Stock indices trended lower all week to end the week right on their lows. Option Vol spiked higher

In late August, my primary trading view was that the summer’s complacent, pro-risk market sentiment was due for a correction. “Everybody” was a buyer. Stock index option Vol was at the rock-bottom lows of the past few years.

The DJIA closed this week ~760 points (~2%) below last Friday’s close. The S+P and DJIA futures registered five consecutive lower daily closes for the first time since February 2020.

The US Dollar rallied this week as sentiment turned risk-off

The US Dollar Index hit a 9-month high on August 20th as stock indices reversed up from a 3-day mini-correction. For the next two weeks, the USDX trended lower as stocks rallied. The negative correlation between stock indices and the USDX has been strong for the past couple of months – which means when the market is in a Pro-risk mood stocks rally and the USDX falls – and vice versa!

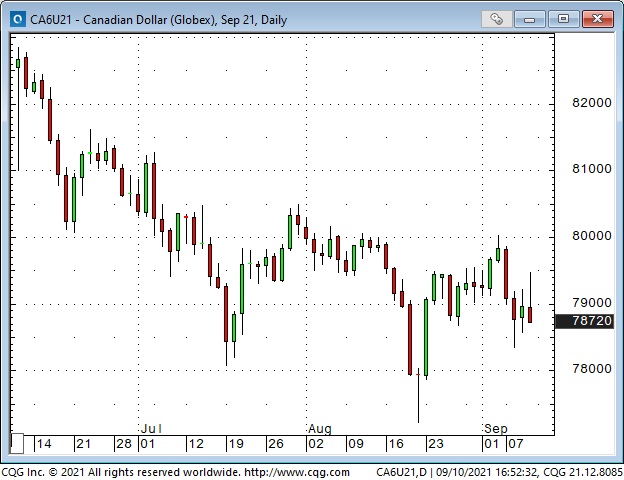

The Canadian Dollar has had a very tight negative correlation with the USDX since April.

Historically, the CAD is negatively correlated to the USDX, but the relationship has been especially tight since April. The CAD has also had a strong historically positive correlation with commodity and stock indices – which means that when the market is in a Pro-risk mood the CAD goes up, along with commodity and stock indices and the USDX goes down – and vice versa!

The CAD fell as stock indices fell early this week but rallied in anticipation of the Canadian employment report on Friday. The report was in line with bullish expectations, but the CAD fell back as stock indices tumbled and both markets ended the day on their lows.

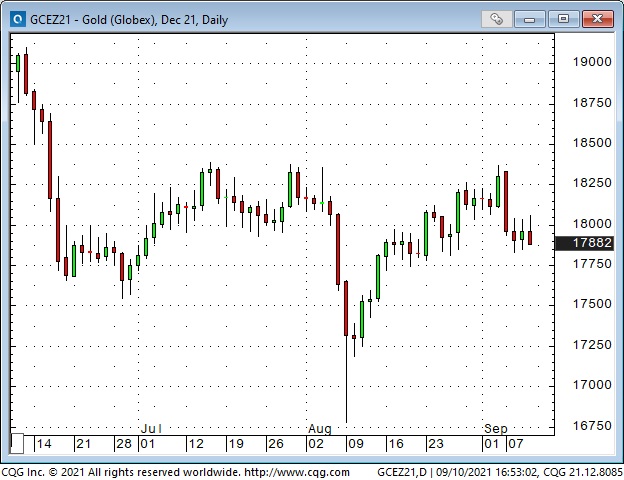

Gold Traded lower this week as the USD was bid

Copper had its biggest one-day jump in months

Copper seems to be influenced from time to time by the swings in equity market risk sentiment, and it did weaken early this week, but it surged higher on Friday even as the stock indices made new lows for the week. Perhaps the soaring price of aluminum (following the coup in bauxite-rich Guinea) contributed to copper’s gains.

This week’s close on WTI crude oil was the best since late July

WTI has chopped back and forth mostly between $68 and $70 for the past ten days after rallying more than $8 from the August lows. US production cuts and refinery shutdowns due to hurricane IDA have been a factor, as has anticipation of Covid’s impact on consumption.

Nat Gas and Uranium continued their powerful rally.

My short-term trading

I ended last week short Dow futures. I was stopped out of the trade, for a small loss, during the Sunday overnight session, but re-shorted the market during the holiday Monday session. I covered that trade for about a 200 point gain on Tuesday. I got short again Thursday and picked up another 200 or so points.

I was happy to not be short during the Thursday overnight session as the market rallied over 200 points on Biden’s push for more vaccinations and his telephone conversation with Xi.

My “Big Miss” for the week was not getting short again on Friday when the market jumped higher on the cash opening but almost immediately reversed course and the DJIA fell ~500 points to register its lowest close in six weeks.

In keeping with my observation that trading is not a game of perfect, I bought equity index futures a couple of times during the week looking for a bounce. The net result of those trades was a small loss.

My net P+L gain on the week (this is always realized gains or losses, and does not include unrealized gains or losses) was ~1.5%. In hindsight, I could have done better just sitting with the short trade I put on Monday – but, I didn’t. I’m flat at the end of the week, but looking forward to next week!

As noted in the “On my radar” section of last week’s notes, I was looking for a correction once we got past Labor Day – but the correction came at me faster than I expected and even though I had a good week I feel I should have done better. Welcome to trading!

On my radar

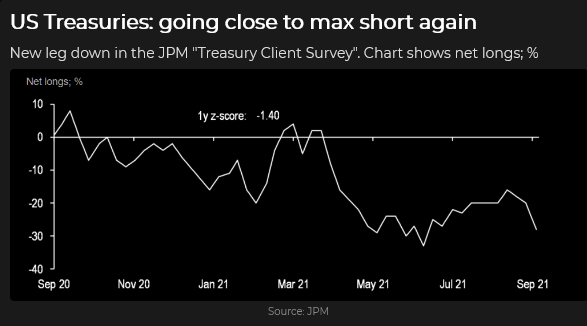

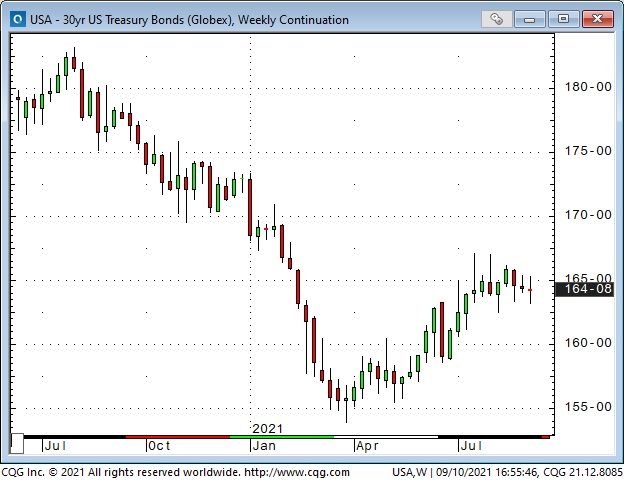

I’ve been looking at the bond market. The chart below shows that clients of JPM are short bonds. Maybe they think interest rates and/or inflation are going up, maybe they think the economy is going to heat up. Maybe they got short bonds last year and are still holding the trade. But the chart shows that they’ve increased their short position over the last five months, so those trades are probably underwater. If the stock market falls will the bond market rise? If the bond market rises will the people who are short bonds start buying back their positions? Should I be buying bonds?

Apple introduces their new phone and watch next week. AAPL hit new ATHs this week and also had its biggest down week since February. If the new product debut is not well received that could be a problem for the market.

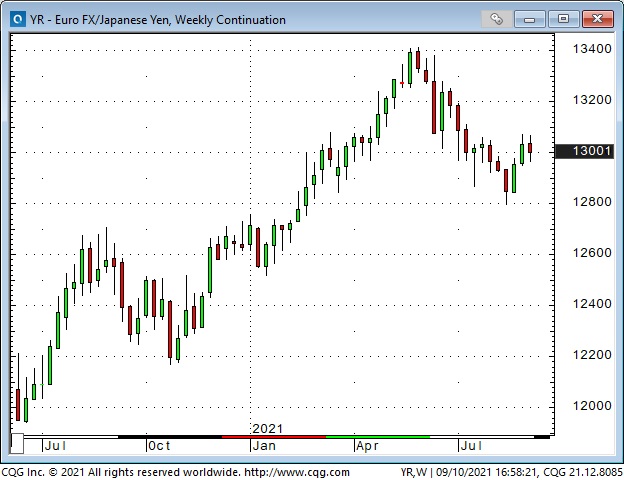

The Yen has a very large spec net short position that was mostly put on Between January and April when the Yen fell against the USD. Since then the Yen has gone sideways. If the pro-risk market sentiment that has taken stocks to All-Time Highs starts to wobble will the Yen get a “safe haven” bid? Will those Yen shorts become buyers? Is the best trade to buy Yen against the USD or against the Euro?

In this chart, a rising market means the Euro is going up Vs. the Yen.

The S+P is down ~90 points (2%) from last week’s All-Time Highs. So far, the “dip” is less than what we saw in each of June, July and August. (The last time the S+P fell by more than 10% was September 2020.) I think there is more to go, maybe much more, but that brings up the subject of “time horizon.”

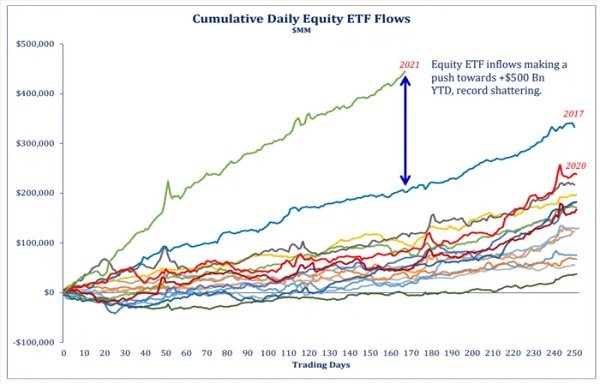

This chart, created by Strategas Research Partners, was in the FT this week. In a nutshell, it shows that the flow of capital into the stock market YTD has been MUCH bigger than in any recent years. One of the reasons given for why all of this money is flowing into equities is because of the persistence of the rally, up over 100% from the March 2020 lows, with barely any pullback.

When I look at this chart I think of Bob Farrell’s 10 Rules – especially Rule #5: The public buys the most at the top and the least at the bottom.

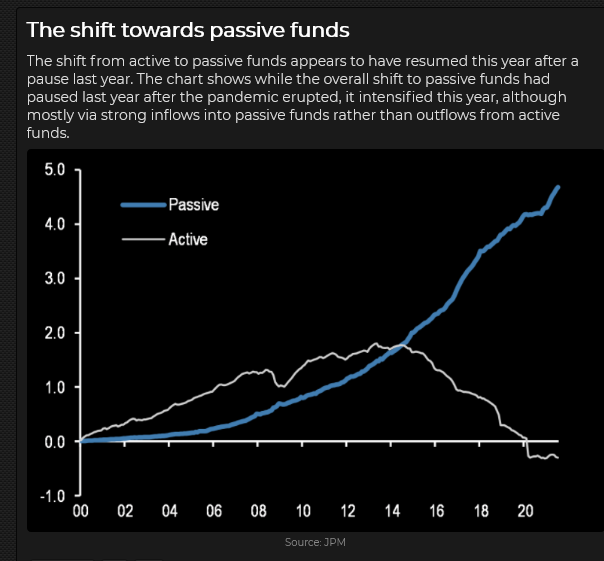

This next chart shows that most of the retail money flowing into the stock market is passive – which means that people make regular monthly purchases, regardless of price, because they believe that, over time, the market only goes up. Passive money buys the indices, which, these days, are heavily weighted by a handful of Big Tech stocks.

I think passive investors will be “slow” to bail out of the market if it goes down. They won’t even notice a 5 or 10% decline. They will just keep buying. I wonder if the stock market goes down for six consecutive months if they will start selling. I don’t know.

So, getting back to “time horizon,” it’s possible that we’ve seen the high for the year. Short-term speculators will look for opportunities to get short. Longer-term investors (especially those with a long-only mandate) may get more defensive, sell some stocks to buy other stocks. Passive investors will just keep buying the indices. The financial market commentariat will find “reasons” why the market is weaker.

Thoughts on trading

I know I could be/should be a better golfer than I am. I feel the same way about trading, even though I know in my heart-of-hearts that trading, just like golf, is not a game of perfect.

One of my core beliefs about trading is that you have to find a way to trade that suits you. That probably means a lot of years of trial and error, but that’s how it goes. I know I will never be a “check-list” trader; a guy who has a list of conditions that a trade must meet before he pulls the trigger. I’m intuitive. I’m more like a poet than an engineer. But I also have a healthy respect for risk. I will probably always trade “too small” because I don’t want to get hit with a devastating loss. Some guys swing for the fences, I just try to keep getting on base.

I’ve noticed that when I get on a winning streak that my time horizon gets shorter. If I was trading week-to-week swings I start looking to take advantage of intra-day swings. That usually ends with a flurry of small not-well-thought-out trades – that result in net losses!

I read about retail buying a lot of short-dated options – to gain extra leverage. I almost always look at buying options as a way to reduce, not increase leverage or risk. I’m not comfortable when I’m naked short premium because I imagine I’m taking a big risk to earn a small premium. (I know some folks like to be naked short options, and that works for them.) If I’m right about the direction of a market move I want to earn a profit that is much bigger than what I think my potential loss will be if I’m wrong.

I’m more comfortable doing a covered write. For instance, I’ll buy futures and sell short-dated OTM calls against the futures. The short calls reduce the risk on the futures and also give me the opportunity to take in some time premium. However, the short calls also cap the max gain I can make on the trade, but if the market moves in my direction I can just do the trade again; buy more futures at a higher price and write more calls at a higher strike.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Therefore, this blog, and everything else on this website, is not intended to be investment advice for anyone about anything.