Traders are more interested in the market’s reaction to news than the news itself.

This week’s news flow felt like a tsunami after the dog days of summer, but for the markets I trade, the big news was the monetary and fiscal stimulus in China, the acceleration of Israeli attacks on Hezbollah, and the shift in Saudi energy policy.

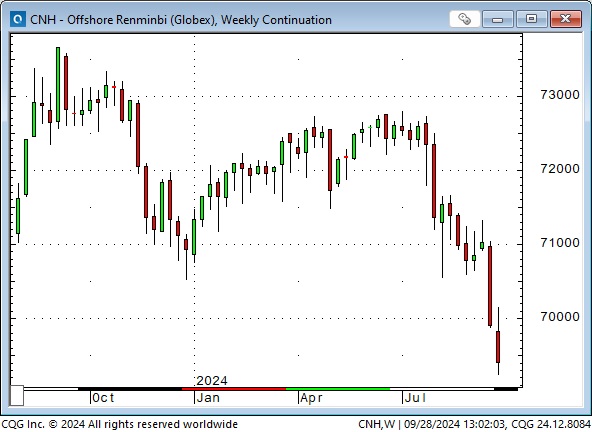

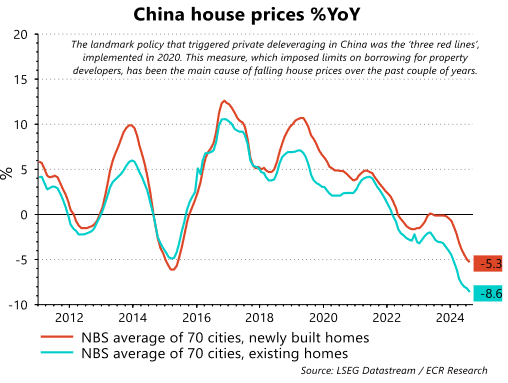

Last week, I wrote that the deflation story in China was more important than the Fed rate cut story. China was likely in a balance sheet recession as highly levered real estate assets collapsed in value even as the debts remained, causing investors to delever. (Think of Richard Koo’s description of Japan twenty years ago.)

The PBoC lowered interest rates this week, and the Chinese government announced aggressive fiscal stimulus. Chinese stock indices soared from depressed levels, registering their biggest weekly rally since 2008.

The Renminbi, which had been strengthening since July as the USD fell against most currencies, extended its rally to a 15-month high. (In this chart, lower prices mean that it takes fewer RMB to buy a Dollar.)

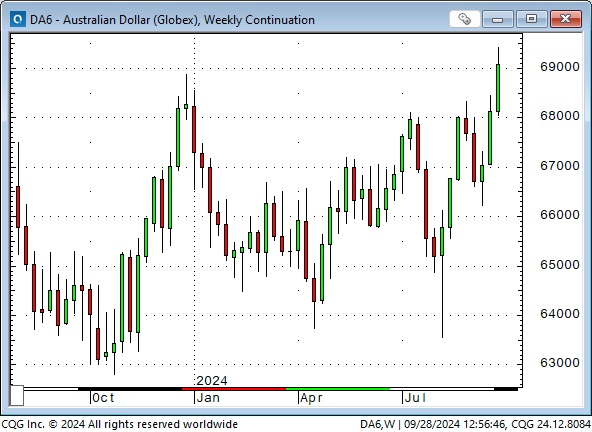

The prospect of a more “vibrant” China saw the Australian dollar extend its recent rally from August’s lows to close this week at a 20-month high.

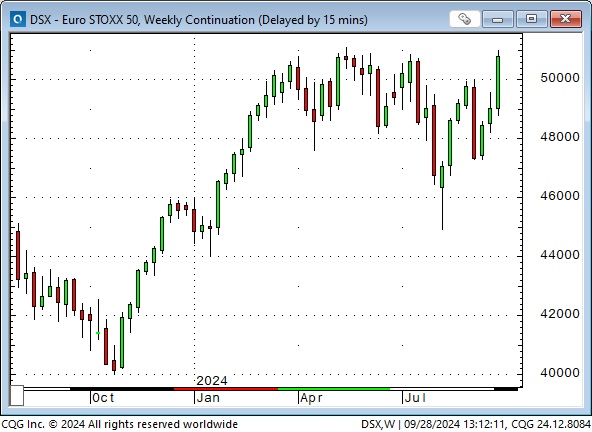

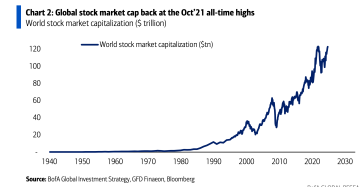

The rally in Chinese stocks buoyed benchmark stock indices worldwide, with many reaching new all-time highs.

This coming week is Golden Week in China, and banks, stock exchanges, and many businesses will be closed, so it will be challenging to know if this week’s enthusiasm in China will be sustained. I’m skeptical. Chinese people and corporations lost a lot of money (I’ve seen estimates at $10 trillion) by taking on too much leverage to buy real estate assets, which have tumbled in price. Do they want to “double down” and borrow more money at lower interest rates? In a balance sheet recession, the net answer is “No.”

Does it get any better?

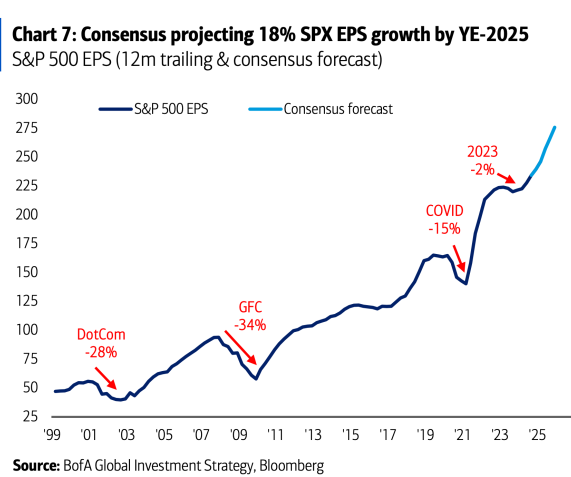

Following last week’s 50 bps Fed cut (and hints of more cuts to come), the S&P closed at new record highs on Friday. And why not? Even with buybacks diminished during the quarterly report season, and despite negative seasonality and election uncertainty, bullish enthusiasm prevailed as MSFT’s bid for a nuclear reactor to power a data center reinforced the “weight” of the burgeoning AI sector. Earnings estimates are “very bullish.”

Crude oil prices are near four-year lows, and central banks worldwide (X-Japan) are cutting rates. A senior Goldman Sachs trader declared (following the Chinese stimulus) that it was “the most bullish morning of the year” while also allowing that “there was a lot priced into the markets.”

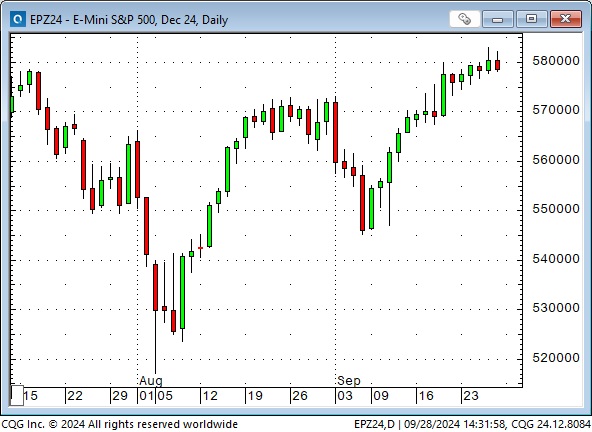

Was the Chinese stimulus news the cherry on top? The initial market reaction in China saw depressed stock indices rally hard, but the S&P, despite closing the week at new highs, closed lower on Friday.

The rally in global stock markets since 2009 has been massive. Market cap has increased from ~$30 trillion to ~$120 trillion.

Energy

The MSFT bid for a nuclear reactor to power a data center, and news that fourteen major banks and financial institutions expressed support to triple nuclear energy by 2050 boosted the uranium market this week.

Going the other way, Saudi Arabia’s decision this week to win back market share by increasing production contributed to WTI futures closing below $70 on Friday despite the escalating Israeli attacks on Hezbollah.

Are the Israeli attacks on Hezbollah increasing or decreasing geopolitical tensions?

People talk about the “risk premium” built into the crude oil price or how gold will rally on “geopolitical stress.” (Gold jumped ~$150 to all-time highs when Russia invaded Ukraine but gave all that and more back when the Fed began to raise interest rates.)

Gold rallied to new record highs this week but closed lower on Friday. If that seems counter-intuitive, given the intensity of the Israeli attacks on Hezbollah, consider that (as the senior Goldman trader noted) “there’s a lot already priced into the markets.”

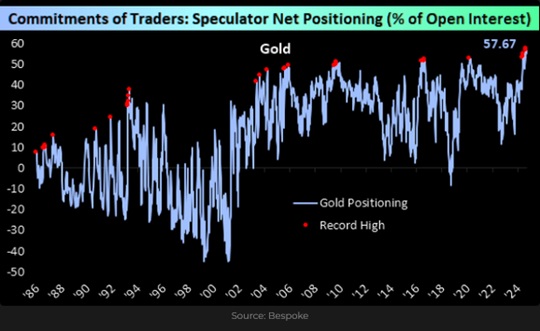

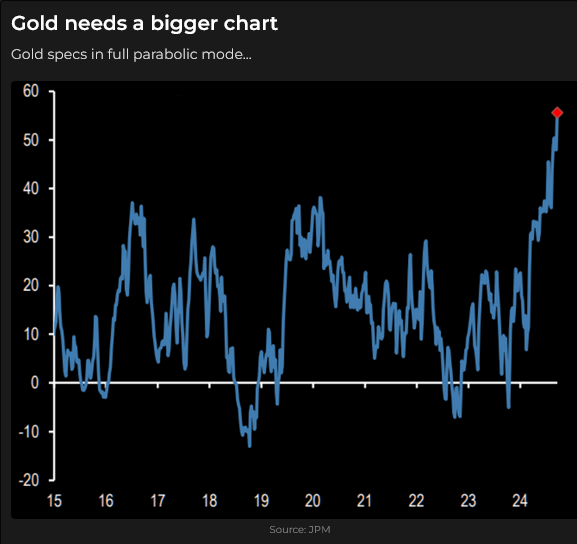

Gold has rallied ~$200 (8%) from the early September lows and $300 (14%) from the August lows. It is up ~$700 (35%) from the February lows and ~$900 (50%) from the October 2023 lows. The net long speculative positioning in gold futures (as of September 24) rose again this week and is the highest in over four years. Speculator’s net positioning as a percentage of open interest has never been higher. (Ross Norman, a London-based gold analyst, published an excellent piece this week arguing that derivatives, not traditional factors, are currently driving the gold rally.)

In terms of “how markets react to the news is more important than the news itself,” is it possible that gold closed lower on Friday because some traders believe that the Israeli attacks are demonstrating that Iran, Hezbollah, Hamas, Houthis, et al., are “no match” for Israel and that the risk of a wider mid-east conflict has therefore gone down, not up?

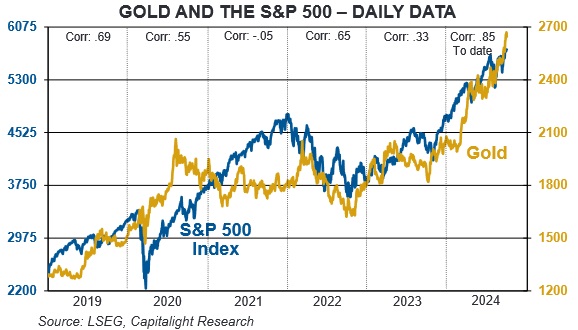

Gold and the S&P fell in 2022 as the Fed and other central banks raised interest rates, but since October 2022, they have both rallied ~65% to this week’s record highs. (This chart is courtesy of Martin Murenbeeld.)

Silver futures rallied to a 12-year high this week, up $5 (18%) in three weeks!

Copper rallied over 50 cents in the last three weeks (a derivative of the AI story and prospects of a looming grid build-out), with the Chinese stimulus news accelerating the rally this week.

Currencies

The US Dollar Index has fallen ~5% since the beginning of July (expectations of Fed cuts) and is near its lows of the past 30 months.

This week, the Swiss Franc hit record highs against the USD (outside of a few brief spikes.) It is at record highs against the Euro.

Quote of the week

“We are at the end of a cycle. The moral posturing of the woke agenda has collided with reality and no longer has credible solutions to offer to the actual problems of the world.” Javier Milei, President of Argentina, addressing the UN this week.

My short-term trading

I started this week short CAD and long T-Bond puts. Both positions had been established on September 12.

I covered the CAD for a slight loss on Monday when it traded above last week’s highs. I reshorted it on Thursday about 50 bps higher as stayed short into the weekend.

I covered the T-Bond puts on Monday for a decent profit.

I shorted the S&P a couple of times early this week and was stopped for tiny losses. I shorted it again on Thursday and held that trade into the weekend.

I shorted gold on Friday when it broke below the lows of Wednesday and Thursday. I held the trade into the weekend.

The short S&P and gold trades are counter-trend trades, so I’m trading small size.

On my radar

The US employment report is due on Friday, October 4. The Fed is now focused on employment, not inflation.

Several key US corporate quarterly reports will be released over the next three weeks. The market has high expectations.

The looming strike by dockworkers on the US East and Gulf coasts.

The Barney report

Summer is over, but Barney still needs to go outside at least three times a day—rain or shine! The boys are dressed for rain, and it’s raining!

Listen to Victor talk about markets while hosting the Moneytalks show this morning

Jeff Olin and I discussed how he uses the stock market to trade real estate. Ozzy told us why local real estate developers complain about excessive regulation and costs. Rob Levy and I talked about the wild action in financial markets, while Mike Campbell had a terrific opening comment, shocking stat, and quote of the week. Grant Longhurst unveiled our first-ever anti-goofy award. You can listen to the whole show here.

There will likely be no TD Notes next weekend – I’m off to Calgary to attend my nephew’s wedding!

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.