Animal Spirits experience an Icarus Moment as the adrenaline rush from Trump’s election victory fades.

The NAZ rallied ~28% from early August lows to this week’s all-time highs, with nearly half the gains made since Trump’s election victory (circled.) The NAZ was up ~60% from October 2023 and was “by far” the best-performing stock index over the last year, owing to its heavy weighting of big-cap tech. The index was vulnerable to a correction and broke hard on Wednesday’s “hawkish cut” from the Fed.

The S&P rallied ~6% from the election to record highs on December 6 but drifted sideways to lower before breaking hard on Wednesday.

The DJIA rallied ~7% from the election to record highs on December 4 but then fell eleven sessions in a row, giving up virtually all of the post-election gains.

The Trannies rallied ~9% from the election to record highs on November 25 but slumped ~12% to this week’s lows – decisively below election levels.

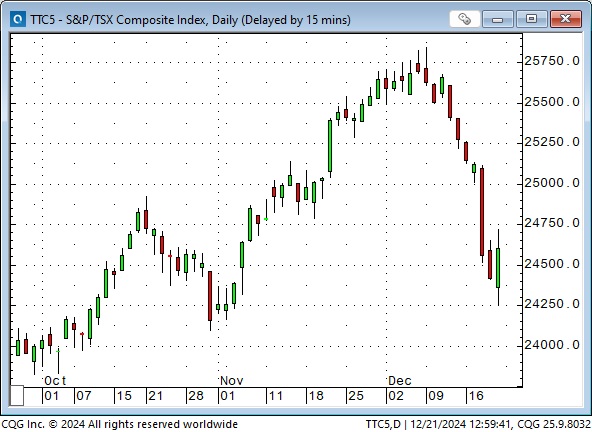

The TSE rallied ~6% from the election to record highs on December 9 but then tumbled back to pre-election levels.

Bitcoin rose ~100% from early September to mid-December record highs before correcting this week.

TSLA rose more than 100% from early November to record highs in mid-December. Perhaps it was also overdue for a correction.

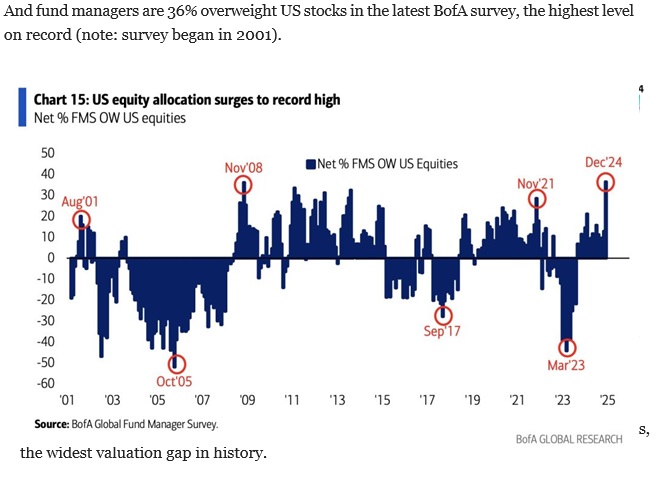

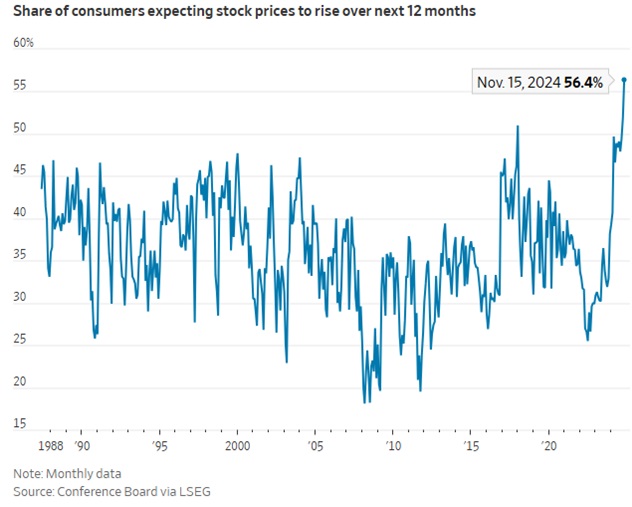

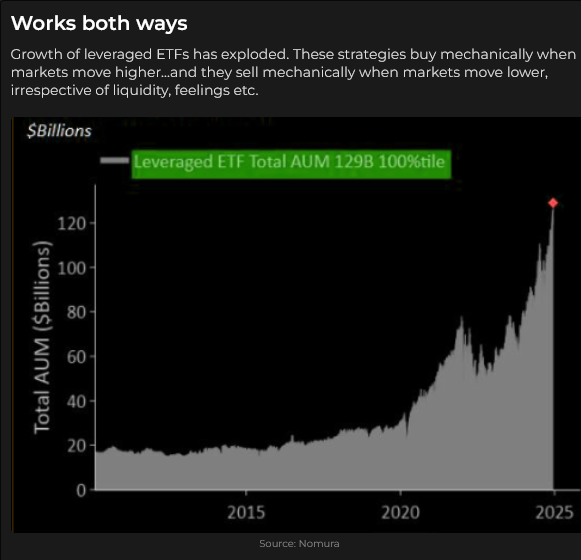

Coming into this week, traders and investors were bullishly positioned in risk assets (no kidding!), which may have left the market “vulnerable” to a swift correction.

Corporate buybacks, which have been running at ~$6 billion daily over the last three weeks, will slow dramatically from now into January in the blackout period ahead of quarterly corporate reports.

This happened fast!!

Bonds

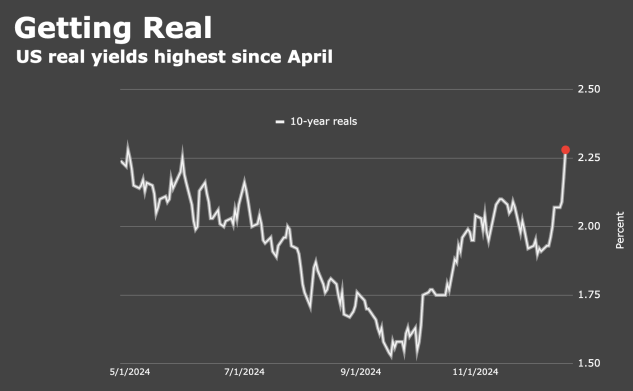

The 10-year Treasury yield hit a 16-year high of ~5% in October 2023. This year’s low was ~3.62% in mid-September when the Fed began a rate-cutting cycle that markets expected to produce 100 bps of cuts in 2024, followed by another 200 bps of cuts in 2025. We’ve had the 100 bps in 2024, but the market is now pricing cuts of less than 50 bps in 2025. Friday’s closing yield on the 10-year was ~4.52%.

The 90 bps rise in 10-year yields since late September, while inflation rates have only moved fractionally higher, has caused a sharp increase in real yields.

Bonds gapped higher on November 25 (circled) following Trump’s nomination of Bessent as Treasury Secretary but have fallen well below that level the past two weeks as markets contemplate sticky inflation, the prospect of growing fiscal deficits and the Treasury’s $~9 trillion refinancing prospects for 2025.

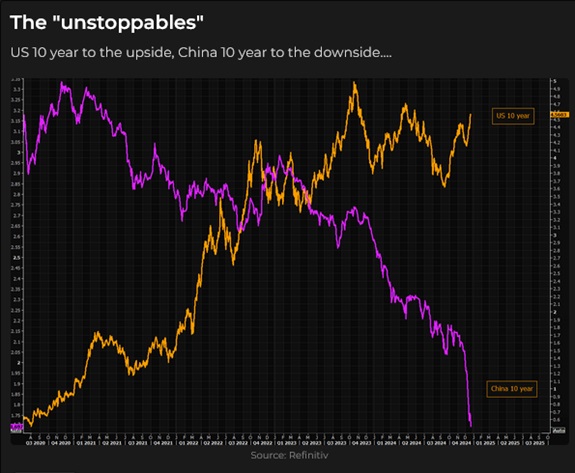

Chinese bond yields continue to fall, with 1-year yields at record lows of ~0.8% and the 10-year at ~1.7%. Is China teetering on deflation even with record exports? Will exports fall next year? Is China in 2025 a reprise of Japan in 1990? What would that do to commodity prices? (In this chart, Chinese 10-year yields are purple, and US 10-year yields are orange.)

Currencies

The US Dollar index has rallied ~8% from the end of September to this week’s 25-month high. This rally has been in step with US interest rates rising relative to foreign rates, and it received a substantial boost from Trump’s election victory (circled.)

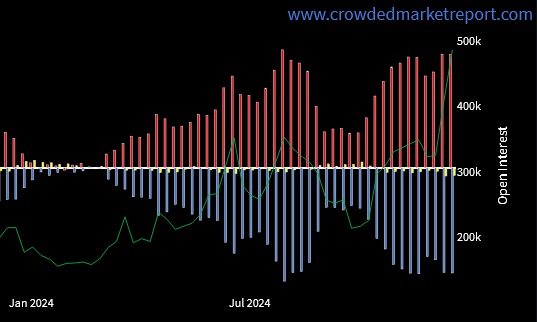

Sunday, Dec 22 Edit: The Crowdedmarketsreport.com display of COT data as of December 17, 2024, shows the aggregate speculative positioning of all CME currency futures is more net short (USD bullish) than at any time since the October 2014 to January 2016 period (rectangle on chart below) when the USDX rose ~18% from ~85 to ~100.

The current massive aggregate speculative net short position was primarily built in the last two months (since Trump’s election victory) as the USDX rose ~4% from ~104 to ~108. (The expiration of December FX futures this week may have accounted for ~5% of the week-over-week decline in aggregate net long spec positions.)

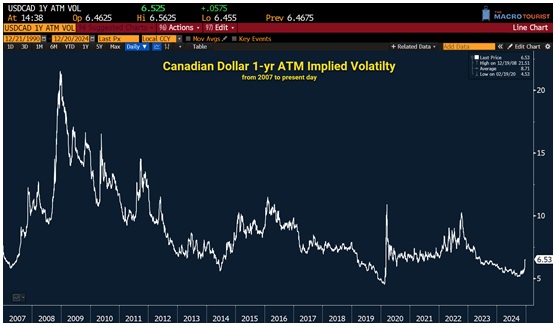

The Canadian Dollar fell ~5 cents (~6.5%) from late September to this week’s lows as the USDX soared against all currencies. (The Euro fell ~7.5%, the Pound ~7%, the Aussy ~ 11%, the Yen ~11% and the Brazilian Real ~15%.)

The CAD took a hit on November 25 (circled) when Trump threatened 25% tariffs on all imports from Canada and Mexico (if they didn’t stop the flow of illegal migrants and dangerous drugs into the USA.) The historically high premium of US interest rates over Canadian rates (~1.25bps across the curve) adds to the pressure on the CAD.

Since April, speculators in the Chicago futures market have held historically large net short positions against the CAD and have benefited enormously as the CAD has fallen. Open interest in CAD futures is ~3X its average over the past ten years (that’s a massive increase in any futures market.) As of December 17, speculators hold essentially their largest-ever net short CAD position. (This chart is used with permission from a subscription service: Crowdedmarketreport.com. They provide the best COT futures market positioning format I have found. Red bars are commercials net long, blue bars are large speculators net short, and the yellow bars show small speculator positioning.)

When sentiment and positioning in any market I follow get historically one-sided (as stock indices and other risk assets have recently), I watch for price action or “events” that might trigger a reversal. Sentiment and positioning in CAD futures are currently extremely bearish. What could cause the CAD to rally?

I often note that the value of the CAD against the USD is frequently determined by “events” outside of Canada and sometimes by “Canada-specific events.” If the USD were to start falling against most actively traded currencies (for instance, Trump claims that the USA is suffering because other countries keep their currencies too low), the CAD would probably rally. If there is evidence that “regime change” in Canada is imminent, the CAD would probably rally.

Over many years, I’ve also noticed (and written about) the fact that when a reporter for the local TV evening news calls me to provide “colour” on a market story they are doing, it is a “sure sign” that the market is about to reverse direction. I’ve had three calls to comment on the falling CAD in the last two weeks!

My long-time friend, Ross Clark, an excellent technical analyst, has just published a report noting that the CAD is “generating an extreme downside capitulation (seen 14 times since 1990) coupled with a Sequential 9 Buy setup.”

I’m interested in catching a turn in the CAD because the speculators who are currently short may (voluntarily or otherwise) cover their positions by buying CAD. Their buying would accelerate a rally.

The Japanese Yen fell ~50% from 2012 (when Prime Minister Abe introduced his Three Arrows policies to invigorate the Japanese economy) to 35-year lows in July 2024, when Japanese authorities intervened in the FX market to boost the Yen’s value.

All Asian currencies are grossly undervalued against the USD. This is part of a mercantilist policy to facilitate exports to the USA, but from an American perspective, it results in Asian countries running substantial trade surpluses. To reduce these surpluses (and in an attempt to “bring jobs back to America”), Trump may decide to initiate or increase tariffs against Asian imports and/or pressure Asian countries to increase the value of their currencies. The Yen may be due for a replay of the 1985 Plaza Accord.

My short-term trading

I started this week with short positions in the S&P I had established over the past two weeks. When the market suddenly broke hard on Wednesday, I was of two minds. Firstly, the S&P has typically bounced back over the last few years after a sharp break. Should I take the money and run? Secondly, I’ve been anticipating a long-term top in the stock market, and I don’t want to lose my position, so I have to stay short and treat the 200+ point drop as just the beginning of a big move.

I then defaulted to my “golden rule,” which is, “My job is to make money, not to prove that I’m right.”

I dramatically lowered my stops and was stopped overnight for a gain of over 150 points. When the market began to fall back from Thursday’s high, I got short again and covered that trade early Friday morning for a good profit when the market started to rally from overnight lows (the market rallied ~100 points after I covered my short!) I was flat the S&P going into Christmas week.

On Tuesday, I was away from my trading desk (travelling to Vancouver to visit my son) when my wife texted me that Trudeau had resigned. I was not happy. I expected the CAD was rallying, and I had missed a great buying opportunity. It turned out my wife was wrong; he had not resigned, even though 10 million people were hoping he would.

I decided I needed to be long the CAD before any future bullish news hit the market. (I usually wait for the “event” before taking a trade, but I was willing to make a limited-risk bet that the CAD was “way overdue” for a rally.) I bought OTM February calls on Wednesday and Thursday. VOL is historically low.

On Friday, after the Yen tumbled on Thursday when the BoJ did not raise interest rates, I bought the Yen (in line with my thoughts above.)

The Barney report

Barney came to live with us in September 2021 when he was eight weeks old. We had picked him from the litter as “our guy” when he was only three weeks old. Before he came here, I occasionally lost a sock. It usually turned up in the laundry room. These days, I don’t bother looking in the laundry!

Listen to Mike Campbell and I discuss markets.

This morning, Mike and I discussed the sharp fall in the stock market and the Canadian dollar on the Moneytalks podcast. You can listen to the entire show here. My spot with Mike starts around the 51-minute mark.

I don’t plan to write any Notes on December 28. I wish my subscribers a Merry Christmas and a Happy New Year.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

.