Fear trumps greed, but volatility is mean-reverting

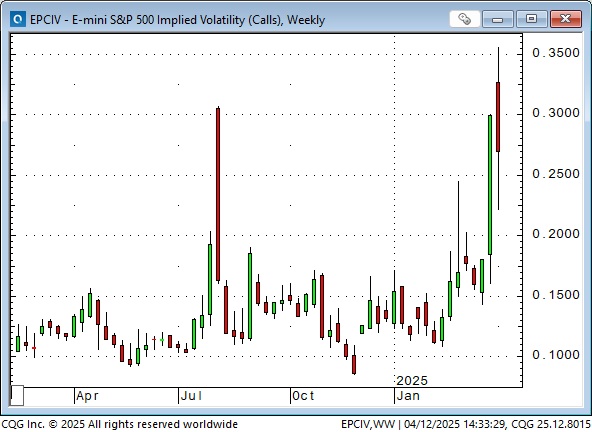

The cash S&P hit 15-month lows on Monday, down ~21% from February’s all-time highs. It then rallied ~13% to Wednesday’s highs as Trump paused tariffs on most countries other than China, where he dramatically increased tariffs.

Last week’s big drop and this week’s big gain were among the most dramatic S&P moves we’ve seen in years.

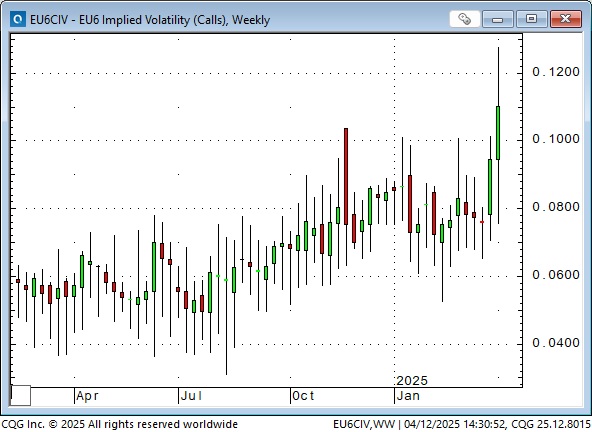

The US Dollar Index has dropped ~10% from January’s high to 3-year lows, while the Euro rose to 3-year highs.

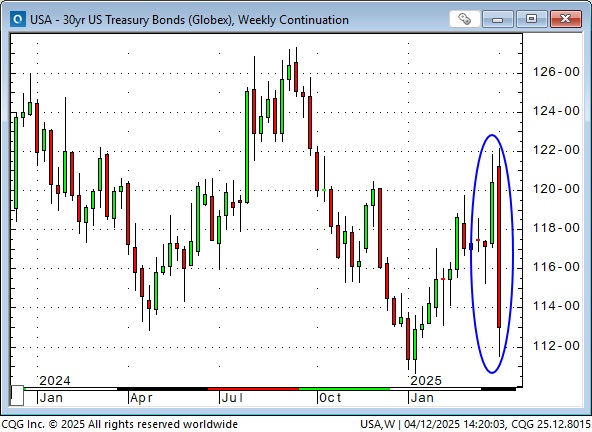

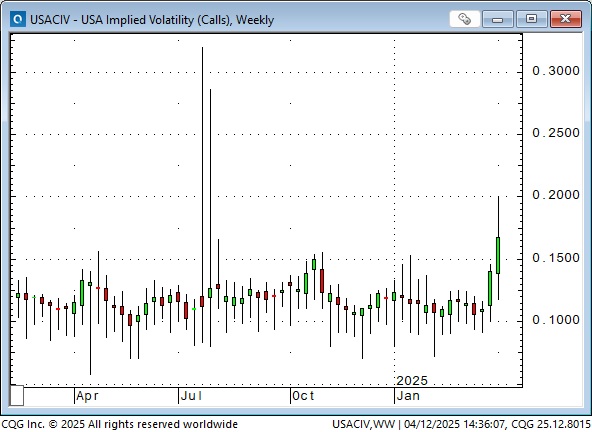

The US long bond fell hard this week.

When the US stock market, the US Dollar, and the US bond market fall simultaneously, you know the market is under severe stress.

Gold hitting all-time highs, up nearly $300 from this week’s lows, confirms that markets are stressed.

NYMEX WTI tumbled from ~$72 highs last week to ~$55 lows this week, a 4-year low.

Volatility metrics reflect the stress. Euro VOL traded this week at 3X last year’s lows.

S&P VOL traded this week at >3X last year’s lows.

Bond VOL traded this week at 3X last year’s lows.

Gold volatility spiked this week.

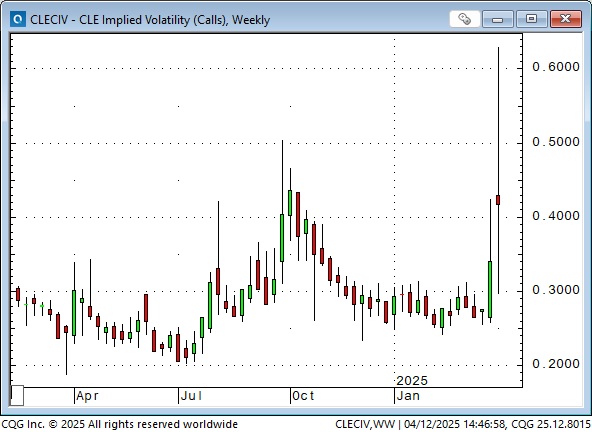

WTI VOL this week was astonishing.

These VOL charts are rudimentary; I only use them to illustrate how dramatically VOL exploded this week. (I looked at shorting short-dated options in stocks, bonds, FX, and WTI this week, and VOL levels were well above what you see on these charts.)

I was looking at shorting short-dated options because fear creates wild price swings, which increases VOL, which increases option prices. Volatility goes up as liquidity goes down. If fear or “uncertainty” peaked and began to dissipate, option premiums would likely collapse, especially for short-dated out-of-the-money options.

When I woke up early on Friday morning, the first thing I looked at was the bond market. It had fallen hard all week, even as the stock market steadied on Trump’s tariff pause. I worried that if bonds kept tumbling, it would mean that the “stress” in markets had morphed from worrying about tariffs to worrying about the credibility of American capital markets. (The German bond market, for instance, was not under pressure.)

Bond futures were down, but not dramatically, and later in the day, after watching price action in stocks, FX, and bonds, I made some trades based on the idea that fear had peaked, at least in the short term.

The credibility of American capital markets

Is the “exorbitant privilege” resulting from American exceptionalism over? Is the capital flow that used to come to America for safety and opportunity in the process of being repatriated? Is the worrying about the credibility of American capital markets signalling a secular shift, or is this just another example of people imagining “the worst” when markets are stressed?

My answer to that question depends on your time frame. I can imagine that America’s relationships with the rest of the world are undergoing a fundamental change (and the rest of the world may be realizing that more quickly than Americans are), but I don’t trade on that time frame. Financial markets are interconnected, but correlations change, and I’m looking to fade deviations from the mean. I think the “hysteria” is overdone. I’m trading accordingly, and (as always) I’m prepared to be wrong.

My short-term trading

I held no positions at the start of this week. I bought the S&P Sunday evening and was stopped for a 70-point loss overnight. I bought the S&P again Monday morning and sold it for a 260-point gain when the market surged on reports that Trump would pause the tariffs. (The White House denied those reports, and the market tumbled.)

I shorted the S&P on Tuesday as it fell away from overnight highs and covered the trade for a gain of 110 points later in the day.

I bought the S&P on Wednesday and was stopped for a 20-point loss just seconds before the market exploded for a 400+ point gain on reports that Trump had changed his mind and would pause tariffs.

I bought and sold the S&P three times later on Wednesday, resulting in a slight net loss.

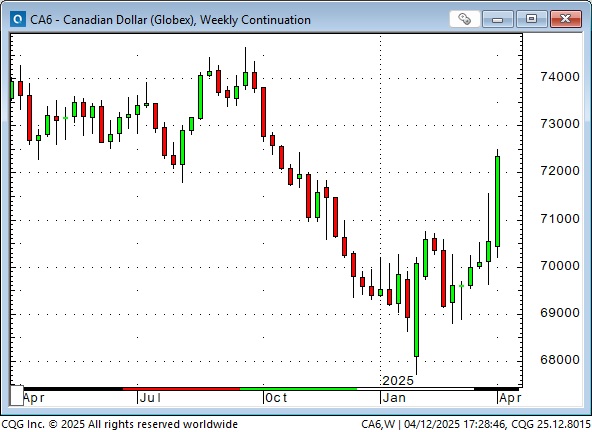

I shorted the Canadian dollar on Friday as it hit 6-month highs after rallying over two cents from Wednesday’s lows. I thought the CAD was being swept higher with other currencies as the market dumped the USD.

I also shorted the Swiss Franc after it skyrocketed to all-time highs against the USD and the Euro. I have stops in the CAD and the Swiss if they take out Friday’s highs.

I shorted 25 delta short-dated puts on the 30-year bond on Friday, with the June future near 112. VOL was ~30%.

I held my short CAD, Swiss, and bond option trades into the weekend. Each trade represents my idea that panic peaked on Friday in the currency and credit markets.

Thoughts on trading volatile markets

Rule #1: Protect your capital, both your P+L and mental capital. You don’t have to trade. If you trade, trade small. Wait for a good location before entering the market. Don’t chase. Trade to make money, not to be right. Have a plan for being wrong—use stops. Correlations work until they don’t. Failed correlations, especially relative-value correlations (for instance, gold relative to silver), can be a risk management nightmare.

Quote of the Week

“The bond market’s going good. It had a little moment, but I solved that problem very quickly.” President Trump, April 11

The Barney report

Barney knows I have a bowl of dog biscuits on my desk, and he usually paws me when he wants one. Sometimes, that works. But yesterday, he tried a new technique—giving me “the eye” and then looking at the bowl. That worked!

It’s Masters week. Here’s Barney watching the action with my wife on Saturday – moving day.

The Masters

I’m writing the Notes in my office upstairs while my wife and Barney watch the Masters downstairs. I’m astonished at the crowd noise. It sounds like a bunch of drunks at a hockey game. I remember when “the patrons” at Augusta National would clap politely when a player hit a good shot. Is The Game going the way of the Waste Management Open?

April 12 Moneytalks podcast

I hosted the Moneytalks podcast again this week while Mike Campbell, the regular host, was on a European vacation. My first guest was Eddie Markus, the founder and chief economist at ECR Research in the Netherlands. I’ve read ECR research for over twenty years and interviewed Eddie a few times several years ago. I wanted him on the show to get a European perspective on markets and the changing relationship with the USA. Eddie did not disappoint me! I also had Joseph Schachter, our “go-to” energy guy, on the show. Joseph told us the current sharp sell-off in the energy markets is a “table-pounding” buy for the oil and gas stocks he follows. Mike Levy, one of the regulars on the show, had a great discussion with me about current markets, and Ozzy gave his views on the Canadian real estate market (he’s a buyer). Grant Longhurst, the show’s producer, covered for Mike and provided an excellent shocking stat and quote of the week. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.