Key Turn Date – February 2, 2023 – The Fed Will Be Higher For Longer

The market was “Fighting the Fed” for the past couple of months – the forward short-term interest rate market was pricing the Fed to stop raising rates in Q2 and to cut rates by ~50bps by December 2023 (and by ~200bps by December 2024) – despite clear warnings from Chairman Powell that the Fed WOULD NOT cut rates this year. Powell has repeatedly said that cutting rates might re-ignite inflation and therefore cutting rates was not a risk worth taking.

The market had “a change of heart” about The Fed cutting rates this year following last week’s FOMC meeting, especially following Friday’s UE data, and has repriced December 2023 s/t rates higher by ~60bps since February 2.

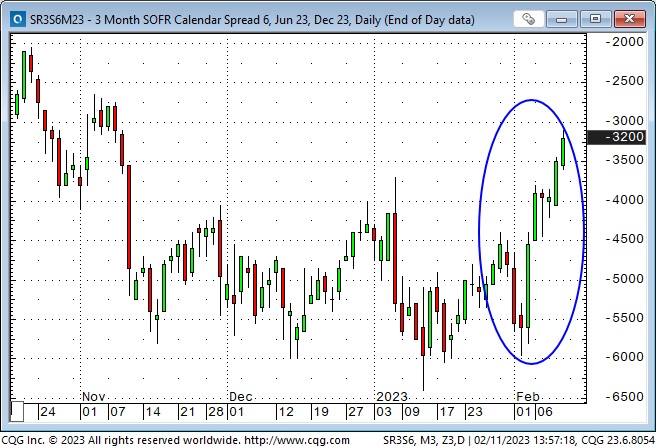

The SOFR futures (Secured Overnight Financing Rate) trade at a discount to par (100.) A price of 95 = 5%. This chart shows prices dropping (yields rising) ~60 bps from February 2 to 10.

The current Jun/Dec SOFR spread is ~32 points, down from recent highs of >60 points, so the market still expects modest cuts from the Fed later this year and into 2024.

February 2 was a Key Turn Date because that’s when several markets reversed course – a signal that something BIG happened on that date – and I believe the “something” is that markets now believe the Fed will hold s/t rates higher for longer. The “test” of the KTD idea will be the market’s reaction to Tuesday’s CPI report.

Here’s a look at some markets that reversed course on the KTD. The “common cause” for correlation across these different markets is a sensitivity to the Fed holding rates higher for longer than previously thought.

The US Dollar Index hit a 10-month low on February 2 (down ~12% from 20-year highs made at the end of September) and has reversed higher.

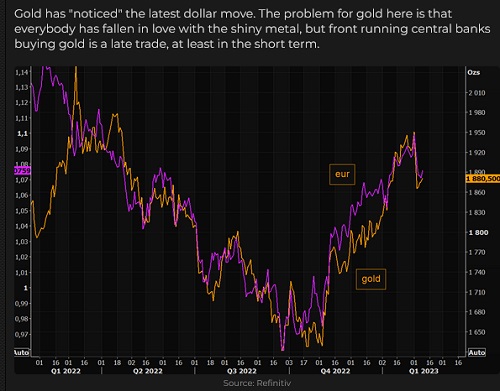

The Euro hit a 10-month high on February 2 and has reversed lower. Since late Q3 2022, speculators in the currency futures market have been aggressively buying the Euro as the spectre of an “Existential Winter” in Europe due to energy shortages faded away, and many things European looked like a bargain. (The UK FTSE stock index hit an All-Time High this week.) If the Euro continues to fall, those speculators will likely start selling their positions, exacerbating the Euro’s decline.

The Japanese Yen made a lower high on February 2 and reversed lower. The Yen hit a 32-year low in October and rallied ~18% in three months as the USD weakened against virtually all currencies.

Gold hit a 10-month high on February 2 and has reversed lower by ~$100 after rallying ~$325 from early November. Gold had rallied from 30-month lows in September when the USD started to fall but couldn’t sustain that rally until early November when interest rates (especially real interest rates) began to fall. Silver hit a 10-month high on February 2 and fell ~12% to this week’s lows.

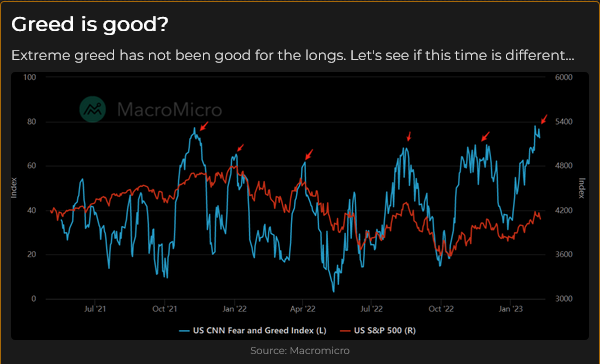

The S+P hit a 6-month high (Nasdaq hit a 5-month high) on Feb 2 and has reversed lower. Stock indices worldwide roared out of the gate in early January after worrying about recessions in December, and the tone was aggressively risk-on. FOMO was back BIG TIME, especially with markets assuming the Fed was nearly done raising rates, but I think that assumption went out the window on February 2. Many of the “dogs” of 2022 rallied hard in January.

The Transports hit a 10-month high on February 2 and dropped ~6% to this week’s lows.

Implied S+P Vol touched a 12-month low on Feb 1 and reversed higher.

ARKK hit a 5+year low in December, down ~80% from 2021 ATH, bounced ~55% to a 5-month high on February 2, but then reversed lower.

XHB (Homebuilders ETF) hit a 12-month high on February 2 and reversed lower. Lumber reversed lower on Feb 1 and has dropped ~8% since.

The US Treasury bond futures made the 3rd leg of a triple top on February 2 and reversed lower.

A new era of higher inflation and higher interest rates?

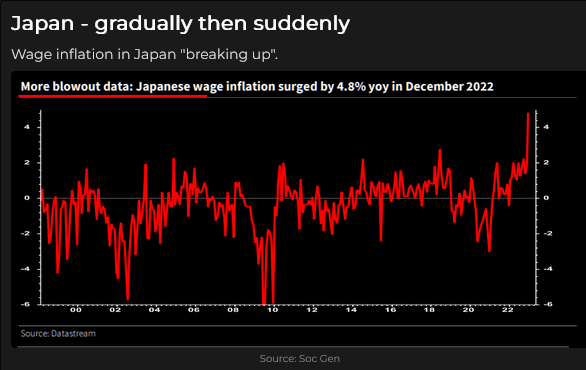

I’m a trader, not an economist, and I know some economists foresee a recession or possibly even deflation ahead. They may well be correct, but I guess that consumers understand that prices of important things have increased far more than the CPI reports. I believe that consumers will try to earn more to “catch up” to rising prices (the wage/price spiral idea.)

The antidote to a wage/price spiral might have been a dramatic increase in unemployment – people would stop trying to earn more and “feel lucky” if they still had a job when their friends lost theirs.

But Powell (and others) have been suggesting that the American (and Canadian) economy may be staring at an endemic, structural shortage of workers, which would give labour an advantage in wage negotiations.

Government energy policies are fundamentally inflationary, as is the prospect of increasing global energy demand stressing inelastic supply.

And then there is the soaring debt issue. Governments learned during Covid that voters don’t care about deficit spending. (We’re all MMTers now.) I don’t expect that to change, and as governments continue to run debt-financed deficits, the purchasing power of money will keep falling.

I understand that some readers will wince when I say “a new era”, but I believe there has been a “sea change” after forty years of generally declining interest rates and twenty years of benign CPI inflation.

Geopolitical risk is underpriced

Last weekend, I was on the closing panel at the World Outlook Financial Conference in Vancouver. Michael Campbell, the host, asked the four of us on the panel what we thought might be the biggest surprise for markets this year.

I said that markets were so obsessed with divining monetary policy changes that they were underpricing geopolitical risk – particularly concerning the war in Ukraine. Western markets seem to believe (want to believe) that Ukraine is “winning” the war or is at least “holding its own” against Russia. Western markets seem to think that the war is “contained” and that, at worst, it will be a stalemate until a peace treaty is negotiated.

That may well be the case, but I think markets are underestimating the possibility of escalation or of Russia prevailing.

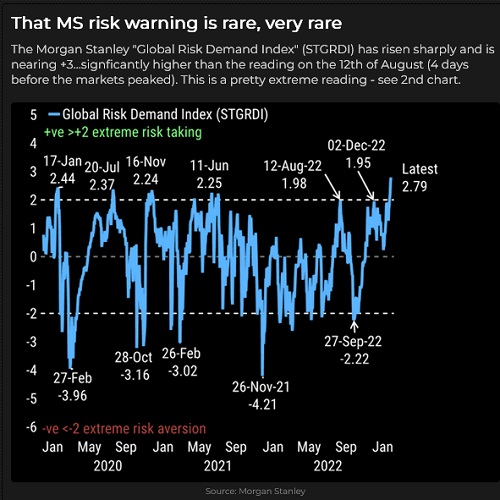

From late October until early February, as markets sensed that the Fed was slowing, the market tone and positioning became increasingly risk-on; if the war in Ukraine takes a turn for “the worst” and/or if other geopolitical issues flare up, I expect markets would quickly go risk off as traders try to unwind positioning. I expect gold, the USD, and US bonds would rally while other currencies (especially the Euro) and stocks would fall.

North America’s energy self-sufficiency, relative to energy scarcity in other parts of the world, would also attract capital to America in times of crisis.

My short-term trading

My trading bias in January was that the Euro and gold were overdue for a correction and that the stock market rally would run out of steam.

I shorted the Euro a few times in January, but other than catching the sharp break during the first week of the month, I took losses on those trades.

I shorted gold a few times with mixed results. For instance, I was short coming into the week starting Monday, January 30. The trade was nicely ahead when gold tumbled on Tuesday, but I was stopped for a slight loss on Wednesday and missed the $100 plunge on Thursday/Friday.

I thought the stock market rally was suspect but other than catching a mid-month dip; I mostly left it alone in January. (I didn’t see good risk-adjusted setups to get short.)

I missed the Thursday/Friday plunge in gold and the Euro because I was travelling and then involved with the conference in Vancouver. It seemed “prudent” to not be trading when I was absent or distracted.

I’ve often said that missing a good trade feels worse than losing money on a trade – or at least, that’s how it feels at the time!

It took me a couple of days after travelling and being at the conference to get back in sync with the markets. I made some money shorting the S+P this week but lost money shorting CAD when it jumped on a much stronger-than-expected UE report Friday morning. I’m flat going into other weekend.

On my radar

The CPI report on Tuesday morning could be dangerous for long and short positions!

I remain USD bullish and will look for (technical) setups to sell FX against the USD. One of the reasons I am USD bullish is that the USDX has corrected ~61% of the rally from the January 2021 3-year lows to the Sept 2022 20-year highs and has turned up. I also like that speculators have been aggressively buying the Euro – the Anti-dollar trade. I like the convexity of being long the USD when I believe markets are WAY underpricing geopolitical risk. Remember, capital flows to America for safety and opportunity.

We’ve just had several months of capital flowing away from America in search of “bargains” elsewhere. That reminds me of veteran analyst Donald Coxe’s warning, “Emerging markets are markets you can’t emerge from in an emergency!”

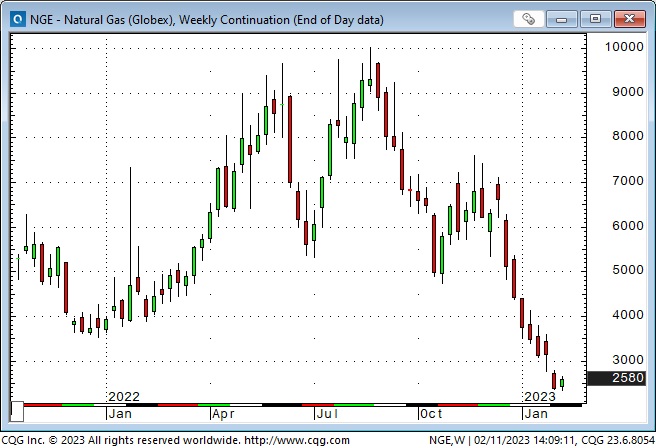

Natgas looks egregiously oversold, down ~70% from last year’s highs to 20-month lows. Downside momentum is stalling. Open interest has soared ~20% YTD. I might be tempted to be a buyer – the convexity of being long “cheap” energy appeals to me when I believe the market is underpricing geopolitical risk.

I am bearish on equities and will look for setups to get short. I’m suspicious of the assumed “Goldilocks” environment – Fed slowing as inflation falls, robust job growth but wage growth moderating, no recession, low volatility. Remember, in October, the leading stock indices were at 2-year lows, the DJIA was down ~22% from ATH, and the Nasdaq was down ~37% from ATH; there has been a HUGE rally from those lows and sentiment has gone from very negative to very positive.

Money market funds are at record highs. Cash is not trash now that s/t rates are around 5%, and I can imagine that people like having the opportunity to earn 5% with virtually zero risk rather than having to “take their chances” in the equity markets because TINA. Therefore, I don’t agree with the notion that “all that money” is just “dry powder” which will rush into the stock market if it keeps going higher.

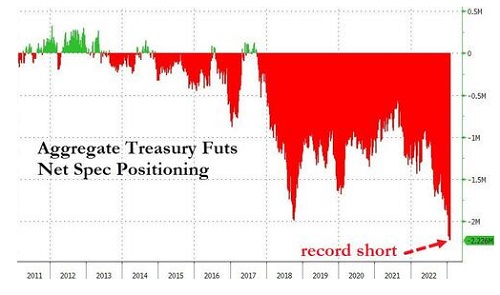

I mentioned above that bonds would rally on a geopolitical event. I think that would be a relatively short-term rally because a tsunami of bonds is coming to finance government deficits.

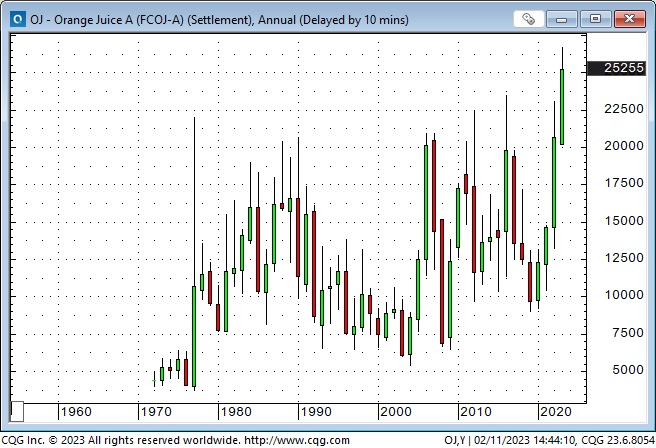

The “Trading Places” movie

In 1983 everyone from the Conti Vancouver office (~20 of us) went as a group to see Trading Places with Eddy Murphy, Dan Aykroyd and Jamie Lee Curtis. There were a lot of groans from our group at some of the “poetic license” taken when the movie portrayed action on the orange juice trading floor in the World Trade Center in New York, but, on balance, we all loved the movie! Looking good, Billy Ray! Feeling good, Lewis!

This reminds me, OJ traded at All-Time Highs this week.

The 2023 World Outlook Financial Conference

It was good to be “back in the room” after two years of video conferences! There were ~1,000 people at the conference and many excellent presentations from our mainstage speakers and breakout room speakers. I was busy with MC and admin duties and couldn’t pay close attention to all of the presentations, so I’m looking forward to watching the video this weekend. You can get access to the entire conference streaming HD video here.

The Barney report

My wife and I dropped Barney off at the kennel Thursday morning before we went to Vancouver for the conference. We picked him up late Sunday afternoon, and he was very happy to see us. The folks who run the kennel are very strict about the vaccination records of all the dogs, the staff obviously love dogs, and the facility is excellent – but we still feel “bad” about putting him in a kennel, so we’ve found a lovely young lady who will housesit Barney when we go to Victoria this week to wave goodbye to my wife’s son as he sails off for his first 3-month deployment as an officer in the Canadian Navy.

My big leather reading chair has become Barney’s favourite place for afternoon naps and nighttime sleep!

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. You can listen to us talk about markets on February 11 on the Moneytalks podcast.

I recorded a 30-minute interview with Jim Goddard on February 10 for This Week in Money. It will be posted here later today.

Headsupguys

At the World Outlook Financial Conference, I had the opportunity to briefly tell the audience about Headsupguys and why I support the work they do.

I support this project because I’ve had friends who took their own lives. Headsupguys helps men deal with depression. Headsupguys has had over five million hits on their website, and over a half million men have taken the self-check. Most men who click on the website do so after midnight their local time. Headsupguys saves lives.

The Archive

Readers can access weekly Trading Desk Notes going back five years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.