Powell was more hawkish than expected – stocks, bonds, and gold tumble – USDX hits a new 20-year high

Powell’s Jackson Hole speech on August 26 was much more hawkish than markets had expected. He said that the Fed is determined to get inflation back to its 2% target and that “restoring price stability will likely require maintaining a restrictive policy stance for some time.”

The DJIA closed down >1,000 points Friday following Powell’s speech.

The DJIA, S+P, NAZ and VTI registered their lowest daily close since late July. The message was clear – if you’re buying stocks, you’re fighting the Fed.

Currencies

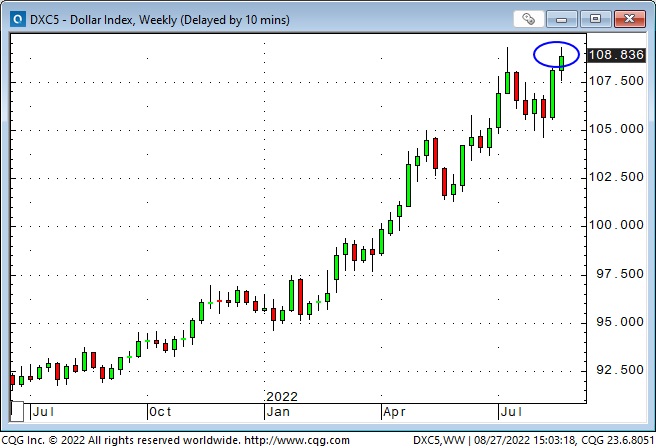

The weekly chart of the US Dollar Index closed at a new 20-year high. The message was clear – if you’re short the USD, you’re fighting the Fed.

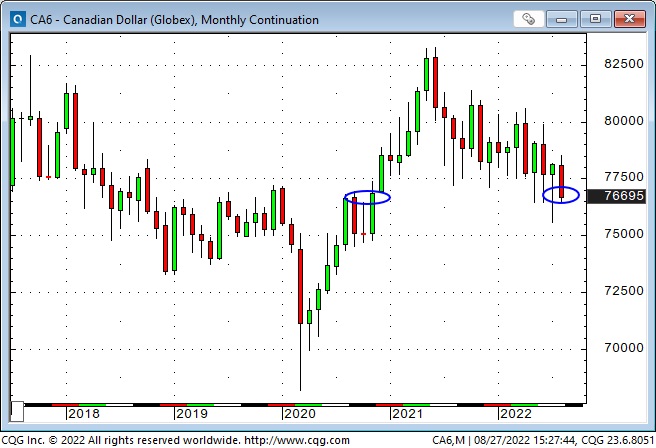

The weekly chart of the CAD closed at its lowest since November 2020.

The weekly chart of the Euro closed at its lowest in 20 years.

Interest rates

Yields fell at the very long end of the curve, the mid-curve was flat, while 2-year yields rose. It looks like the longer-duration bonds see the Fed’s determination to reign in inflation as good news, while the short-end is pricing in the Fed pushing short rates higher.

Will the Fed get inflation back to its 2% target?

Some analysts have opined that supply shortages have caused inflation and that the Fed doesn’t have the tools to “fix” supply – the Fed can’t “print” copper, natural gas, or electricity. But, as Powell made clear, the Fed can (and will) take sustained action to (try to) reduce demand.

For the past few months, markets have been trying to find “Peak Fed,” the moment when the market stops pricing in higher expectations of forward interest rates. In an everyday sense, the stock market wants to discover when inflation (and Fed policy) stops getting worse and improves – once the “worst” is priced in, it’s time to get out the blue tickets.

Heading into the mid-June FOMC meeting, the DJIA dropped ~3,000 points in seven days, and the “worst” seemed to be priced in when the Fed raised s/t rates by 75bps and warned of much more to come. The DJIA rallied >4,500 points over the next two months (I called it a bear market rally.)

Friday’s stock market’s reaction to Powell’s Jackson Hole speech implies that the “worst” is yet to come. We will see. If the stock market takes out the mid-June lows, then the rally since mid-June was a bear market rally.

It may be “too obvious” to mention, but it seems that the Fed is focused on inflation and that even if peak inflation is behind us (and I’m not sure about that), I’m willing to bet that inflation won’t tumble anytime soon – which means that the Fed will keep s/t rates higher for longer than the market is currently pricing.

I think there is a good chance that inflation will not tumble because the Fed will NOT be able to “moderate demand to better align with supply” (to quote Powell). After all, on a global basis, “demand” for critical items (like energy) is growing, and the “supply” is short. In addition, I expect a “catch-up” pricing cycle, whereby goods producers raise their prices to reflect sharply rising energy input costs, and buyers demand higher wages to pay for goods, etc.

Rising energy costs feed through to everything else

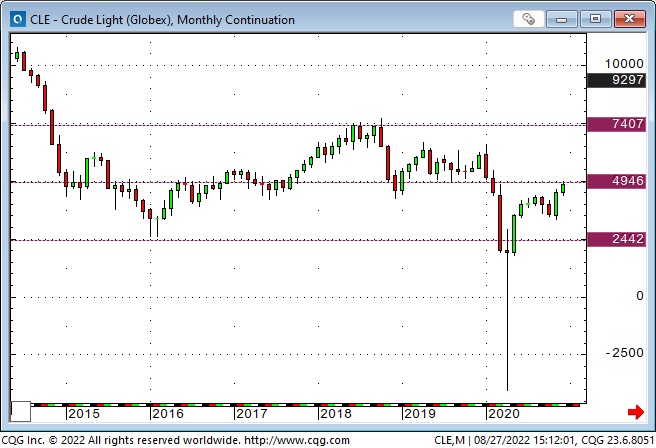

WTI averaged ~$50 from 2015 to 2021 (NYMEX Natgas averaged ~$2.70), and people may have thought that energy costs would stay low “forever.” (Europe decided it was OK to rely heavily on Russia for energy supplies.)

YTD average prices for WTI and NYMEX are about double what they were from 2015 to 2021.

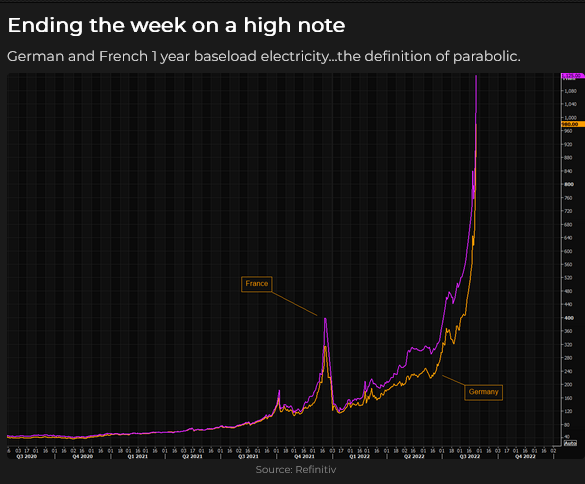

In Europe, Nat Gas prices have soared: Dutch TTF futures are at All-Time Highs, and electricity prices have gone parabolic. French President Macron talks about the end of abundance.

UK Natgas prices are up >100% from July lows, 12X the average price from 2008 to 2020.

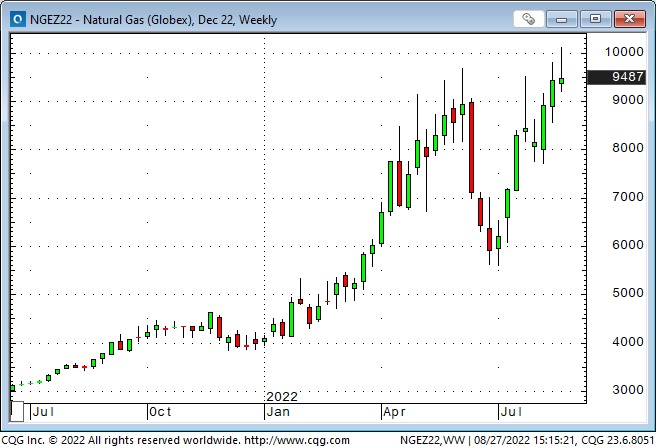

US Natgas prices are at a 14-year high after nearly doubling in the last two months. (Natgas is used to generate ~38% of electricity in the USA and ~60% of home heating.)

Canada is producing record amounts of Natgas (more than domestic requirements). Still, with exports limited to the American market (no LNG export terminals!), domestic prices are ultra-low compared to other G20 countries.

Comparative Natgas prices from Oilprice.com : Holland $85, Japan $65, USA $9, Canada: $2.50.

High energy costs have consequences

The Euro currency is at 20-year lows against the US Dollar and is at All-Time Lows against the Swiss Franc. (The Swiss produce ~60 % of their electricity from 680 hydropower plants throughout the country and ~33% from nuclear reactors.)

Japan plans to restart more idled nuclear plants (closed following Fukushima in 2011.) Share prices for uranium “issues” jumped on this news Wednesday and stayed higher for the week despite the sharp sell-off in the broad market on Friday.

Soaring Natgas prices = pressure on other energy prices = more coal will be burned.

My short-term trading

I decided last weekend to take a full-on holiday this week. Friends and family were planning to visit, and I hadn’t taken any “time off” in at least two years. I also believed that my trading time horizon had become too short (I had become a day trader), and I thought a “vacation” would help me realign my trading time horizon with my preferred analysis time horizon (a few days to a few weeks.)

I slept in every day until nearly 6 am and took Barney for his morning walk during the first half hour of the S+P floor session. The only trade I made all week was to buy the T-Notes Friday morning, about two hours after Powell’s speech. (I deliberately stayed away from my screens for over an hour after his speech – to give the market time to “settle down” – and I felt I was too late (again!) to sell stocks. The T-Notes were still red on the day while the ultra and the long bond were green – so I bought the 10-year Notes thinking they would follow the long bond in assessing Powell’s speech as being “good” for bonds.)

I’ll admit to “buyer’s remorse” for not being short the S+P. The “M” top to the June-to-August bear market rally (with a lower 2nd high!) was just the sort of thing I had been looking for – but I didn’t pull the trigger!

I’ll try to get back to work next week, although I think the “real action” will start after Labor Day.

My good friend Martin Murenbeeld drove his motorcycle from Victoria to my place on Tuesday, and we solved a few of the world’s problems over a good BBQ dinner and (at least) one good bottle of wine! At the risk of misquoting Martin, I think he said that gold bulls would have to be patient until the Fed changes course (excluding another geopolitical shock.)

The gold share ETF, the GDX, got hit with the double whammy of a falling gold price and a falling stock market on Friday and registered its lowest weekly close since March 2020.

Like me, Martin doesn’t see inflation returning to the Fed’s 2% target anytime soon.

The Barney report

Barney and I timed the tides pretty well this week and hit the beach twice for an hour-long ball-fetching / swimming session. We also got in a couple of extra-long off-leash walks in the forest trails. During those walks, I can plod along at a steady pace while Barney races ahead, darts off into the forest and eventually catches up to me.

I love playing hide and seek with him during those off-leash walks as a way to train him not to stray too far away from me. I hide and whistle, then reward him with a treat when he finds me.

I had a little scare with Barney mid-week. My wife had gone to Vancouver to visit friends, and Barney and I were home alone. I BBQed some chicken legs, and Barney grabbed one off the patio table while I was in the house. I couldn’t catch him in the backyard and couldn’t find any trace of the chicken leg. I feared the worst and watched him (and his poops) like a hawk for the next four days, but he seemed normal – full of life and eating all his meals.

A request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you’d like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for >22 years. The August 27 podcast is available at: https://mikesmoneytalks.ca.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.