“Uninvestible”

Daren Woods, the Chairman and CEO of ExxonMobile for the past nine years, delivered a succinct message about Venezuela to President Trump at the White House on Friday. Big Oil will NOT be spending zillions of dollars in Venezuela any time soon. There will NOT be a flood of crude coming out of the country any time soon. There are daunting infrastructure problems and massive political risks (Google: Diosdado Cabello).

Iran

The people are rioting, and the ruthless theocracy is trying to crush the dissent while blaming the US and Israel. US military assets are moving into position. Regime change, or a violent squashing of the revolution, will likely curb oil exports. Still, regime change seems inevitable, and ultimately, more unsanctioned crude will flow into global markets.

Energy

The world wants, needs and will pay for more uranium.

Nymex February natural gas prices have plunged nearly 40% from the early December highs. About 20% of American natural production is now exported (pipeline to Mexico, LNG to Europe). About 40% of US electricity is generated by natural gas-fired plants.

Stock indices around the world are making new highs

The S&P 500 closed the week at record highs, up ~44% from April’s lows.

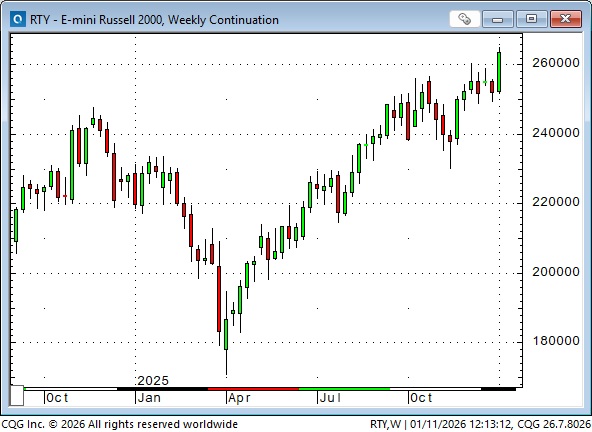

The Russell 2000 soared ~5% this week and closed at a record high, up ~54% from April’s lows.

The Nasdaq 100 did not close the week at record highs, but it is up ~58% from the April lows.

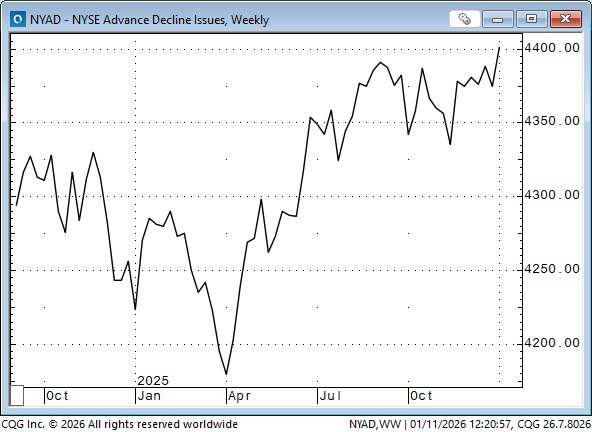

The NYSE A/D ratio closed at a record high, as capital is rotating out of some tech stocks into other market sectors. (AAPL is down ~10% from December’s record highs, MSFT and NVDA are down ~12% from their highs, while GOOG closed at record highs, up ~132% from the April lows.)

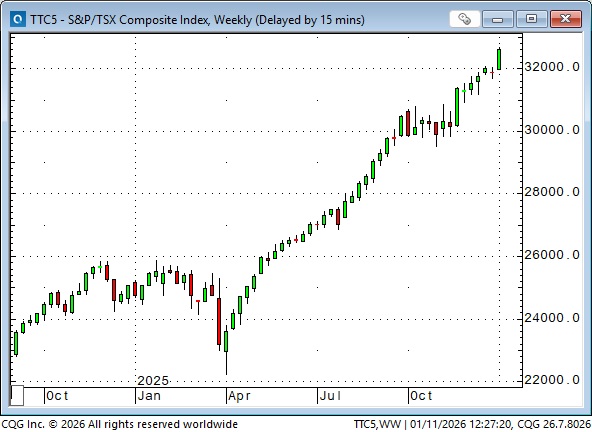

The Toronto Composite Index surged to new highs this week, up ~47% from the April lows.

The Nikkei 225 also surged to record highs this week, up ~77% from the April lows.

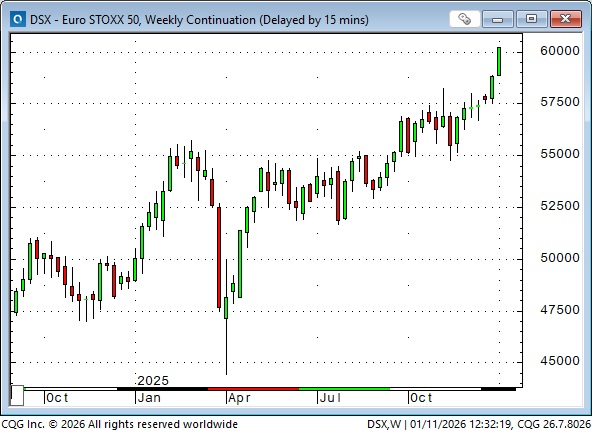

The Euro Stoxx 50 surged to record highs this week, up ~35% from the April lows.

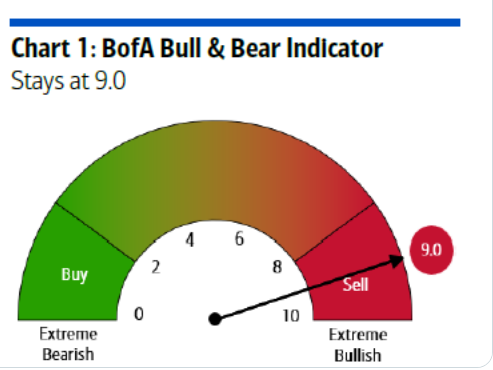

Sentiment across equity markets is very bullish.

Does anybody care about stock dividends these days?

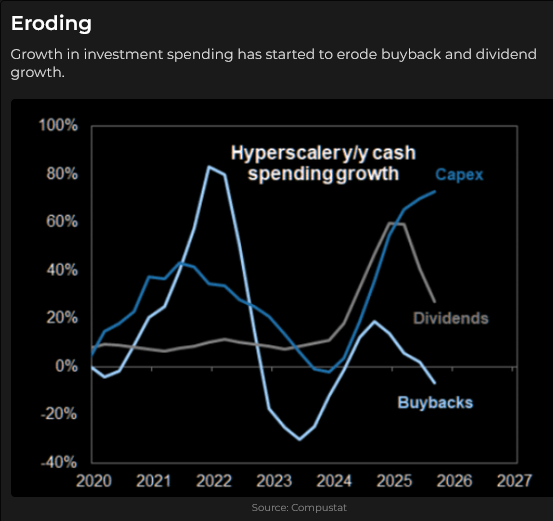

Corporate buybacks have frequently been described as one of the most potent bullish forces powering the equity market rally. Will massive capex spending reduce the amount of capital available for buybacks and dividends, or will companies borrow to pay shareholders?

Markets are entering the quarterly corporate reports season, with ALL leading Wall Street analysts forecasting higher earnings and higher S&P 500 prices for 2026.

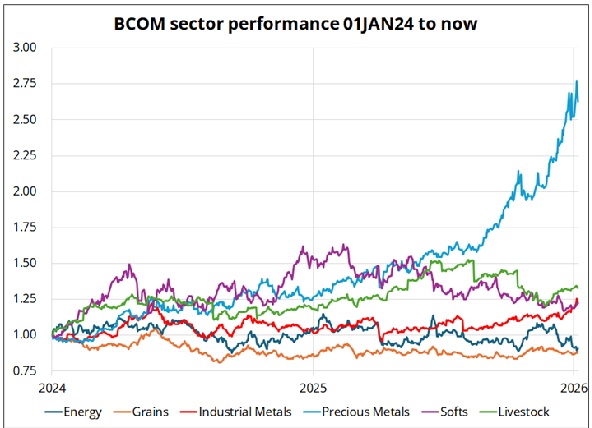

Metals

Comex February gold reached a record high of ~$4,585 on December 26, fell ~$300 to the December 31 lows, and recovered most of that decline by Friday’s close.

Comex March silver price action has been more volatile than gold, with a record high weekly close of ~$79.79 on Friday.

Comex front-month (March) copper closed above $6 per pound for the first time on Tuesday.

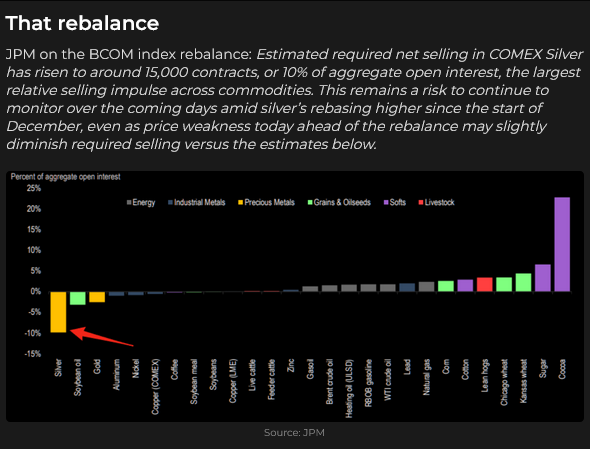

The BCOM (Bloomberg Commodity Index) rebalance

The massive precious metals rally in 2025 will trigger a substantial rebalancing of the index, meaning that (starting last Friday), there will be orderly selling of gold and especially silver over the next several days.

Currencies

The DXY US Dollar Index has rallied ~2% from the Christmastime lows. Mark Farrington, a veteran FX analyst, expects a stronger USD in 2026 as massive US IPO issuance, the “Monroe Doctrine” policies, rising US defence spending and energy dominance continue to draw capital to the USA.

The Euro (the Antidollar) has fallen by ~2% during the same time period.

The CAD has closed lower for 10 consecutive days, tracking the Euro’s decline against the USD.

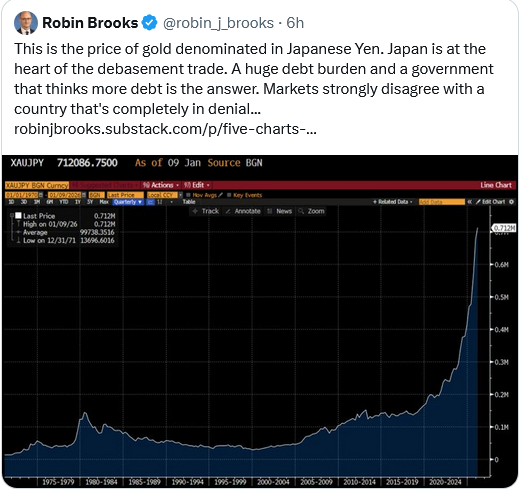

The front-month Yen futures contract closed at its lowest weekly level since July 2024 (blue ellipse in the lower-left corner of the chart) just before aggressive intervention by Japanese authorities ignited a short-covering rally that lifted the Yen by ~16% over 10 weeks. Rising tensions between China and Japan (including China restricting rare earth exports to Japan) may be weighing on the Yen.

The biggest market question I’ve pondered for the past few months is “What would it take for the Yen to rally – against the USD, against the Euro?” Embedded in that question is another question: “Why would Japan want/agree to have a stronger Yen?” Their stock market is at record highs, and a weak Yen supports mercantilist policies favouring strong exports (at the expense of higher import costs, which boost inflation).

Kevin Muir and Mark Farrington have (separately) proposed that Japan (and Korea and Taiwan) may take steps to repatriate capital (thereby boosting their currencies) to “pay” for continued access to the American market. (We know Trump thinks Asian countries “rip off” the US by keeping their currencies low. Was there an “undocumented” quid pro quo during his Asian tour last fall?)

Robin Brooks thinks that the weak Yen is a “safety value” for a country trapped by high and rising debt.

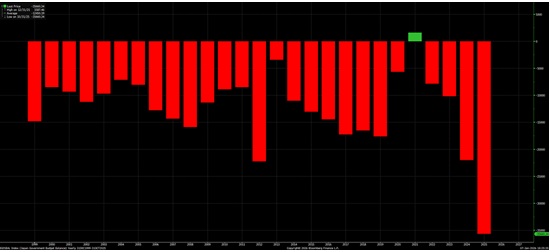

This chart shows Japan’s annual budget deficit.

Adding to uncertainty over the Yen are rumours of Takaichi calling a snap election.

Trump

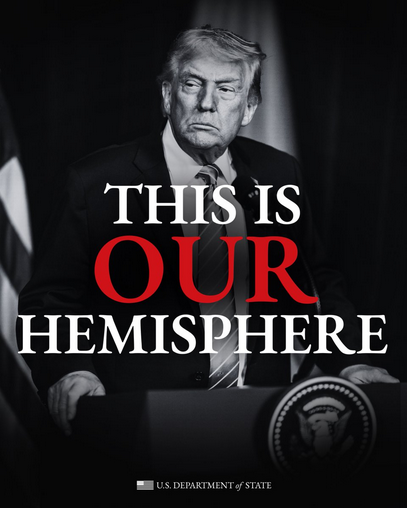

Last week, following the events in Venezuela, I noted that the Monroe Doctrine was alive and well, and that the USMCA was due for review/renegotiation by July 2026. I should have added that the Monroe Doctrine is a fundamental part of the American National Security Strategy. This social media screenshot from the US Department of State makes that “clear.”

I also asked, “What will Donald Trump do to make sure the Republicans retain control of Congress in the mid-term elections that are less than nine months away?”

From an economist’s perspective, he’s going to “run it hot,” meaning stimulative fiscal and monetary policies, which could include “tariff dividend” checks to citizens, banning institutional buying of single-family homes, buying $200B of residential mortgages to get mortgage rates lower, limiting the interest rate on credit cards to 10%, driving gasoline prices lower, appointing a new Fed Chairman to get short-term interest rates lower, and who knows what else.

From a “patriot’s” perspective, I expect he will continue activities to “Make America Great Again” by substantially increasing “defence” spending and expanding America’s “area of influence”, particularly in the Western Hemisphere.

From a geographic perspective, here’s a link to a time-series map of the dozens of border changes since 1793 in what we currently consider North America. Borders, both past and present, are subject to change.

My short-term trading

I started the week with no positions and made no trades. It’s unusual for me to be at my desk all week without making any trades. I was tempted a few times, but I never had the “courage of my convictions” to do something.

Here are a few ideas that I’m considering: Buying S&P puts, Selling Yen puts, buying Yen, selling Euro, (CAD will probably weaken if the Euro is weak, but I can’t sell it after it has dropped for 10 consecutive days), selling NAZ against the S&P, buying WTI and Natgas. I’m watching the metals closely, but the extraordinary volatility makes it hard to manage risk, so I haven’t made a trade.

The Barney report

It’s the rainy season here in the Pacific Northwest rain forest, so when there is a lovely sunny break in the weather, Barney and I like to get out and soak it up. He loves to climb up on things, in this case, a boulder near the golf course irrigation pond, to get a better look around. He turned four years old in September, but there’s still a lot of puppy in him, and I don’t mind that at all.

Listen to Mike Campbell and me discuss markets

On the January 10 Moneytalks show, Mike and I discussed how geopolitical events are swamping economic data, how global stock markets are soaring to record highs, the wild price action in the precious metals, and the relatively subdued price action in oil markets, given the events in Venezuela and Iran. You can listen to the show here—my spot with Mike starts around the 52-minute mark.

The annual World Outlook Financial Conference will be at the Bayshore Hotel on February 6 & 7, 2026. I will be the lead-off speaker on Friday afternoon. You can view the agenda, see the list of speakers, and purchase a ticket here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.