Current positioning:

On Friday, March 7, I bought the S&P and shorted the Yen, Gold and T-Note calls. I held those positions into the weekend. See the short-term trading section below for more detail.

A weaker US Dollar and a weaker US stock market

The S&P (my favourite risk barometer) closed lower for three consecutive weeks, dropping ~8% from mid-February all-time highs to Friday’s 4-month lows. The NAZ fell ~11.5%. The MAG7 stocks are down ~12% from December’s record highs.

NVDA has fallen ~30% from January’s record highs, and its market cap is down ~$1.25 trillion.

The US Dollar Index hit 23-year highs in January (aside from a few weeks in late 2022) and fell ~6% to this week’s lows. COT data (as of March 4) shows that total net short currency positioning has fallen ~85% from January’s multi-year highs as the USD declined. (For instance, speculators have covered short Euro positions and have gone net long.)

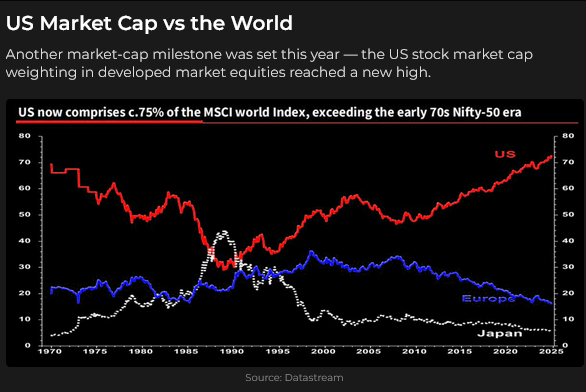

Is American exceptionalism peaking – after a multi-year run?

Two weeks ago my answer to that question was: My Macro view is that (years of) capital flowing to the USA for safety and opportunity helped create American Exceptionalism – which meant a strong US Dollar and US stock markets outperforming the Rest Of The World. American Exceptionalism may have peaked in January (along with Trump’s approval rating and ability to get what he wants) as the US Dollar Index hit 23-year highs and reversed lower.

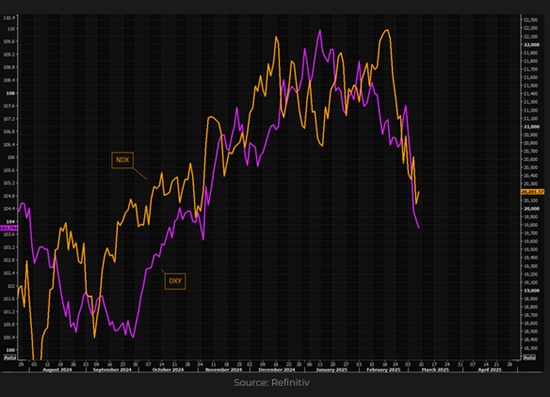

In this 8-month chart, the NAZ is the gold line and the US Dollar Index (the DXY) is the purple line.

In my view, the “cherry on top” of the multi-year trend of “American exceptionalism” was the expectation of a “new golden era” following Trump’s election. Confusion over Trump’s policies darkened the economic outlook (and the expectation of a new golden era), and as the USD and the stock market began to fall, declining prices caused over-leveraged investors to sell. Selling begets more selling.

Two themes helped reverse the USD and US stock market: 1) confusion over Trump’s policies, especially the potential impact and implementation of tariffs, and 2) A “new era” dawning in Europe in reaction to Trump’s “America First” directives.

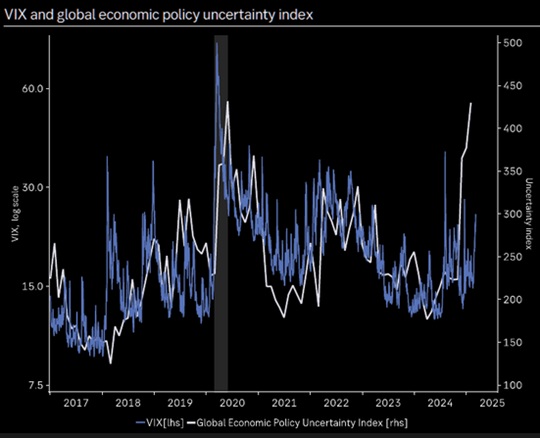

In this chart, the white line is Global Economic Policy Uncertainty (it’s higher now than when covid hit in 2020) and the blue line is the VIX.

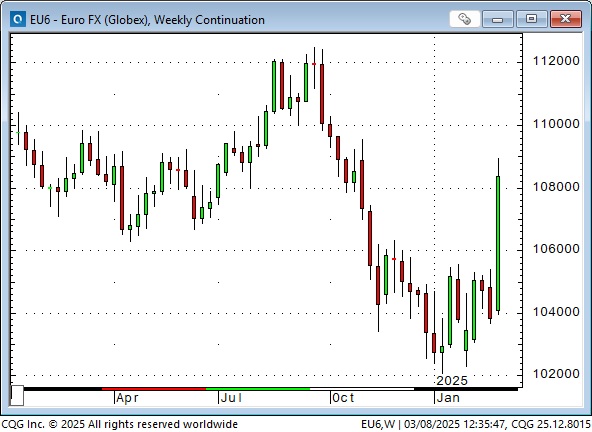

While the US Dollar index has fallen ~6%, the Euro (the Anti-Dollar) has rallied ~7% from January’s lows to this week’s highs. This week’s extraordinary gains were accelerated by news that Germany is planning a constitutional amendment to allow massive deficits to finance defence and infrastructure spending.

The German DAX stock index has rallied ~17% YTD, to all-time highs, while the S&P is down ~3.5% YTD.

The recent outperformance of the DAX over the US equity market came after 15 years of remarkable underperformance.

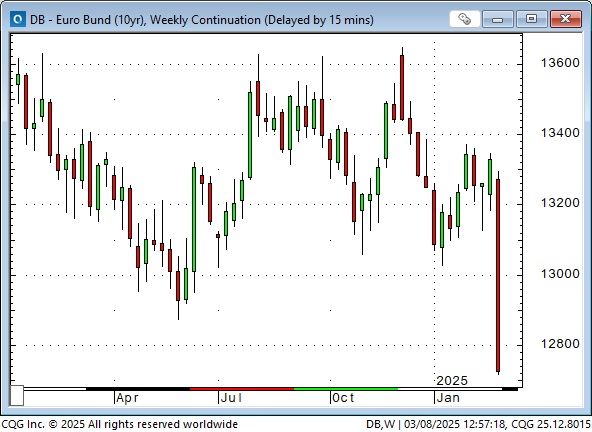

German bund yields soared the most this week since the fall of the Berlin Wall in 1989, as markets braced for a possible 500 billion Euros worth of deficit financing for defense and infrastructure.

This chart by Brent Donnelly shows the correlation between the EURUSD and the 10-year rate differential between Germany and the USA. The Euro (in black – right scale) has soared as the premium of US rates over German rates (in red – left scale) has fallen.

Central Banks

The ECB cut 25 bps on Thursday to 2.5%. The BoC meets March 12 and is expected to cut 25 bps to 2.75%. The FOMC meets March 18/19. No rate cut is expected until June, but the forward market is pricing 3 X 25bps cuts by year-end.

My short-term trading

S&P futures:

I started this week long the S&P, a position I bought last Friday (February 28) when the market rallied back from 6-week lows. I covered the trade for a decent profit when the market opened higher Sunday afternoon, but couldn’t sustain the gains.

I bought and covered the S&P five times from Tuesday, March 4 to March 7 for small net gains and held the last buy into the weekend.

The market has been in a strong downtrend for the last three weeks with a few strong counter-trend rallies.

T-Note futures:

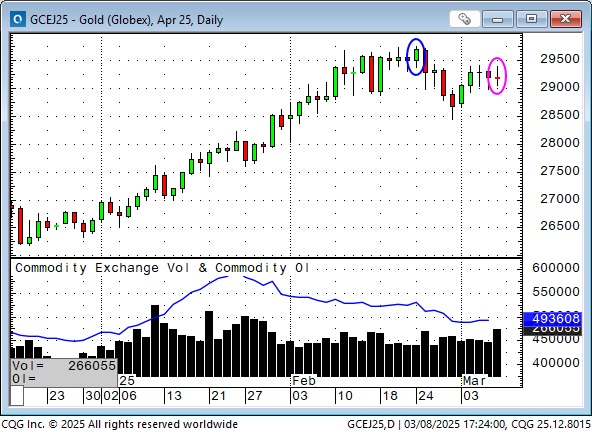

I bought the T-Notes on February 21 (blue ellipse) and (unfortunately) hedged the position the next day by selling OTM calls. I covered both positions the following day for good net profits but my “micro-managing” left a lot of money on the table!

I wanted to fade the market on Tuesday when it fell back after hitting 112, but I didn’t for two reasons, 1) I would be trying to top-tick a strong bull trend, and 2) the employment data on Friday could move the market sharply against me.

I shorted the 112 calls after the employment data on Friday (pink ellipse) with the market falling from a “lower high.” The sharp fall in German bund prices this week may have shifted market opinion from the bullish view that has prevailed since January.

Yen futures:

Since late January, I have bought the Yen and been stopped for small losses a few times, but lately, my bias has shifted to watching for shorting opportunities. COT data as of March 4 shows that net speculative long positioning has ramped up sharply over the last six weeks and is now the largest in at least 20 years. Open interest has nearly doubled since the Yen turned higher in mid-January and is tied with the record-high OI levels of September 2024, when the Yen reversed from a 1000-point rally. Long Yen is a very crowded trade.

I shorted the Yen on Friday (blue ellipse) when it reversed from 5-month highs following the US employment report, and held that position into the weekend.

Gold futures:

I shorted gold a couple of times in early February for small losses. I got my money back shorting it on February 24 (blue ellipse) and covering two days later. I shorted it again on Friday (pink ellipse) and held that position into the weekend.

My rationale is that the ~$1,200 rally from the October 2023 lows has (more than) discounted a lot of bullish news and is over-bought and tired. I’m willing to sell what looks like a “lower high” here in early March. I could be wrong, but selling pressure will likely increase if gold breaks below $2,850. Open interest and net long speculative positioning have been drifting lower for six weeks.

Thoughts on trading

Trends often last longer than you think they will.

It isn’t easy to keep the time frame of your trading in sync with the time frame of your analysis. For instance, you may have a bullish long term view on a market, but in the short term, if you want to make a trade, it’s a short.

I don’t have “high-conviction” trades. I form opinions about how a market might go, then watch the charts for a low-risk entry point. Low risk means that if the market goes against me, I’ll lose a lot less than I’d make if the market went my way. Low risk also means I rarely risk more than 1% of my account capital on a trading idea. Rule #1 is protecting my capital (both the P+L and the mental kind).

If I close out a trade the same day I put it on, it’s almost always a losing trade. If I close out a trade I’ve been in for two weeks, it’s almost always profitable.

On my radar

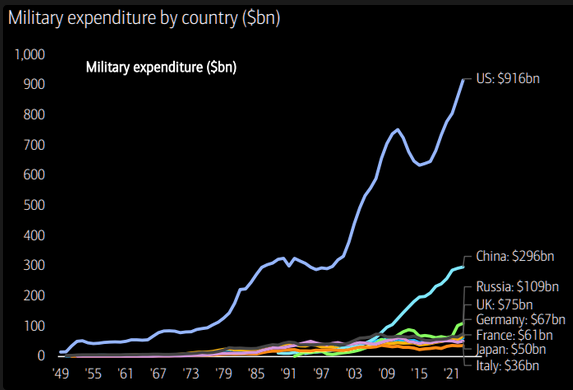

How much has this contributed to American Exceptionalism?

The liberal leadership race will be decided on Sunday. Has Trump’s behavior increased the chances of the Liberals winning the next election?

Will the Chinese People’s Congress lead to substantial fiscal stimulus?

Ukraine. Gaza. Iran.

Trump has been doing “everything” by Executive Order in the name of National Security. Are the House and the Senate getting restless?

Is DOGE going to reduce the fiscal deficit significantly? If not, are bonds a short?

The WTI crude oil futures price is now at record lows relative to gold, outside the spike low in April 2020, when WTI prices went negative.

Cheap and plentiful oil and natural gas could provide a powerful boost to the Canadian economy if governments could reverse the carbon tax ideas they hold.

The Barney report

Barney is patiently waiting in his chair for Papa to finish today’s trading desk notes so that we can do something fun—like go outside for a run!

Listen to Mike Campbell and me discuss markets.

On this morning’s Moneytalks show, Mike and I continued the discussion we’ve been having for the past few weeks: American Exceptionalism, as manifest in a strong US Dollar and a US stock market that left the rest of the world in the dust, peaked in January and February as 1) confusion over Trump’s tariff policies and 2) the dawning of a “new era” in Europe hit the markets. You can listen to the entire show here. My spot with Mike starts around the 42-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!