The bull market in risk assets continues

Bitcoin reached new all-time highs this week, up ~60% from the April lows.

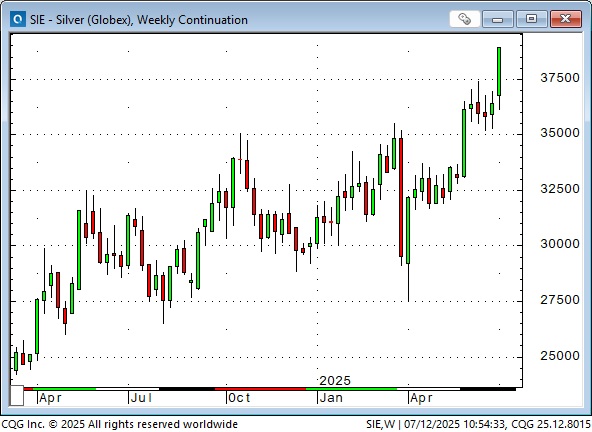

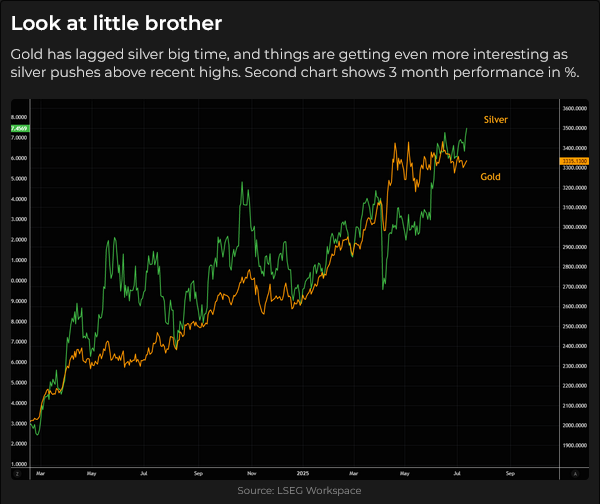

Silver surged to a 14-year high, up ~42% from the April lows.

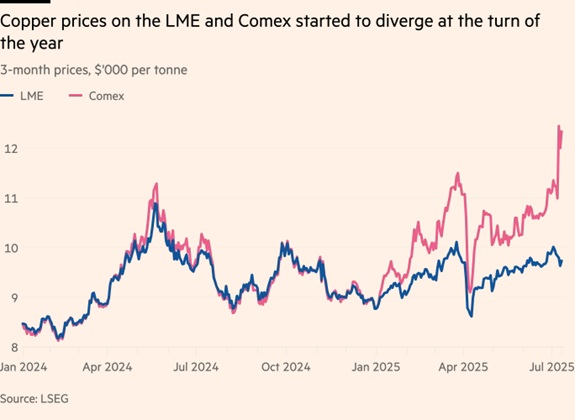

Copper hit all-time highs of ~$5.90 (basis September Comex), up ~43% from April lows.

Comex copper futures surged from ~$5.00 to ~$5.90 (~18%) in four minutes following Trump announcing a 50% tariff on copper imports.

The spread between LME and Comex copper has historically been very tight, but has widened dramatically in 2025, with Comex now at a ~28% premium. There have been massive imports of copper into the USA over the last several months, likely in anticipation of tariffs.

The bullish copper narrative over the last few years has been based on the “electrification of everything and there is not enough copper in the world” story, but prices remained capped around $5. Perhaps the fact that China accounted for ~50% of global copper demand, and the Chinese economy has been cooling (and weakening demand for EVs), may explain why prices have not been higher.

Platinum surged to a 14-year high, up ~60% from the April lows.

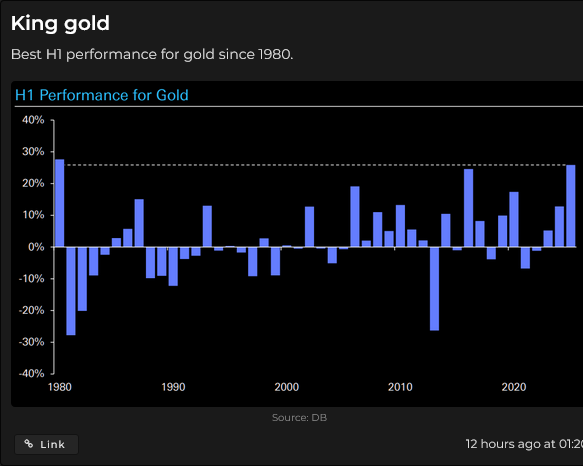

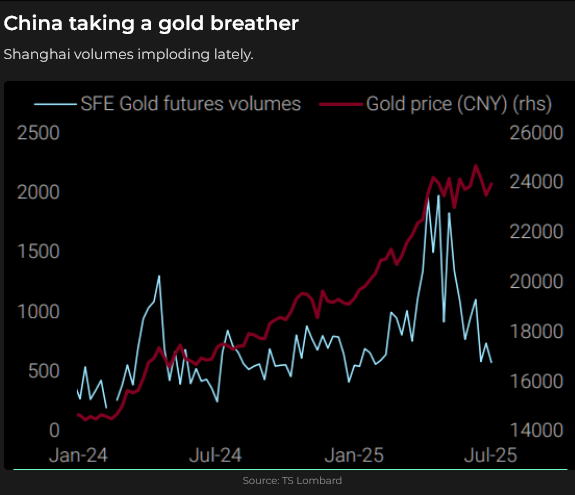

Gold has sustained its 2025 gains, up ~15% from the April lows and up ~27% YTD.

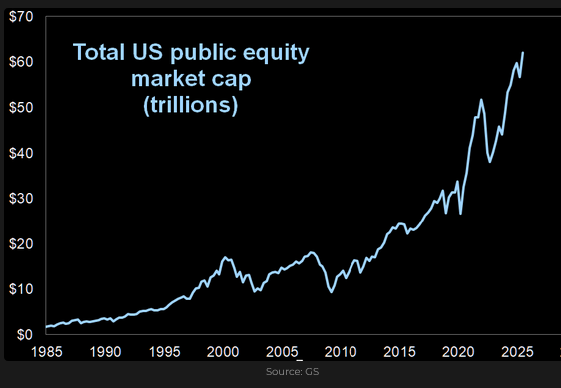

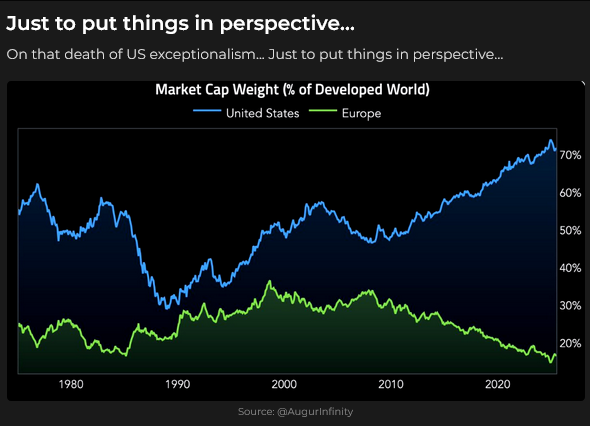

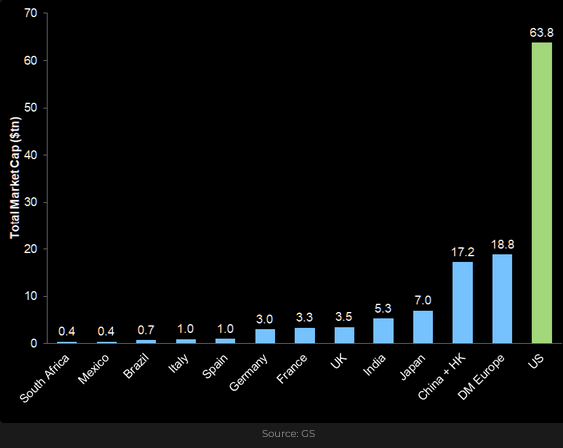

The Nasdaq 100 stock index is at all-time highs, up ~40% from the April lows.

The S&P is at all-time highs, up ~31% from the April lows, up ~6% YTD.

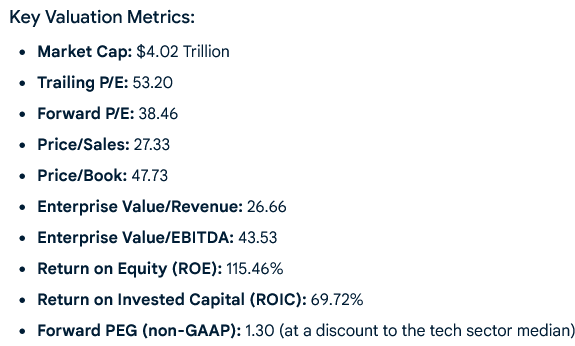

NVDA is at all-time highs, up ~92% from the April lows, up ~14% YTD, with a market cap of over $4 trillion, which is greater than the GDP of Germany, France or the UK.

Here’s a snapshot of NVDA’s valuation metrics:

Tom Thornton at Hedge Fund Telemetry has daily, weekly and monthly countdown 13’s for NVDA.

Quarterly corporate earnings reports start in earnest this coming week.

Currencies

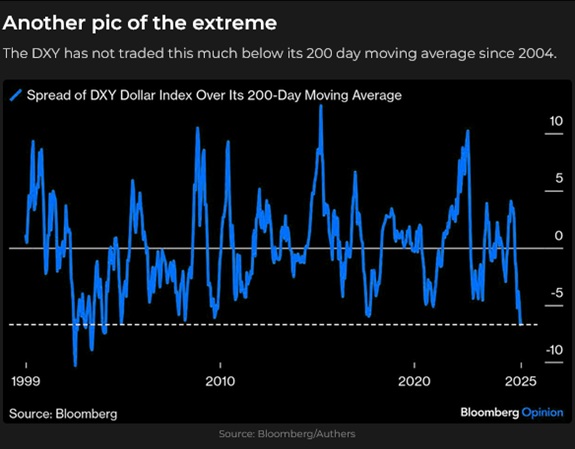

The US Dollar Index hit a 40-month low at the beginning of July, down ~13% from January’s highs, the worst H1 performance for the USD in 50 years. It has rallied ~1.5% from the lows.

The Euro (the Anti-dollar) is the “flip side” of the USD, rallying ~17% from January’s 32-month lows to 44-month highs at the beginning of July.

The Euro is (essentially) at all-time highs against the Yen (save for a brief period in July 2024 when the Yen was at 34-year lows against the USD).

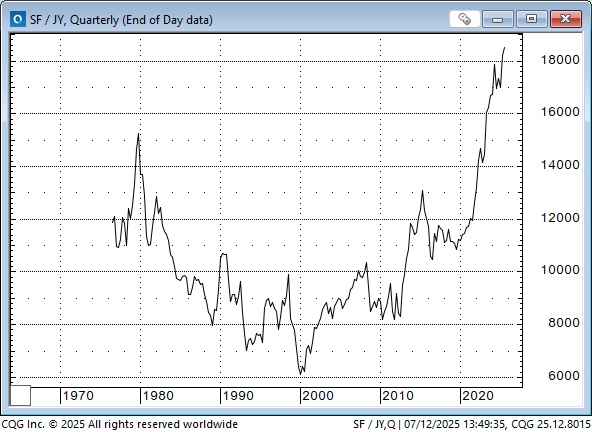

The Swiss Franc is at an all-time high against the Yen, rising 3X against the Yen over the last 25 years.

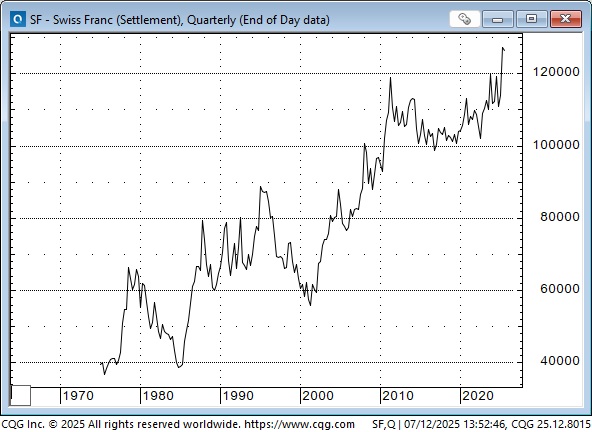

But then the Swiss Franc is at all-time highs against every currency, including the USD! The Swisse has risen more than 3X against the USD since 1985.

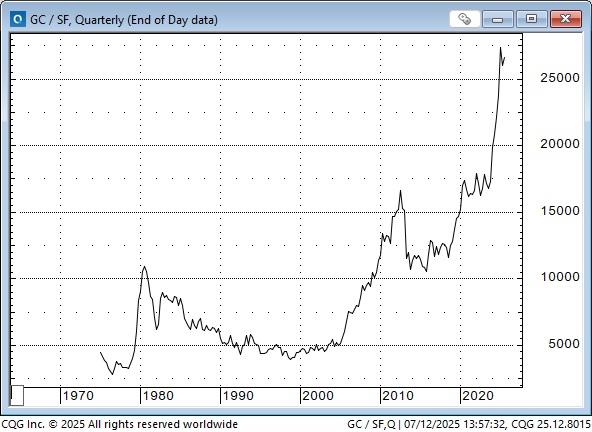

Gold has risen ~5X against the Swiss Franc since 2005, and much, much more in terms of other currencies!

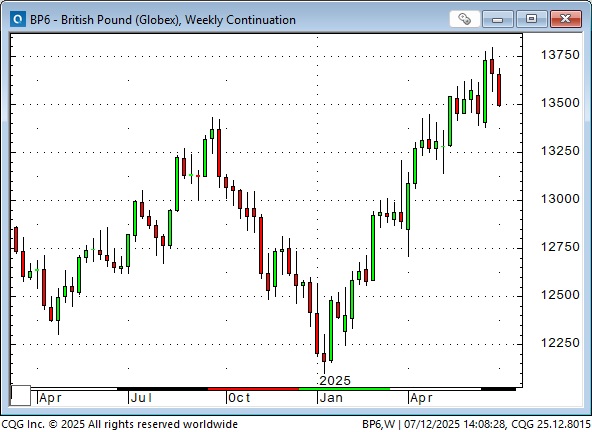

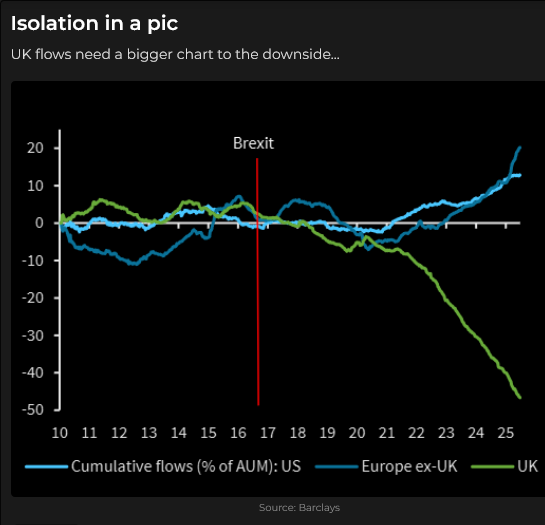

The British Pound was “pulled higher” from January to July as the USD fell against virtually all other currencies, but the Pound is at risk of falling back, given the UK’s precarious fiscal position (compounded by “poor” energy policies).

Interest rates

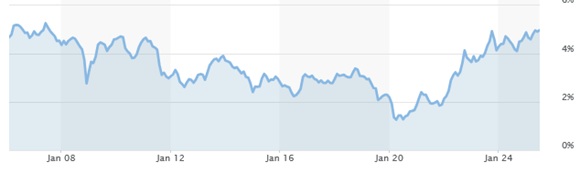

The Japanese 30-year bond yield is at an all-time high of 3.05%.

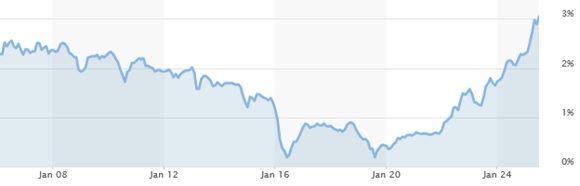

The US 30-year bond yield is at an 18-year high of 4.95% (outside of a brief spike to 5.05% in May 2025).

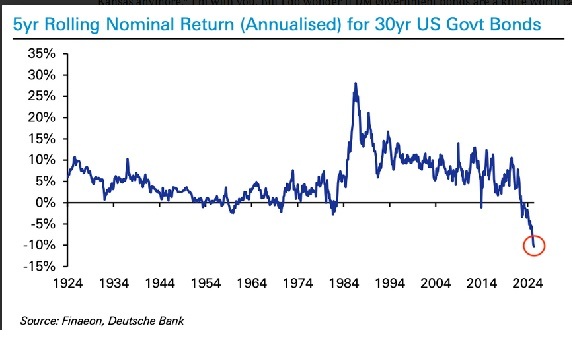

The CBOT ultra-long bond futures contract has fallen by half since the covid spike to record low yields in 2020.

Both the Bank of Canada and the FOMC will be announcing their short-term interest rate policies on July 30, 2025. Markets expect no change in rates with the BoC staying at 2.25% and the FOMC staying at 4.25%.

It appears that Trump would like Powell (if not the entire FOMC) gone so that he can have both stimulative fiscal and monetary policies. Perhaps he will be patient until Powell’s term is up in May 2026 (he did respond to a reporter’s question on Friday by saying that he will not fire Powell), but then he will likely be nominating an “ultra-dovish” Chairman. The bond market has good reason to worry.

Trump tariffs

Now that the BBB is law, Trump is ramping up his tariff demands. Japan and Korea have been told they will “pay” 25%. Canada has been hit with 35% on items that don’t qualify for USMCA exemptions. Brazil (which has a trade deficit with the USA) was hit with 50% tariffs, and a host of other countries were told what new, high tariffs they would pay if they don’t “make a deal” before August 1. Mexico and the EU were hit with 30% tariffs this morning (July 12, 2025).

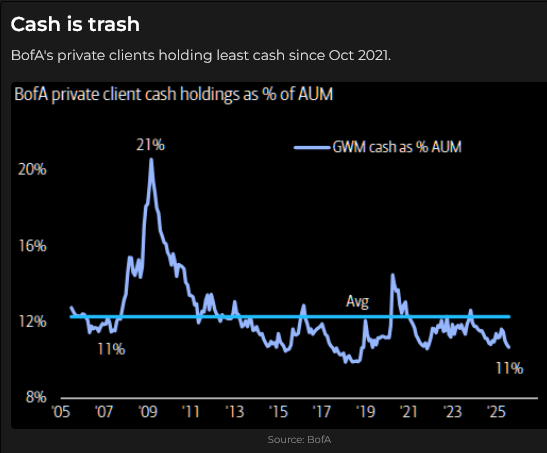

The markets have been relatively “sanguine” about tariffs (perhaps believing that “TACO” will prevail), but I suspect that the risk of a “trade war” is underestimated, especially with risk assets so richly priced.

My short-term trading

I covered my short 116 bond calls on Tuesday this week at one tick. I was short at 29-30 ticks, and I decided the risk/reward of holding them to Friday’s expiry didn’t make sense since my P&L upside was one tick; the downside was without limit. (Thank you, Levente, for giving me that risk management advice years ago.)

I covered my short Euro calls on Thursday for a decent gain (they also expired this Friday) and shorted the British Pound. (I sold the Pound and wrote OTM puts against the position, which allowed me to place my stop on the short futures at a higher price. (With me, managing risk is always the most important consideration.) I held the net-short Pound trade into the weekend.

I bought the S&P on Tuesday (casually joining the “BTD” crowd) but bailed at a breakeven when the modest rally reversed.

I shorted the S&P on Friday when it bounced from overnight lows. (The S&P had traded to record highs on Thursday, but fell below Thursday’s low in the overnight session.) I held that short position into the weekend.

Trade ideas

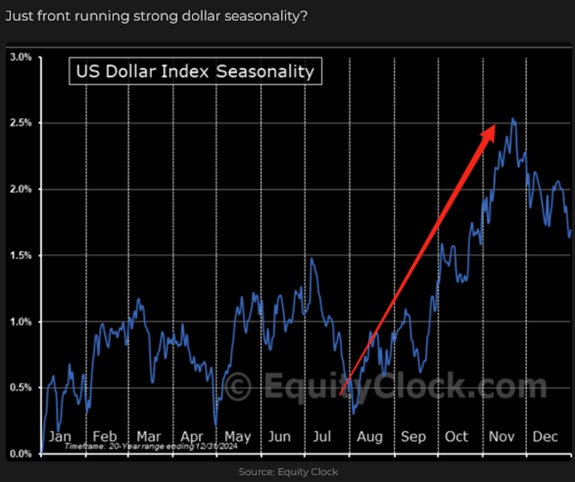

1) On a trading time horizon, I’m looking at opportunities to buy the USD. The main question is “against what?” The Pound seems the most vulnerable, but the Euro will be the “go-to” currency to short if sentiment turns positive (it is currently very negative) on the USD.

2) I’m watching the EUR/YEN (for a shorting opportunity) near the record highs it reached last year when the Yen was at 34-year lows against the USD.

3) I’ve considered shorting OTM S&P calls, but VOL is low and the rally has been relentless, so I’ve kept my powder dry.

The Barney report

The weather has turned hot (well, hot for the Pacific Northwest Coast, which means ~24 degrees Celsius) and dry, and I carry drinking water for Barney when we’re out for a walk. He’s wearing a fur coat in this heat, and he needs to stay cool.

Listen to Mike Campbell and me discussing markets.

On this morning’s Moneytalks show, Mike and I discussed the surging bull market in risk assets (what, me worry?), copper, tariffs and what might happen to markets if Trump gets stimulative monetary policy in addition to stimulative fiscal policy. My spot with Mike starts around the 45-minute mark. You can listen to the entire show here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.