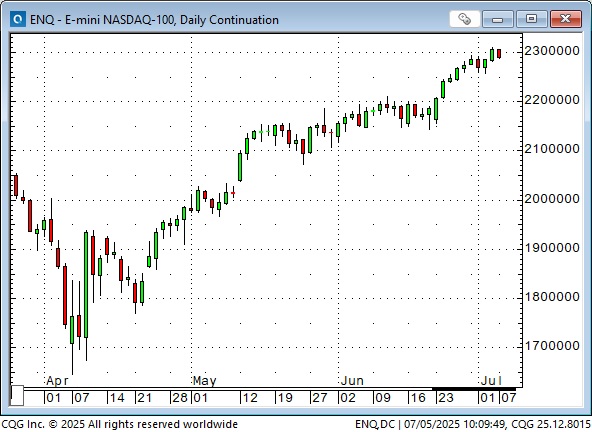

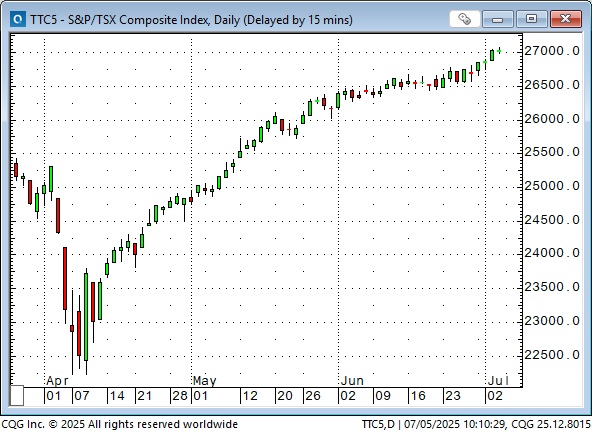

The S&P, NAZ and TSE hit new record highs this week

The S&P is up ~30% from the April lows (~7% YTD), the NAZ is up ~40% from the April lows (~8% YTD), and the Toronto Composite is up ~22% from the April lows (~9% YTD).

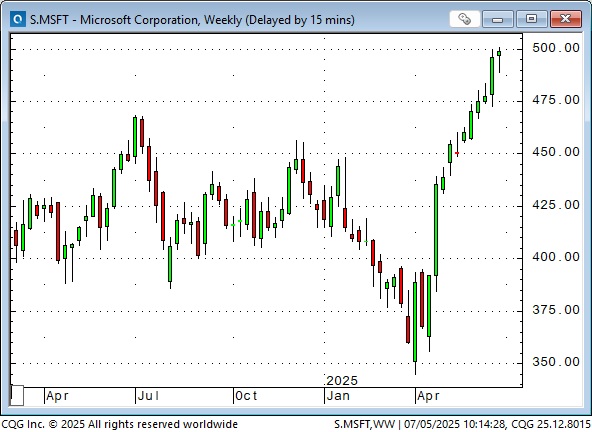

Big Cap Tech has led the rally, with MSFT up ~45% from the April lows (18% YTD).

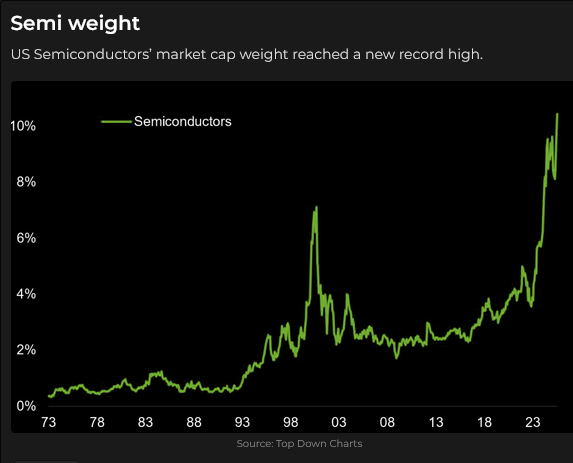

NVDA is up ~86% from the April lows (~11% YTD), with a market cap of ~$3.9 trillion.

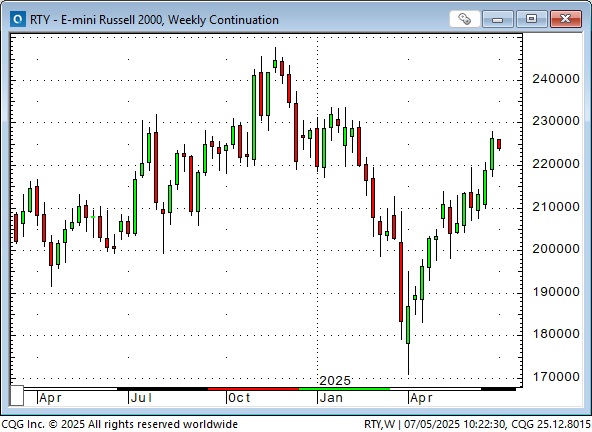

But the rally has been broadening, with the Russell 2000 up ~20% from the April lows (down ~2% YTD).

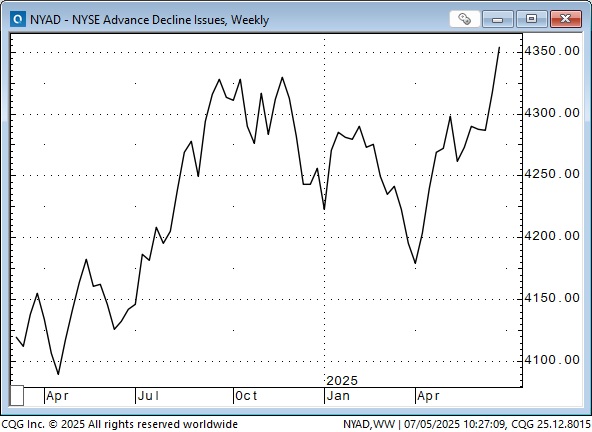

The NYAD has surged to all-time highs as the rally continues to broaden.

The venerable DJIA has surged nearly 3,000 points in the last two weeks, and is a whisker away from new all-time highs. It is up ~22% from the April lows, ~5% YTD.

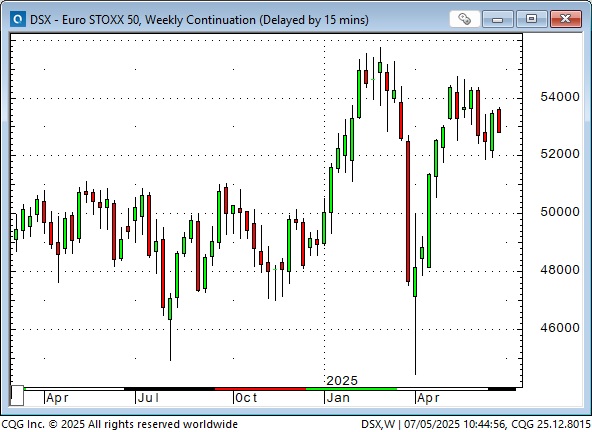

The Euro STOXX 50 Index reached all-time highs in March (on the idea that “American exceptionalism” was over, after years of US stock market outperformance, and as Germany moved to stimulate economic growth with deficit spending), but the bounce back in the index from the April lows (~19%) has not taken the market to new highs.

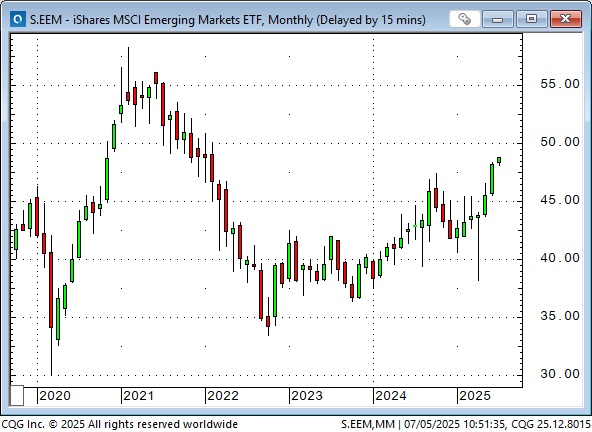

The MSCI Emerging Markets Index has rallied ~17% from the April lows to 3-year highs.

The Shanghai Index has rallied ~14% from the April lows to make new highs for the year. (The steep rally from multi-year lows last fall was in reaction to government stimulus programs.)

The iShares Mexico ETF reached 10-year highs in April 2024 (when the Peso reached 9-year highs) before the election of Claudia Sheinbaum as President, but was down ~33% by the end of the year.

It has rallied ~32% from the April lows, buoyed by global stock market enthusiasm.

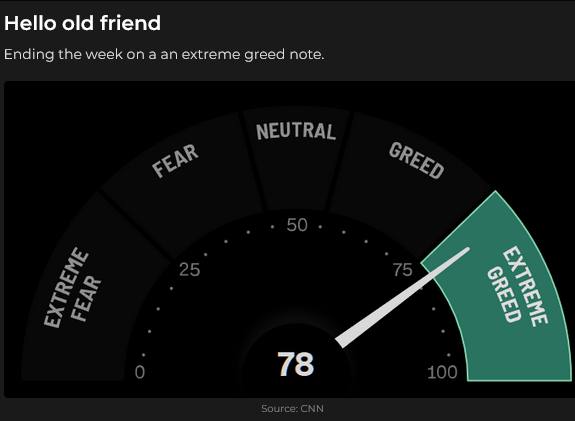

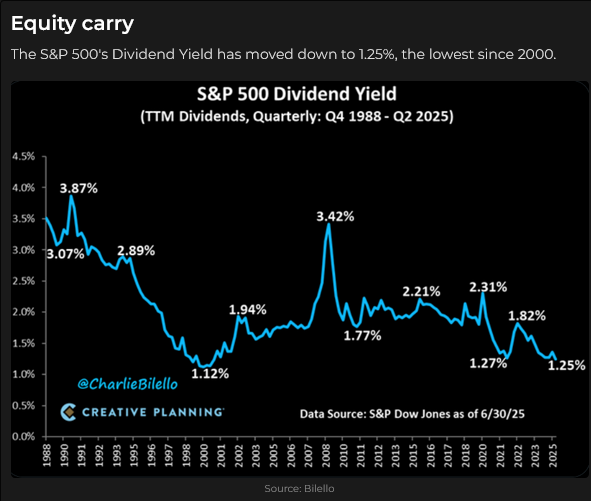

Bullish enthusiasm for the stock market has increased as prices have risen. TINA seems to be 100% true, inducing FOMO fever in skeptics and underweight portfolio managers. Corporate buybacks are expected to total over $1 trillion in 2025, and systematic buying is accelerating. The BBB will cut taxes, and Trump believes it will drive economic growth, which is the fundamental support for rising stock prices. S&P earnings estimates for 2026 are $295, up from $260 for 2025. The market may not be “irrationally exuberant,” but this is No Country For Old Bears!

Stocks plummeted hard in April due to “tariff shock,” but the stock market doesn’t seem to care about tariffs now. However, the weak close in stock index futures on (low volume) Friday may be an acknowledgement that Trump could drop a few tariff tape bombs this coming week.

Interest rates

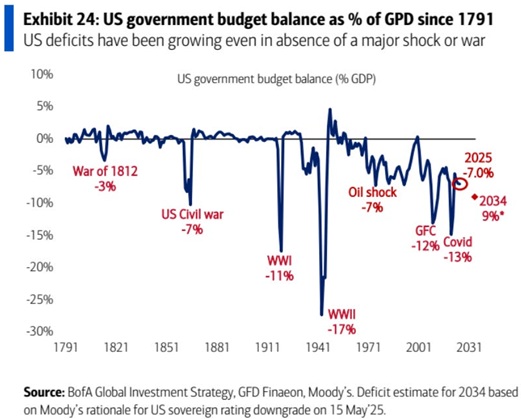

Trump’s recent run of “wins” may have emboldened him to say things about Powell that no President should ever say about the Federal Reserve Chairman. It appears Trump wants to spur stronger economic growth by implementing both stimulative fiscal and monetary policies. That would likely light a fire under the economy, but it would also accelerate inflation, dampening inflation-adjusted growth and pushing interest rates (and the government’s debt service costs) higher. The market is expecting Trump to “move” against Powell, perhaps with an early nomination of an “ultra-dovish” replacement.

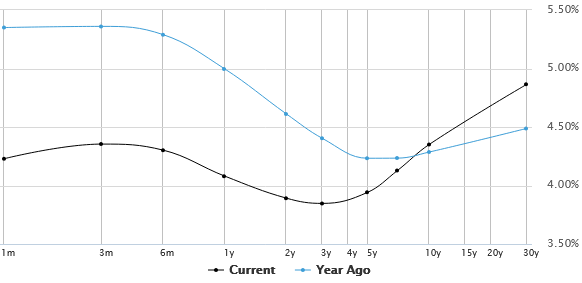

Last week, the STIR market was pricing a possible (insurance) cut by the Fed at the July FOMC meeting. Thursday’s stronger-than-expected NFP report (blue ellipse) killed that idea.

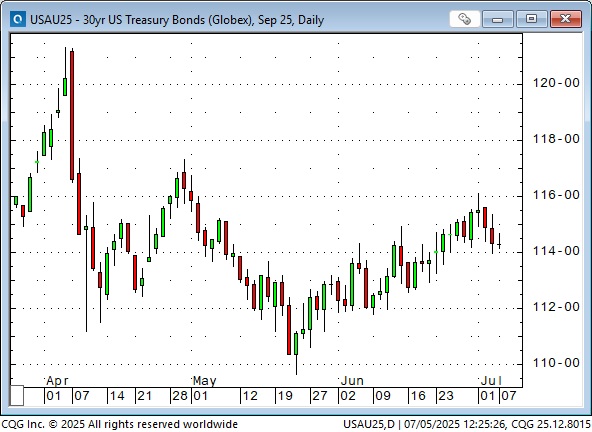

The long bond, which had been trudging quietly higher since mid-June, also dipped lower this week.

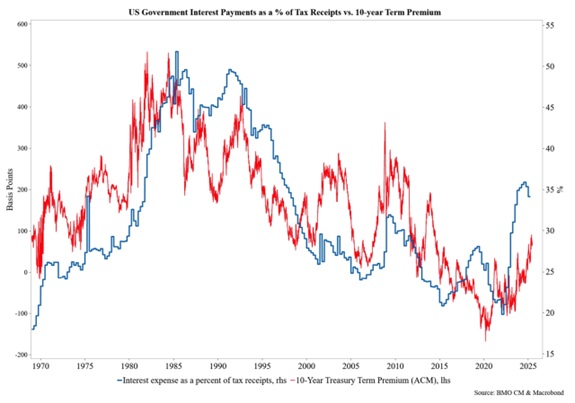

US Government Interest Payments as a % of Tax Receipts (blue line) vs the 10-Year Term Premium (red line)

Over the last year, the 2/10 yield curve has shifted from the 10-year yield being ~20 bps below the 2-year (an inversion) to the 10-year now being ~50 bps above the 2-year. If the bond market continues to worry about rising deficits and inflationary pressures, I’d expect the yield curve to steepen as the term premium increases.

Currencies

The US Dollar Index (the “Dixie”) fell to a new 40-month low at the end of June, marking its worst first half of a year in 50 years. It is down ~12% from January’s highs.

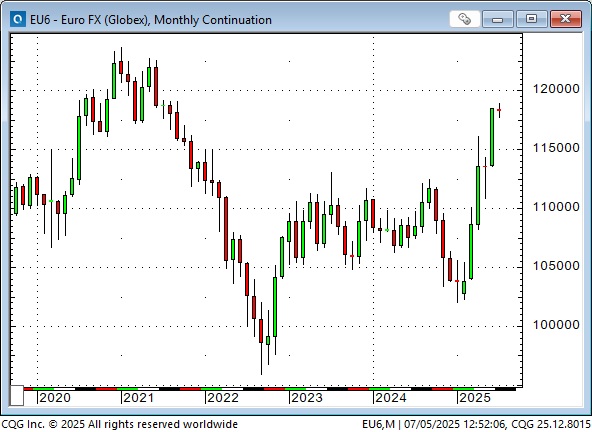

The Euro (the Anti-Dollar) has rallied ~17% from January’s lows to 40-month highs.

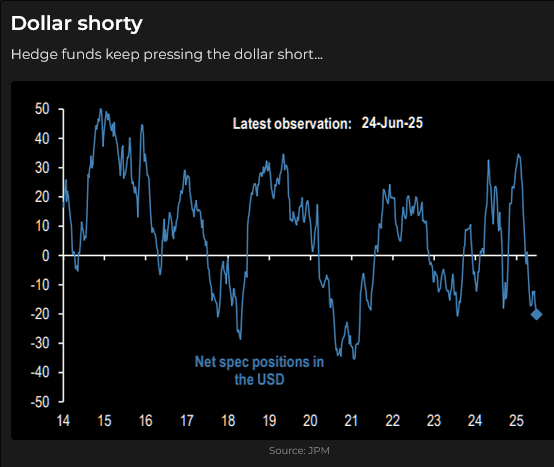

The futures market Commitments of Traders (COT) data shows that net short speculative positioning against the USD is at a 4-year high.

The USD was “overdue” for a correction in January. The trade-weighted US Dollar index was at an all-time high, and American stock markets had hugely outperformed the rest of the world (ROW) for over a decade. The correction was spurred by the idea that the inauguration of (bad) Trump was a signal for the “end of American exceptionalism.” The collapse of the USD to 3-year lows on the “Liberation Day” fiasco (blue ellipse) reinforced the “end of American exceptionalism” idea.

The 6-month correction in the USD provided a fertile environment for those who declared that the ROW had “lost confidence” in American institutions and economic policies, and that it was time for capital to leave America for better opportunities virtually anywhere else.

Another cohort viewed the fall of the USD as part of a “plan” to devalue the Dollar, reduce the trade deficit, and thereby reduce government debt, and (as sure as night follows day) increase economic growth. (That’s a hell of a plan!)

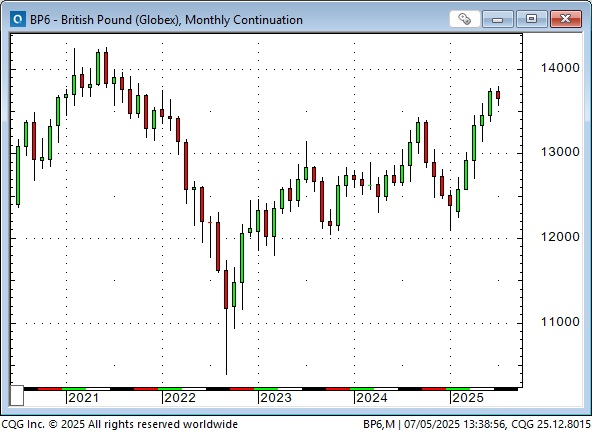

In last week’s Notes, I wrote that the Euro was egregiously overpriced, and I had sold OTM Euro calls. I think the British Pound is also too high (up ~33% from the “Liz Truss” moment in September 2022), and I will be looking for opportunities to short it.

My bullish USD thesis is, in part, based on the idea that (to paraphrase Mark Twain) “reports of the death of American exceptionalism are greatly exaggerated.” I think this is especially true concerning the differences between (North) American energy policies and European energy policies.

I also see that bearish USD sentiment and positioning are at a 4-year high. Ross Clark, my friend for over forty years, notes that the USDX has completed “13” countdowns on both the weekly and daily charts. Ross also notes that there have been over 25 weekly 13’s in the last 50 years, and each one has seen a reversal in prices to the 20-week EMA.

One of my currency trading mantras over the years is that trends often go further than seems to “make any sense” (so the USD may fall further before turning around), and then the market turns on a dime and goes the other way.

A thesis, or a trading idea, alerts me to “watch for an opportunity” to enter a trade. It is not a call to take immediate action.

I also note that the Euro ended June at a 16-year monthly high against the CAD, and it is at resistance levels that have caused it to reverse three or four times in the last ten years. The Euro may continue to trade higher against the CAD (triple tops rarely hold), and a breakout to new highs could spur a sharp advance. However, given my view that the Euro is egregiously overpriced, I will look for opportunities to short it against the CAD.

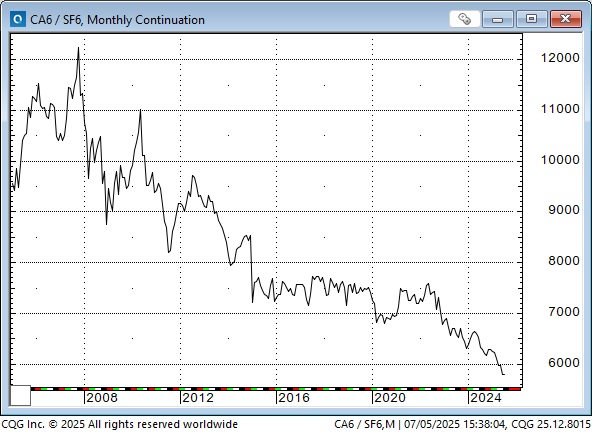

The CAD fell to an all-time low against the Swiss Franc this week. It has fallen by half since October 2007, when the CAD was (briefly) at 1.10 against the USD.

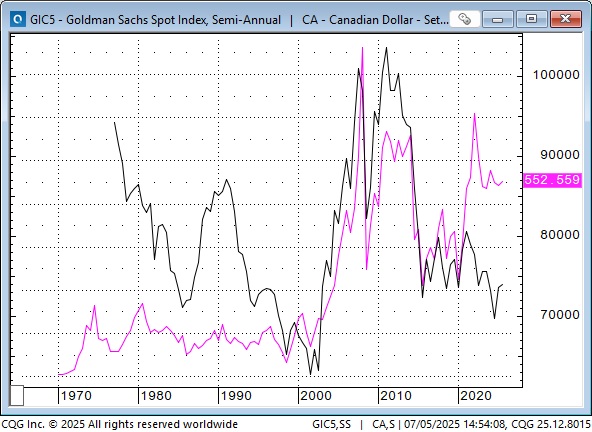

Over the past 30 years, the CAD has had a positive correlation to the (energy-heavy) Goldman Sachs commodity index (pink line). If Canada takes advantage of the opportunity to become an energy superpower (as Mark Carney envisions), the CAD may significantly outperform the Euro and other European currencies like the British Pound and the Swiss franc. Hopefully, my readers will understand that this is a trading idea, not investment advice, and that timing is of the essence!)

Canada starts exporting LNG

The first cargo of LNG was loaded at the LNG Canada export facility at Kitimat, British Columbia, this week. This is a milestone in Canada’s development as an energy superpower, coming after two decades of obstruction and foot-dragging. Hats off to the people who got the job done!

My short-term trading

I started this week short OTM calls on the Euro and the long bond. I was stopped on the Euro trade for a modest loss when it rallied to new highs on Monday. The Euro traded higher again on Tuesday, but turned lower on Wednesday, and I shorted calls at a higher strike.

I stayed with the short bond calls. The long bond fell sharply this week, and the trade is working nicely.

I shorted the S&P on Tuesday and covered the trade for a slight loss on Wednesday. This trade was from the “got a hunch, bet a bunch” school of trading. I can’t justify shorting a market at all-time highs, but I confess that, even with 50 years of trading experience, it’s still possible to make a dumb trade once in a while.

The Barney report

Barney and I were walking the abandoned train tracks that run through the forest near our home yesterday when we met a couple walking their dog. The husband warned us that he had been stung by a wasp and said there might be a nest where we were headed. We continued to talk, but I noticed that Barney was licking the back of the man’s leg. I asked him where he had been stung, and he said, “Right here, where Barney is licking my leg.” We were all amazed that Barney had quickly located the wound and was doing his best to make it better. Doctor Barney, MD. (Medical Dog.)

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I discussed the soaring stock market, the weakness in the US Dollar and why I think the Canadian Dollar is a buy relative to European currencies. You can listen to the entire show here. My spot with Mike starts around the 48-minute mark. Don’t miss Mike’s conversation with our friend James Thorne – the man who electrified the audience with his presentation at this year’s World Outlook Conference in Vancouver in February. James’ interview starts around the 7-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.