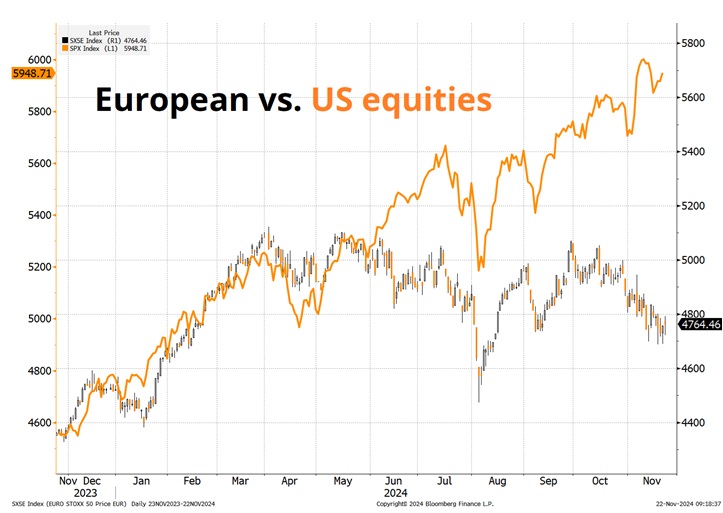

American exceptionalism: US stocks have hugely outperformed the rest of the world.

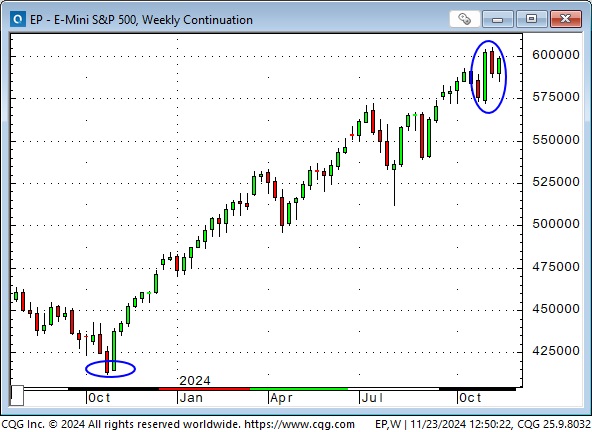

The S&P is up ~46% from its October 2023 lows. It jumped ~5% during election week, the biggest weekly gain YTD, corrected a bit last week and rallied again this week.

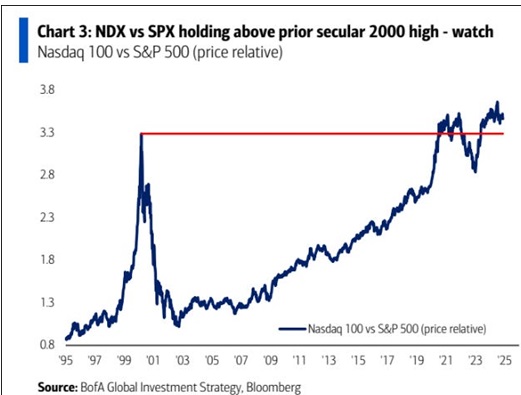

The NAZ is up ~51% from October 2023 lows.

The NAZ has dramatically outperformed the S&P over the last twenty years.

TINA and FOMO: Market sentiment sees no alternative to US stocks, causing capital to flow to the USA, boosting the US dollar.

The US Dollar Index is at a 2-year high, up ~8% since late September.

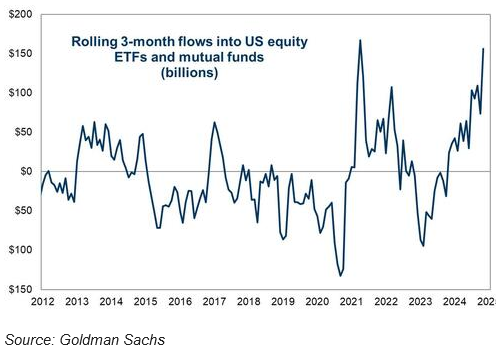

YTD Capital flows

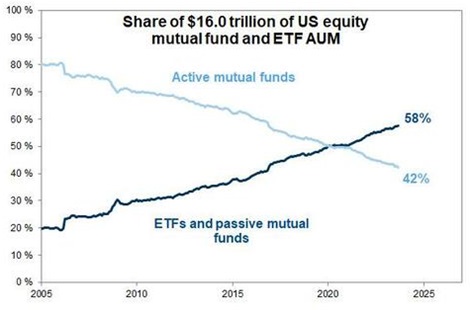

YTD flows into global equity: $625 billion, of which $400 billion was into US equities. $988 billion went into equity ETFs, with $363 billion coming out of mutual funds as capital shifts from active to passive.

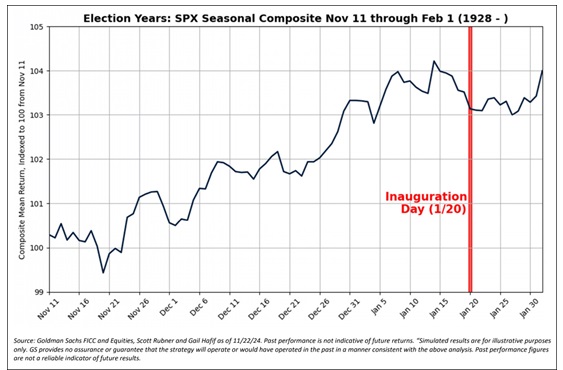

The S&P is seasonally strong from now until early January. Substantial daily corporate buybacks are expected to continue until late December.

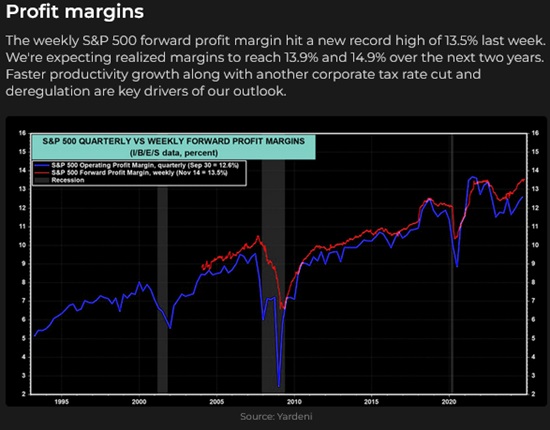

Analysts are expecting corporate profits to continue growing.

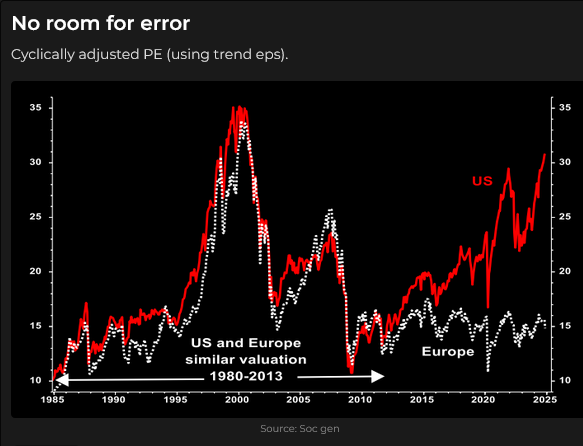

American cyclically adjusted P/E ratios have soared relative to Europe.

Capital flows into US shares are strong, and valuation metrics are historically high. The commitments of trader’s data show that small speculators hold their largest net long position in S&P futures in over three years.

Bullish enthusiasm (a willingness to take on more risk) is vividly displayed in some issues.

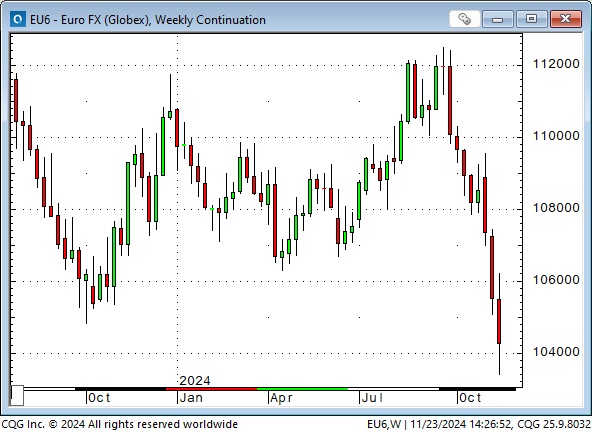

The stellar US equity market is not the only magnet drawing capital to America. Interest rate differentials are also positively impacting the value of the USD. The Euro fell to a 2-year low this week on expectations that the ECB will cut short-term rates from the current 3.5% to ~1.4% by July 2025, while the Fed is expected to cut rates from 4.6% to 4.0% by July 2025. (With inflation “sticky,” the economy steady, the stock market surging, and Powell sounding slightly hawkish, the odds of the Fed cutting 25 bps on December 18 are ~50/50.) The German 2-year bond yield was 2% at Friday’s close, and the US 2-year bond yield was 4.38%.

My favourite “risk barometer” for Europe is the Euro / Swiss Franc spread, which shows the Euro is now at its lowest level since the common currency was launched in 1999. (European money goes to Switzerland for safety.)

I’m considering a longer-term FX trading idea: buying the Yen against the Euro. The Yen and most Asian currencies (they compete with each other for export markets) are grossly undervalued against the USD (mercantilist trade policies), and Trump may pressure them to revalue. I also like the chart, which shows the Euro reaching all-time highs against the Yen in July, falling ~12%, bouncing back to a lower high, and turning lower again.

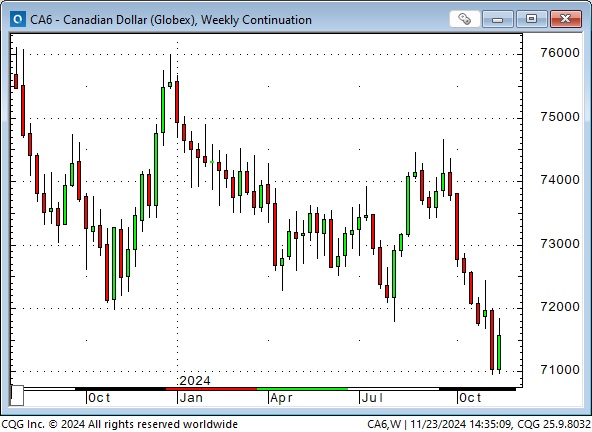

The Canadian dollar bounced about a half-cent from last week’s close this week. It had closed lower for the previous eight consecutive weeks, reaching a 4-year low. The 72-cent level may present a formidable resistance level for further CAD strength (but if it clears that resistance, it could run.)

The CAD’s ~5% decline over the previous eight weeks was primarily due to the USD surging against virtually all currencies (I would have said all currencies, but there are ~30 currencies around the world that are pegged to the USD.) The CAD’s weakness was exacerbated by the premium of US interest rates over Canadian rates (the spread hit multi-year wides last week at ~1.1% but came into less than 1% this week) as the BoC maintains an easier monetary policy than the Fed due to the relatively weaker Canadian economy.

A massive buildup of speculative short positions in the CME futures market also pressured the CAD. COT data shows that those short positions were reduced slightly as of November 19. Based on the price action this week and the decline in open interest, I expect we will see a further reduction in the speculative short position in next week’s COT report.

The rise in the CAD this week, while all other currencies traded in the CME futures market fell against the USD, means that the CAD was “the world’s strongest” currency, at least for this week!

While some Canadians may feel a little wounded national pride with the CAD near the lowest levels of the last twenty years (and some Snowbirds may modify their travel plans), a weaker currency accrues many benefits to Canada. Exporters benefit—for instance, the Canadian oil patch exports more than four million barrels daily to the USA. A CAD of 1.40 rather than 1.35 generates extra revenue of ~$15 million daily, or ~$5 billion yearly.

Canadian tourism should also benefit from a weaker CAD.

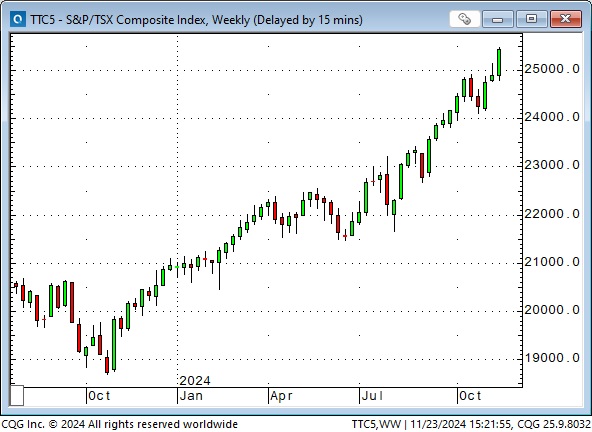

I suspect that the weaker Canadian dollar may have contributed to the rise in the Toronto Composite Index (up ~36% from the October 2023 lows.) Shares of Canadian exporters may have risen due to increased revenues, and foreigners may have seen “bargains” on the TSE due to the lower CAD.

Gold

Comex December gold futures hit record highs of ~$2,800 at the end of October, fell ~$250 (~9%) to mid-November lows, and bounced back ~$175 as of Friday’s close. Prices rose every day this week, and the market surged into Friday’s close—nobody wanted to be short into the weekend. Gold rallied from the 100-day moving average this week.

Open interest in gold futures has dropped ~80,000 contracts (~14%) from the late October highs to Friday’s close, and COT data as of November 19 shows that net speculative positioning is down ~20%.

This week’s rally was sparked on Sunday by the news that Biden “allowed” Ukraine to use longer-range missiles against Russia. The rally was sustained once Ukraine fired those missiles (and missiles from the UK) into Russia, and Russia retaliated by firing a long-range rocket back at Ukraine.

Gold shares (the GDX ETF) hit a four-year high in mid-October and had fallen ~10% by the end of October when gold topped out and turned lower. The GDX has also not bounced back this week as much as gold. I suspect this is because the GDX is “not gold” but is a leveraged play on the price of gold, and the gold market has rallied this week (as has the USD) on geopolitical worries, not on profit-seeking.

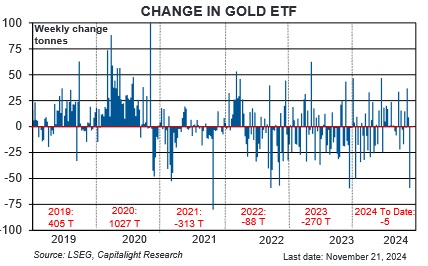

This chart from Martin Murenbeeld’s weekly GOLD MONITOR shows a relatively significant reduction in gold ETFs this week.

Silver fell ~15% from October highs to last week’s low (compared to a ~9% decline in gold) and bounced back less than gold this week. Silver does not have the central bank support that gold has and doesn’t get the “geopolitical stress” buying that gold gets.

Trading thoughts

Trump announced late Friday that Scott Bressent was his pick for Treasury Secretary. American stock and credit markets should like that; if they don’t rally on that news, that could be a “news failure.”

Sunday, November 24 edit: The more I think about the market’s reaction to Bressent’s nomination when it opens this afternoon/tomorrow morning, the more critical it becomes. The S&P closed last week on its highs and “should” gap higher on this news. Bonds have been drifting sideways for eight days at 6-month lows. They “should” gap higher. The USDX closed last week at 2-year highs after rallying 8% in the previous eight weeks. It “should” gap lower. If those gaps don’t happen, then I’ve got to wonder “why,” especially if there is no news/event that trumps the Bressent nomination.

In August/September, markets were considering a possible recession by year-end or early 2025. Those thoughts are now virtually banished, with the market pricing just over 60bps of additional easing from the Fed by June 2025. The market is also expecting aggressive fiscal stimulus from the Trump administration. Bond prices have been steeply declining since September (speculators are massively short the 5-year Treasury futures), and any “second thoughts” about a recession could spark a credit market rally.

“Animal Spirits” have flourished across markets since Trump’s victory and may be due for a correction.

Sunday, Nov 24 edit: Photo of the week

I had a brainwave – I should add “Photo of the week” to the TD Notes. I already do that (to some degree) with the “feature image” on the home page – this week, it’s the classic photo of Scott Bressent – but the software only allows me a tiny space for that.

Anyway, I’ll give it a try. Here’s my first Photo of the week:

Quote of the week

The debasement of global fiat has been great for US equities, crypto, and gold but not so good for oil, silver, European stocks, and many other assets. Debasement is a tailwind but it’s not a single variable that makes all assets go up. Brent Donnelly

My short-term trading

I started this week long gold and the S&P and short bond puts.

On Wednesday, I covered the gold position for a gain of ~$60 oz and the S&P for a slight profit. I also covered the bond puts for a slight gain.

I bought the CAD on Sunday evening as it started to rally back from Friday’s 4-year low and covered for a decent profit when it ran into resistance on Wednesday.

I bought the CAD again as it appeared to steady and held that into the weekend. The CAD was the strongest currency this week, and I know there is a massive short position that may start to cover if the CAD rallies. (I think “the world” sees Canada as a “little brother” to the US, and some of the capital that flows to America for safety and opportunity will go to Canada, particularly once we get a change of government at the Federal level.)

I rebought the S&P and held that into the weekend.

The Barney report

I bought a new cell phone last weekend and have struggled to “get up to speed” on it. (It would have been much easier if I could have transferred data from my old phone, but it was destroyed by road traffic.) One of the first things I learned on my new phone was how to take pictures of Barney. Here he is on the tracks, proudly strutting along with a big stick. That boy loves sticks!

Listen to Mike Campbell and me discuss markets on the Moneytalks show

This morning, Mike and I discussed the high-flying stock market, the bounce back in the CAD while other currencies fell and how the gold market reacted to geopolitical stress. My friend and terrific stock picker, Paul Beattie from BT Global Growth, was also on the show. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.