The S&P closed at record highs last week, but fell to 1-month lows this week

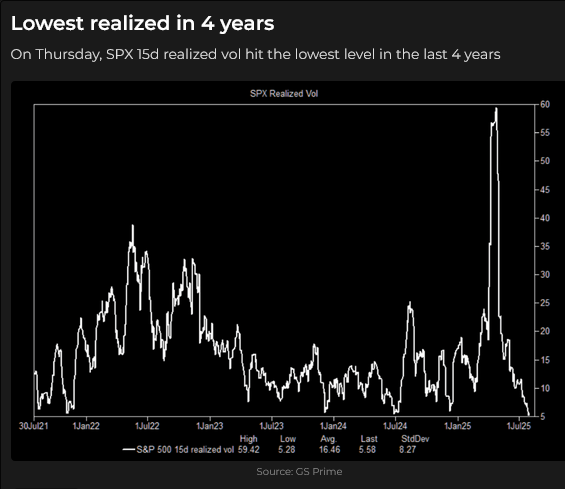

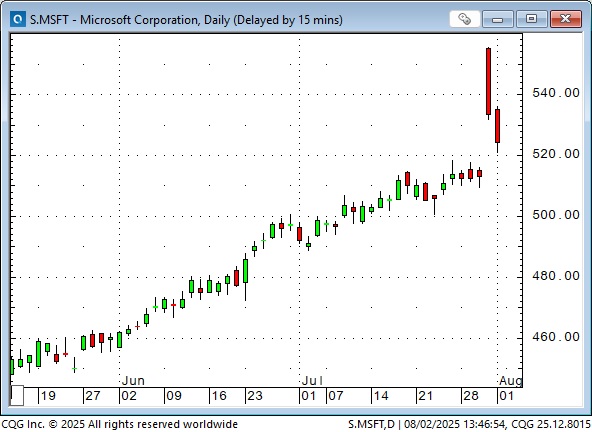

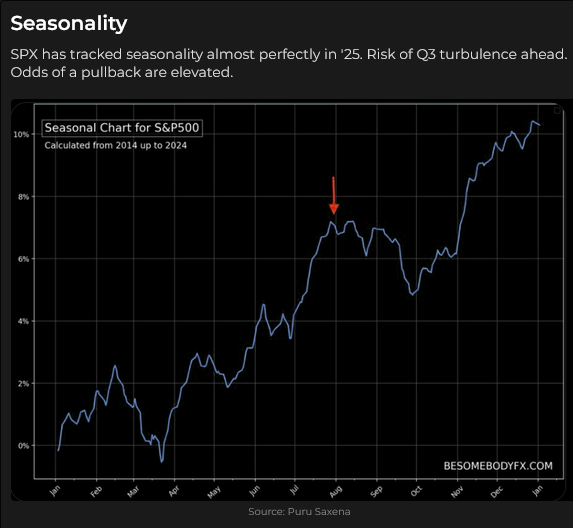

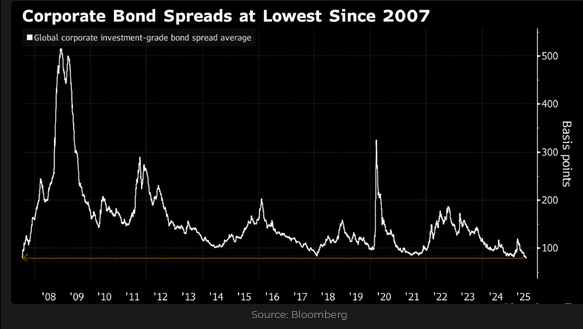

The September S&P futures closed at record highs last week, traded higher on Monday, fell off ~100 points to Wednesday’s lows, but gapped higher after the close on strong MSFT and META reports. The market opened higher on Thursday, but couldn’t sustain the gains and tumbled on Friday on tariff news and a soft employment report. (The leading US stock indices have risen in tandem with rising earnings expectations. If weaker job growth leads to lower earnings expectations (?), then the stock indices will weaken, especially if, as now, bullish sentiment/positioning is extreme.)

The weekly S&P chart is a classic Key Reversal Down: The market traded above last week’s highs and closed below last week’s lows.

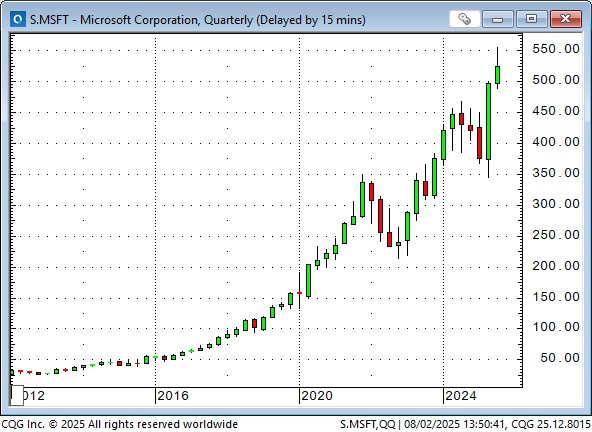

MSFT’s market cap was briefly above $4 trillion Thursday morning (it was ~$1 trillion at the lows in 2020).

MSFT is up more than 10X in the last ten years. MSFT YTD profits (~$280 billion) are greater than the combined YTD profits of Canada’s fifty largest companies. h/t Brent Donnelly.)

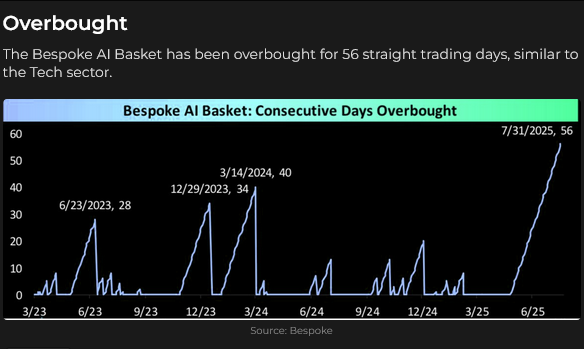

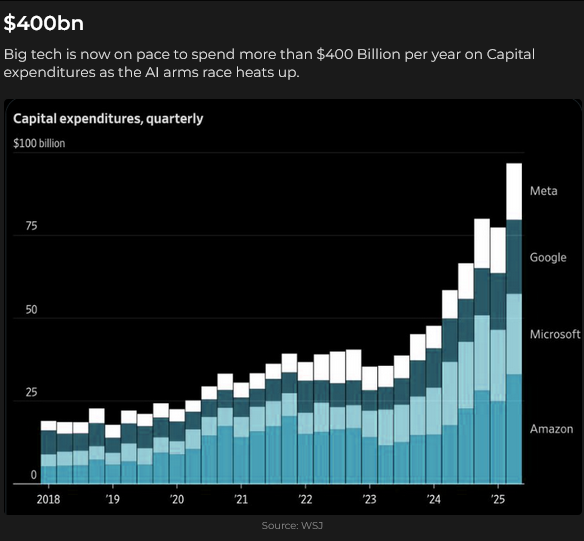

S&P earnings growth expectations are buoyed (in part) by ideas that AI will cause a productivity surge. Maybe (and that’s in the price), but perhaps not (and if the market’s infatuation with AI cools, the indices will weaken.) Data farms require a lot of electricity. Will it be available? Will it be rationed?

Interest rates

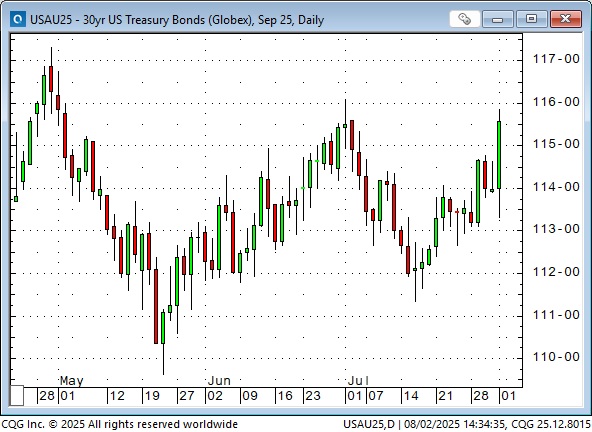

The FOMC voted to leave rates unchanged on Wednesday, although two members dissented. The much weaker-than-expected employment report on Friday (with downward revisions to May and June totalling ~258,000 jobs) caused short-term rate markets and bonds to rally sharply, increasing expectations that the Fed will cut in September and December.

Currencies

The US Dollar index surged ~2.5% from Sunday afternoon to Friday morning following a US/EU trade “deal” announced after Ursula von der Leyen met with President Trump at his golf course in Scotland on Sunday. Ursula was quoted as saying, “It was the best we could get.”

The USDX gave back about half of those gains following the weaker-than-expected jobs report on Friday morning.

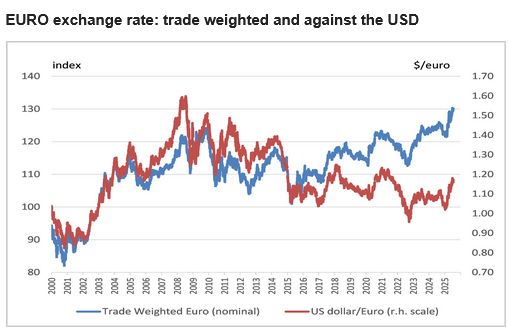

The surge in the USD when European trading began on Monday morning was the flipside of pronounced Euro weakness as markets saw the “deal” as great for the US, and terrible for Europe. French President Macron and German Chancellor Merz quickly said the “deal” was a disaster for their countries.

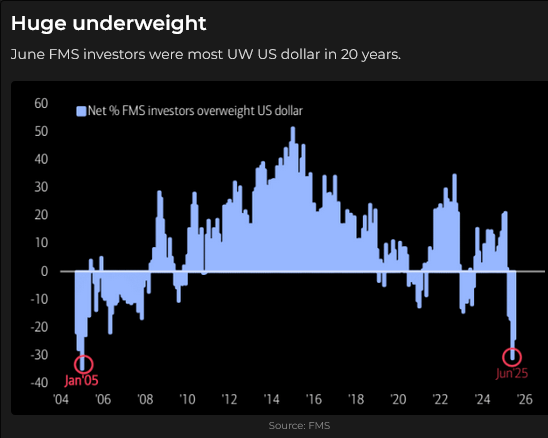

This week’s sharp decline in the Euro/rise in the USD was exacerbated by very bearish USD sentiment/positioning.

Last week, I noted that the trade-weighted Euro was at record highs, making it more difficult for Europeans (let alone the Swiss with their sky-high Franc) to export to Asia or compete with Asian countries in exporting to the US and the rest of the world, and they do not want to see their currencies go higher.

I also noted that markets were underestimating the risks not only from trade wars, but also from potential currency wars.

One of the reasons Asian countries have had substantial trade surpluses with the US is that their mercantilist policies have kept their currencies undervalued against the US Dollar (and also against the Euro). China’s domestic economy has been deflating (the yield on the Chinese 10-year is at a record low ~1.6%), and they have supercharged exports to breathe some life into the economy. If the global economy slows, other countries may try to ramp up their exports (or curtail imports) by devaluing their currencies – currency wars.

The Yen fell more than 50% against the USD from 2012 to 2024.

Other Asian countries have devalued their currencies to compete with Japan. The Indian Rupee has declined by ~40% since 2012, reaching record lows against the USD.

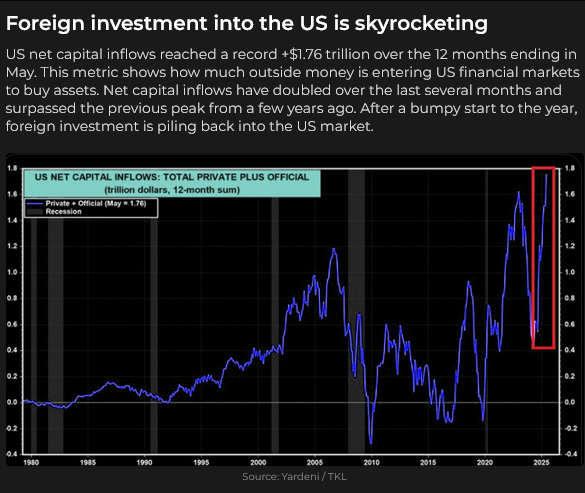

My favourite FX mantra for the past forty years is that capital flows to the USA for safety and opportunity.

Copper

For the past few years, I’ve been puzzled about copper. What, exactly, are we trading when we trade copper? Are we trading pallets of red metal or some form of over-hypoticated Chinese financial instrument? Is the “electrification of everything” driving prices higher, or is the slowing Chinese economy, which previously accounted for half of global demand, weighing on prices?

On July 8, Trump announced 50% tariffs on copper imports, and front-month Comex copper futures soared to record highs near $6 per pound (blue ellipse). Comex prices went to record wides over LME prices.

On July 30, Trump announced there would be no tariffs on imports of refined copper, only on goods made of copper. Comex prices plummeted over $1.25 (22%) in a heartbeat. (Blue ellipse.)

I was astonished by Trump’s “about face” on copper imports. I assume some people were angry. It would seem that someone on his team realized there had been a significant “mistake” (gross incompetence?) in the July 8 announcement – the USA imports about half of the copper it uses, and with only two copper refineries in the country, could not possibly ramp up refined copper production to meet domestic demand, so why score an “own goal” by placing tariffs on refined copper imports? (The US exports copper concentrates from domestic mines and copper scrap to China, where the material is refined and returned to the US.)

The plot thickens. On July 28, two days before Trump declared there would be no tariffs on imports of refined copper, there was a sharp price break on the Comex. (blue ellipse.)

In one minute of trading, over 4,500 contracts of copper traded (each contract is for 25,000 pounds of copper), with prices dropping from ~$5.70 to ~$5.42. Within 15 minutes, prices bounced back near where they had been before the sharp break, and most traders probably assumed there had been a “fat-finger” mistake (for instance, someone wanted to sell forty-five contracts at the market but entered an order for 4,500 in error).

Another possibility is that someone either knew or guessed that there was going to be a reversal in the copper tariff policy, and they hit every available bid. Will we ever know what happened?

Tariffs

Getting back to Ursula von der Leyen and her plaintive, “It was the best we could do” comment after negotiating with Trump, here’s a (lightly edited) August 2, 2025, comment from an old friend, Hubert Marleau, the patriarch of the Palos team in Montreal: “America’s trading partners can ill afford not to do any business in America because it is the largest economy, the richest country and the biggest military power in the world…the US is the only (western) country that can offer a security blanket…western democracys are willing to put up with (American) demands in return for accessibility and protection.”

Firing the messenger

Trump wants Erika McEntarfer fired. She is/was the Commissioner of the Bureau of Labour Statistics and was appointed to her role by President Joe Biden. Trump claims she manipulated employment figures (Friday’s downward revisions to the May and June job totals). The President alleged that the data had been “RIGGED in order to make the Republicans, and ME, look bad”.

I assume that the President doesn’t know (or doesn’t care) that the BLS monthly revisions have been routinely negative for the last four years.

My short-term trading

On Sunday, when I saw the “trade deal” that had been negotiated between the US and the EU, I thought it was bearish for the Euro. Still, when the markets opened Sunday afternoon (my time), the Euro was a few ticks higher, and I thought I must have missed something, so I did not short the Euro.

The Euro fell sharply when European trading began Monday morning (midnight in my time zone – I was sleeping), and when I got to my desk at 5 am my time, the Euro was down ~70 ticks and I couldn’t sell it “in the hole.”

My most crucial risk management rule is, “What am I going to do if I’m wrong on this trade? At what price am I wrong?” That’s where I place my stop immediately after entering a market. If the stop is too far away from the current price, I don’t take the trade.

I watched the Euro fall ~350 points in three days without me being short. Rules are rules.

I shorted the S&P on Monday after it fell back from record highs and was stopped for a 30 tick loss when it made new highs Thursday after the MSFT and META quarterly reports Wednesday afternoon.

I reshorted the S&P on Thursday when it fell back from record highs and covered that position on Friday for a profit of 170 points. I think the market goes lower, but I was willing to take a good profit and wait for the BTD boys to give me an opportunity to resell the market at higher prices. I was flat into the weekend.

Quotes of the week – from Kevin Muir, the Macrotourist

The Barney report

Here’s my boy resting in the shade during one of our forest walks this week. It’s been hot, and as much as he loves to be outside and run on the trails, he’s wearing a fur coat in this weather. I weighed him yesterday: 73 pounds. Almost exactly what he weighed a year ago.

Listen to Mike Campbell and me discuss markets.

On this morning’s Moneytalks show, Mike and I discussed the weak employment report, Trump tariffs, the Fed meeting, copper, currencies and corporate earnings. You can listen to the show here. My spot with Mike starts around the 39-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.