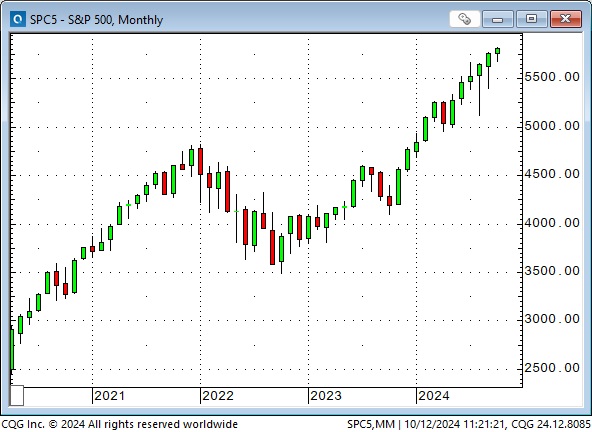

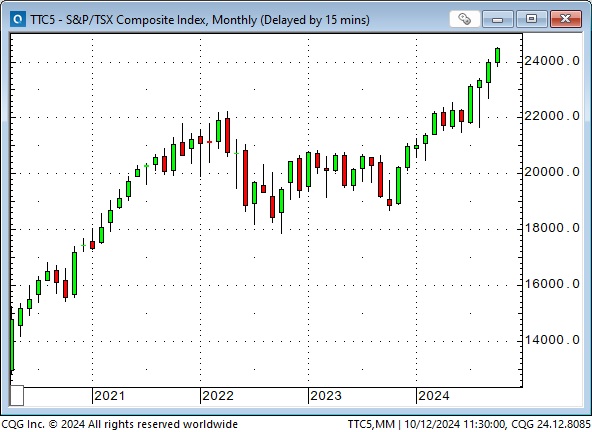

The leading North American stock indices are at record highs

The S&P has closed higher for 9 of the last 10 weeks, rising ~14% from its early August lows. The index is up ~22% YTD, ~41% from year-ago lows, and ~65% from two year-ago lows. It has closed higher for 11 of the last 12 months.

The Toronto Composite Index is up ~31% from its year-ago lows and 37% from its two-year-ago lows.

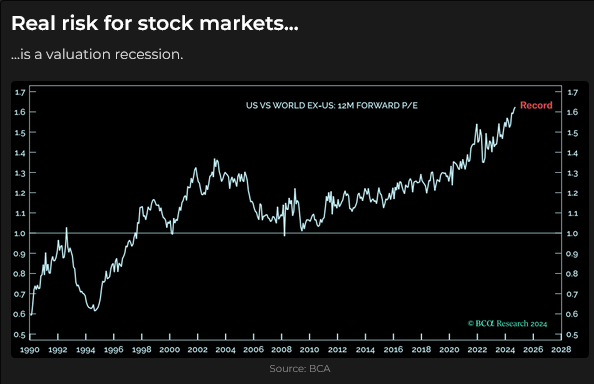

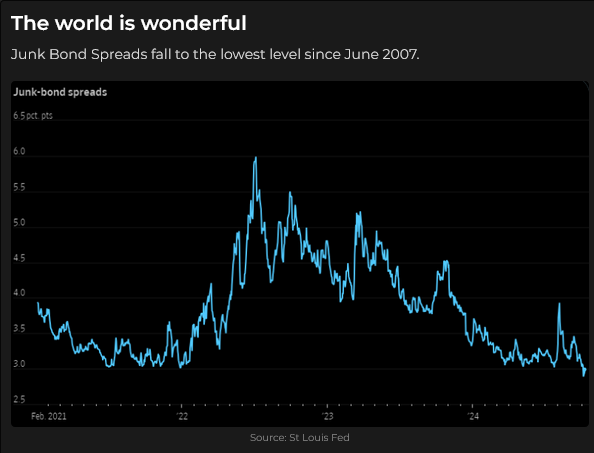

Global liquidity is at record highs, and the money “has to go somewhere.” Forward earnings expectations and P/E multiples are high, especially in the US relative to the rest of the world.

Seasonality favours higher share prices into yearend.

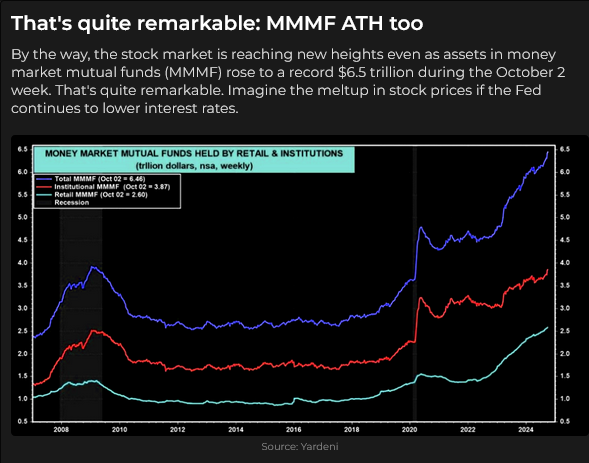

American money market assets are at a record high of ~$6.5 trillion. Some analysts expect capital will leave MMF for the stock market if interest rates continue to decline. I beg to differ. I see MMF as “rainy day money.” Barring short-term interest rates falling back to ~0, capital will continue to flow to MMF “just in case” something takes the wind out of the stock market’s sails.

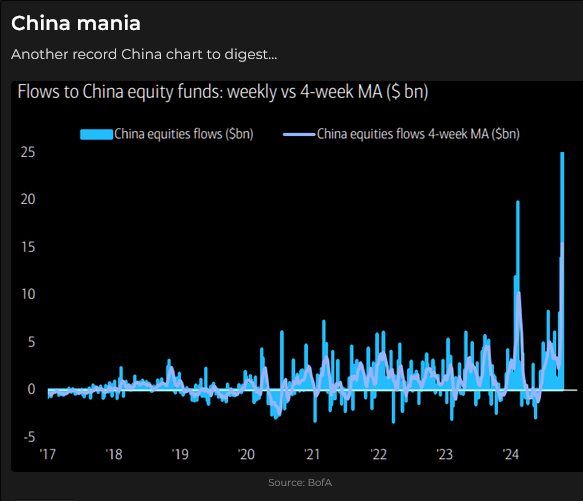

The Shanghai stock index hit 5-year lows in February, bounced into May, but was trending back towards the February lows when stimulus measures were announced on September 24. The index soared nearly 40% in six trading days but fell back ~13% to this week’s close.

Arthur Kroeber of Gavekal Dragonomics wrote an excellent, insightful essay in the Financial Times on October 10, 2024, about the market’s reaction to the Chinese stimulus. Here’s an excerpt: “Markets were right to see the stimulus announcement as an inflection point and an opportunity to venture back into oversold Chinese assets. But they misjudged the underlying intent, which is to stabilize the economy rather than generate a major reacceleration. And they underestimated the constraints on stimulus imposed by Xi Jinping’s long-run strategy and by policymakers’ desire not to repeat past errors.”

Interest rates

From early June through mid-September, the forward short-term interest rate market (the Secured Overnight Financing Rate: SOFR) priced in a drop of nearly 200bps for the June 2025 contract. This happened as the Fed signalled an end to raising rates and the beginning of a rate-cutting cycle. The Fed cut rates by 50 bps on September 18, marking the top of the SOFR rally. Since then, the market has “back-pedalled” as much as 80 bps as economic reports (especially employment data) have shown a stronger-than-expected economy.

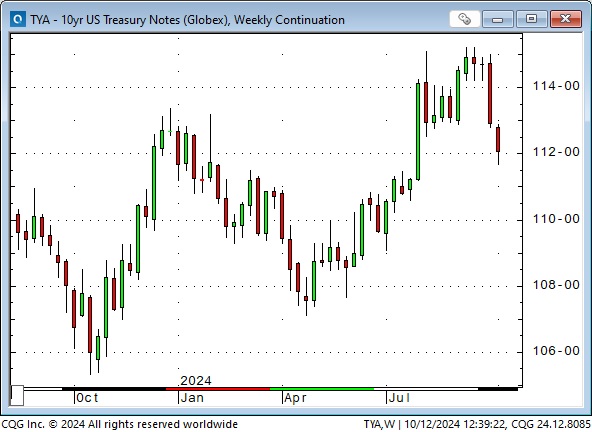

The 10-year Treasury futures market shows a similar pattern to the short-term interest rate market.

Currencies

From early June through mid-September, the Euro (and many other currencies) rallied, pricing in more aggressive interest rate cuts from the Fed than from the ECB. However, as interest rate markets began to “back-peddle” on signs of a stronger-than-expected US economy in late September, the Euro (and many other currencies) fell.

The Canadian Dollar reached an 8-month high in late September but then tumbled ~2 cents (dropping for 11 of 13 trading days) as the USD rallied against nearly all other currencies. The Loonie may have also weakened on speculation that the Bank of Canada might cut interest rates by 50 bps at the October 23 meeting.

Events/markets outside of Canada often influence short-term changes in the CAD. For instance, the CAD frequently trades “tick-for-tick” with the S&P or Euro. (Changes in WTI prices also frequently impact the CAD.) Since late September, however, the S&P has been steady to higher while the CAD fell. This time, the “outside influence” on the CAD has been the USD rallying against nearly all other currencies on the back of changing interest rate expectations.

Gold

Comex December gold futures hit a record high of ~$2,708 on September 26. Over the next ten trading days, as the USD and interest rates rose, the price fell ~$90 to this week’s low on Thursday. Prices bounced back ~$50 by Friday’s close ahead of the 3-day weekend.

Friday’s close, in any market, is the most significant price of the week. That’s the price traders will “live with” for two days while the markets are closed. A Friday close ahead of a three-day weekend is that much more significant. In this case, a possible retaliation by Israel for the most recent Iranian missile attack could happen over the weekend, so gold prices were bid higher (but not high enough to make new record highs.)

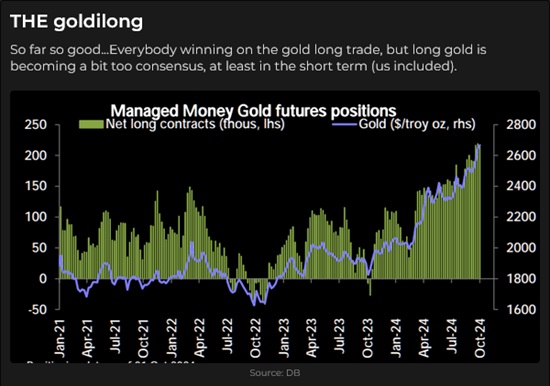

The historical negative correlation between gold, the USD, and interest rates has been weak over the past year, with market participants more focused on geopolitical stress and the long-term implications of soaring sovereign debt and deficits. The net-long speculative position on COMEX is near a 4-year high.

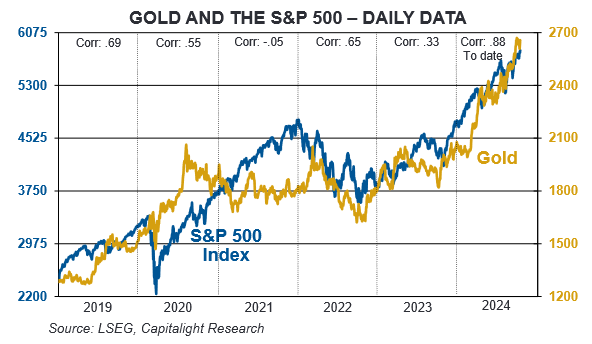

Gold is up ~50% from the one-year-ago lows made immediately before the Hamas attack and ~67% from the October 2022 lows. (The percentage gains from the October 2022 lows are nearly identical with the S&P gains over the same period.)

The chart below is courtesy of my long-time friend and internationally acclaimed gold analyst, Dr. Martin Murenbeeld. (Martin writes the excellent weekly Gold Monitor for institutional investors, major mining companies, and individual investors. Click here to get a free trial.)

Energy

WTI hit 12-month lows in September at ~$65, down ~$22 from the April highs made when Israel and Iran fired missiles at each other. It spiked ~$12 in early October (rising Middle East tensions, Chinese stimulus, hurricanes, and likely short-covering) and ended this week around $75.

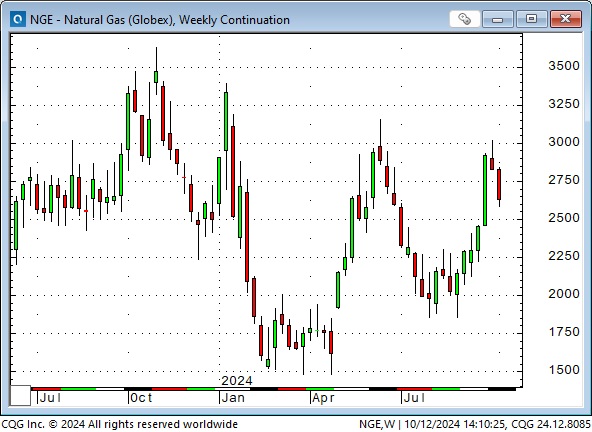

Nymex natural gas futures traded near 20-year lows of ~$1.50 early this year but have rallied back to ~$3. This is still a historically low price (especially on an inflation-adjusted basis), but “a lot” of natural gas is available in the North American market.

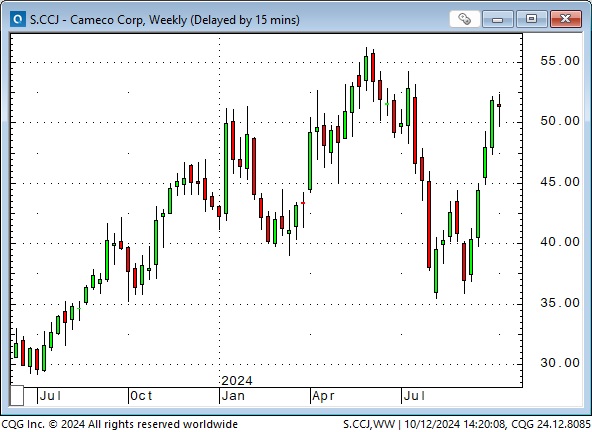

The uranium market had a spectacular rally from the 2020 lows to the June 2024 highs (Cameco rallied 10X.) There was a steep correction in early August, but the market has been aggressively bid as investors realize how much electricity data centers will need.

I will be in Calgary on October 19 for Josef Schachter’s “Catch the Energy” conference, and I look forward to hearing presentations from the many excellent energy companies that will be there. Readers who invest in the energy markets should attend the conference and subscribe to Josef’s reports.

My short-term trading

I began the first week of October short the CAD, S&P and gold. I covered most of my positions before the Friday employment report for a modest net gain. (I was going to Calgary early Friday to attend a wedding and wanted no open positions, but I inadvertently stayed short a small gold position.)

I kept the position this week. Gold moved ~$50 in my favour from Monday to Wednesday, but the unrealized gain evaporated when the market rallied back on Thursday and Friday. I have an open stop around the October highs.

I bought the 10-year Treasury notes on Friday and held that position into the weekend. The 10-year has had a steep sell-off in the last two weeks and may bounce back.

Over the past two weeks, I’ve been “distracted” by outside events and travelling and have done minimal trading because I didn’t feel like I was “on the job.” I’ll be away from my trading desk on Wednesday and Friday this week, so I probably won’t be trading much.

Thoughts on trading

When I return to my trading desk after being away, it takes me a while before I feel “connected” again. There is some (self-imposed) pressure to “do something,” but I try to be patient until I’m confident that I’m “re-connected.”

Years ago, when I worked with several other brokers, we knew that taking a vacation always came with unexpected costs. When we were away, another broker would be covering our clients, and invariably, there would be a “miscommunication” with a client that resulted in an error or some other cost. We also knew that the first trade we made after a vacation was almost always a loser, so we put on a trade, took the loss, and got it over with. Welcome back, sucker!

I will be in Calgary from Friday, October 18, to Sunday, October 20, to attend Josef’s energy conference. There will be no Trading Desk Notes next weekend.

The Barney report

Summer is over. It is colder and darker in the mornings and evenings when I take Barney out for a walk, but we still manage at least an hour-long off-leash walk/run mid-day. Barney loves to run, especially if he’s got a good stick in his mouth!

Listen to Victor talk about markets

On this morning’s Moneytalks show, Mike Campbell and I discussed the wild action in the Chinese equity markets, the North American stock indices’ new record highs, currencies, and gold. You can listen to the entire show here. My 6-minute spot with Mike starts around the 56-minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the This Week in Money show. We discussed my macro overview of markets, the wild price action in Chinese equities, the leading North American indices going to record highs, the tight correlation between interest rates and currencies, the oil market’s reaction to geopolitical stress and the possibility that markets may be “fundamentally different” now as a result of massive global fiscal stimulus. You can listen to the entire show here. The other guests on the show, Ross Clark, Josef Schachter and Martin Straith, are all friends of mind and have some great insights into today’s markets.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.