LATE NEWS: Iran fires missiles into Israel. As much as the market worried that this could happen, there was hope that Iran would not retaliate at this scale. This will likely have a MAJOR impact on markets, especially if Israel and the US counterattack.

Is the Fed wrong – again?

For traders and investors, the Elephant in the Room question has been, and continues to be, “What’s the Fed going to do?” For over a year, I’ve been writing that any signal that the Fed would start cutting rates would be a “Green Light Special” to buy stocks. Powell sent that signal on November 1 (following the FOMC meeting), and stocks had a fantastic five-month rally, with the S&P up ~26% to All-Time highs on April 1, 2024. (April Fools Day.)

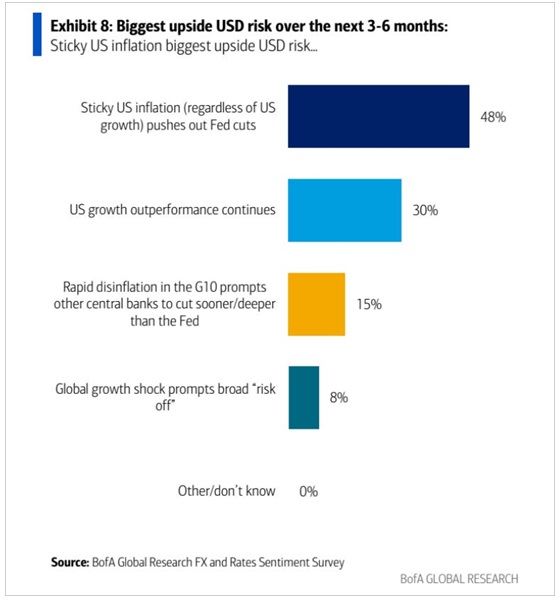

In early January, forward s/t interest rates were pricing more than six 25bps cuts in 2024. Over the next two-and-a-half months, the anticipated cuts were reduced as economic and inflation reports were stronger than expected. Still, the leading stock indices continued to make new highs (perhaps believing that a strong economy was good for corporate earnings and the next move from the Fed would be to cut rates—what’s not to like, and, anyway, TINA.)

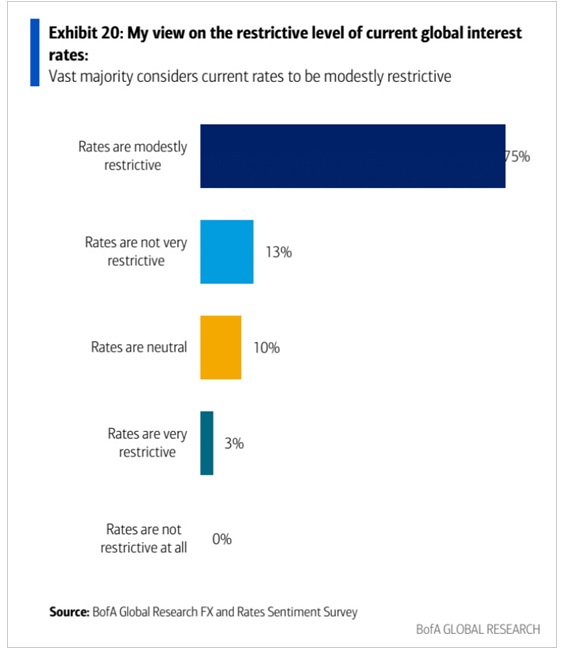

I agree with analysts who argue that the Fed has been wrong to believe that inflation will come down to ~2% (just as they were mistaken to think inflation was transitory), that current rates around 5% (a 23-year high) are not restrictive, and that the Fed’s next move, if they want to get inflation down, will be to raise rates. (The Fed may be constrained from raising interest rates because that will increase debt service costs for the government and the private sector, and the Fed may also be constrained from raising rates in an election year.)

I like the fact that my view is different than the consensus view that global interest rates are “restrictive.”

If the stock market begins to believe the Fed will raise or not cut rates, that will be a “Red Light Special.” Stocks have been rising because interest rates are not high enough to fight inflation—buying stocks has been a hedge against inflation.

A rising stock market is inflationary because the “wealth effect” it creates means that people who own stocks (and other assets like real estate) are not financially restricted from paying higher prices for goods and services. Their buying power helps push prices/inflation higher.

From a positioning perspective, if stocks start to fall, there could be a “domino” effect as “everybody” is long. (A substantial correction will tighten financial conditions, and the Fed may not need to raise rates.)

Last week’s NFP report and this week’s CPI data accelerated the recent increase in interest rates, and stock indices took notice. DJIA futures had their lowest weekly close since the second week of January. (The DJIA, S&P, and Russell futures had Weekly Key Reversals down last week and followed through this week.)

Currencies

The US Dollar Index surged to a six-month high this week. The USD has rallied as traders expect other central banks to cut interest rates sooner and more than the Fed (just as the USD fell in November and December when traders expected the Fed to lead other central banks in cutting rates).

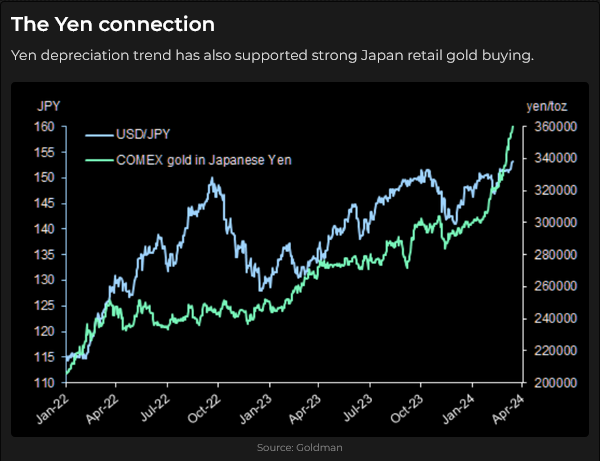

The Yen fell to 34-year lows. Despite sabre-rattling from Japanese authorities, speculators in the currency futures market have increased their net-short Yen position to the highest level in nine years.

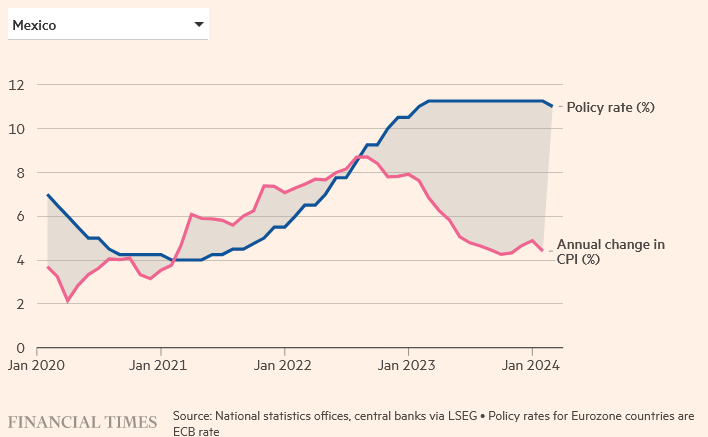

The Mexican Peso has been the strongest currency in the world recently, surging to a 9-year high against the USD before Wednesday’s CPI report. Short-term interest rates of ~11% have helped drive the Peso higher (the carry trade loves buying MEX), but the weekly reversal, along with other market risk-off signals, may mark a turn in bullish MEX sentiment. (The USD rose against all currencies this week, and EM FX was particularly weak.)

European currencies fell hard on the CPI report, with the Swiss Franc falling to 7-month lows, closing lower for 13 of the past 15 weeks. Net speculative short positioning in the Suisse (as of Tuesday, the day before the CPI report) surged to a 5-year high and likely increased following the CPI report.

The Canadian Dollar was hit with a “double whammy” on Wednesday: 1) a dovish Bank of Canada statement and 2) the stronger-than-expected US CPI report. The CAD has fallen ~4.5% from last December’s highs and closed the week at 6-month lows.

Gold

COMEX gold futures rallied ~$400 (~20%) from late February to Friday’s highs but dropped ~$100 (4%) to close near the day’s lows.

Gold option volatility soared this week to levels not seen since the March 2023 SVB crisis.

Silver followed the same price change pattern as gold but with the usual “Alpha boost” that silver provides. Silver rallied ~33% from the end of February to Friday’s highs but dropped ~7% to close near the day’s lows.

There has been some “mystery” about “what caused” gold’s spectacular rally, especially given that it has come while interest rates and the USD have been rising. (A combination of rising rates and a stronger USD are historically kryptonite for gold.)

Stepped-up central bank buying (especially since Russian assets were seized following the invasion) is often cited as a leading cause of the gold rally. Rising geopolitical concerns (the list is long but includes Iran/Israel, Russia/Ukraine, Taiwan, and North Korea) and rising inflation also get credit for spurring the gold rally. I’ve proposed that Chinese retail demand doesn’t get enough credit, and I forgot to mention that Costco is selling $100 – $200 million worth of one-ounce wafers every month.

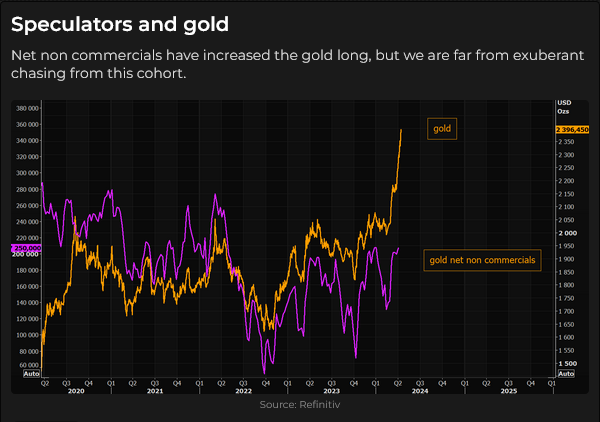

However, gold ETF sales are negative YTD, and the COMEX market open interest, volume, and speculative positioning have been “steady” for the last six weeks. (The two big volume days on COMEX in the previous month were when prices fell sharply.)

Ross Norman, a highly respected gold analyst based in London, says there has been monumental buying of gold options in the OTC market, in addition to Central Bank and geopolitical buying.

If true, the OTC option buying (likely a levered bet by a hedge fund in a relatively small market) could be a play on a combination of 1) continuing government fiscal profligacy and 2) half-hearted inflation-fighting efforts from the central banks, which will ultimately lead to a future of financial repression, including yield curve control, the return of QE and ultimately to Central Banks buying all government debt.

Then again, a hedge fund may have made a highly leveraged play to ignite “animal spirits” in the precious metal markets, and they may have sold the highs on Friday and turned their attention to other opportunities. I don’t know!

Energy

WTI futures touched six-month highs this week and last, but like gold and silver, closed Friday on the day’s lows.

XLE, a popular energy sector ETF, hit a 10-year high on Friday but sold off hard to close at the lowest level in nine days.

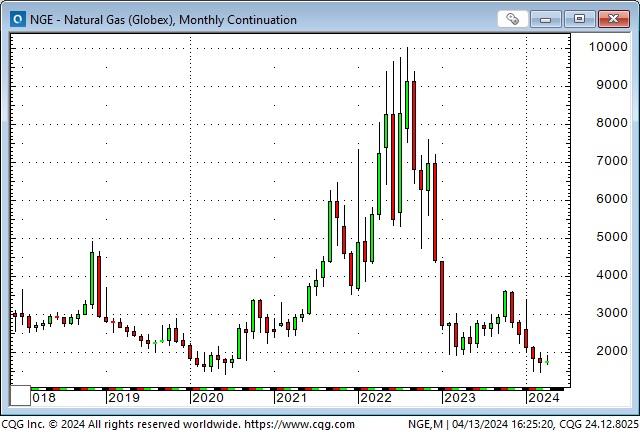

Natural gas continues to trade near multi-year lows below $2 as North American supplies are plentiful. Cheap and abundant natural gas gives North America a competitive energy advantage over other countries, which will only increase if/when natural gas becomes more widely used, especially if it becomes the fuel of choice for transportation.

My short-term trading

I started this week with the long Swiss Franc position established last Friday. The trade closed last week with a nice gain, and the chart looked promising, but there was no follow-through once trading resumed Sunday night, so I covered for a slight loss.

I shorted gold on Wednesday when it traded below Tuesday’s low but was stopped for a slight loss when the market rallied overnight. (I looked hard at shorting gold on Friday when it fell below Thursday’s high, but I didn’t want to be net short gold into the weekend. The irony is that I probably should have taken that trade!)

I shorted the S&P on Wednesday after the CPI report and was nicely ahead by Wednesday’s close, but the market rallied back Thursday, and I was stopped for another slight loss.

I shorted the S&P on Friday when the market turned lower again and stayed with that trade into the weekend. My net P+L for the week was another slight loss.

Thoughts on trading

I make notes about possible trades I see across markets. Most of my ideas never develop into actual trades, but I continue to do the “homework” to prepare me to take a trade if it develops.

This week, I wrote a note, “Is the Peso too strong for Mexico?” It’s at a 9-year high against the USD and is the strongest currency in the world. Short rates are ~11% against 5% in the US. Banxico cut rates by 25bps last month. Could they cut more? Spec net long positioning is at a 4-year high (carry trade?), and if MEX starts to fall, they may become sellers.

The MEX seems to have a high correlation to the S&P (risk barometer). If market sentiment shifts to risk-off, will the MEX be sold?

The MEX broke hard this week, especially Friday, and I didn’t get short because I was already short the S&P, but I’ll keep an eye on it. I’d love to see it rally back but not make a new high and start falling away.

Here’s a link to a great 14-minute interview with Greg Coffey (once known as the Wizard of Oz), who has had an astonishingly successful trading career. If you are a trader, you will love this interview!

Quotes of the week

Jason Shapiro – Crowded Market Reports – April 2024

Mike O’Rourke – Jones Trading – April 2024

The Barney report

It’s Masters week in Barney’s house.

Listen to Victor talk markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed this week’s wild market swings in the equity, currency, interest rate, and gold markets as traders try to price in a “new way” of looking at inflation and what may happen if the Fed raises interest rates instead of cutting them. You can listen to the entire show here. My spot with Mike starts around the 47-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.