Risk assets had a key turn date

When several markets reverse course on or around the same date, I define that as a Key Turn Date (KTD). It signals a (profound) change in market sentiment/psychology/positioning.

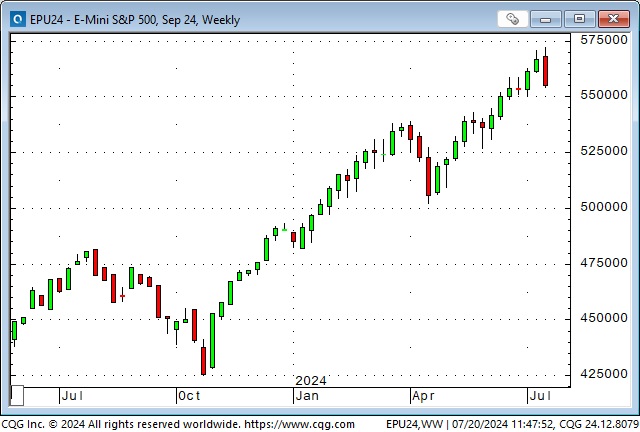

My favourite barometer of risk sentiment is the S&P 500 Index. S&P futures (and the cash market) closed at a record high on Tuesday and fell (~3%) Wednesday through Friday to close below last week’s low, creating a classic weekly key reversal.

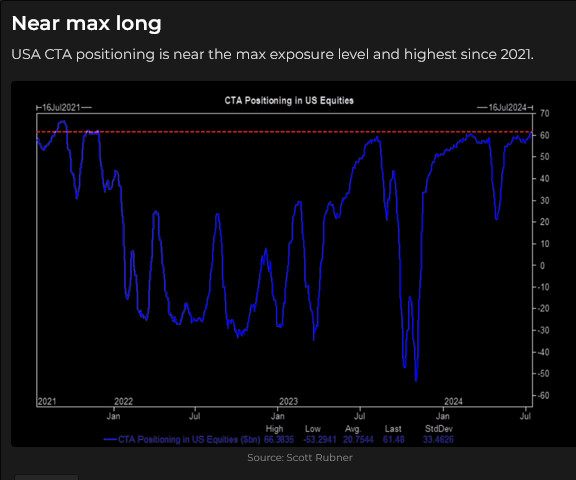

For the past two-plus months, small speculators have held their largest net long position on the S&P since September 2021 (the S&P doubled between the panic lows of March 2020 and September 2021).

The NAZ hit a record high last week and reversed. It fell further this week, down ~6% from the highs, and closed at 5-week lows.

The Dow futures hit a record high on Thursday while the S&P and the NAZ fell (rotation), then dropped ~1,200 points to Friday’s low.

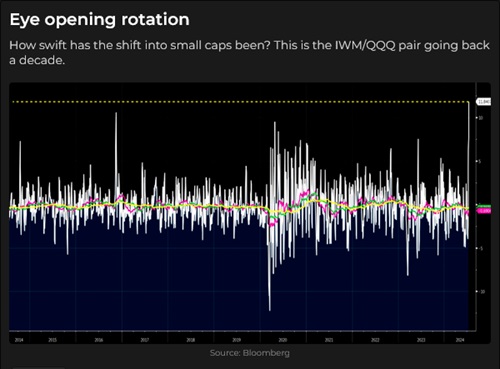

The small-cap Russell 2000 hit a 33-month high Wednesday (up ~13% from last week’s lows) on “rotation” and then gave back ~38% of those gains by Friday’s close.

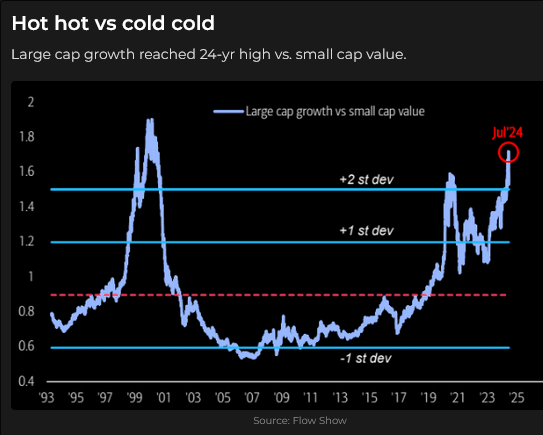

The “rotation” was most dramatic between the Russell 2000 and the NAZ and began last Thursday (July 11) following the CPI data. (If you’re going to panic, panic early.)

The Nikkei index hit all-time highs last Wednesday, then began a ~7% decline (in step with the NAZ) to this week’s lows.

Japanese authorities intervened in the FX markets last Thursday when the Yen hit a fresh 34-year low. The Yen rallied as much as ~4% to this week’s highs. This intervention may have negatively impacted the Nikkei.

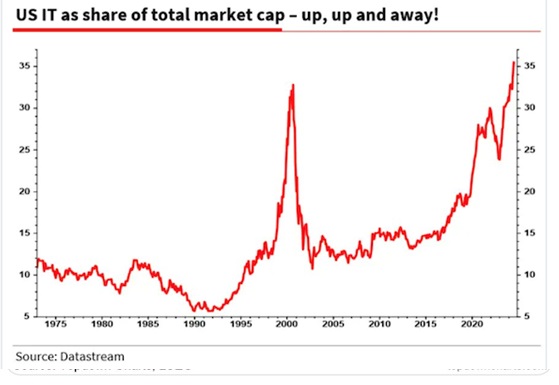

The persistence (and steadiness) of the equity market rally from last October’s lows created positioning risk – “everybody” was long, in size, with leverage.

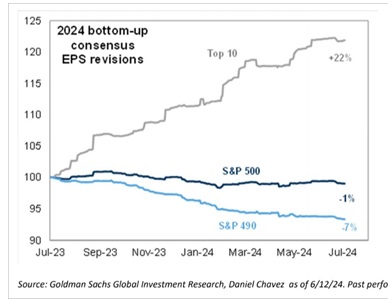

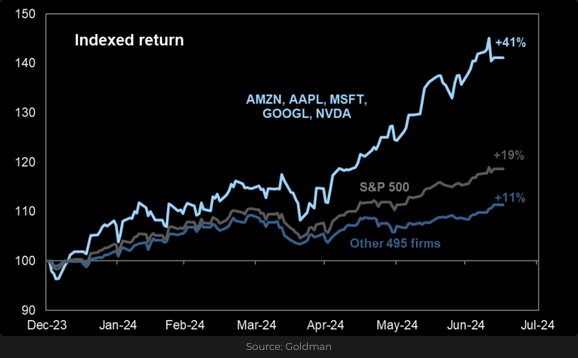

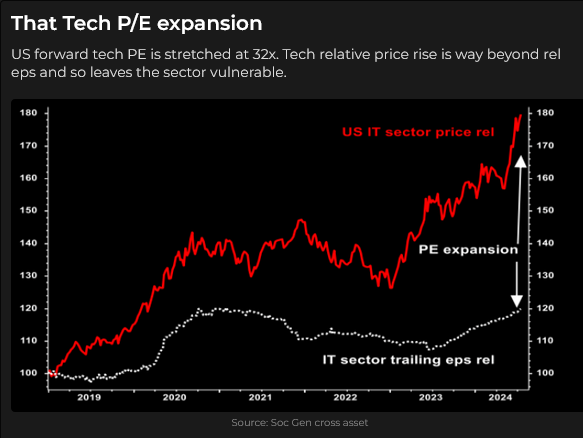

The persistent rally caused people to willingly “pay up” to own stocks, particularly the big-cap stocks.

The concentration of capital in a handful of big-cap stocks concerned veteran traders, but the rally continued.

The dramatic outperformance of big-cap tech vs. the S&P is well-known, and many analysts have expected a “correction” because of that outperformance. But here’s the same thing in a different market. Lily tripled in the last 15 months, hitting a record high on Monday, but it was down 13% at Thursday’s lows. Animal spirits had a setback.

Gold

Gold hit record highs on Wednesday (spot at ~$2,469, Comex June futures at ~$2,488) and then reversed with June futures dropping ~$93 to Friday’s close.

Comex open interest has risen 35% since late June to the highest levels since March 2022 (the Ukraine invasion), as gold rose ~$180 to record highs. (Open interest dropped ~13,000 contracts on Friday’s $50 sell-off.)

Net long speculative positioning in gold futures (as of Tuesday, July 16) was the largest since January 2021 (larger than the Ukraine invasion.)

Silver hit 12-year highs in May (after a ~34% rally from February lows) but has been weaker than gold since then. Speculative net long positioning is at ~4-year highs.

Comex copper hit record highs of ~$5.20 in May, with net long speculative positioning at a 3-year high. The “electrification of everything” narrative seemed to be the driving force behind the speculative buying. Since then, copper has fallen ~$1 (~20%) as high prices have been the best cure for high prices. (Substantial exports from China have had a desultory effect on prices.) Speculative net long positioning declined modestly during the fall from record highs but rebounded slightly before this week’s decline. A further price decline may result in more long liquidation, voluntary or otherwise.

Currencies

The US Dollar index hit 4-month lows on Wednesday as gold hit record highs. The USDX bounced back from those lows to close slightly higher this week.

The Yen rallied from 34-year lows on intervention last week and added modestly to those gains this week. In last week’s Notes, I suggested that speculators (who held their largest net-short position in the Yen in at least 20 years) may be reluctant to cover those positions with the Yen/Dollar interest rate differential of ~4.5% on short-term funds. The fact that the Yen has trended lower against the USD for 12 years would add to that reluctance, and the “widowmaker” appellation applied to traders who tried to pick the turn in Japanese bonds would further deter attempts at picking the turn in the Yen.

However, the prospect of “President Trump” may have defined a bottom in the Yen. We may be seeing a historic change in trend.

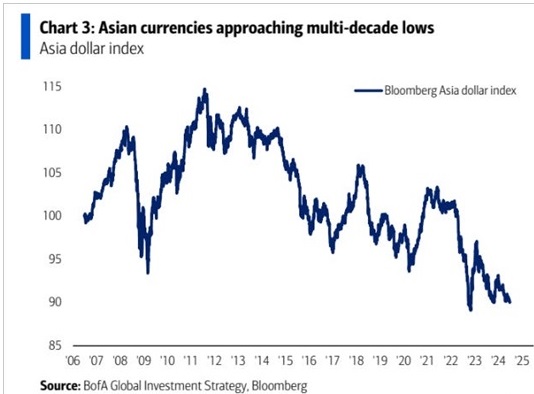

Trump has made it clear that he believes foreign countries (especially Asian countries) have “taken advantage” of the US by keeping their currencies artificially low against the USD – and he intends to remedy that situation with tariffs and a lower USD.

My good friend, Dr. Martin Murenbeeld, has argued for years that the Asian currencies were far too low—witness the American trade deficits with Asia. I agree that “Asia” has taken a mercantilist attitude to global trade, keeping their currencies low to enhance trade balances. (China recorded a $100 billion trade surplus in June, a 30+ year high, as it tries to revive its domestic economy by increasing exports.)

The British Pound rallied to a 12-month high on Wednesday but then fell along with other risk assets to close down on the week. Speculators had reached a 10+ year high in net long positioning last week but increased that by over 50% as of July 16. (It appears that this huge increase took net long positioning to a record high.)

The Canadian dollar trended lower from January to April and has gone broadly sideways in (effectively) a 1-cent range since then. Open interest (outside of delivery spikes) has doubled since January, and the net short speculative positioning over the past five weeks has stayed around record highs. Markets expect the BoC to cut interest rates by 25bps this coming week. American imports of Canadian crude oil are now running at a record rate.

What impact will “President Trump” have on Canada? Can you imagine being in Trudeau’s shoes if/when the embodiment of “woke” visits the White House?

Corn

CBOT corn futures are trading at roughly half the near-record levels they reached following the invasion of Ukraine. Speculators now appear to hold their largest-ever net short positions. (Time for a bounce?)

Politics

The market impact of recent elections in India, Mexico, France, and the UK pales in comparison to the potential impact of the American election. It seems that after too many years of “woke,” the tide is turning, and common sense is returning, albeit described as “far-right” nonsense by the left.

Various commentators and analysts are trying to “map out” what will happen to markets if/when Trump becomes President. I read their predictions with an open mind but with the fundamental belief that the market changes as sentiment, psychology and positioning change.

In the spirit of Macbeth

Life’s but a walking shadow, a poor player,

That struts and frets his hour upon the stage,

And then is heard no more. It is a tale

Told by an idiot, full of sound and fury,

Signifying nothing.

Here’s a link to a video showing how dramatically European borders have changed over the last thousand years. Nothing lasts forever, it seems, regardless of how many lives are lost defending the status quo.

My short-term trading

I started the week short the CAD, a position established after it rallied on last Thursday’s US CPI report and then fell back. I stayed short the CAD all week and held the trade into the weekend.

I shorted the S&P on Monday and was stopped for another (five in a row) slight loss on Tuesday. I missed the overnight decline on Tuesday but shorted it early Wednesday morning and remained short into the weekend.

I shorted gold on Wednesday after it rallied above Tuesday’s highs to make new all-time highs but then started to fall back. I stayed short into the weekend.

I shorted the British Pound on Thursday when it traded below Wednesday’s low. (It made a new 12-month high on Thursday but couldn’t sustain those levels.) I stayed short into the weekend.

My unrealized gains this week are probably my best YTD and certainly more than offset the small losses I’ve taken over the past few weeks.

Thoughts on trading

My friend Peter Brandt and I worked for ContiCommodity in the late 1970s and early 1980s. We never met back then, but I had a wonderful two-hour visit with him near Tuscon a few years ago.

Peter has had a very successful multi-year run trading his own account, mainly in the futures and FX markets. He repeatedly talks about the Pareto Principle (you might know it as the 80/20 rule) and how it shows up in his trading. (He keeps meticulous trading records.)

Peter reports that not only >80% of all of his trading profits (over a multi-decade time frame) come from <20% of all of his trades, but that >80% of total profits come from <20% of the total months he spent trading. So, on average, he generated nearly all of his trading profits in less than two months each year.

Peter says, “Be careful” what you do in the other ten months of the year. Try not to lose too much money while waiting for those two good months!

On my radar

I can imagine the yield curve becoming uninverted, with short rates falling relative to long rates.

I can imagine the Yen (and other Asian currencies?) rallying against the USD and other currencies.

I will look for good setups to short risk assets where speculators are hugely net long.

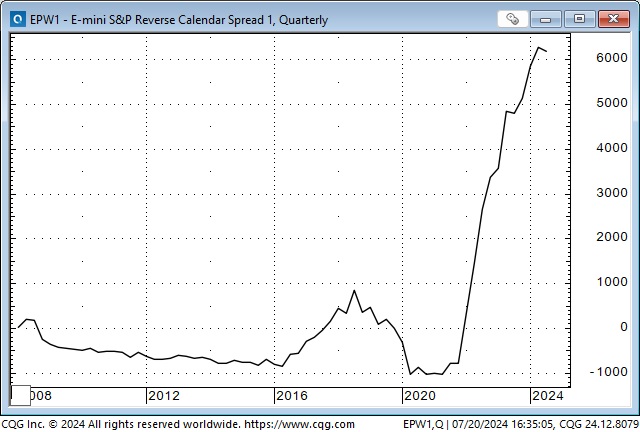

I’m intrigued by the opportunities to short S&P calendar spreads. (I traded thousands of S&P calendar spreads in my brokerage career.) This week, the front spread (Sept/Dec) has traded with Dec 62 and 64 points premium Sept. I believe the fundamental pricing of that spread is the difference between the S&P’s dividend yield and the short-term financing rate. Here’s a look at what the rolling 3-month spread has done over the years.

For most of the time between 2008 and 2022, the spread was flat to negative (negative, meaning that the front month price was higher than the back months) as the financing rate was less than the dividend yield. That changed dramatically when the Fed raised rates from zero to 5%+, causing the premium of deferred months to rally against the front month.

This is a “carry trade,” and opportunities like this are everywhere in the markets due to the rapid increase in short rates since early 2022. For instance, I’ve written about the short Yen / long Mexican Peso spread being a spectacular winner over the past four years. That was essentially a play on widening interest rate differentials. (If the Yen rallies, that trade may reverse!)

Quote of the week

The Barney report

The heat wave continues on Vancouver Island (after a long, wet, cold winter, I like a little global warming), and Barney loves to find a shady spot to lie down and drink some of the water Papa carries.

We set up a wading pool on the back patio for him, but it doesn’t interest him much compared with opportunities to find “new toys” he’s not supposed to have.

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the dramatic moves in the stock indices this week, the sharp drop in gold after hitting all-time highs, and The Big Short positioning in the Canadian dollar. You can listen to the whole show here. My 5-minute spot with Mike starts around the 1-hour, 2-minute mark.

Heads up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. So many times when that happens, people say, “I would have done something if I’d known he was struggling.”

If you, or someone you know, is down or depressed, reach out to these guys. They can help.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.