Do you believe in mean regression?

The NAZ is up ~50% from last October’s lows, 100% from the 2022 lows, and >200% from the 2020 lows. It’s up ~20X from the 2009 lows. At what point does mean reversion kick in, or does that never happen?

The S&P has closed higher for 11 of the past 12 weeks, up ~14%. It is up ~39% from last October’s lows.

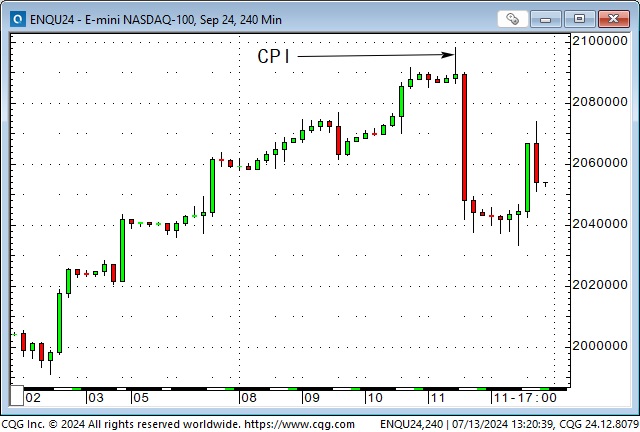

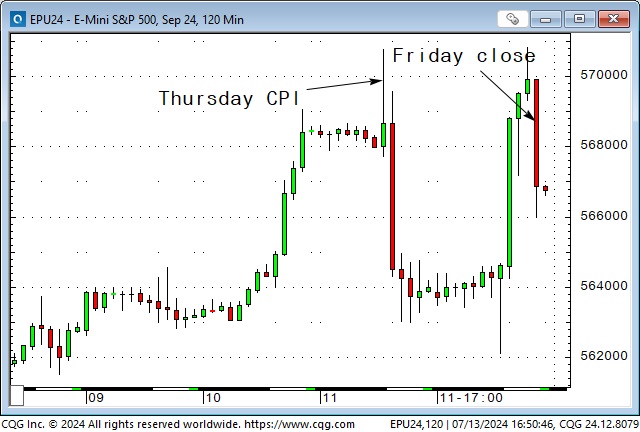

Powell’s Congressional testimony buoyed stock indices on Tuesday and Wednesday, and Thursday’s CPI data sparked a rally to record highs in the S&P and NAZ. But the NAZ rally was fleeting; a few hours later, it was down ~3% while the small-cap RUS soared to 30-month highs.

If the NAZ and the RUS (and the S&P and the DJIA) had all rallied on the CPI and then tumbled like the NAZ, it might have been a classic “buy the rumour, sell the news” turning point in stock market sentiment. Instead, the heightened prospects of Fed interest rate cuts were causing a “rotation” between market sectors, with “interest rate sensitive” sectors such as real estate and small-cap companies benefiting from capital flows leaving big-cap tech. The market cap of the MAG7 fell ~$600 billion on Thursday.

Some analysts have suggested that the surge in the small-cap index, accompanied by the NAZ swan dive, may have reflected hedge funds scrambling to exit long NAZ/short RUS spreads. Such spreads would have been immensely profitable over the past two years.

The DJIA reached a new high this week, rallying over 1,000 points from Wednesday’s lows to Friday’s highs.

The Transports also rallied this week but remain down YTD.

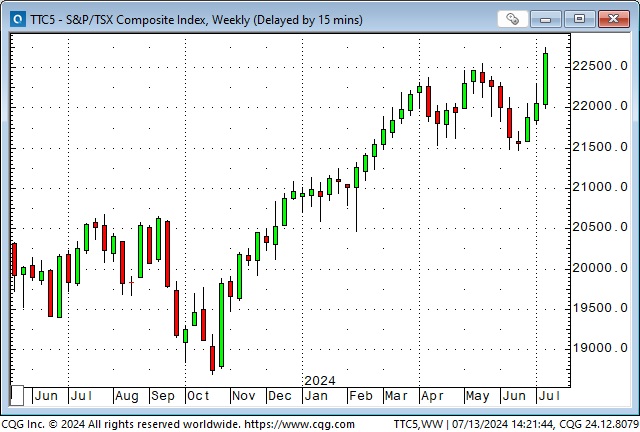

The Toronto Composite Index hit a record high this week.

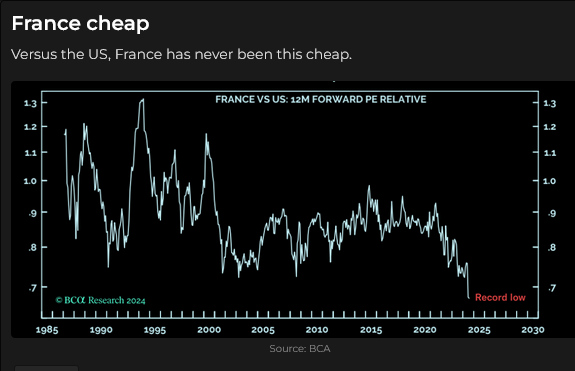

French stocks plunged recently on election worries, and European stocks have generally underperformed American stocks for years. If American stocks were to “mean revert,” this spread might also reverse.

Interest rates

The combination of Powell’s Congressional testimony (the Fed is less worried about inflation, more worried about softening employment) and the “benign” CPI data has the market pricing at least two cuts from the Fed (September and December) with a 50% chance of three cuts.

Bond prices have trended higher since hitting six-month lows in April.

Currencies

The US Dollar index fell ~2% in the last two weeks, closing this week at a 4-month low.

The British Pound rallied in the last two weeks, closing this week at a 12-month high. COT data shows net-long spec positions at a 10-year high.

Japanese authorities were believed to have intervened in the FX market again this week as the Yen was making fresh 34-year lows against the USD. (When asked if they had intervened, there was “no comment”.) If they were “in” (and they were), then they chose their moment auspiciously, with the USD on the “backfoot” following the CPI report.

If FX market volatility stays low (and it has been historically low), the intervention may have only a temporary impact as the 4%+ interest rate differential makes it challenging for speculators to buy the Yen.

In last week’s “On my radar” notes, I wrote that the Yen “might be a buy around here,” but I didn’t. (Darn!)

The Canadian dollar has been virtually “dead in the water” for the last six trading days (save a brief spike on Thursday’s CPI report), trading effectively in a 20-tick range.

I’ve frequently reported that changes in the CAD price are often more the result of “events” outside of Canada than a reaction to domestic issues. For instance, if the USD is weak against most currencies, especially the Euro, then the CAD will probably rise, and if the S&P is falling (risk-off), then the CAD is likely also falling. This week, the CAD did not rise with the Euro but spiked and quickly fell on Thursday in harmony with the S&P. However, it did not rise with the S&P and the Euro on Friday. Given the historically large net-short speculative position in the CAD (that I have commented on in previous Notes), I’m puzzled as to why the CAD has “marched quietly to a different drummer” the past several days.

The Mexican Peso was probably the strongest currency in the world from April 2020 to May 2024 (Mexican short rates of ~11% helped). Still, it tumbled sharply before and after the Mexican elections (as did the Mexican stock market.) The Peso has been rallying back from the June lows (it’s hard to say “no” to that yield premium) and closed this week at a 1-month high.

Gold

Gold rallied to a two-month high on Thursday’s CPI report, up ~$100 from last week’s lows. Open interest is at a two-year high, and the net-long speculative positioning is the highest since the Ukraine invasion. (The speculative net-long positioning in silver is at a 4-year high.)

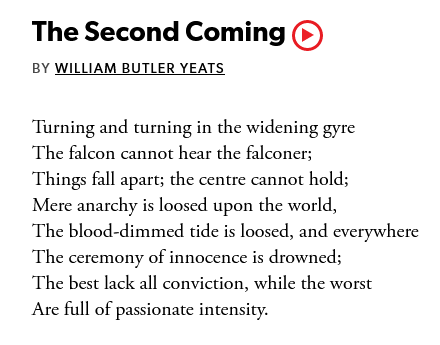

Quote of the week

My short-term trading

I started this week short the CAD, a position I established last Friday when it appeared to be struggling while the Euro and the S&P rallied. I covered the trade for a slight loss on Wednesday.

I shorted gold on Monday as it fell back from last Friday’s highs. I assumed it had been bid aggressively last Friday ahead of the weekend in anticipation of “trouble” over the weekend. Gold dropped ~$30 after I got short, but when it failed to take out last Friday’s lows and started to rally back, I covered the trade at breakeven.

I shorted the S&P four times this week and was stopped for minimal losses each time. I was anticipating something like what happened to the NAZ on Thursday, but my timing was off! Despite these losses, I think the S&P is looking toppy here, given the price action around the “bullish” CPI data and the late sell-off Friday after hitting all-time highs.

On Tuesday, I shorted the Euro against the Swiss Franc, thinking that the rally off the mid-June lows was over. I was stopped for a loss the next day.

I shorted the CAD on Thursday when it could not sustain its gains following the CPI report and kept that position into the weekend.

On my radar

As I’m writing this, there are reports of Trump being shot but not seriously hurt. This makes the GOP convention, starting Monday, and his choice of a running mate all the more critical.

Tesla-driving Democrats must be chagrined to learn that Musk has donated “substantial sums” to a Trump Super PAC.

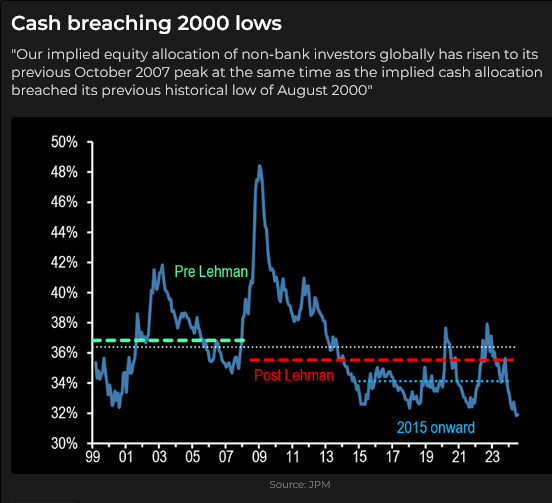

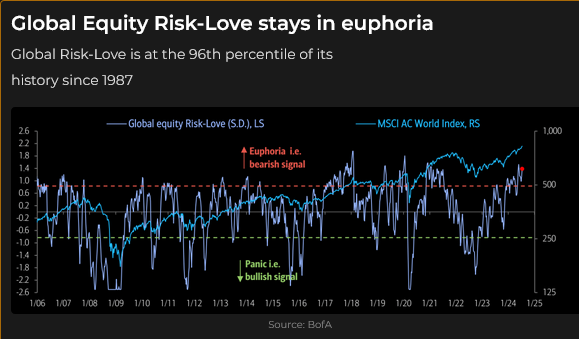

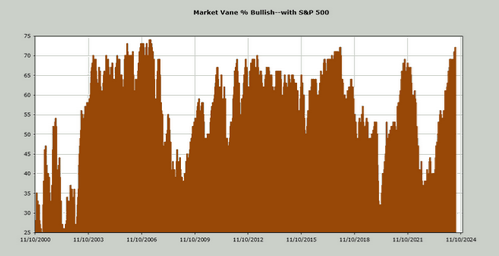

These charts support my view that the stock indices are probably nearing a “mean reversion” moment.

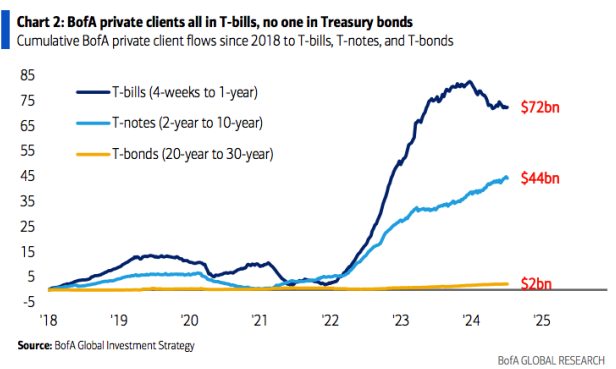

This chart makes me think about buying bonds (and putting on a yield curve steepening trade.) The best reason not to buy bonds is the worry about profligate fiscal policy (no matter who wins the election.)

The Barney report

I took Barney to the beach again yesterday. We were near low tide, with about 200 yards of sandbanks to run and play on. Barney had a great time running on the sand and chasing the ball into the ocean, but he also drank a lot of seawater and had the usual after-effects! The joys of owning a puppy.

Here’s a photo of Barney on one of his favourite logs while walking on the shaded forest trails during this week’s heat wave.

Listen to Victor talk about markets

On this morning’s Moneytalks show, Mike Campbell and I discussed the short-term volatility in the stock market, the unusual market reaction to the bullish CPI report, the Canadian dollar, and the rebound in gold. You can listen to the show here. My spot with Mike starts around the one-hour and eight-minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the This Week in Money show this morning. We “covered the waterfront,” talking about several different markets and the trading I’ve been doing. My long-time friend and excellent technical analyst Ross Clark was also a guest with Jim on this morning’s show. You can listen here.

Heads up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. So many times when that happens, people say, “I would have done something if I’d known he was struggling.”

If you, or someone you know, is down or depressed, reach out to these guys. They can help.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.