US stock indices soared on Trump’s victory—the DJIA, S&P, and NAZ rallied to new record highs this week.

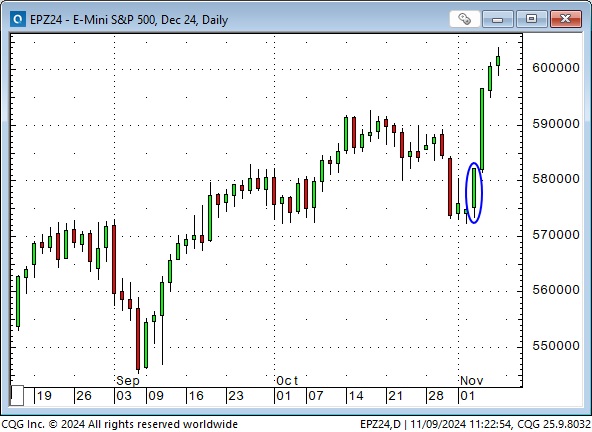

The S&P and the DJIA hit record highs in mid-October but then trended lower into month-end, perhaps de-risking ahead of the election. On election day (ellipse), the indices were bid aggressively from the opening bell, soared in the overnight session, and remained well bid into Friday’s close.

Dow futures rallied ~2,500 points (6%) from Monday’s low to Friday’s record high. The S&P climbed ~5.5%, and the NAZ was up ~6%. The DJIA closed this week up ~12,000 points (37%) from October 2023 lows. The S&P is up ~45% from a year ago, and the NAZ is up 50%.

The Russell 2000 (small cap) index rallied ~10% from Monday’s low to Friday’s high but did not exceed the all-time highs made in November 2021.

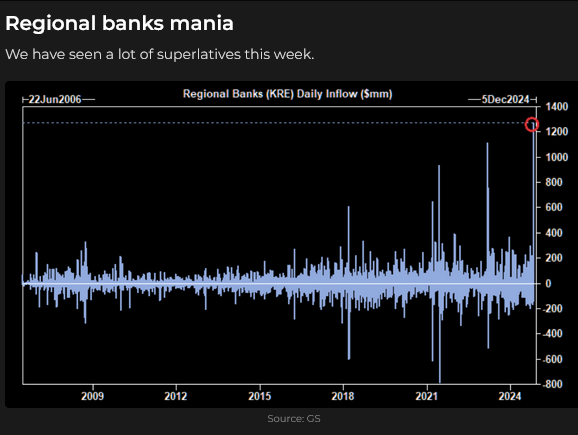

Bank stocks liked the Trump victory.

For some unknown reason (!) TSLA shares have substantially outperformed the S&P following Trump’s victory.

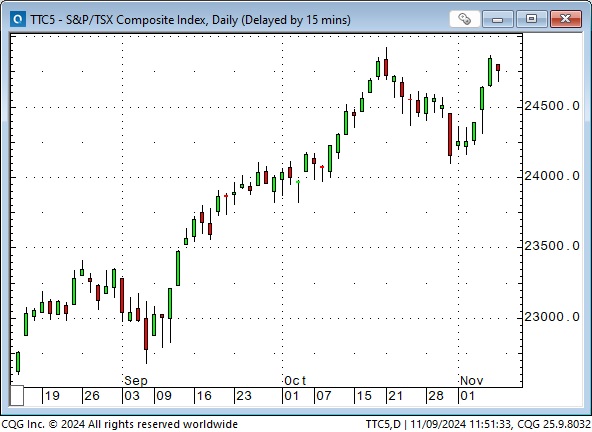

The Toronto Composite Index hit record highs in mid-October and then trended lower into month-end like the American indices. It rallied ~3% this week, underperforming the US market.

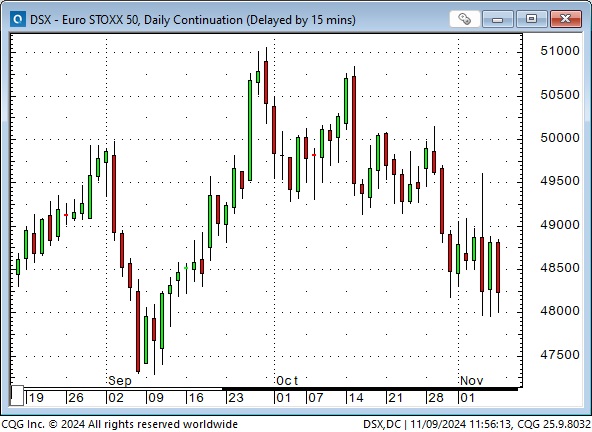

The Euro Stoxx 50 index (a pan-European big-cap index) closed down on the week with no lift from the American markets.

The Nikkei 225 Index received some support from the American markets on Wednesday but gave most of that back by Friday’s close.

The Mexican stock market fell to a 2-year low on Wednesday‘s opening (down ~30% from April’s highs) but bounced sharply to close slightly higher on the week.

Currencies

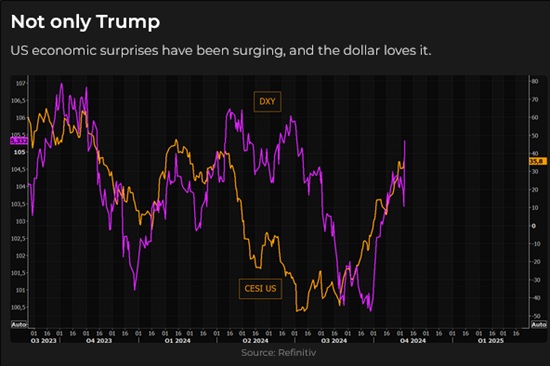

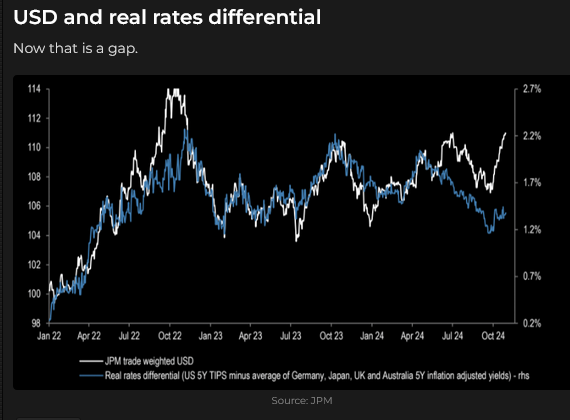

The US Dollar Index surged higher Wednesday afternoon on early signs of a Trump victory and continued to rally in the overnight markets. It fell back Thursday but rallied on Friday to close this week ~5% higher than late September levels.

The Canadian dollar gapped higher Sunday afternoon after closing last week at +4-year lows. It rallied further on Tuesday and sustained those gains until early Wednesday afternoon when it began to tumble on early signs of a Trump victory. It closed slightly higher on the week after very choppy daily price action. COT data (as of Tuesday, when the CAD made its high of the week) showed that speculators once again increased their net short positioning against the CAD to near-record levels. American interest rates across the yield curve remain at ~1.1% premium to Canadian rates, a multi-decade high.

The Mexican Peso fell to a 2-year low on Wednesday, down ~20% from April’s 9-year highs. It rebounded sharply from the lows and rallied further on Thursday but fell back on Friday to close the week little changed. (Note that the peso’s price action was very similar to the Mexican stock market ETF, as noted above.)

Interest rates

The yield on the 10-year Treasury was around 3.65% when the Fed cut short rates by 50 bps on September 18. It hit a high of ~4.45% on Wednesday as markets reacted to Trump’s victory and closed the week at ~4.31%.

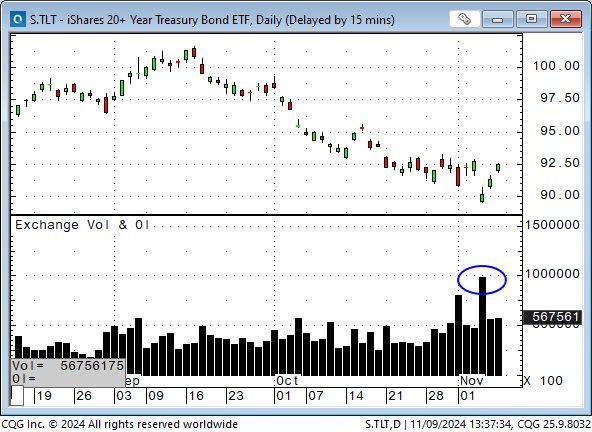

The 20-year Treasury ETF rallied sharply from 6-month lows on Wednesday on the highest-ever daily volume.

The short end of the curve is pricing more cuts from the Fed next year, just not nearly as many as previously expected. The June 2025 3-month SOFR futures contract is pricing ~100 bps less than expected in September.

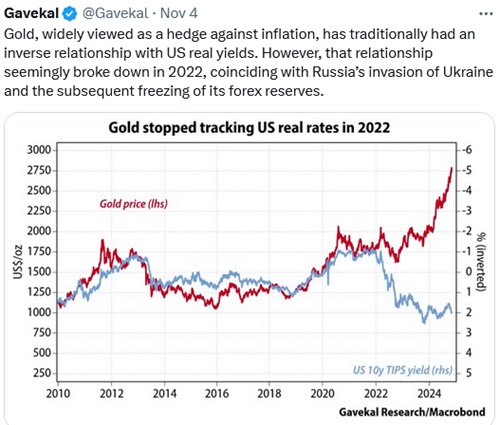

Gold

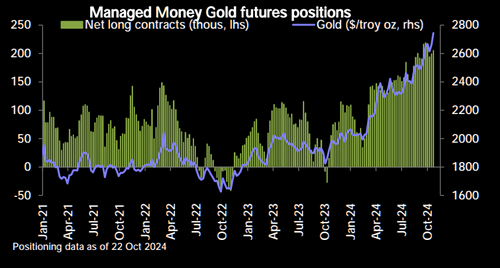

Comex December gold futures hit a record high of ~$2,800 near the end of October but fell ~$150 (~5%) to this week’s low. The surging USD and higher interest rates may have contributed to the decline. The prospects of reduced geopolitical stress following Trump’s victory may also have weakened the gold market. As noted last week, upside momentum has faded.

COT data shows that speculators have (more or less) sustained their largest net-long positioning in over four years for the past several weeks.

Energy

Speculators have ramped up their net short positioning in natural gas over the past four weeks to the largest since early 2020, when prices reached a 22-year low.

Volatility

Volatility across asset classes ramped up over the past few weeks before the election but fell sharply once the market realized there would not be a protracted fight over “who won.”

Thoughts on trading

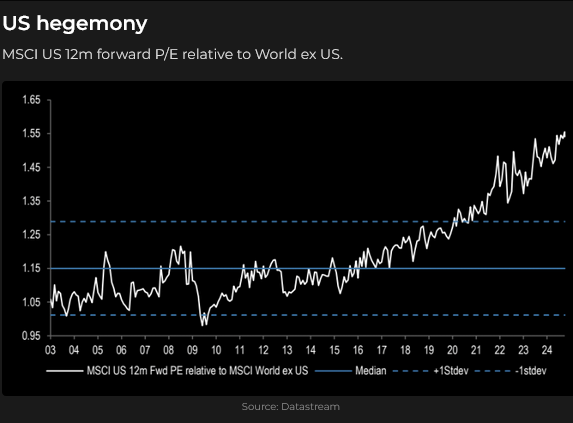

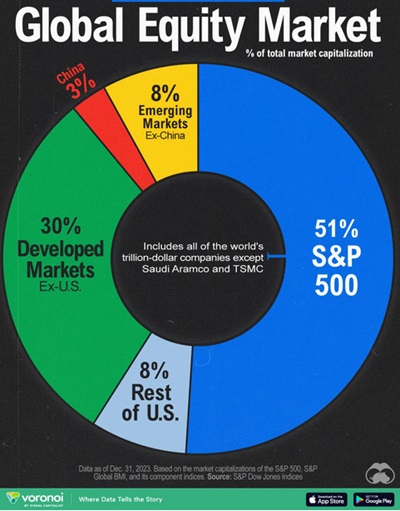

The leading US stock indices have rallied powerfully over the last year. Earnings growth has been strong, especially for big-cap stocks, and P/E ratios are near record highs. The American equity markets have outperformed the Rest Of The World (and capital comes to America for safety and opportunity.)

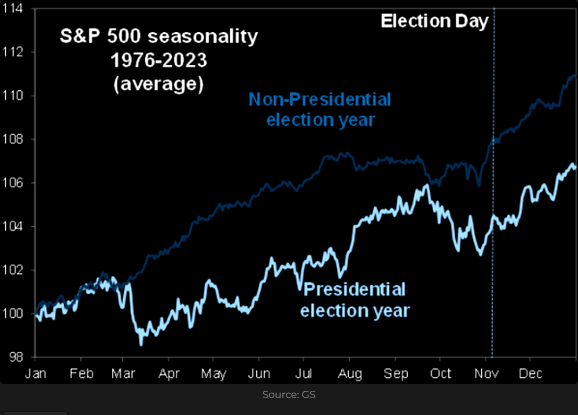

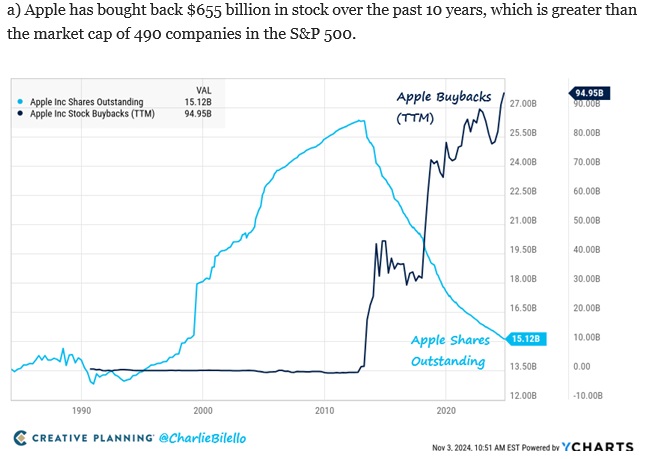

Seasonality favours a continuation of the rally, and corporate buybacks averaging over $5 billion daily will provide strong support.

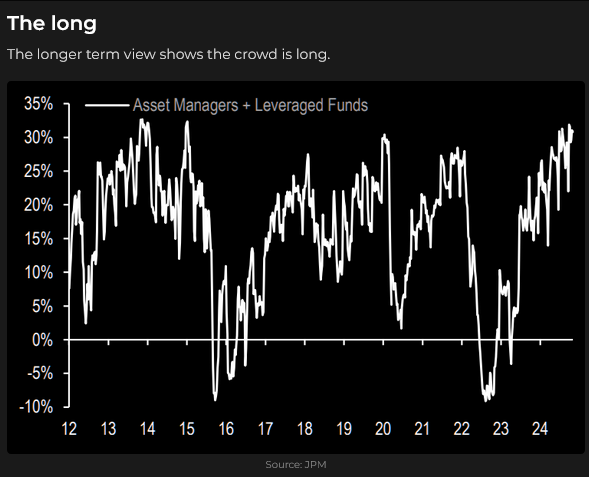

Some investors and analysts expect much higher stock prices under Trump2.0, with tax cuts, reduced regulations, and a “new era” of technological advances. They may be correct, but the markets have come a long way, and the bullish view is commonplace.

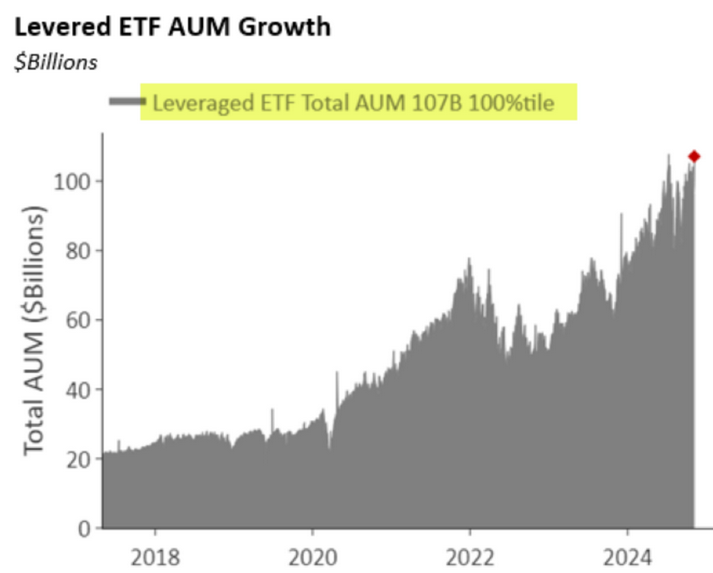

Some folks are so bullish that they need to use extra leverage.

My short-term trading

I started the week short the S&P and short OTM T-Note puts. I bought the S&P three times late last week, looking for a bounce, but it stayed heavy, so I chose to get short. I covered the short for a slight loss on Monday’s opening.

I bought the CAD Sunday night when it gapped ~15 points higher after closing at 4-year lows last week. I was ahead ~50 ticks Tuesday morning, but then the FX market broadly decided that Trump would win, and the USD started to rally against everything. I covered for a small profit. I bought the CAD again on Wednesday when it rallied back after taking out last week’s 4-year lows and was ahead ~40 ticks on the trade at Thursday’s close. It fell back on Friday, and I covered at a breakeven.

I shorted gold on Monday and covered for a $70 gain on Tuesday. I looked for an opportunity to get short again on Friday but didn’t make the trade.

I bought the Yen on Monday but covered for a slight loss on Tuesday.

I bought the Mexican Peso on Wednesday when it came roaring back from a 2-year low and covered for a small profit on Thursday when it couldn’t sustain the 3-week highs it reached.

The 10-year T-Notes sold off hard on Wednesday (as stocks and the USD rallied) and traded below where they had been when I sold OTM puts last week, but the sharp decline in volatility caused a sharp decrease in the price of the puts, so I stayed short. The T-Notes rallied on Thursday and Friday, leaving me nicely ahead on my short puts. I sold OTM calls late Friday to hedge the puts and improve my chances of making net profits on the T-Note options trades. The resulting T-Note strangle was the only position I carried into the weekend.

My net realized and unrealized P+L gains for the past two weeks have been almost entirely due to gaining ~$100 on the short side of gold and being net short VOL on the T-Notes. The other trades more or less offset each other.

On my radar

Domestic economic data: CPI Wednesday, PPI Thursday and Retail Sales Friday.

The election: As I write this, it is still unclear who will control the House of Representatives, which means we still don’t know how decisive the “Trump victory” will be. The markets seem to have priced a “Red Sweep,” but if the Democrats control the House, there may be a “rollback” on some positioning.

Trump will likely pick his key people over the next few weeks, and the markets will try to guess what that means regarding policies.

The Trump victory has the potential to fundamentally change many things on a grand scale, creating all kinds of trading/investing opportunities. Trump’s reputation for being mercurial could keep volatility at a higher level, and I hope other countries (like Canada) will follow the American lead and abandon far-left politicians.

The Barney report

The long sunny days of summer are history, and the shorter, wetter, and darker winter days have arrived in the Pacific Northwest rain forest. There are less than ten hours of daylight now, so we try to take advantage of every opportunity to get out for a walk (run) when the weather is good. Here’s Barney searching for another excellent stick.

Listen to Victor discuss markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the reactions to Trump’s victory in the stock, interest rate, currency, and gold markets. You can listen to the entire show here. My spot with Mike starts around the 55-minute mark.

This morning, I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money show. We discussed the election, the stock market, interest rates, currencies, gold, and the energy markets. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.