NVDA goes to the top of the market cap leaderboard

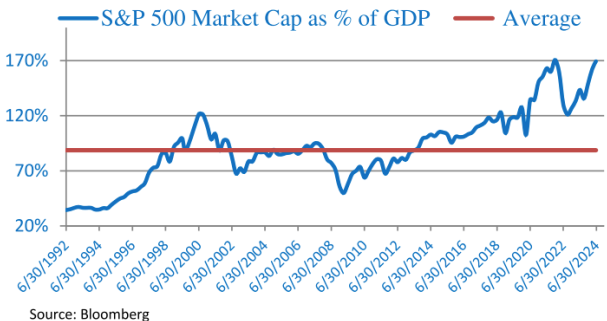

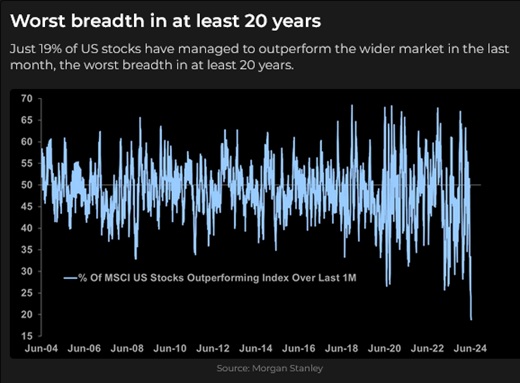

The total market cap of NVDA, MSFT, and AAPL is now over $10 trillion. NVDA, MSFT, GOOGL, AMZN, and META collectively are up ~45% YTD, representing ~25% of the S&P market cap and ~60% of S&P YTD gains (NVDA alone accounts for ~35% of the S&P YTD gains.)

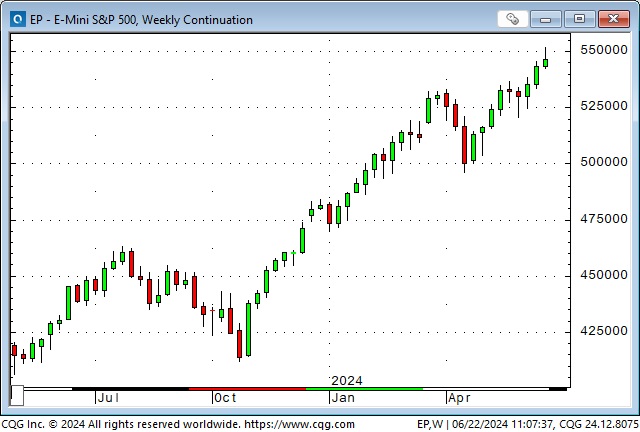

The S&P and the NAZ both reached new all-time highs this week.

The TSE index has fallen for five consecutive weeks, touching a four-month low.

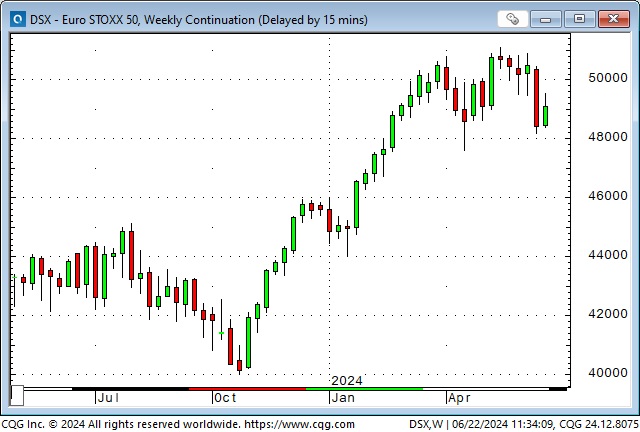

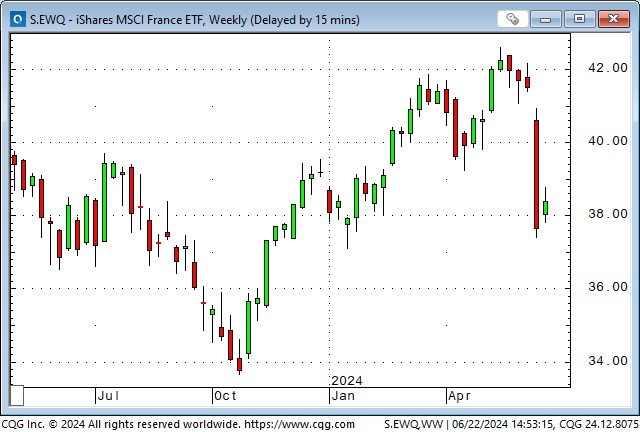

The Euro Stoxx 50 Index has fallen from its mid-May highs.

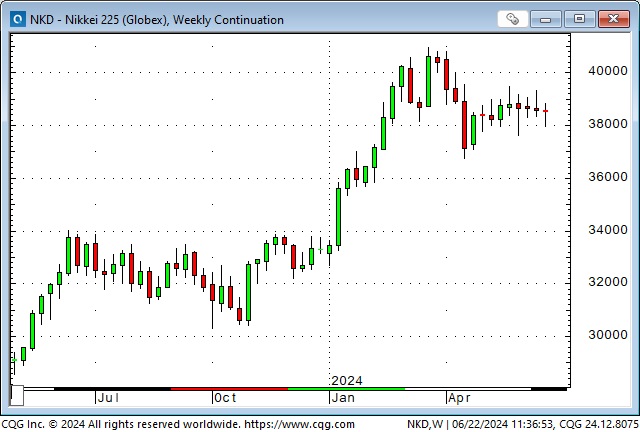

The Nikkei is down ~6% from March’s all-time highs.

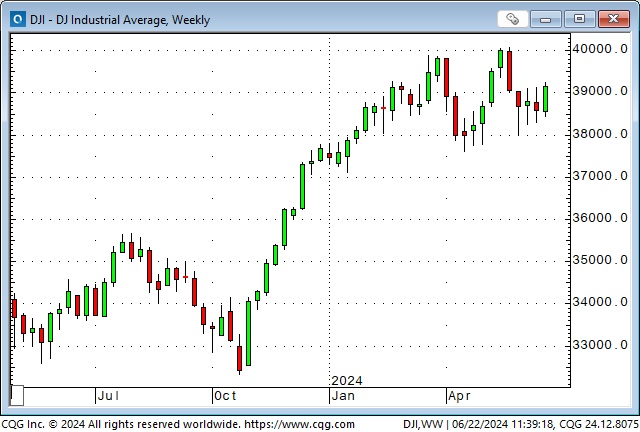

The DJIA hit all-time highs six weeks ago and has traded lower since then.

The DJT has not made a new high in 2024 and touched a 7-month low last week.

The Russell small cap index made a 2-year high in April and is down ~2% YTD. It is down ~18% from November 2021 ATH.

Mega-cap tech is in a world of its own, with capital inflows at record highs.

What could possibly go wrong?

1) Election risks. The first Trump/Biden debate is five days away. Trump’s sentencing date is July 11. The GOP convention is July 13 – 18 (when Trump reveals his running mate), and the DEM convention is August 19-22. The French election is the first week of July, and the UK votes on July 4.

2) Geopolitical risks. The Russia/Ukraine war is intensifying, with both sides targeting energy infrastructure. Will it escalate? Will the Israel/Hezbollah conflict escalate?

3) A slowing economy. The economic reports have been mixed; some show the economy humming while others show signs of softening. I’m focused on the consumer (~70% of the economy), where the gap between the “haves and the have-nots” continues to widen, setting the stage for a “bottom-up” weakening of the economy.

4) The Fed overstays “higher for longer.”

5) A credit event. Commercial real estate risks are supposedly “known and contained,” but maybe an unpleasant surprise lurks.

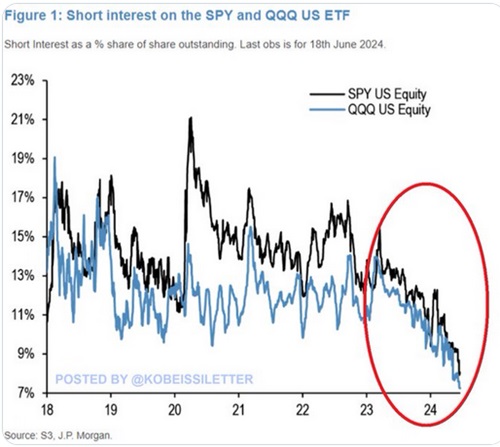

6) Positioning risk. (Bob Farrell’s 10 Rules for Investing.)

7) A black swan. You never see it coming.

Interest rates

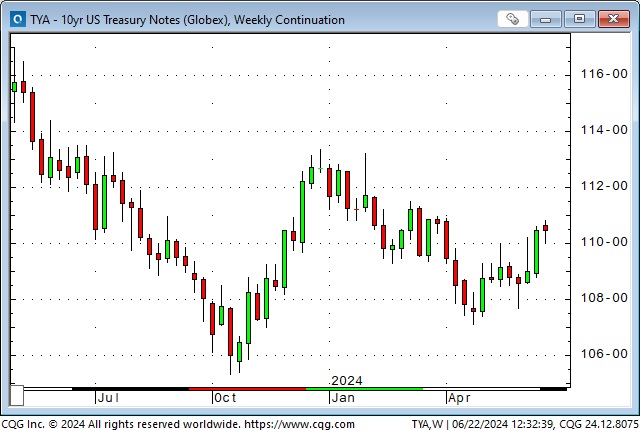

The CBO revised its deficit forecast for the current fiscal year to $1.9 trillion, up from $1.5 trillion in February. Markets are expecting a substantial increase in TBill issuance.

Long-term yields have trended lower (prices higher) since April.

Forward markets are currently pricing about two Fed cuts of 25 bps by December.

Currencies

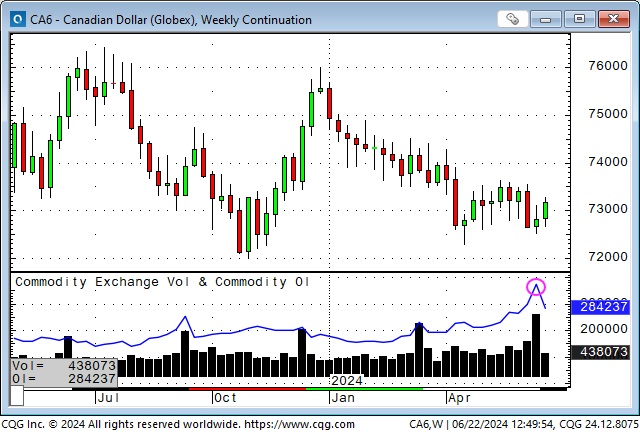

The Canadian Dollar has traded in a narrow one-cent range on either side of 73 cents for the past three months, but COT data (as of June 11) shows that since March, non-commercial accounts (speculators) have built up a massive net short position in CAD futures. (This week’s COT data release has been delayed until Monday due to this week’s holiday.) Open interest hit a record on June 14.

Canadian interest rates have historically been at a premium to US rates, but for most of the past two years, CDN 2-year rates have been below US rates. The 2-year spread is currently ~80 bps, the widest in over four years.

Speculators shorting the CAD may be focusing on this spread and expecting it to widen if the BoC cuts rates more or faster than the Fed. Interest rate differentials often substantially impact FX rates, with low interest-rate currencies weakening against currencies with higher rates. For instance, the Japanese Yen, with ultra-low or negative short rates, has fallen against most other currencies over the past several years.

Speculators may also be focused on differences between Canadian and American residential mortgages. Canadian mortgage terms are mostly five years or less (American terms are typically much longer), and a “refinancing wall” for Canadian mortgages (at substantially higher interest rates) is looming.

Here’s a quote from Canadian Mortgage Services: 80% of all mortgages outstanding as of March 2022 are coming up for renewal in 2024. This amounts to approximately $250 billion in mortgages. 2025 is expected to be an even bigger year, with a whopping $350 billion in mortgage renewals expected. Although rate cuts are within sight, between now and 2026, almost all mortgage holders will see an increase in their mortgage payments – some as high as a 54% increase.

The “refinancing wall” may negatively impact the Canadian economy if consumers struggle with higher mortgage payments. It may also concern the BoC, causing it to cut rates more than otherwise.

Positioning: The record-sized CAD speculative short position is no secret to currency traders. If the CAD starts to rally, the market will know that those shorts must become buyers to cover their positions, which may accelerate the rally. Alternatively, if the CAD starts to fall, the shorts will benefit and may add to their positions.

The Japanese Yen has fallen to new 34-year lows, below the levels of the April intervention by Japanese authorities, with the spot nearing 160. (This chart of September Yen exaggerates the decline due to forward interest rate differentials but illustrates the weakness.)

The Swiss Franc rallied ~3% from late May to Wednesday this week but tumbled on Thursday when the SNB surprised markets by cutting rates another 25 bps. (In previous editions of the TD Notes, I wrote about the buildup of massive speculative short positions in the Franc from January to May and how covering these positions would likely accelerate a rally. Something similar could happen if the CAD rallied.)

The Swiss Franc / Euro spread is among my favourite “European Stress” barometers. (When the Euro falls sharply against the Franc, there’s “trouble” in Europe.) This chart shows that the Euro has tumbled against the Swiss Franc since mid-May.

The recent decline of French shares may be part of the reason the Euro is falling against the Swiss Franc.

Metals

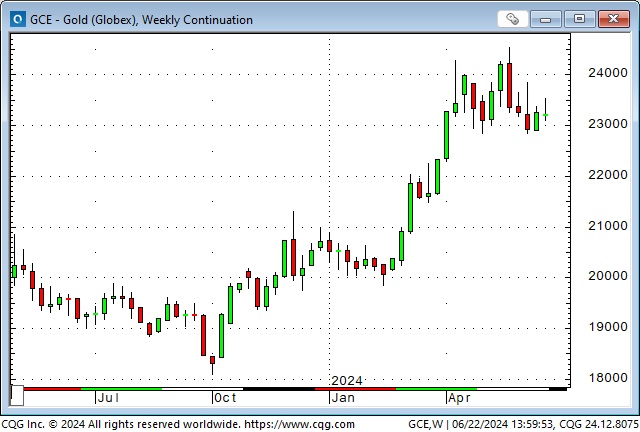

Gold hit record highs of ~$2,450 in mid-May but has fallen back ~$150. Aggressive retail Chinese buying defined the high.

Copper hit record highs of ~$5.20 in mid-May but has fallen back ~80 cents. Aggressive speculative buying based on the “electrification of everything” defined the high.

Did we see a widespread “turn” in risk sentiment in mid-May?

Many stock indices (with the notable exception of the tech-heavy S&P and NAZ), such as the DJIA, the DJT, the TSE, and the European, Japanese and Mexican indices, turned lower in mid-May, as did precious metals and copper. The US Dollar Index hit a low in mid-May and has increased since then. Short and long-term interest rates turned higher in mid-May, but, to be fair, they subsequently dropped to lower levels. Even crypto markets have fallen from their mid-May highs.

Since mid-May, I sense that market participants have “backed away” from aggressively bidding risk assets higher except for the tech-heavy S&P and NAZ, and even there, the FOMO fever has cooled.

My short-term trading

I did relatively little trading in the past two weeks. (I was wonderfully distracted by family visits and terrific get-outdoors weather!)

I shorted the S&P twice last week and was quickly stopped out for tiny losses. I shorted the S&P this Thursday and remained short into the weekend. This chart looks toppy!

I bought the CAD on Monday (thinking about all those shorts that will have to cover if the CAD rallies), but I closed the trade on Friday for a small profit. (Those shorts might be right; if the S&P falls, as I think it might, it may pull the CAD lower as the market turns risk-averse.) If CAD continues to increase, I should have plenty of opportunities to buy before those spec shorts start to cover.

On my radar

If stock indices correct from here, capital may flow into cash or short-term government bonds. Given the government funding requirements (and my views of inflation continuing above the Fed’s 2% target), I could see the yield curve inversions going back toward normal.

This week’s delayed COT data is scheduled to be released on Monday. I’ll be looking at that for positioning changes.

The Thursday Trump/Biden debate has the potential to rock markets.

The PCE data Friday morning could also roil the markets.

Markets seem to have priced in a landslide win for Labour in the UK election on July 4, but they had recently priced in a landslide win for the Morena party in Mexico. When that happened, “all hell broke loose,” and the Mexican stock market and the Peso tumbled.

The French elections are the first week of July and could also roil markets.

Thoughts on trading

Everybody wants more money. This week, I received another one of those “we need to raise our prices because our costs have gone up” messages. I considered cancelling the service or paying the higher price, which made me think that people everywhere were making those same decisions. Pay the higher price, or don’t buy the item.

As I’ve written in previous Notes, people who have assets (real estate, stocks, savings) and have benefited as those assets rose in price or paid the highest interest rates in years are more able or willing to pay higher prices, but the “have nots” are likely NOT to pay the higher prices – and this is what starts a “bottom-up” recession.

I see lots of “marketing hype,” which claims that “commodities are super-cheap compared to stocks.” The “message” is that now is a “can’t lose” time to buy commodities. My reaction is to think that stocks are probably outrageously overvalued, not that commodities are super cheap.

If you’ve been around markets for a few decades, you’ve probably heard that the bond market is way more intelligent than the stock market. Bond traders are geniuses compared to the goofy teenagers trading stocks, and the bond vigilantes rule the world. What if that’s not true? What if the bond vigilantes were de-fanged years ago, and the central bankers control the bond market, lock, stock and barrel?

The Barney report

We had a cooler and wetter-than-normal spring, but recently, the weather improved, and Barney and I have had some great summer walks. Here he is on the longest day of the year, the hottest day of the year to date, running free in this vast open green space in the middle of the forest. This boy loves to run!

Listen to Victor talk about markets

On this morning’s Moneytalks show, Mike Campbell and I discussed the divergence between Mega-cap tech (which keeps going up) and everything else. We also discussed the massive speculative short position against the Canadian Dollar and the coming election risks. Mike’s feature market guest this morning was Tony Greer, who has been super bullish on stocks but explains why he is now expecting a correction. You can listen to the show here. My spot with Mike starts around the one-hour and six-minute mark.

I did my monthly 30-minute interview with Jim Goddard on the “This Week In Money” show last Saturday, June 15. We “covered the waterfront” on financial markets. Two of my long-time friends, Ross Clark and Josef Schachter, were also on the show. You can listen here.

Heads up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. So many times when that happens, people say, “I would have done something if I’d known he was struggling.”

If you, or someone you know, is down or depressed, reach out to these guys. They can help.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.