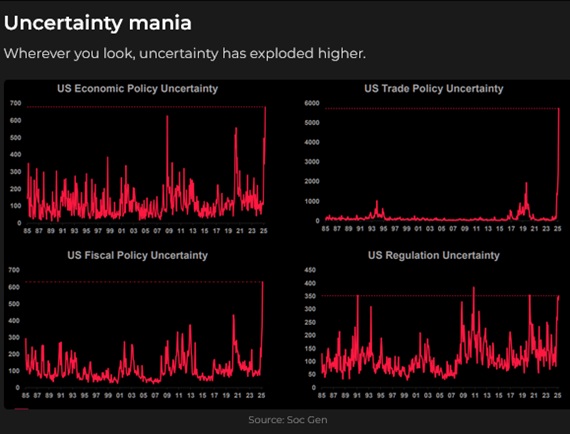

The Bull in the china shop = uncertainty, volatility & capital flight

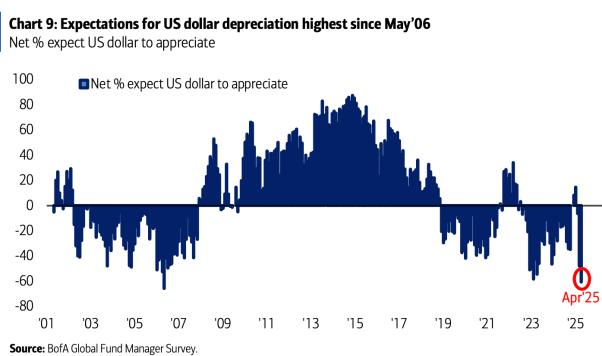

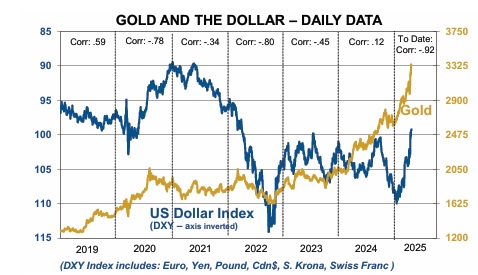

The US Dollar Index has fallen ~10% since Inauguration Day (blue ellipse) to the lowest level in nearly three years.

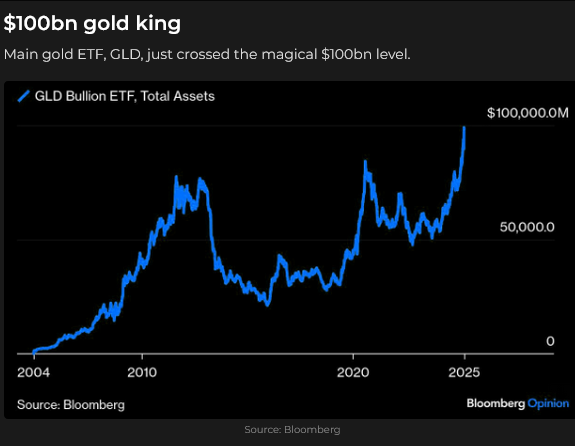

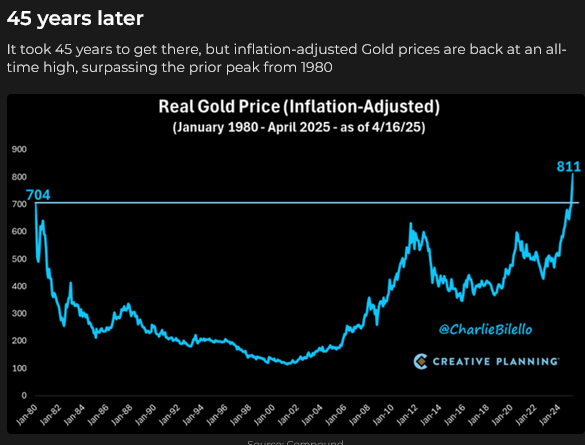

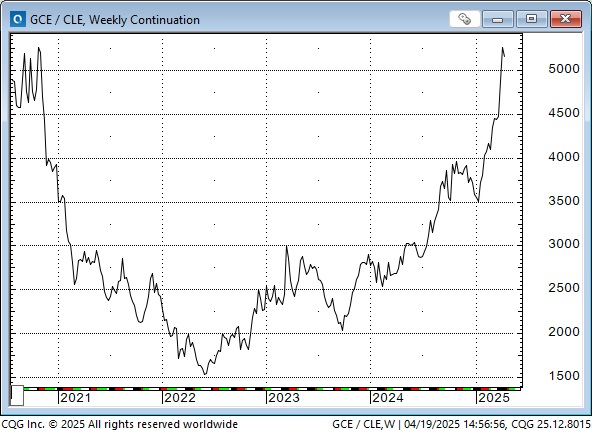

Gold has rallied ~$600 (~22%) since Inauguration Day to all-time highs.

The Gold Monitor: Gold is surging as the US Dollar falls..

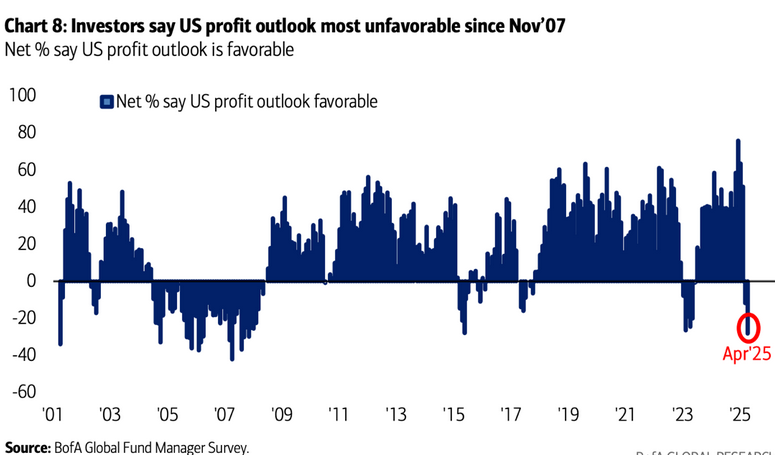

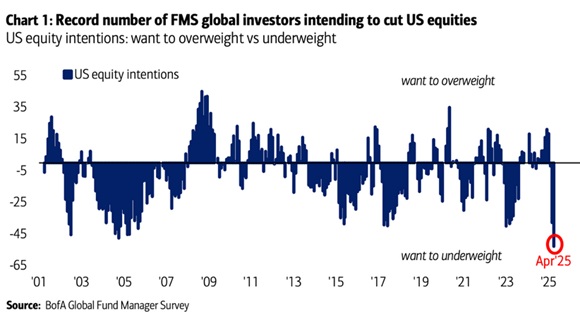

The S&P is down ~12% since Inauguration Day.

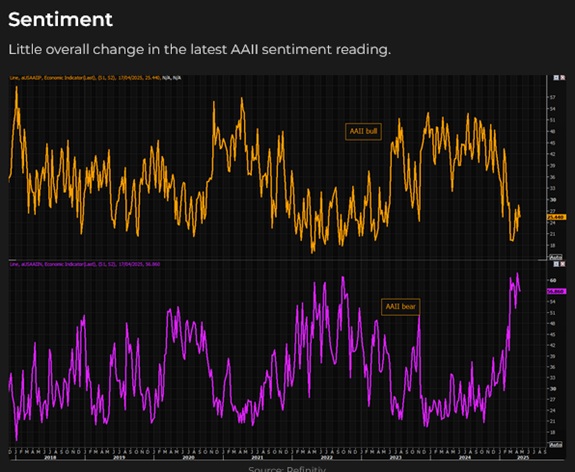

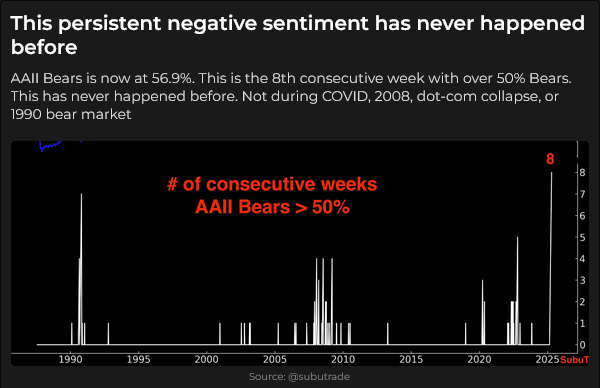

Sentiment: Bullish sentiment (gold colour) is near multi-year lows while bearish sentiment (purple colour) is near multi-year highs.)

Currencies

The Euro (the Anti-Dollar) traded at 26-month lows in early January but soared by more than 12% to 3-year highs as “American Exceptionalism” lost its allure and capital was repatriated to the Eurozone. In January, the net speculative positioning across all currency futures was the most USD bullish in over 10 years; it is now modestly net bearish.

The Japanese Yen hit 35-year lows in July 2024 (it was down ~50% from 2012 all-time highs, and speculators were massively short), but intervention by Japanese authorities sparked a monster short-covering rally into mid-September. The Yen gave back nearly all of that rally when the USD soared against all currencies from late September to early January as traders embraced the “new golden era” theme.

The Yen has rallied ~12% from early January lows, and net speculative positioning is the most bullish ever (in contrast to the most bearish ever in July 2024).

The Canadian Dollar fell to 20-year lows on February 3 (blue ellipse) when Trump announced 25% tariffs on Canada and Mexico. Later that day, when Trump paused the tariffs, the CAD had its best one-day rally in years.

Speculators built a massive short position against the CAD as it fell from September through January. However, they have reduced that position by more than 50% as the CAD (along with virtually all other currencies) rallied back from the Jan/Feb lows. Those speculators buying back their short positions helped the CAD rally, but I see the rally as a sign of USD weakness, not CAD strength.

The Swiss Franc rallied ~14% against the USD from the February 3 (blue ellipse) lows to last week’s highs. The Swiss Franc is now (effectively) at all-time highs against the USD and the Euro. Speculators have been net short the Swisse for the past year (very low Swiss interest rates made it a carry currency), but they have reduced their position by ~50% since January. (I suspect Swiss authorities are not happy with the Franc being the strongest currency in the world, but they understand it gets bid when capital markets are stressed.)

Gold

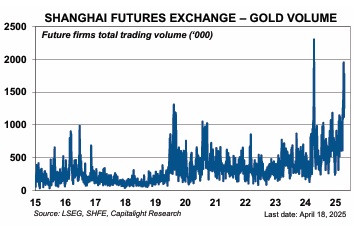

Comex gold futures hit all-time highs this week, but the NY market is only “tagging along” with developments elsewhere, particularly in China. Since early February, Comex gold volumes have been unremarkable, open interest has declined by ~16%, net long speculative positioning has fallen by ~30%, and gold has risen by ~$500. The “driving force” behind the gold rally is Shanghai, where volumes have exploded higher recently (like they did in February to May 2024) and prices are at substantial premiums to London and New York.

Gold has surged to new highs against all major currencies and commodities. In June 2022, WTI crude oil was trading at ~$120 following the Russian invasion of Ukraine, and it took only ~15 barrels of WTI to buy one ounce of gold. It now takes ~55 barrels.

Bonds

The US bond market rallied from early January to early April as the US stock market and the USD fell, but then last week, it broke hard amid rumours of heavy foreign selling, disasters in the “basis trade,” and other concerns. It felt like a “Sell it all, today” moment with US stocks, US bonds and the US dollar all down hard.

That’s no way to run a country

The markets steadied at the end of last week and into this holiday-shortened week, but the existential questions remain: “Is this the BIG turning point? Is this the global reset? Are we witnessing “the world” losing confidence in the USA, and if so, what does that mean in terms of “reserve currency,” “global policeman,” and “the world order?” And then there’s the truly existential question, “What will Trump do next, and how will the markets react?”

I don’t know the answers to those questions, but the markets seem to have priced in a lot of “bad” news. However, if Trump tries to “fire” Powell, that will be more than just a “paradigm shift,” and the risk of that happening is already discouraging some (many?) people from owning US stocks, US bonds and US Dollars.

For instance, I think gold has run too far and fast, but it would likely explode higher if Trump tried to fire Powell. Heavy foreign and domestic selling would cause US stocks and bonds to tumble. Instead of hoping Trump doesn’t “step over the line,” the markets would love to see a statement of respect for the Fed and Chairman Powell. But what are the chances of that?

My short-term trading

I started this week short the CAD, the Swiss, and US bond puts. I established those positions last week, thinking markets had “overreacted” by selling the USD and US bonds too hard.

I was stopped Sunday night on my short CAD as it rallied above Friday’s highs. I shorted it again when it fell back and was ~40 ticks ahead by Tuesday’s lows. However, it rallied on Wednesday and Thursday, and I was stopped for a 20-tick loss.

I added to my short Swiss trade and held that into the long weekend.

I sold 107 (~25 delta) bond puts for 55 ticks on Friday, April 11, when the June futures were ~112. (VOL was extremely high.) I covered the trade for 2 ticks on Wednesday with the futures ~115. The options expire on April 25, but rather than hold the short puts until expiry, I covered a week early. My thinking was that the most additional profit I could make was 2 ticks, which was not worth the risk of holding the position for another week.

I shorted the Yen twice this week and was stopped for slight losses both times. I see the massive speculative long Yen position and look for a place to get short. I should have been more patient and waited for a better signal to get short (a news failure, for instance).

I bought the S&P on Wednesday when it bounced back after testing 5350 support a few times, but it rolled over, and I was stopped for a slight loss when support didn’t hold. (I was happy to be out; the S&P fell another 100 points to Wednesday’s lows.)

Despite the nice gain on the short bond puts, the losses on my other trades resulted in a slight P&L loss for the week. The only trade I held into the weekend was the short Swiss.

The Barney report

Barney will be four years old in September and is “mellowing” a bit with age. That means he will (usually) “sit,” “wait,” and “come” when I ask him. I count that as training progress. Here he is “sitting” on the abandoned railroad track when we took our midday walk today. What a good boy!

Listen to Mike Campbell and me discussing markets

Mike and I discussed the currency markets on today’s Moneytalks podcast. This week, his featured guest was Rick Rule, a very perceptive and successful veteran investor. You can listen to the podcast here.

Listen to Jim Goddard and me discuss markets

I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show today. We discussed my macro view and then drilled down into the gold, currency, stock, bond and energy markets before wrapping up with my trading approach to volatile markets. You can listen to the entire show here, starting with my longtime friend and excellent technical analyst, Ross Clark. Another longtime friend and excellent energy market analyst, Joseph Schachter, is also on the show.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.