Quote of the week:

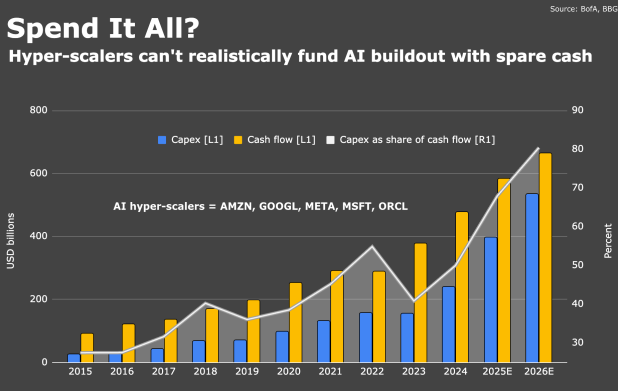

“Hyperscaler cash flow can’t cover the AI capex arms race.” Mike Hartnett, Chief Investment Strategist, Bank of America

The S&P and the NAZ gapped higher when markets opened on Sunday afternoon, October 26 (blue ellipse), and both indices reached new record highs on Monday through Thursday that week, but registered their lowest close of the week on Friday (pink ellipse), as doubts about AI began to circulate. Those doubts intensified this week, with the NAZ trading lower from Tuesday through Friday. At Friday’s low, the NAZ was down ~6.5% from last week’s highs (after rallying ~61% from April’s lows to last week’s high).

In last week’s Trading Desk Notes, I wrote:

Is AI in a “Drill baby, drill” phase?

I’m inclined to think so, if that means investors may “step back” if they start to question whether the vast sums being spent on AI infrastructure will ever yield vast profits. I understand some folks believe AI will blossom into the Biggest Thing Ever. They may be right, but from a short-term trading perspective, I’m willing to bet that AI (and AI is the market) is vulnerable to at least a correction. Here’s a fantastic quote from Stephen Innes (a veteran trader I highly recommend you check out on Substack): “Momentum without cash flow is just gravity deferred.“

As the top chart illustrates, hyperscalers could previously fund AI capital expenditures (capex) from their cash flow. However, as expectations for capex have grown exponentially, it appears they will need to borrow hundreds of billions of dollars. However, the credit markets may be more skeptical than the equity markets have been about the AI hype, especially with NVDA CEO Jensen Huang saying, “China will win the AI race with the US.”

Traditional equity market valuations were “stretched” during the run to record highs, with an unprecedented concentration in Big Cap Tech accounting for ~40% of the S&P market cap. Those “stretched” valuation metrics were ignored as share prices soared, but they may come into focus if share prices decline.

The opportunity for corporate buybacks is now wide open after the blackout period surrounding quarterly reports. Still, I wonder if the forecasts for $5 billion a day between now and January and $1 trillion in buybacks in 2026 will be trimmed back due to capital expenditure demands (or demands from lenders). Buybacks have provided a HUGE boost to equity prices over the past few years.

There are a million questions about AI and how it will change the world, but from a trading perspective, the key questions are about ROI. For instance, will there be enough electricity available, on time, and at what cost? Will there be another Deepseek moment, similar to the one we saw in January 2025?

ORCL soared to all-time highs on AI hype a month ago, but has 100% round-tripped as of Friday.

PLTR has a similar chart pattern.

MSFT had a rough two weeks, falling ~11% from October’s highs.

Meta’s share price was hit hard after last Wednesday’s quarterly report.

With Bitcoin under pressure, MSTR is down over 50% from the July highs.

The US Supreme Court began to examine the legality of Trump’s tariffs

The USSC heard verbal arguments on Wednesday, and the tone of the questioning from the bench has prediction markets giving Trump ~30% odds of prevailing, which adds to the market’s “uncertainty.”

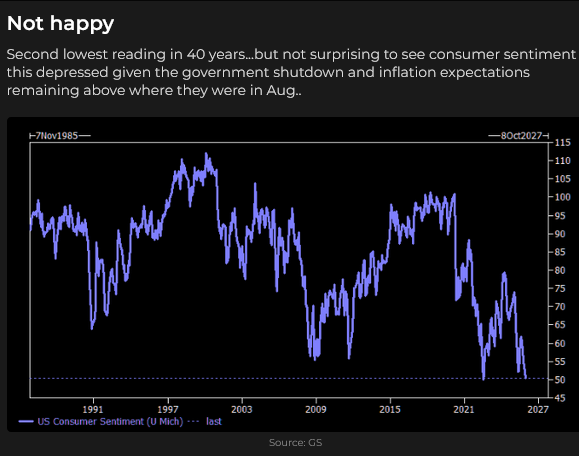

Consumer sentiment is depressed

Consumer sentiment may also be in the dumps because consumers are deeper in debt than ever, and job openings appear to be dwindling.

On the bright side, rumours (which turned out to be false) that Congress was close to ending the government shutdown helped lift the S&P from 7-week lows late Friday (blue ellipse). If the US Federal Government indeed reopens, that will likely give the equity markets a boost.

Currencies

The DXY US Dollar index rallied to its best levels since May on Wednesday, but drifted lower on Thursday and Friday. The index had dropped to a 4-year low on September 17 (the day the FOMC cut short-term rates by 25 bps, and indicated more cuts to come).

The Yen has been the weakest of the major currencies over the last several months, falling ~10% against the USD since April (and falling to record lows against the Euro).

Interest rates

Bond prices had been trending higher since May, but sold off sharply (blue ellipse) following Powell’s post-FOMC comments that another cut in December was not a foregone conclusion.

The Treasury will auction a total of $125 billion of 3, 10 and 30-year bonds in the coming week. The cash market will be closed on Tuesday in observance of Veterans’ Day.

Copper

Comex copper prices seem to find a floor around $4.50 following the July 30 price plunge on the government’s “clarification” that not all copper imports would be subject to tariffs. Open interest has increased by ~40% over the last 10 weeks to an 18-month high.

Energy

Nymex WTI rallied from below $58 following Trump’s sanctions against Russia. Still, prices have drifted lower over the past two weeks as those sanctions are not expected to cause a material decrease in Russian exports into a market that is presumedly oversupplied.

Nymex January natural gas prices have jumped ~18% from the October lows as the market prepares for winter demand. (The January contract is traditionally the most expensive month.)

Cameco spiked to record highs last week as the US government committed more money to the “uranium space,” but the share price subsequently reversed sharply, perhaps in sync with the overall decline in risk assets that had enjoyed a massive rally since April. (At last week’s highs, CCJ was up more than 200% from its April lows).

Gold

Comex gold rallied over $1,000 (~29%) in the two months from mid-August to mid-October, then tumbled over $500 (~14%) in six trading sessions, and has traded quietly either side of $4,000 during the past two weeks.

Sunday morning edit:

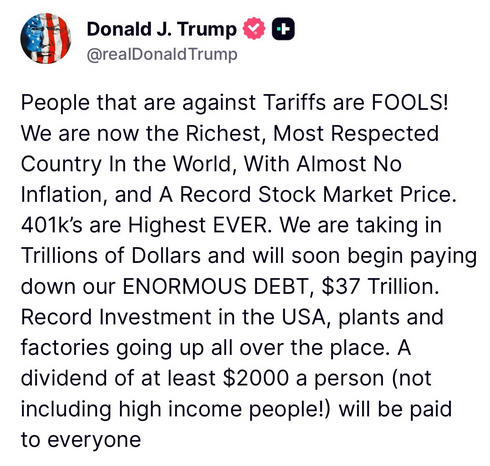

President Trump posted this on Sunday morning, November 9, 2025:

I suspect the Sunday TV talk shows will discuss this message six ways to breakfast, depending on their political persuasion (it does invite criticism), but what does it mean for markets? To me, it’s another example of debt-financed fiscal stimulus (there have not been trillions of tariff dollars received), and people will likely spend the money, just as they did during covid times, so stock markets and casinos should expect fresh cash inflows.

My short-term trading

I started this week with a short WTI position, a long Yen call position, and a short S&P position. I bought bond calls on Monday.

I covered my short S&P position for a gain of ~75 points on Tuesday and earned an additional net 150 points by shorting the S&P from Tuesday to Thursday. I bought the S&P three times on Friday morning and finally caught the rebound, resulting in a net gain of ~60 points. I was flat the S&P at the end of the week.

I stayed short on WTI all week and was approximately $2 ahead on the position at Friday’s close.

I was underwater on the Yen calls at the start of the week, and that position improved modestly as the Yen drifted higher. I kept the position into the weekend.

I’m slightly underwater on my bond calls, but held the trade into the weekend.

Thoughts on trading

My P&L has experienced some decent gains over the past three weeks (shorting gold and the S&P at the right time helped), which reminded me of the old saying that a trader’s job is to “stay alive” (using good risk management) long enough to get lucky.

Another old saying is that “the trend is your friend,” or as Adam Mancini puts it, “90% of trading is getting the trend right. You get it right, you have a tailwind at your back.”

Here’s a comment I made on the Market Vibes Substack this morning (I subscribe to Market Vibes and highly recommend it to serious traders) :

The Barney report

Barney and I are home alone this week, with my wife attending a conference in Texas. We’ve taken two walks so far today, and we will go out for another once I finish today’s Notes. Meanwhile, Barney alternates between waiting patiently for me to finish playing on my computer and bumping me with his nose, as if to say, “Come on, Papa, let’s do something.“

Listen to Mike Campbell and me discuss markets

On this morning’s Moneytalks show, Mike and I primarily discussed this week’s volatile price action in the stock market, which was driven by rising concerns over AI. You can listen to the entire Moneytalks show here. My spot with Mike starts around the 1-hour and 6-minute mark.

Mike Campbell’s 2026 World Outlook Financial Conference will be on February 6 & 7 at the Bayshore Hotel in Vancouver. Click here for information and to buy a ticket.

I also conducted my monthly 30-minute interview with Jim Goddard on the “This Week in Money” show this morning. Jim and I opened the interview with a discussion of this week’s Big Story: the dramatic “sentiment change” around Big Cap Tech and then drilled down into my thoughts on equities, gold, the US Dollar, WTI and interest rates. We wrapped up the interview with a discussion on why I think TOO MUCH LEVERAGE is the market’s Achhilies heel. You can listen to the show here. My spot with Jim starts around the 49-minute mark.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past five years by clicking here.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.