Leading global equity indices (and other risk assets) tumble on a sharp rise in US/China trade tensions

China’s announcement of comprehensive restrictions on rare earth exports on Thursday had little impact on equity markets (but gold and silver tumbled). However, Trump’s aggressive social media response on Friday morning sparked a relentless day-long decline across equity markets. Trump followed up with a second message after the markets closed, threatening an additional 100% across-the-board tariff on all Chinese exports.

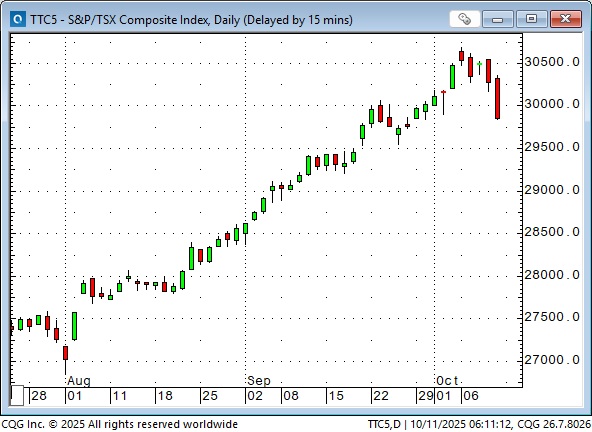

Global equity markets were trading at or near all-time highs (the S&P was up ~40% from the April lows) and were vulnerable to “something” sparking a correction.

Trump and Xi were set to meet at the upcoming APEC conference in Korea, at the end of October, with markets likely expecting that meeting to be an opportunity to “bury the hatchet” on the China/US “trade war.” However, in Trump’s morning message, he indicated there wasn’t any point in meeting Xi, given China’s restrictions on rare earth exports; however, later in the day, he said that he hadn’t yet cancelled the meeting.

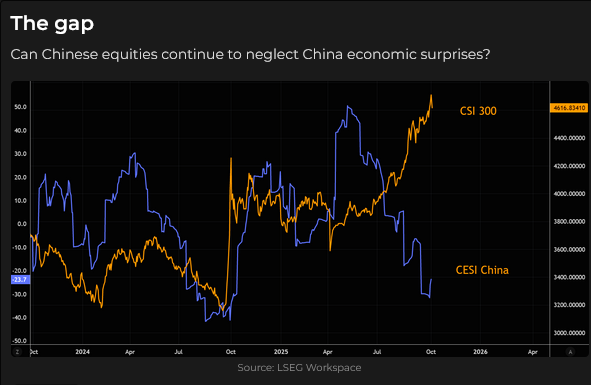

It is entirely possible (likely) that China announced the rare earth restrictions this week to gain “leverage” ahead of Xi’s meeting with Trump, and they likely anticipated his response. Now what? Markets will be watching (holding their breath) for signs of de-escalation. Barring that, risk assets will remain under pressure. Monday is Columbus Day, a bank holiday in the USA, and the cash bond market will be closed. Monday is also a holiday in Japan (sports day), and markets will be closed.

China controls the rare earth market

About 70% of global rare earth production comes from China, and they control around 90% of global processing. They account for ~93% of global magnet production.

Why were markets vulnerable to “something” causing a correction?

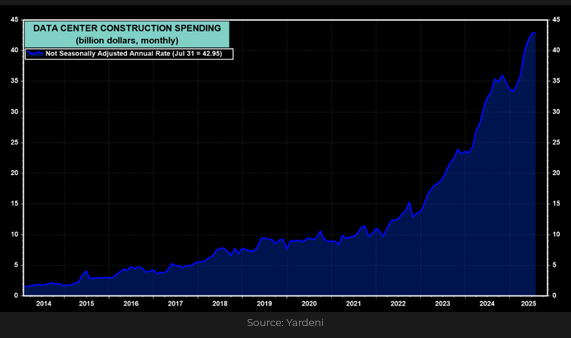

The S&P had rallied ~40% in six months, with more speculative assets up much more than that, and investor confidence (and positioning) was very bullish, causing huge capital flows into equities worldwide. People were using leverage in many different ways (no kidding). Volatility was low, systematics were steady buyers, and corporate buybacks were on pace to exceed $1 trillion in 2025. Earnings forecasts were high and rising; the hype surrounding the AI rollout was icing on the cake. FOMO and TINA were powerful forces, and “Buy The Dip” was the mantra of the day. “Old School” valuation metrics no longer applied because “this time it really is different!” I could go on, but you get the idea. I hope regular readers caught the skepticism in my Notes over the past couple of months.

How bad can it get?

If there is no de-escalation between China and the US by Monday, I think risk assets remain under pressure as selling begets more selling. I expect the Trump administration will take steps to calm the markets, but even if they do, I expect this week could be an inflection point in risk asset pricing. Investors will seek to mitigate risk across markets if they believe China and the US are on the path to a more adversarial relationship.

Interest rates

Treasury bonds were bid on Friday as stock prices fell.

High-yield corporate bonds were sold. Fixed-income quality spreads had become historically very tight, but widened dramatically this week. (The failure of down-market car dealers might have had something to do with that!)

Metals

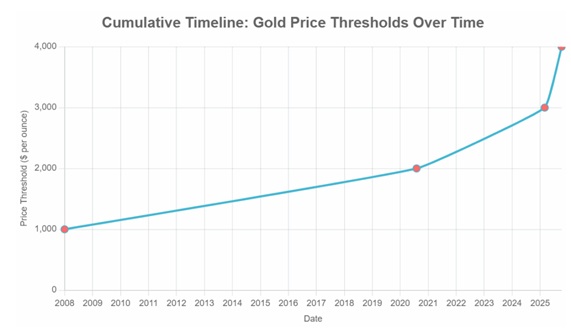

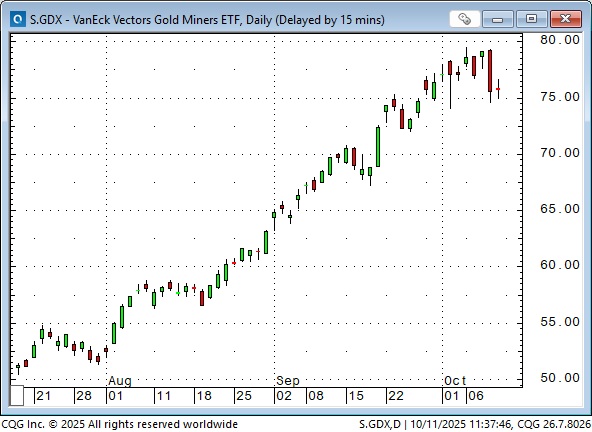

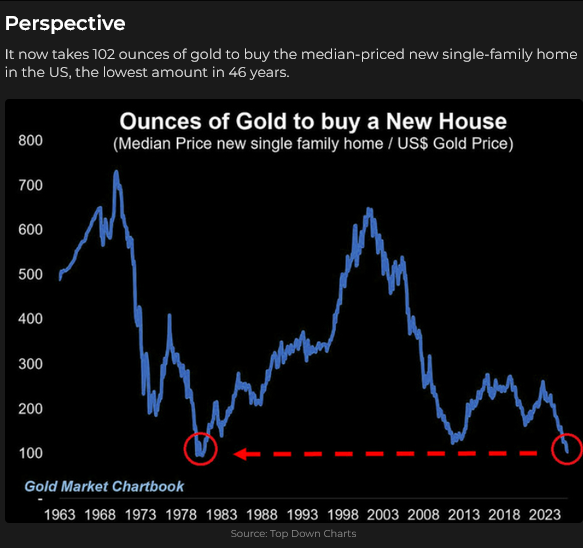

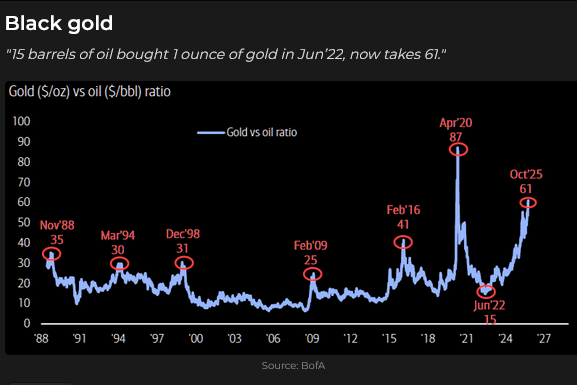

Comex December gold futures have closed higher for eight consecutive weeks, rising ~$730 since mid-August.

December Comex gold futures registered a record high close on Wednesday at $4,081 and a record high daily volume on Thursday, when prices dropped approximately $120 from the high to the low.

Gold shares have outperformed gold YTD, but they fell with gold on Thursday and didn’t bounce back on Friday when equities tumbled. (Gold shares are shares, not gold.)

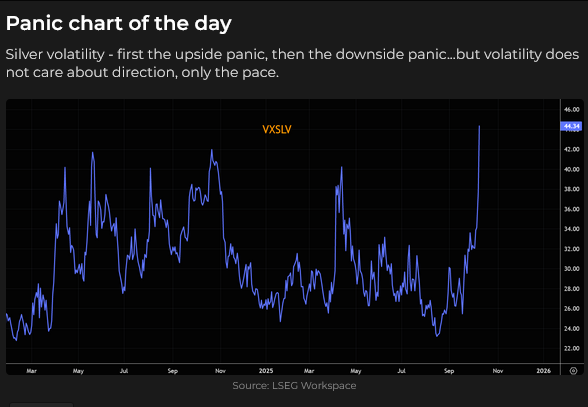

Comex silver futures traded within a few cents of $50 on Thursday, and then plunged nearly $3 within a couple of hours, as gold prices fell by ~$120.

Comex copper futures hit record highs of $6 in late July (trading at a substantial premium to foreign markets). Still, prices plunged more than $1.50 in a matter of minutes on July 30 when the Trump administration “clarified” that tariffs on copper imports did not apply to refined copper, only to “things” made of copper. The market drifted sideways in August, but prices and open interest began to climb in September and into October as traders believed that copper had found a “floor” around $4.50 and was destined to rally on the “electrification of everything” idea. Prices tumbled ~40 cents on Friday as “risk assets” were hit by the sharp rise in China/US tensions.

Currencies

The DXY US Dollar index fell to a 40-month low on September 17 (blue ellipse), when the FOMC cut US interest rates by 25 bps and signalled more cuts to come. It has rallied ~4% since then, rising against nearly all other currencies.

The Japanese Yen traded at a 2-month high on FOMC day (blue ellipse), but gapped lower (pink ellipse) following the surprise election of Sanae Takaichi as head of the LDP party (and likely to become the first female Japanese Prime Minister). Note that it rallied sharply on Friday as global stock markets fell.

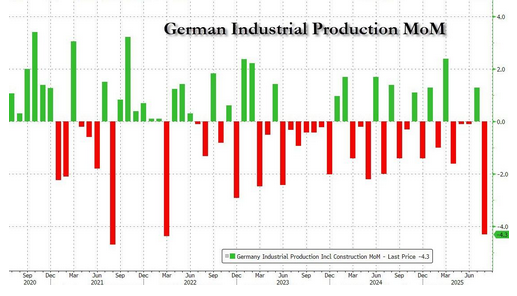

The Euro traded to a 40-month high on FOMC day (blue ellipse), but then declined ~3% to this week’s low with French political/fiscal concerns and German recessionary concerns weighing on the market. The Euro also rebounded on Friday as stock markets fell.

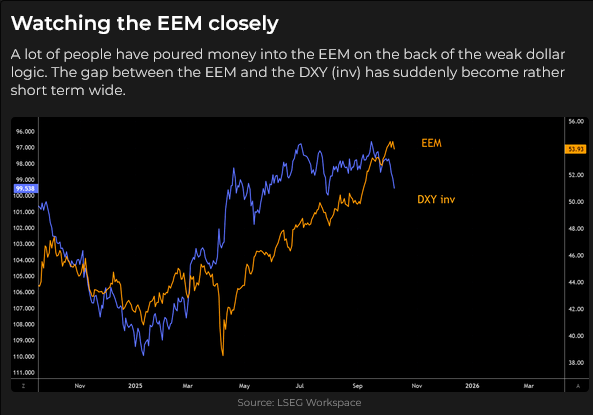

Emerging market stocks rallied alongside developed market stocks as the USD weakened. What now for EEM?

Energy

Front-month Nymex WTI crude oil has fallen by ~$8 over the past two weeks, with half of that coming in the last two days. Concerns that supply was overwhelming demand were exacerbated by “Peace in the Middle East” and trade tensions between China and the US.

Uranium issues have rallied to record levels over the past two months, but reversed hard on Friday.

My short-term trading

I was long the Yen to start this week, and it gapped lower Sunday afternoon on the unexpected Takaichi win. I cancelled my stop before the opening, and was pleasantly surprised that the Yen didn’t open lower. But it continued to drift down, and I covered for a (reasonably) small loss on Tuesday.

I took two tiny losses shorting the S&P on Monday and Tuesday and shorted it again on Thursday, only to be stopped for another slight loss first thing Friday morning. As the market started to fall away from its highs on Friday, I shorted it again and covered for a 100-point gain a couple of hours later. I realized that something BIG was brewing, so I shorted the S&P again and stayed short into the weekend.

My realized and unrealized gains on Friday more than offset the net losses I have incurred by shorting the S&P over the past few weeks. I’ve been anticipating a break like the one we had on Friday, and I thought it was essential to “be short” before “something” caused the vulnerable market to break.

I shorted gold on Wednesday, but I was stopped for a loss of $30 per ounce early Thursday. I reshorted it Thursday, and was ahead ~$70 at the lows of the day. I covered the position on Friday, for a gain of ~$30, which offset the Thursday loss. I was flat gold into the weekend.

The Barney report

I weighed Barney this week, and he was 77 pounds, up 3 pounds YTD. I decided that (soft touch) Papa has been feeding him too much, so this week we’ve been playing a lot of fetch – I throw the ball and he runs as fast as he can to get it and bring it back to me. He loves doing that (he’s a retriever), and we keep it up until he gets tired.

The TD Notes have been a little shorter than usual this week as we have a lot of family, including twin three-month-old girls, arriving shortly for the Canadian Thanksgiving weekend. There will be no TD Notes next week as I will be in Calgary for Joseph Schachter’s annual Catch The Energy conference.

Best wishes to all my Canadian readers for a good family weekend.

The Josef Schachter Annual Energy Conference – Calgary, October 18, 2025

I look forward to attending Josef’s annual energy conference again this year. I’ve attended every one over the past several years, and I’m not only continually amazed at the quality and diversity of the presenters, but I also learn more every year about the energy business and the incredible technological advances the industry is undergoing. For more information about the conference and to buy a ticket, click here. Check out Josef’s weekly “Eye On Energy” letter on Substack.

Listen to Mike Campbell and me discuss markets

On this weekend’s Moneytalks show, which was recorded on Thursday, before the Friday selloff, I told Mike that there were signs of speculative excesses in the equity markets, especially in options and other leveraged vehicles, and that our listeners should consider taking defensive action. You can listen to the entire show here; my spot with Mike starts around the 1-hour, 1-minute mark.

Listen to Jim Goddard and me on Howe Street Radio

I recorded my monthly 30-minute interview with Jim Goddard on the This Week In Money podcast yesterday. We discussed Friday’s brutal selloff in the equity markets, as well as price action in precious metals, currencies, interest rates, and the energy markets. You can listen to the entire show here.

The Archive

Readers can access any of the weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post new content, typically four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.