Brief notes today – lots of charts

The S&P surged on Wednesday and Thursday after the not-so-hawkish (?) cut from the Fed, nearly making a new record high, but slipped lower overnight Thursday and tumbled on Friday as traders seemed to have “second thoughts” about AI.

The “second thoughts” about AI were more pronounced in the NAZ, which closed on Friday at December’s lows.

The Dow and the Russell traded to new record highs on Thursday, providing evidence (?) that capital isn’t fleeing the equity markets, it’s just “rotating away” from the high-flying AI issues.

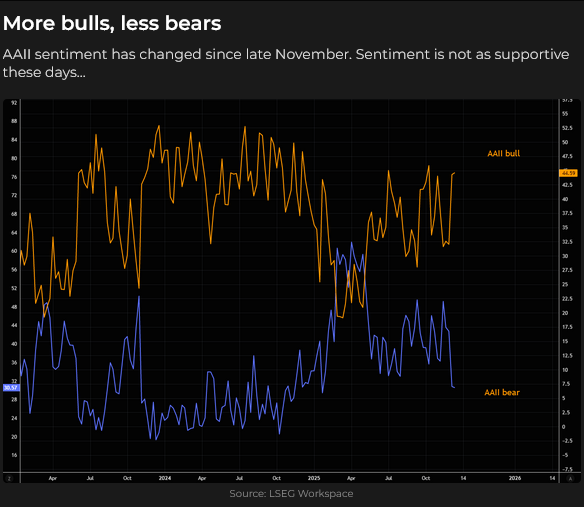

Market sentiment on Thursday after the post-Fed rally.

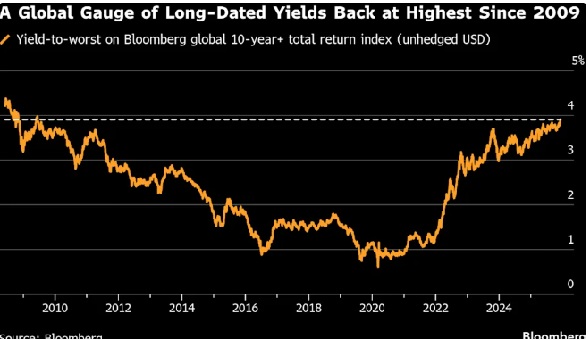

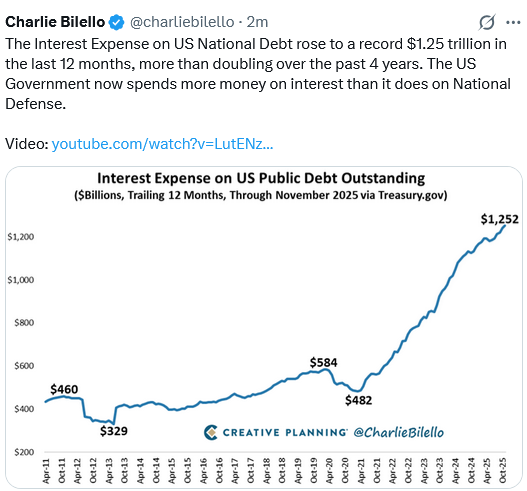

Interest rates

The long bond has been trending lower since mid-October (could it be that the bond market doesn’t like that 3% is the new 2%?). Please tell me that the bond market is too sophisticated to fall for the old “Head and Shoulders” chart pattern (which would point to a target of ~112).

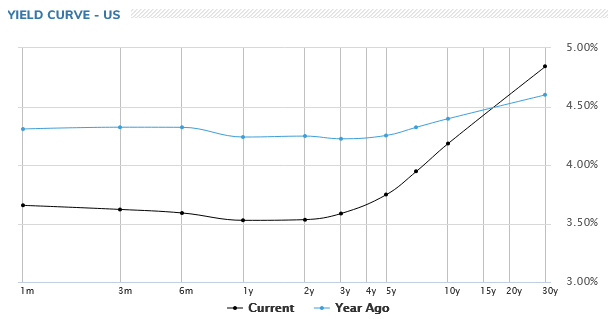

The US yield curve keeps steepening.

Currencies

The DXY US Dollar index closed above 100 in mid-November for the first time in six months, but couldn’t sustain the gains. FX markets appear to embrace the notion that a shrinking US interest rate premium relative to other currencies implies a lower US dollar. (And for that flimsy reason, traders are willing to buy the Euro and GBP against the mighty USD?)

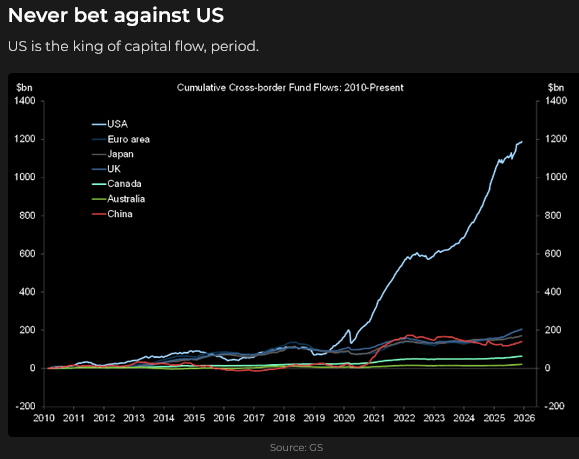

Did I hear somebody say that, “capital flows to the USA for safety and opportunity?”

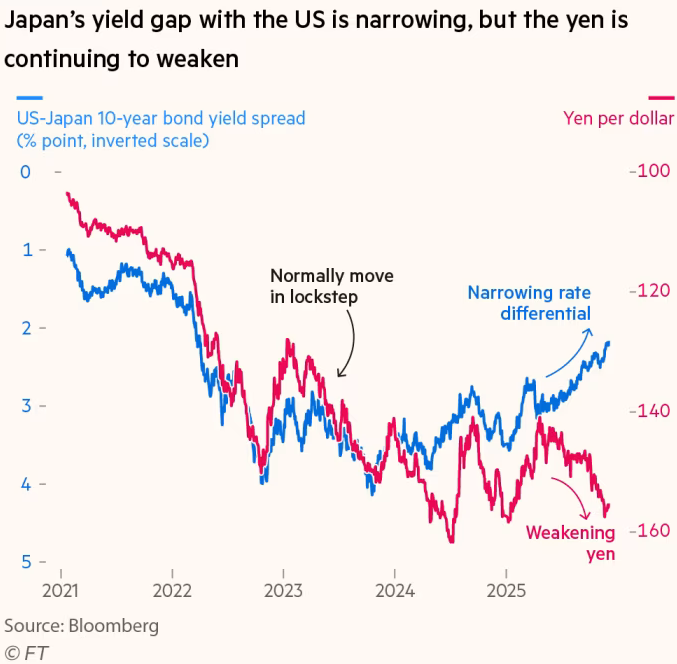

The Yen remains weak against the USD.

The Yen closed this week at a new record low against the mighty Euro.

The Canadian dollar trended lower from June to November, falling from ~74 to ~71 cents, and speculators increased their bearish positioning. Recent better-than-expected Canadian employment and GDP data (along with a generally negative view on the USD) inspired some short-covering and a 1.5-cent pop over the last three weeks.

Ever-so-precious metals

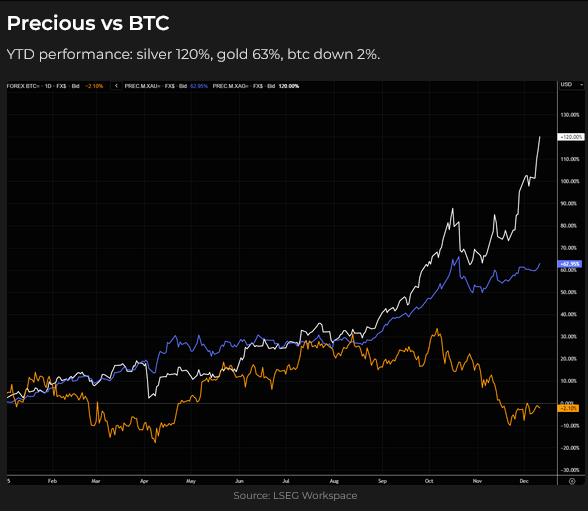

Silver has been the “wild child” of the metals markets, with the Comex front month (March 2026) reaching $65 early Friday morning (before correcting $4 per oz in three hours), for a gain of ~116% from the April lows.

Gold appears relatively benign compared to silver, despite a $100 intraday correction on Friday.

Bitcoin has been struggling lately, down ~36% from October’s record highs, and flat YTD, while gold and silver have soared.

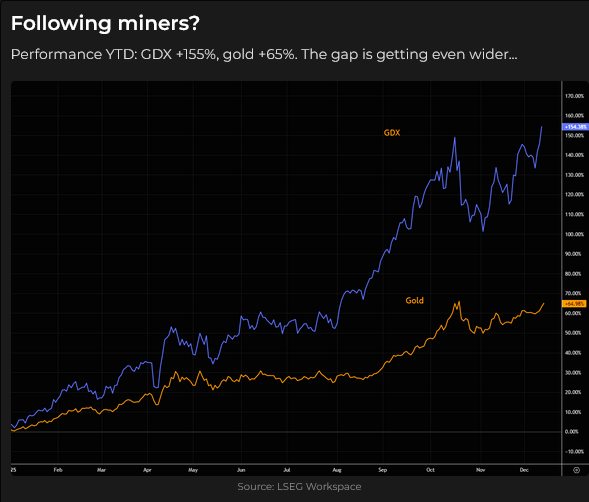

Gold mining shares continue to outperform gold.

Energy

This week’s close on front-month Nymex WTI ($57.53) was the lowest weekly close in nearly five years, as supply continues to outweigh demand.

Front-month Nymex Natural Gas closed at a 3-year high last week ($5.38), then plunged ~25% to this week’s close (warmer weather?), maintaining its reputation as the widow-maker market.

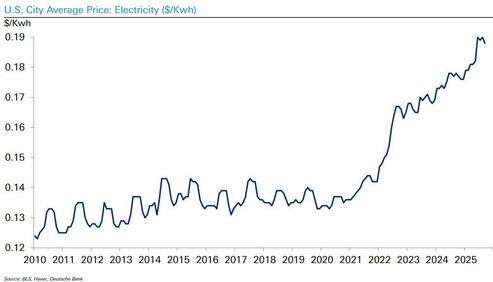

There is a rumour circulating that the sharp rise in US urban electricity prices (with more to come) may be attributable to AI centres. (Say it ain’t so, Joe!)

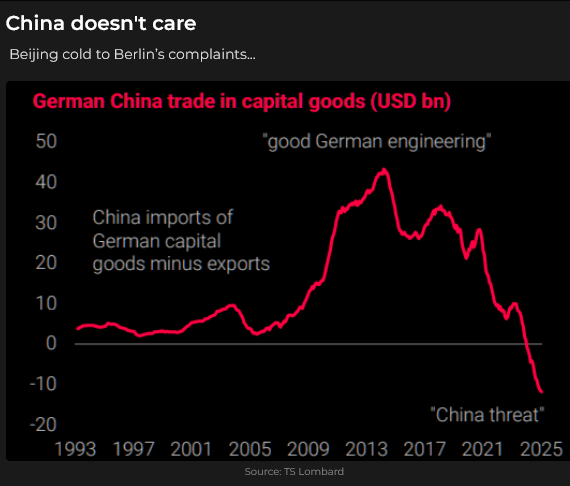

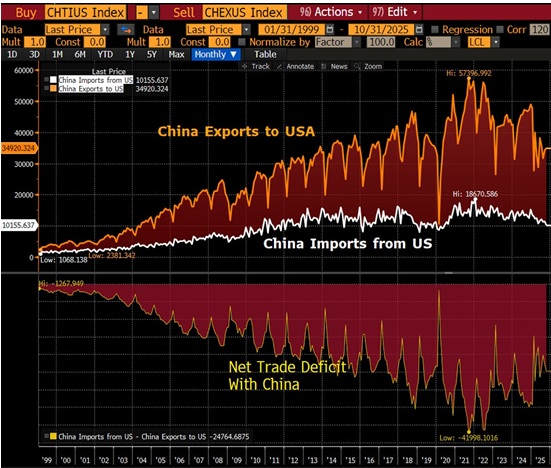

China steps up their export game

China’s trade surplus with the Rest Of The World was north of US$1 trillion for the first 11 months of 2025.

China doesn’t want to trade; it wants to export stuff. They produce far more cars than any other country, and they’re flooding EM with their automotive exports. Exports to the USA are down, but exports to the ROW are surging.

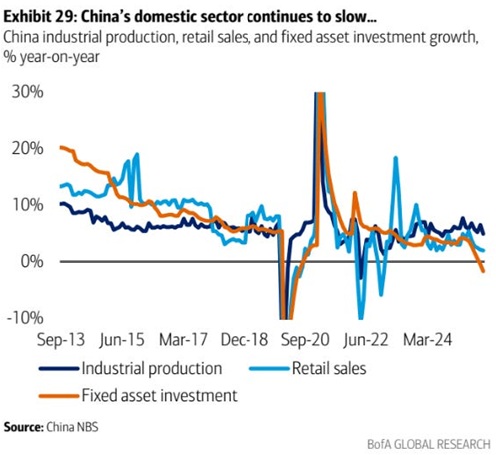

At the same time, their domestic market is struggling with subdued demand (a balance-sheet recession) as the hangover from massive real estate speculation persists.

My short-term trading

I started this week long CAD and YEN. I covered the Yen for a tiny loss on Monday, tired of waiting for it to show some signs of life. I closed the CAD on Thursday for a decent gain of nearly 1.5 cents.

I bought OTM bond call options on Wednesday ahead of the Fed news, and was nicely ahead on the trade early Thursday morning. I covered the trade for a slight loss when the market opened lower on Friday.

I shorted the S&P twice on Thursday when it appeared it couldn’t sustain Wednesday’s post-Fed gains, but I took two slight losses. I shorted it again on Friday morning when it fell through the overnight lows. With the market closing Friday near its lows for the week, I kept the trade into the weekend.

The Barney report

AS we creep towards the winter solstice, there is less and less daylight in the Pacific Northwest Rainforest, but Barney doesn’t seem to mind as long as he gets out for three good walks a day. I’m sure he spends more than half of his time asleep!

Listen to Victor host this week’s Moneytalks show

I hosted the show again this week, with Mike Campbell away, and I had great guests. Lance Roberts of Real Investment Advice in Houston advises clients to get a little defensive after three consecutive years of substantial gains in the stock market. Ozzy Jurock, our resident real estate expert, took a deep dive into the problems created by the recent judicial decision on Aboriginal land claims. Claudia Tornquist, CEO of Kodiak Copper, shared her thoughts on the copper market and developments on their massive copper deposits in BC. Rob Levy, from Border Gold, had a great free-wheeling discussion with me about the volatile precious metals market. You can listen to the show here.

The World Outlook Conference will be at the Bayshore Hotel in Vancouver on February 6 and 7. Click here to view the list of speakers, the agenda, and purchase a ticket.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.