Powell says the time has come to begin cutting interest rates

Markets were expecting Powell to announce that it was “time” to start cutting rates (to lessen the downside risks to employment – the other leg of the Fed’s dual mandate), but the “unequivocally dovish” tone of his Jackson Hole announcement surprised markets.

Small caps soared on the news.

Nasdaq, not so much.

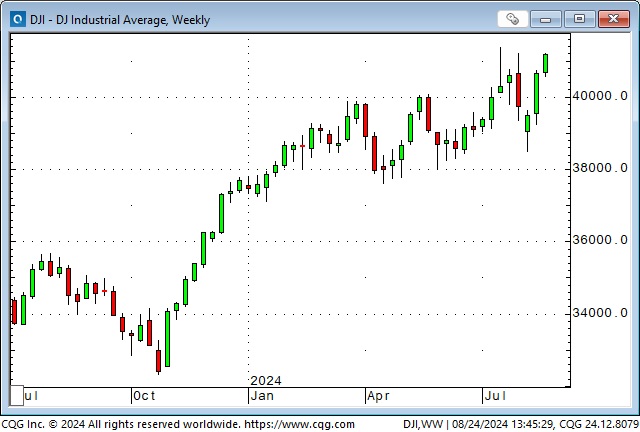

The DJIA’s weekly close was a new record high, up ~2,700 points (7%) from the lows of three weeks ago.

The Toronto Composite hit record highs, up ~8% from the August 6 lows.

Volatility in S&P futures options spiked on August 5 but has dropped sharply as the S&P rallied.

Short rates were little changed on Powell’s speech; they were already pricing 4X25 bps cuts by year-end, down from the ~6 cuts they briefly priced on August 5. The first Fed cut is expected to be 25 bps at the September 18 meeting. A “weak” employment report on September 6 will fan market expectations of a 50 bps cut.

The long bond took Powell’s announcement in stride.

But the USDX got whacked, closing at 13-month lows, down ~5% since the beginning of July.

The British Pound has rallied ~5% in the last three weeks, closing this week at a 30-month high against the USD.

The Canadian dollar came close to a 2-year low three weeks ago (when the stock market bottomed) but has since rallied more than two cents. The Commitment of Traders (COT) data as of August 20 shows some reduction of the massive net short speculative positioning in CAD futures built up since March. Friday’s strong rally was likely assisted by more short covering. (I have previously estimated the average price on the short speculative positions to be ~73 cents.) The weekly close was the highest in six months. The Bank of Canada is expected to cut rates again at the September 4 meeting. At the 2-year tenor, Canadian rates are ~70bps below US rates.

Gold closed higher on Friday but below Tuesday’s record high. The COT data (as of August 20, when gold closed at record highs) shows the largest net long speculative positioning in Comex gold futures in over four years. Gold ETF demand has also surged in the last two weeks. Gold is up ~$700 (~38%) from the 2023 lows immediately preceding the Hamas attack on Israel last October. (With gold above $2,500, the classic 400 oz. “good delivery bar” is worth more than $1 million.)

My thoughts

Stocks: The market was overdue for a correction in July, with the NAZ, super-charged by the MAG7, up ~50% from last October’s lows. The correction lasted four weeks (with the NAZ down ~17% top to bottom and the S&P down ~10%), and now the indices have bounced back to near-record highs. Retail did not panic during the sell-off.

Last year, I said the stock market would treat interest rate cuts as a “green light special” to buy stocks; over the past couple of months, I’ve changed my view to believe the market will see cuts as a sign of a slowing economy—and a possible recession—not bullish for stocks richly priced on expectations of higher earnings.

Corporate buybacks are running at ~$6 billion daily but will hit a pre-quarterly report blackout period beginning in mid-September. The last two weeks of September are historically the weakest period of the year for stocks.

NVDA earnings are scheduled for Wednesday, August 28. Over the last 18 months, NVDA has delivered “blockbuster” reports; another such report could take NAZ to new highs. A “weak” report could accelerate the rotation from tech to more defensive sectors.

The first week of September often sees “reality” come back with a bang after the August “silly season.” This year, it is only 60 days ahead of the American election.

My “intuition” (after sitting on a trading desk for nearly 50 years) is that “reality” probably means lower prices. That doesn’t mean I will be getting short Monday morning and covering around Christmas, but I will watch for “failure” signals that BTD is the wrong play. (For instance, NDVA has a decent report and the stock drops; the indices drop through support levels.)

Currencies have my attention, especially given my long-held belief that currency trends often go far beyond what seems to make sense and then turn on a dime and go the other way.

I’ve written several times over the past few weeks about July 11 being a Key Turn Date (when several different markets change direction on or around the same date). The July 11 CPI report was softer than expected. The NAZ made a new ATH and then began a steep four-week correction. The Yen hit ~35-year lows and then rallied 14% over the next five weeks.

I wonder why the USD has been so weak since early July. Is it due to expectations of lower American interest rates? Do FX markets expect the Fed to cut rates more aggressively than the ECB, the BoE, or the BoC?

Over the years, a LOT of capital has “come to America” for safety and opportunity. Is that money “going home?” (I could see some Japanese money going home.)

Trade deficits (and hamburger pricing) indicate that the USD is overvalued (especially against mercantilist Asian currencies), but that’s been the case for years. Has that suddenly started to matter? (Trump thinks so.)

Has the prospect of runaway American government deficits (regardless of who wins the election) and the subsequent decline in the purchasing power of the USD inspired FX traders to swap US dollars for the safety and security (sarcasm alert) offered by the Euro, the Pound or the CAD?

The British Pound has soared ~5% to a 30-month high in the last three weeks as the new Labour government introduced energy policies that will reduce the UK’s energy production (but make it more expensive and less reliable). See this week’s Doomberg article on UK energy policy.

I’m not a perennial USD bull. I’m a trader, but I’ll look for a signal that the recent weakness in USD is overdone.

I’m skeptical of gold above $2,500. I’ve traded gold for 50 years and know why it’s “going to the moon.” I’m just looking at positioning. Do you know anybody bullish on gold who isn’t already long? I’m not likely to short gold on Monday morning, but I’ll watch for signs of a correction, especially once September arrives. September is often a “turning point” in different markets.

My short-term trading

I’ve been trading the CAD from the long side since August 6, the day after the low. I covered my long position and went short on Thursday, thinking international traders did not know or understand the railroad strike/lockout story. I was stopped for a slight loss when the CAD followed all the other major currencies higher on Powell’s speech. After the market settled, I reshorted the CAD just below 74 cents. That is the only position I held into the weekend. If it keeps going higher, I’ll be stopped for another slight loss.

I traded the S&P from the short side this week and was nicely ahead when the market closed at 3-day lows on Thursday. I was stopped for a slight loss when the market rallied on Powell’s Friday speech.

I got short on Friday when the S&P did not rally above Thursday’s high following Powell’s speech. (A failure to rally on bullish news.) The market rallied enough late in the day to stop me out for another slight loss.

I have a familiar pattern of taking several slight losses around a potential turning point before I catch a good move. I also have a familiar pattern of taking several slight losses around a potential turning point and missing the good move when it finally happens! (As my long-time friend and commodity trader, Peter Appleby, says, “It’s never easy!“

I shorted gold on Monday when there was no follow-through from last Friday’s $50 rally to new highs. I was stopped for a slight loss overnight and missed Thursday’s $50 drop.

The Barney report

Barney and I are home alone again this week, with my wife visiting friends and family in Vancouver. We take three or four walks a day, and this week, Barney had his longest-ever (two-hour) car ride. I set him up in the back seat, limo-style, and he was a champ!

Listen to Victor talk about markets with Mike Campbell

On the Moneytalks show this morning, Mike and I discussed the impact of Powell’s “it’s time to start cutting interest rates” speech. We also discussed the shrinking “big short” in the Canadian Dollar, gold hitting new all-time highs, and how markets often “get serious” once September begins. You can listen to the entire show here. My friend Ryan Irvine is Mike’s feature guest. He has a fantastic multi-year track record of finding great small-cap stocks.

Oceanside Special Olympics

The local chapter of Special Olympics is holding its annual golf tournament on September 21 at the Pheasant Glen golf course in Qualicum to raise money for the 50 or so special needs athletes in the Oceanside area of Vancouver Island. This is the chapter’s one-and-only fundraising event of the year. My team will play (and donate) again this year, and Mike Campbell and Martin Murenbeeld (and their wives) will also participate.

Here’s a link with information about the event. Please consider playing, donating, or becoming a sponsor. You will never regret it! Thank you.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

.