to begin reducing production cutbacks later this year. By Tuesday, the WTI price had dropped ~$5 to 4-month lows but bounced back to be down only ~$2 w/w. The ~$15 decline from April highs to this week’s lows may mean there is minimal “geopolitical risk premium” in current prices.

My short-term trading

I started this week with only one position: long July Swiss Franc calls bought on May 14. The CHF had rallied Thursday and Friday after the head of the SNB said the Franc was too low and hinted at intervention. That rally raised the value of my calls above the purchase price.

The rally continued on Monday and Tuesday (as market sentiment assumed that “higher for longer” was history), and the calls were worth more than double the purchase price. I tried to sell some OTM calls as a hedge against my position but didn’t get filled (Swiss Franc options are thinly traded), so I went into the NFP report net long.

The CHF tumbled on the NFP report, and when there seemed to be no respite from the selling pressure, I covered the options for a tiny net gain.

I shorted the S&P early in the week and was quickly stopped for a tiny loss.

My net P+L for the week was a tiny loss. I was flat going into the weekend.

Important note

There will be no Trading Desk Notes next week – it is Father’s Day, and my son and other family members are coming for a visit.

On my radar

The Fed meets on Tuesday and Wednesday, but no interest rate change is expected. Markets may react to their comments or Powell’s presser.

CPI is due Wednesday, ahead of the Fed.

The Bank of England meets on June 20 and will likely cut rates by 25 bps.

The first televised debate between Trump and Biden is scheduled for June 27, just three weeks away. The markets will be increasingly vulnerable to politics between now and November (and likely after the election).

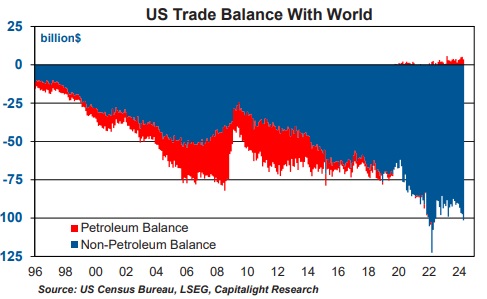

For instance, the USA has a ~$100 billion monthly trade deficit with the rest of the world. Trump apparently doesn’t like that, and there is talk that if elected (especially if the Republicans control Congress), he will increase tariffs and/or devalue the USD. (This chart is courtesy of Martin Murenbeeld, the writer of the weekly Gold Monitor.)

A LOT of capital has “come to America” from the rest of the world over the years and has likely grown substantially. Will some foreigners sell out and repatriate their capital “just in case” Trump becomes President? Will that weaken the stock or bond market? Will it weaken the USD?

The Barney report

Barney is happiest when he can run free, so we go places where there is no traffic, where he can explore to his heart’s content, and I don’t have to worry about him getting hurt.

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the impact of the employment data, why NVDA is the most important stock in the world, the sharp tumble in the gold market following the PBOC news, OPEC’s decision to increase production and what impact the coming American election may have on markets. My spot with Mike starts around the 1-hour and 6-minute mark. Mike’s feature guess this week was Doomberg – beginning around the 6-minute mark. You can listen here.

Heads Up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. Everybody gets down/depressed at some time. My “get out of jail” activity was to 1) do something for somebody else and 2) get outside. This Twitter post rang a bell for me.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.