Interest rates rocket higher

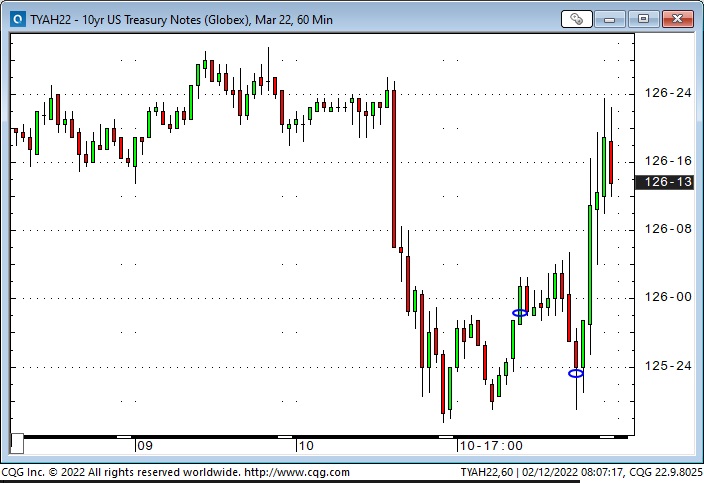

Interest rates have been climbing steadily since early December but rocketed higher this week on the one-two punch of surging CPI and a call from St. Louis Fed President Bullard for the Fed to “immediately” take aggressive hawkish action.

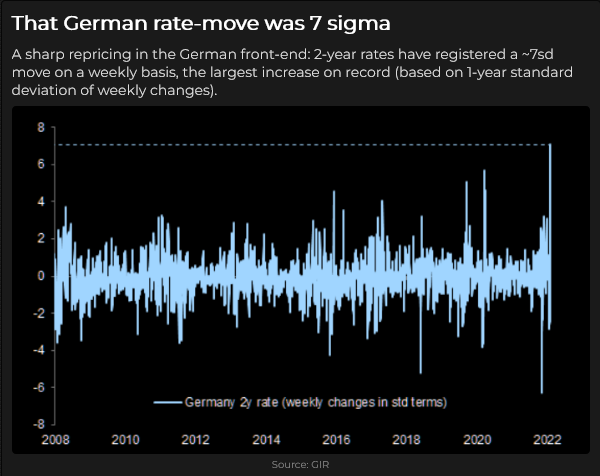

Last week I noted the dramatic “rate of change” in European interest rates when Christine Lagarde surprised the market by opening the door to the ECB raising rates this year. This week the “rate of change” in American short rates was equally dramatic. On Thursday, Eurodollar futures (first chart above – trade at a discount to par) suffered their largest daily drop in over ten years. Ten-year US Treasury yields traded above 2% for the first time in nearly three years.

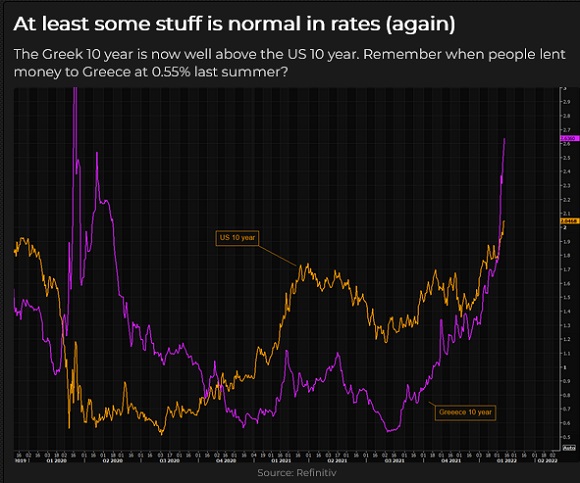

The 10-Year Greek yield rose from 0.55% last summer to 2.63% (Purple line below), while the 10-Year UST rallied from 1.2% to 2.05%. (Gold line.) When interest rates were historically low last summer, weaker credits could borrow “cheap” relative to quality credits. As interest rates have risen, the spreads have “gone out.” This is true for sovereign borrowers as well as corporate. (If you wondered why Greece could borrow at rates substantially below the rates the USA paid, take a bow in the direction of the magnificent ECB bond-buying program.)

(The “rate of change” – the delta – feeds on itself as people (option sellers, for instance) who were unprepared for the speed and magnitude of the recent move capitulate and liquidate their positions, adding weight to the chain of falling dominos.)

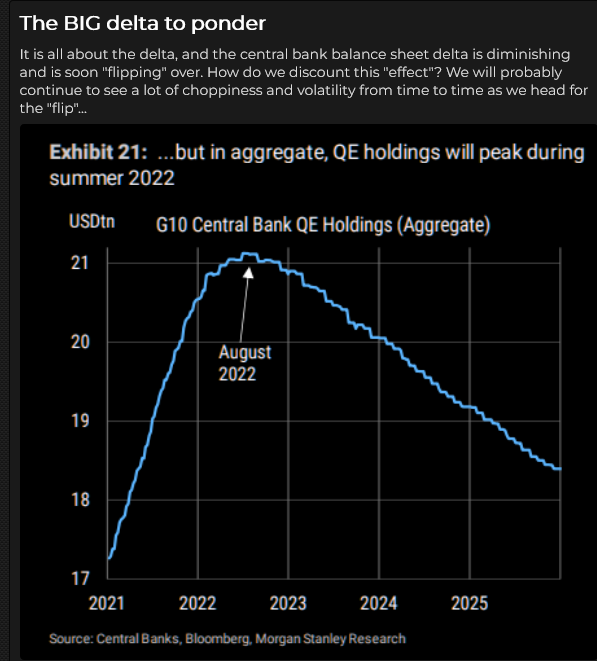

Another “rate of change” to consider is the Fed changing from buying bonds (QE) to selling bonds (QT). The chart below was created on Wednesday. As of Friday, the switch from QE to QT looks more like May than August. (Maybe earlier if Bullard has his way – unless, of course, “Ukraine.”)

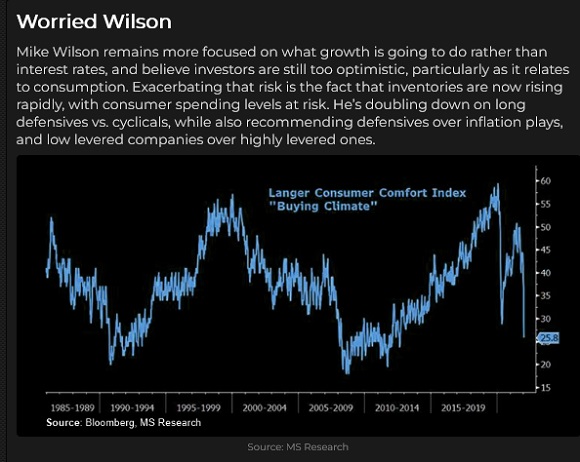

Consumer confidence was reported Friday at the lowest level in more than ten years – consumers are worried about inflation – and may reduce their buying of non-essential items/services.

So what is the Fed going to do?

They are still buying Billions worth of bonds and mortgages every week, and, despite all the talk, they still have interest rates nailed to the floor. The growth in the Fed’s balance sheet since March 2020 is highly correlated with rising stock indices – if they wind down QE and reverse to QT (as they have indicated they will do), will stocks tumble?

I recently suggested that the Democrats, sensing disaster in the mid-terms, may push the Fed to kill inflation, even if it means throwing the stock market under the bus. (Many voters don’t own stocks directly.)

Some analysts are forecasting that the Fed may be tightening into a recession, creating a stagflationary environment, and tightening monetary policy won’t diminish inflation caused by supply chain issues.

And then the Russia/Ukraine wild card problem suddenly got a lot worse

Late Friday morning, the “news” was that the White House expects the Russians to invade Ukraine next week and advised Americans in Ukraine to leave immediately. The US Dollar, Gold and crude oil soared, bonds bounced while stocks and other risk assets fell.

When gold and the US Dollar are rallying simultaneously, it is usually a sign that capital is seeking safety.

The Euro/Yen spread came in as Europe is at risk of Russia (in more ways than one), and the Yen is a go-to haven.

The Russian Ruble fell on the news.

WTI crude oil jumped >$4 on the “invasion” story, with front-month March nearly touching $95. Backwardation steepened with March 2023 at >$14 discount to Mar 2022.

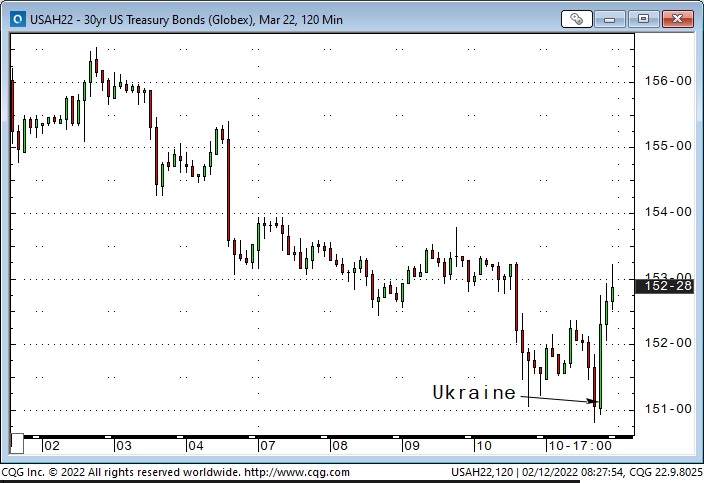

Before the Russian news hit, Treasury bonds were making new lows for the week (10-year yields hit a high of 2.06%). Bonds caught a “haven” and short-covering bid on the news.

My short term trading

I started this week with no position and stayed flat until Thursday. I was waiting for an opportunity to short the stock market, and it was rising Tuesday and Wednesday. The CPI report scheduled for early Thursday was another reason to wait.

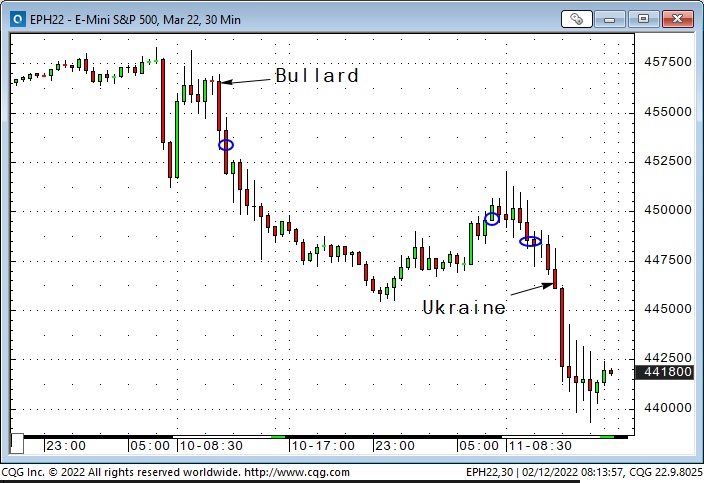

One of my favourite topping patterns is an “M” pattern where the right shoulder is lower than the left. The bounce from the January lows ran into resistance at the Fibro 0.618 level.

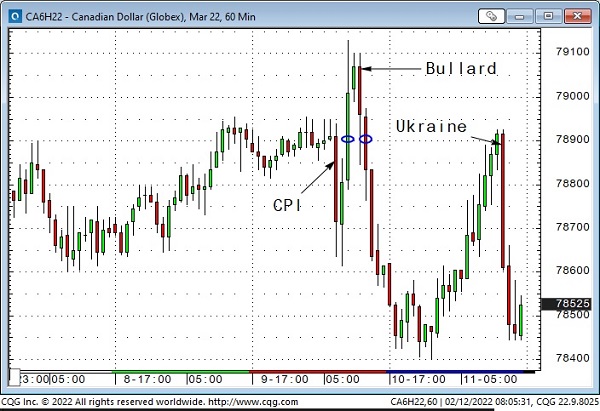

The Thursday CPI report was stronger than expected – interest rates lurched higher and kept rising throughout the day. Stock indices, currencies, gold and crude initially fell on the CPI report but then bounced back – until St. Louis Federal Reserve President Bullard opined that the Fed should “immediately” become aggressively hawkish.

I bought the Canadian Dollar as it rallied back from its CPI-induced dip. The stock market was rallying, crude oil was rallying, and the Euro was rallying – all good news for the CAD, and if it broke above the recent highs ~79 cents, it might soar.

The CAD got to 7910 and then reversed along with other markets on the Bullard comments. When I saw the “across the board” reaction to the Bullard news, I covered my long CAD position immediately at a breakeven.

After covering the CAD, I realized I had a great setup to short the S+P. It had bounced back to last week’s highs on Tuesday, dropped from around those highs on the CPI report, jumped back to the “Bullard” highs and started to fall from there. (Falling away from a lower high.) I got short and watched the market fall ~70 points into the overnight lows.

I covered my short S+P for a gain of ~30 points early Friday morning as the market rallied back ahead of the day session opening. I reinstated the position a couple of hours later when there was no follow-through to the opening range rally. The market then began to break down through technical levels and then plunged on the Russia/Ukraine news. With the market closing near the lows of the month, I decided to stay short into the weekend.

I bought T-Notes during the Thursday overnight session, thinking they were extraordinarily oversold and could bounce, considering the weakness in the stock market. The dramatic rise in short-term interest rates added to my view that the Fed could be tightening into an economic slowdown – yet another reason to buy bonds. My setup was buying the Notes after they bounced from a higher low, but I was stopped for a slight loss very early Friday morning – and missed the “Ukraine” bond rally on Friday.

My P+L on closed-out trades this week was essentially flat; I had unrealized gains on my short S+P of ~0.80%.

On my radar

I’ve thought that the American equity markets may have made a long-term top at the beginning of this year. They’ve had an incredible run from the 2009 lows, with a spectacular run since the 2020 lows, but it may be time for a significant correction – something more than 10 to 15%.

Thoughts on trading

Regular readers know that I believe it is essential to keep the time frame of your analysis in sync with the time frame of your trading/investing. I think this is especially important in terms of risk management – for instance, don’t buy something for a short term flip and then decide to keep it as a long term “hold” because it’s gone against you and you “know” it will be a winner if you “give it a little more time.”

I will sometimes “mix” my time frames to find good entry points. For instance, even though most of the trades I write about are short-term, I definitely have longer-term market opinions. For the past several months, I’ve thought that the multi-year rally in stocks was getting long in the tooth. (Essentially, I thought market psychology had got to the point where too many people thought it was easy to make money buying stocks.)

I have a “bias” that the long-term trend in stocks may have topped out (and I should look for opportunities to make money shorting stocks). Still, I know that “having a bias” is not a timing tool, so I will analyze short-term price action to find setups where I can get short – in sync with my longer-term view of market direction. (I only trade futures and options, so by “stocks,” I mean stock index futures.)

Technical traders would likely describe this technique as “trading in line with the trend.” Depending on their preferences, if a market is in a long-term uptrend and experiences a short-term correction, they might “buy the dip” or buy a breakout to new highs. Either way, they use short-term technical signals to buy a rising market.

Quotes from the notebook

“People have an amazing ability to arrive at a solution before truly understanding the problem.” Chris Blundell P.Eng. 2022

My Comment: Chris is a long-time friend, well-read and well-travelled, who has had great success as an entrepreneur in the Canadian oil patch. He used this quote in a recent email to me. His comment is painfully accurate, and wouldn’t the world be a better place if people put a lot of effort and compassion into understanding a problem before offering their solutions?

“You can always (always) find some indicator, somewhere, that will suggest something is a bubble. If you couldn’t, a legion of bloggers running lucrative doomsday-themed websites would instead be serving gimlets to bankers for tips, rather than lampooning them for click money.” Walt, The Real Heisenberg

My Comment: I’ve been a subscriber to the Heisenberg Report for a few years. It’s well-written, biting, and insightful, and I love black humour!

“The lust for yield has overwhelmed prudence.” Bob Hoye, 2017

My Comment: Bob has been a good friend for 40 years. He is a very well-informed market historian and, as you can see, very quotable! A few years ago, I introduced Bob at a conference as a man who knew a lot about the Dutch Tulip Bubble Mania because he had been there while it happened.

The Barney report

Barney and I were home alone for a couple of days this week when my wife went to Vancouver. He was reasonably patient with me in my office, and I rewarded him (tired him out) with long off-leash walks. He is now five months old and just north of 40 pounds.

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.