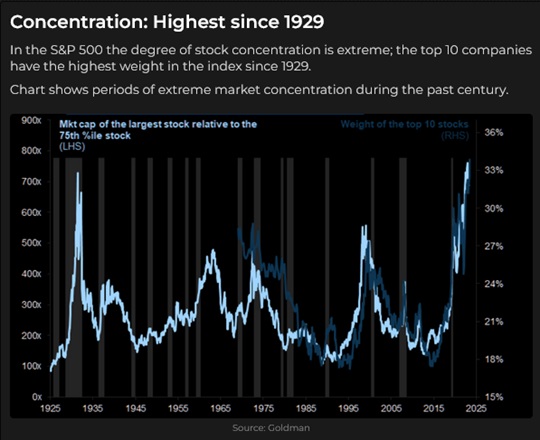

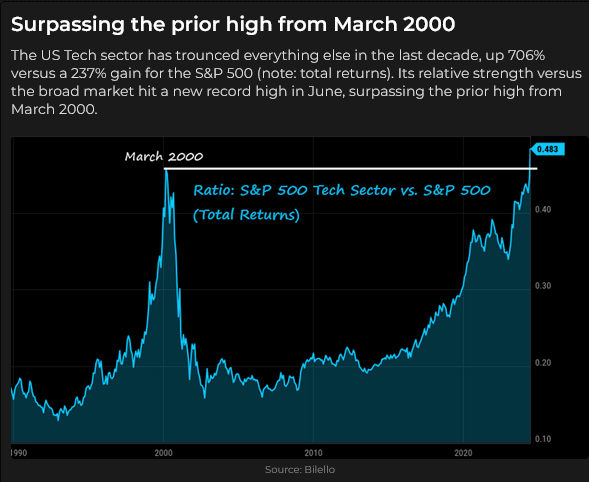

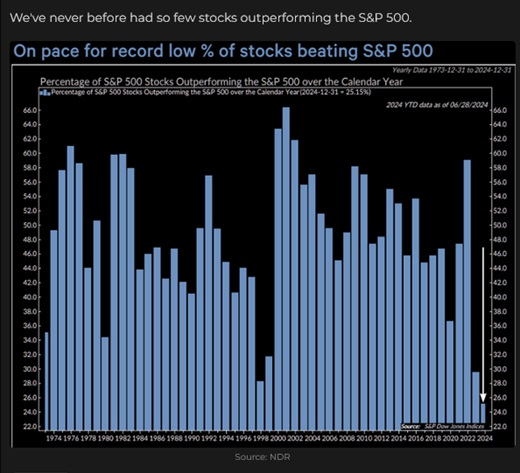

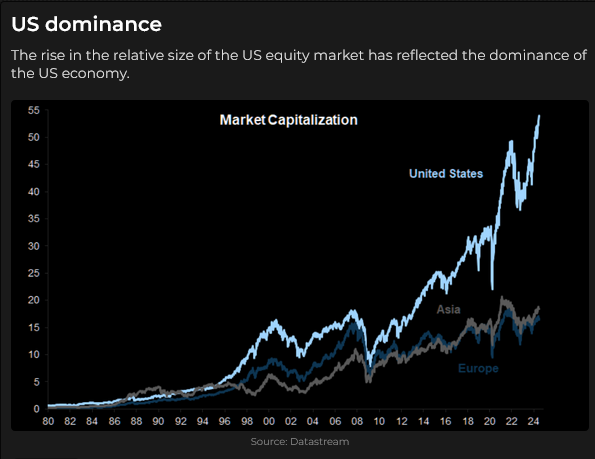

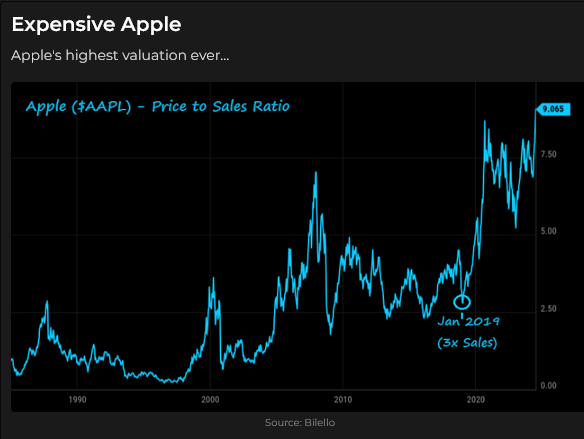

Big-cap tech leaves the rest of the market behind

The NAZ closed green on each of the four days markets were open this week, once again powered by Big-cap tech. It is up ~21% YTD.

The Russell 2000 closed lower this week and is slightly lower YTD.

The DJIA, which includes AMZN, MSFT and AAPL, is up ~4.5% YTD.

Crypto markets have not benefited from the risk-on sentiment driving big-cap tech

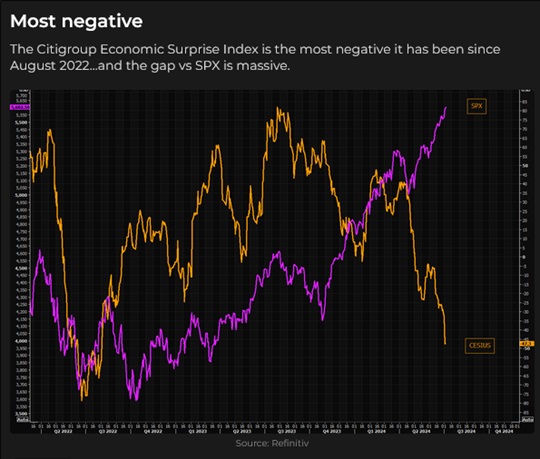

Economic data: the economy is steady to slower

The economic data has been mixed but, on balance, points to a slowing economy, which means the Fed is unlikely to raise rates. After the Friday employment data, the forward markets are pricing better than a 75% chance of two rate cuts this year, with the first in September.

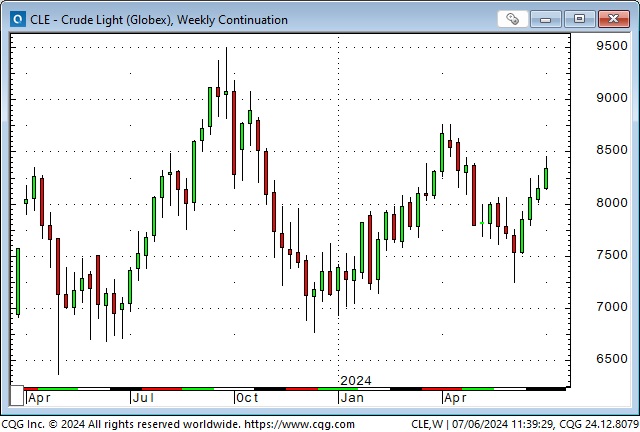

WTI prices are up ~17% YTD (up 11% since early June). Rising fuel prices may keep inflation “sticky.”

Gold rallied ~$100 from last week’s lows and closed this week at a six-week high. The ~$2,300 level has been good support for the past three months. A weaker USD, lower interest rates, the prospect of Fed cuts, and persistent geopolitical concerns have helped buoy gold prices.

Copper soared to a record high in mid-May, then sold off ~17% to last week’s lows but rallied every day this week to close ~34 cents above last week’s lows.

Currencies

The US Dollar Index rallied to a two-month high at the end of June (the Euro and the Yen were particularly weak during June) but fell every day this week.

Euro weakness (against the Swiss Franc and the USD) in June may have been linked to concerns over the French elections. When the first round of voting resulted in something less than a tsunami in favour of the “far-right,” the Euro rebounded. (Sell the rumour, buy the news.)

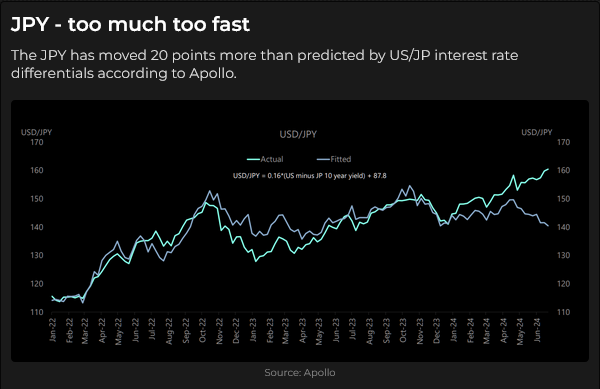

The Yen fell to new 34-year lows this week (rallied through 160 Yen/Dollar) with hardly a “peep” from the Japanese authorities. Following Friday’s US employment report, the Yen rallied along with most other currencies.

Japanese interest rates have been substantially lower than most other countries for several years due to the BOJ’s attempts to stimulate the economy with ultra-low rates. ( Currently, the US 2-year is ~ 4.7%, and the Japanese 2-year is ~0.34%.) As a result, the Yen has fallen more than 50% against the USD since its ATH reached in 2011.

The Japanese authorities’ “failure” to halt the Yen’s decline with their intervention in April may have emboldened speculators to “press” the short side of the Yen. This chart shows that the Yen may be “too weak,” at least regarding interest rate differentials.

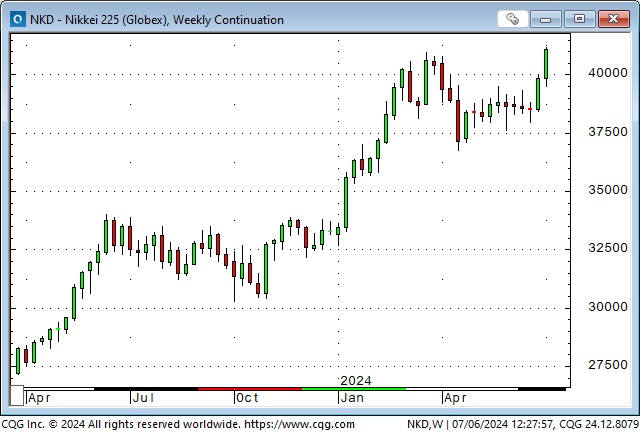

The weak Yen may have contributed to the TOPIX and NIKKEI indices reaching record highs this week (after falling back from record highs in April when the authorities intervened in the FX markets.) A weak Yen increases the profitability of Japanese exports.

The British Pound rallied against the USD and the EUR this week as markets embraced the new Labour government.

The Canadian Dollar has fluctuated mainly within a one-cent range for the past three months. It rallied against the USD on Tuesday and Wednesday (as did most other currencies) but stalled on Friday as Canadian employment data was mildly disappointing. Futures market speculators have built a record-sized short position in the CAD since March, so any breakout from the 3-month range may be accelerated by “positioning.” (This week’s COT report was delayed until Monday due to the July 4 holiday.)

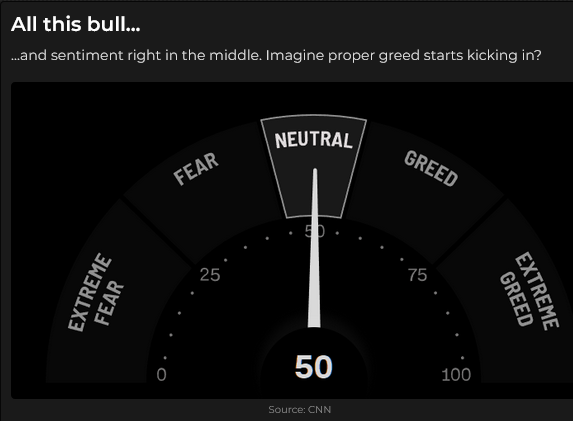

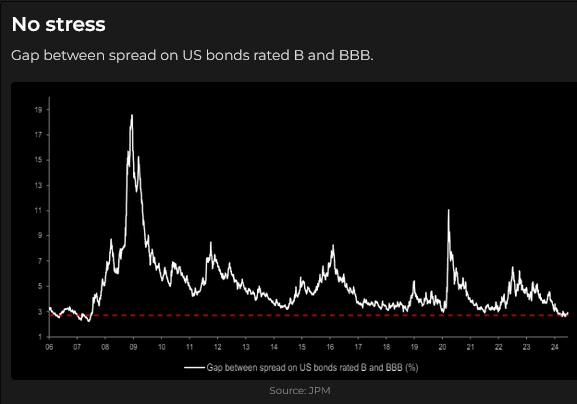

There is a high level of complacency

With stock indices chugging relentlessly higher, with expectations that inflation will continue to fall and the Fed will cut interest rates, and with “no worries” that geopolitical stress will ever reach American shores, there is a high level of complacency across markets.

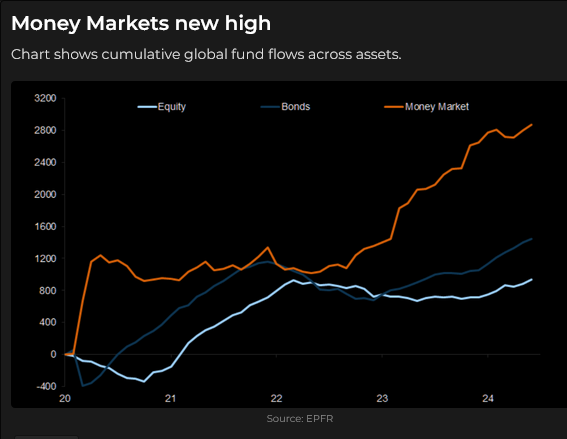

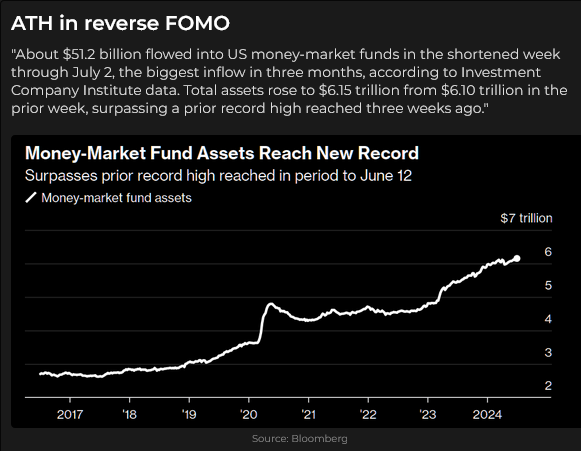

Money market fund assets continue to grow

I do NOT see the growing pile of cash in money market funds as “dry powder” that will FOMO into the stock market at some point. Quite the opposite, I see it as “rainy day” money from people who have seen ups and downs in the stock market over the years and “can’t bring themselves” to buying (more) stocks at these prices.

Quote of the week

“It is impossible to seperate geopolitical risk from capital allocation.”

Mike Pompeo, former Secretary of State

Thoughts on trading

My market opinions and trading setups exist in different time frames. I’ll form an opinion about whether I want to be long or short a market (but will have no bullish or bearish opinion on most markets.) My opinion about a market will usually have a time frame of weeks or months, while I wait for trading setups to develop.

My opinion will be based upon fundamentals, price action, correlations, poitioning, sentiment, etc. – but I won’t trade just on my opinions. I’ll wait for the market to “setup” before I take a trade in line with my opinions. A setup will give me an assumed good risk/reward ratio, a good entry point and a clearly defined “I’m wrong” price level.

A setup could be a buy in an uptrending market that has had a correction and is now reversing higher. It could be a breakout from a range, a reaction to an event, an “M” top or a “W” bottom, a completed or failed head and shoulders pattern, etc., but the important thing is that if I don’t get a setup in line with my opinion I don’t make a trade.

For instance, for the past few weeks my opinion was that gold had topped out and might break down. The top had been defined by aggressive speculative buying, and speculators were heavily long. A breakdown below support at ~$2,300 could trigger heavy speculative selling, but I didn’t get a setup (a break below a support level) so I didn’t get short.

My short-term trading

I started this week short the S&P and CAD – positions established Friday of last week. Both markets traded lower on Monday and early Tuesday, but then started to rally. I covered the trades for small gains, rather than waiting for my stops to take me out. (I would have had small losses if the stops had been hit.)

I was happy to have no position going into Wednesday ahead of what would essentially be a 4-day weekend – with the US and Canadian employment data early Friday morning a potential wild card.

Both markets continued to rally Tuesday and again on Wednesday (and I was happy to not be short.) Both markets rallied Friday morning after the Thursday holiday and the employment reports, but the CAD struggled despite other currencies and the stock indices rallying so I shorted it and stayed short into the weekend.

On my radar

The 2nd round of the French elections is on Sunday and may have an impact on the Euro.

The COT data as of July 2 will be released on Monday and I will take a good look at that for information about speculative positioning.

I think the Yen might be a buy around here, and I’m well aware of the “widowmaker” appelation that applies to people who have tried to pick the bottom of the Japanese bond market or the Yen. I might write Yen puts, although the money to be made doing that would be pocket change compared to being long the Yen if it starts to rally in earnest.

The Barney report

I love to take Barney to places where he can run wild and I don’t have to worry about traffic. This road is like so many forest roads around British Columbia that I have walked over the years. Its a perfect place for Barney.

Here’s Barney emerging from one the trails that connect with the road.

Listen to Victor talk about markets with Mike Campbell

On Mike’s Moneytalks show this morning Mike and I discussed the surging big-cap tech stocks leaving the rest of the market behind, inflation and Fed cuts in 2024, the huge flow of capital into money market funds, and the impact on the Japanese stock market from the Yen falling to new 34-year lows. You can listen to the show here, my 8-minute segment with Mike starts around the 37-minute mark.

Heads up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. So many times when that happens, people say, “I would have done something if I’d known he was struggling.”

If you, or someone you know, is down or depressed, reach out to these guys. They can help.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.